Quiz 7 and Solutions

advertisement

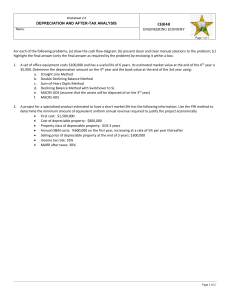

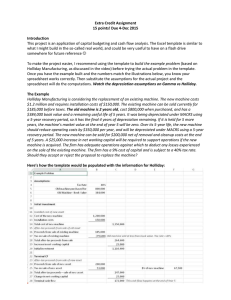

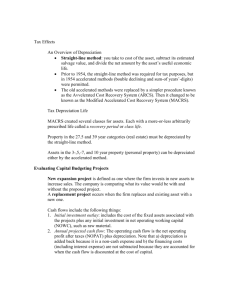

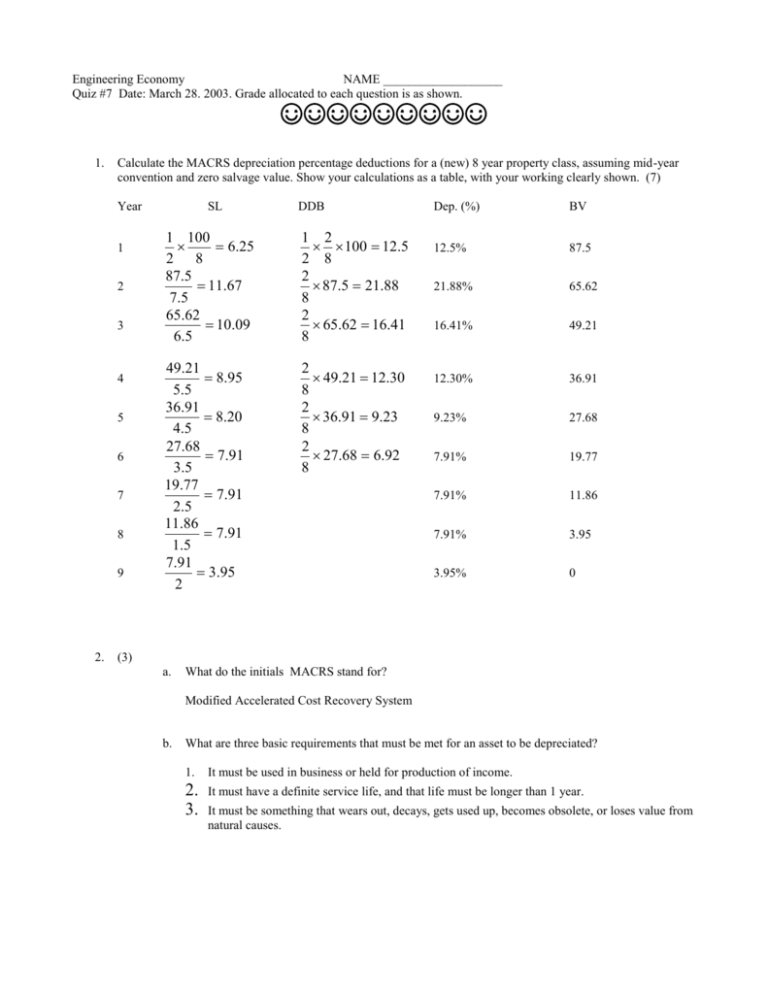

Engineering Economy NAME ___________________ Quiz #7 Date: March 28. 2003. Grade allocated to each question is as shown. ☺☺☺☺☺☺☺☺☺ 1. Calculate the MACRS depreciation percentage deductions for a (new) 8 year property class, assuming mid-year convention and zero salvage value. Show your calculations as a table, with your working clearly shown. (7) Year 1 2 3 4 5 6 7 8 9 2. SL DDB 1 100 6.25 2 8 87.5 11.67 7 .5 65.62 10.09 6.5 1 2 100 12.5 2 8 2 87.5 21.88 8 2 65.62 16.41 8 49.21 8.95 5 .5 36.91 8.20 4 .5 27.68 7.91 3.5 19.77 7.91 2.5 11.86 7.91 1 .5 7.91 3.95 2 2 49.21 12.30 8 2 36.91 9.23 8 2 27.68 6.92 8 Dep. (%) BV 12.5% 87.5 21.88% 65.62 16.41% 49.21 12.30% 36.91 9.23% 27.68 7.91% 19.77 7.91% 11.86 7.91% 3.95 3.95% 0 (3) a. What do the initials MACRS stand for? Modified Accelerated Cost Recovery System b. What are three basic requirements that must be met for an asset to be depreciated? 1. It must be used in business or held for production of income. 2. 3. It must have a definite service life, and that life must be longer than 1 year. It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes.