Making Capital Investment Decisions and Project Analysis and

advertisement

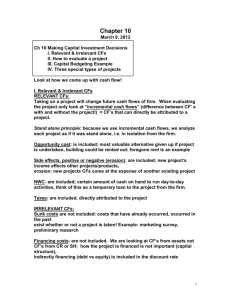

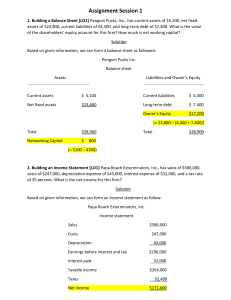

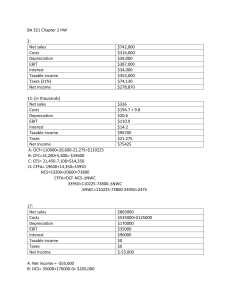

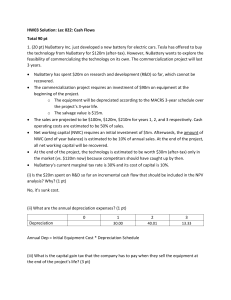

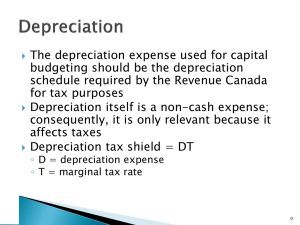

Making Capital Investment Decisions and Project Analysis and Evaluation Projecting Cash Flows PV CFt t t 0 (1 r ) or N CFt NPV - CF0 t t 1 (1 r ) N What Cash Flows (CFt ) are Relevant? Only those cash flows that occur with the project but not without the project are relevant, i.e., only incremental cash flows are relevant. – Sunk Costs? – Opportunity Costs? – Externalities, e.g., erosion Projecting Cash Flows • Projecting Cash Flows – Pro Forma Operating Cash Flow (Cash Flow from Operations) – Pro Forma Changes in Net Working Capital (Cash Flow from Operations) – Pro Forma Changes in Fixed Assets (Cash Flow from Investment) • Question: Why aren’t cash flows from financing part of the cash flow projections? How are Cash Flows Defined? Total Cash Flows = OCF - NWC - Fixed Assets OCF = Bottom Up: Net Income + Depreciation Top-Down: Sales - Costs - Taxes Tax Shield: (Sales-Costs)*(1-T) + T*Depreciation Forecasting Risk: What Can Go Wrong? • Sales = p*q = price per unit sold*quantity sold • Variable Costs = v*q = variable cost per unit*quantity • Fixed Costs = FC = create operating leverage • Costs of New Equipment, Salvage Value, and NWC requirements are all subject to estimation error. Ways of Dealing With Forecasting Error • Scenario Analysis - the determination of what happens to NPV when we ask what-if questions • Sensitivity Analysis - the determination of what happens to NPV when we change only one variable at a time. • Simulation Analysis - the determination of a distribution of NPVs that depends on the distribution of outcomes for individual variables that are inputs for the NPV calculation. Problems 25 through 28 (Base Case) Time 0 Sales Variable Costs Fixed Costs Depreciation EBIT Taxes Net Income Depreciation OCF Changes in NWC $ (450,000) Cost of Equipment $ (750,000) Salvage Value Tax Adjustment Total Cash Flow $ (1,200,000) 1 $ 6,300,000 $ (5,400,000) $ (150,000) $ (150,000) $ 600,000 $ (228,000) $ 372,000 $ 150,000 $ 522,000 2 $ 6,300,000 $ (5,400,000) $ (150,000) $ (150,000) $ 600,000 $ (228,000) $ 372,000 $ 150,000 $ 522,000 3 $ 6,300,000 $ (5,400,000) $ (150,000) $ (150,000) $ 600,000 $ (228,000) $ 372,000 $ 150,000 $ 522,000 4 $ 6,300,000 $ (5,400,000) $ (150,000) $ (150,000) $ 600,000 $ (228,000) $ 372,000 $ 150,000 $ 522,000 5 $ 6,300,000 $ (5,400,000) $ (150,000) $ (150,000) $ 600,000 $ (228,000) $ 372,000 $ 150,000 $ 522,000 $ 450,000 $ $ 522,000 $ 522,000 $ 522,000 $ 500,000 (190,000) 522,000 $ 1,282,000 Problems 25 through 28 (Worst Case) Time 0 1 Sales $ 5,670,000 Variable Costs $ (5,400,000) Fixed Costs $ (150,000) Depreciation $ (172,500) EBIT $ (52,500) Taxes $ (19,950) Net Income $ (32,550) Depreciation $ 172,500 OCF $ 139,950 Changes in NWC $ (472,500) Cost of Equipment $ (862,500) Salvage Value Tax Adjustment Total Cash Flow $ (1,335,000) $ 139,950 2 $ 5,670,000 $ (5,400,000) $ (150,000) $ (172,500) $ (52,500) $ (19,950) $ (32,550) $ 172,500 $ 139,950 3 $ 5,670,000 $ (5,400,000) $ (150,000) $ (172,500) $ (52,500) $ (19,950) $ (32,550) $ 172,500 $ 139,950 4 $ 5,670,000 $ (5,400,000) $ (150,000) $ (172,500) $ (52,500) $ (19,950) $ (32,550) $ 172,500 $ 139,950 5 $ 5,670,000 $ (5,400,000) $ (150,000) $ (172,500) $ (52,500) $ (19,950) $ (32,550) $ 172,500 $ 139,950 $ 472,500 $ $ 139,950 $ 139,950 $ 425,000 (161,500) 139,950 $ 875,950 Problems 25 through 28 (Best Case) Time 0 Sales Variable Costs Fixed Costs Depreciation EBIT Taxes Net Income Depreciation OCF Changes in NWC $ (427,500) Cost of Equipment $ (637,500) Salvage Value Tax Adjustment Total Cash Flow $ (1,065,000) 1 $ 6,930,000 $ (5,400,000) $ (150,000) $ (127,500) $ 1,252,500 $ 475,950 $ 776,550 $ 127,500 $ 904,050 2 $ 6,930,000 $ (5,400,000) $ (150,000) $ (127,500) $ 1,252,500 $ 475,950 $ 776,550 $ 127,500 $ 904,050 3 $ 6,930,000 $ (5,400,000) $ (150,000) $ (127,500) $ 1,252,500 $ 475,950 $ 776,550 $ 127,500 $ 904,050 4 $ 6,930,000 $ (5,400,000) $ (150,000) $ (127,500) $ 1,252,500 $ 475,950 $ 776,550 $ 127,500 $ 904,050 5 $ 6,930,000 $ (5,400,000) $ (150,000) $ (127,500) $ 1,252,500 $ 475,950 $ 776,550 $ 127,500 $ 904,050 $ 427,500 $ $ 904,050 $ 904,050 $ 904,050 $ 575,000 (218,500) 904,050 $ 1,688,050