F301 Financial Management Formula Sheet

advertisement

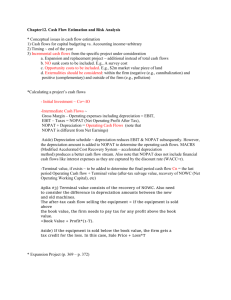

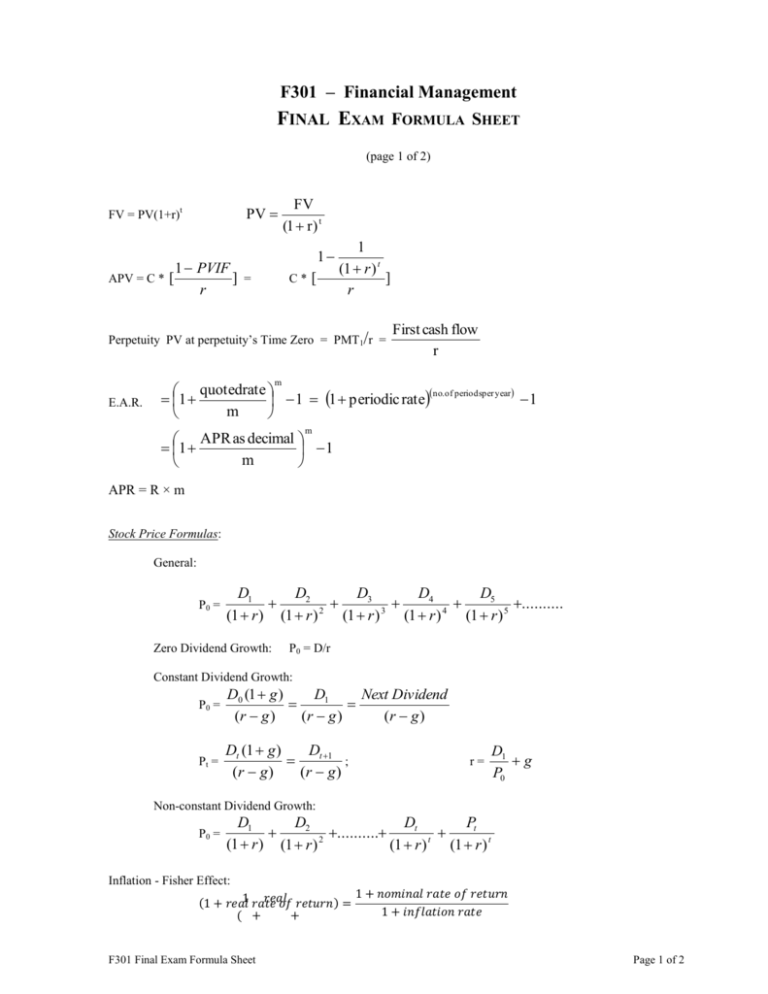

F301 – Financial Management FINAL EXAM FORMULA SHEET (page 1 of 2) PV FV = PV(1+r)t APV = C * [ FV (1 r ) t 1 1 PVIF ] = r C* [ 1 (1 r ) t ] r Perpetuity PV at perpetuity’s Time Zero = PMT1/r = First cash flow r m E.A.R. quotedrate no.of periodsper year 1 1 1 1 periodic rate m m APR as decimal 1 1 m APR = R × m Stock Price Formulas: General: P0 = D1 D2 D3 D4 D5 .......... 2 3 4 (1 r ) (1 r ) (1 r ) (1 r ) (1 r ) 5 Zero Dividend Growth: P0 = D/r Constant Dividend Growth: P0 = D0 (1 g ) D1 Next Dividend (r g ) (r g ) (r g ) Pt = Dt (1 g ) Dt 1 ; (r g ) (r g ) r= D1 g P0 Non-constant Dividend Growth: P0 = D1 D2 Dt Pt .......... 2 t (1 r ) (1 r ) (1 r ) (1 r ) t Inflation - Fisher Effect: ) F301 Final Exam Formula Sheet Page 1 of 2 F301 Formula Sheet (page 2 of 2) EBIT = Sales – Costs – Depreciation OCF = EBIT – taxes on EBIT + depreciation Or OCF = [(Sales -Cost)*(1-T)] + (Depreciation * tax rate) Capital investment terminal cash flow = = Selling price minus tax on gain Selling price – [(selling price – book value) * tax rate] CFA = OCF – increase in NWC – net capital spending NPV = CF0 + CF1/(1+r) + CF2/(1+r)2 + … + CFT/(1+r)T Internal Rate of Return: 0 = NPV when IRR is the discount rate Arithmetic mean = Sum of terms n ( ) ) ) )) CAPM: E(RE) = Rf + E [E(RM ) – Rf ] or, in a slightly oversimplified form: RE = Rf + β(RM – Rf) WACC = (E/V) * RE + (D/V)*RD*(1-TC) + (P/V)*Rp = (weight of equity × cost of equity) + (weight of debt × cost of debt × (1 – T)) + (weight of preferred stock × cost of preferred stock) MACRS depreciation tables: Year 1 2 3 4 5 6 7 8 3-year 33.33% 44.44% 14.82% 7.41% F301 Final Exam Formula Sheet 5-year 20% 32% 19.2% 11.52% 11.52% 5.76% 7-year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% Page 2 of 2