Chapter 10

advertisement

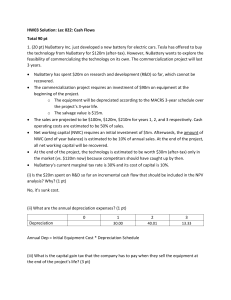

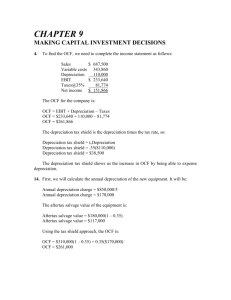

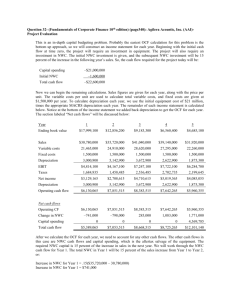

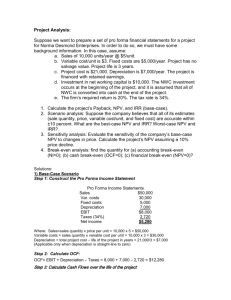

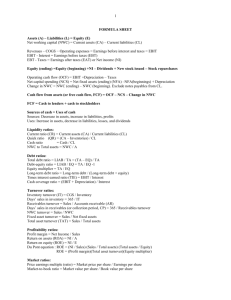

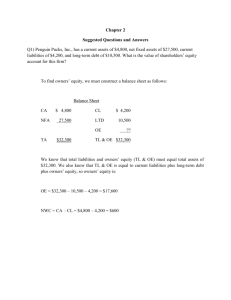

Chapter 10 March 9, 2012 Ch 10 Making Capital Investment Decisions I. Relevant & Irrelevant CFs II. How to evaluate a project III. Capital Budgeting Example IV. Three special types of projects Look at how we come up with cash flow! I. Relevant & Irrelevant CFs RELEVANT CFs: Taking on a project will change future cash flows of firm. When evaluating the project only look at “incremental cash flows” (difference between CF’ s with and without the project!) = CF’s that can directly be attributed to a project. Stand alone principle: because we use incremental cash flows, we analyze each project as if it was stand alone, i.e. in isolation from the firm. Opportunity cost: is included; most valuable alternative given up if project is undertaken, building could be rented out: foregone rent is an example Side effects, positive or negative (erosion): are included; new project’s income affects other projects/products, erosion: new projects CFs come at the expense of another existing project NWC: are included; certain amount of cash on hand to run day-to-day activities, think of this as a temporary loan to the project from the firm. Taxes: are included, directly attributed to the project IRRELEVANT CFs: Sunk costs are not included: costs that have already occurred, occurred in the past exist whether or not a project is taken! Example: marketing survey, preliminary research Financing costs: are not included. We are looking at CF’s from assets not CF’s from CR or SH; how the project is financed is not important (capital structure), Indirectly financing (debt vs equity) is included in the discount rate 1 II. How to evaluate a project? Step 1. Set up pro-forma income statement = income statement that is projected into future years (only using incremental numbers) Step 2. Calculate cash flow from assets for future years= operating CF - additions to NWC (end. NWC - beg. NWC for each year) - additions to capital spending (includes initial investment at t=0 and after tax salvage value = salvage – t(salvage – book value) in last period or salvage value x (1-t) if book = 0 for straight-line depreciation operating CF= EBIT +depreciation - taxes note: if no interest: NI = EBIT - taxes operating CF = NI + depreciation draw for visualization Step 3. Apply different investment criteria, and evaluate the project (NPV, IRR, payback, PI) III. Example Capital Budgeting for Project X if we take on project X (stereo amplifier): sell 500 units per year at $8,000 each, unit sales grow at 10% per year variable cost = $5,000 /unit fixed-cost = $610,000 / year project has a 4 year life initial investment for equipment = $1,100,000 straight-line depreciation Depreciation = Year 1-4= 275,000 after year 4: book value = 0 in 4 years the market value of the equipment is $550,000 Initial investment in net working capital = $900,000 tax rate = 34% Should we accept project using NPV criteria using 20% required return? 2 Step 1: Pro-forma income statement: Sales -variable costs -fixed costs -depreciation EBIT -Taxes NI 1 4,000,000 2,500,000 610,000 275,000 615,000 209,100 405,900 Year 2 4,400,000 2,750,000 610,000 275,000 765,000 260,100 504,900 3 4,840,000 3,025,000 610,000 275,000 930,000 316,200 613,800 4 5,324,000 3,327,500 610,000 275,000 1,111,500 377,910 733,590 765,000 275,000 260,100 779,900 930,000 275,000 316,200 888,800 1,111,500 275,000 377,910 1,008,590 Step 2: CF from assets first CF from operations: EBIT + depreciation - taxes = operating CF NWC Year –1 = 0 Year 0: $900,000 year 4: $0 615,000 275,000 209,100 680,900 Addition (Change): 900,000 Addition (Change): -900,000 Capital spending: initial investment: $1,100,000 market value: $550,000 book value: 0 after-tax salvage value: $550,000 - [.34 x ( 550,000-0)] 550,000 – 187,000 = 363,000 the equipment was over-depreciated, firm paid too little taxes and taxes have to be paid now. (note: book value was = 0, market value of 550,000 is taxable! 550,000 x (1 - .34)) 3 CF from assets: year 0 operating CF - add. to NWC -900,000 - cap. spend -1,100,000 Total CF -2,000,000 1 680,900 0 2 779,900 0 3 888,800 0 680,900 779,900 888,800 4 1,008,590 900,000 363,000 2,271,590 Step 3: NPV at 20%: NPV = 718,847 IRR = .34 PI = 2,718,847/2,000,000 = 1.3594 This investment is quite profitable! IV . Three special types of projects (for first two: don’t need to solve problem only know roughly how to get CFs a) cost-cutting project (machine that will be more efficient and reduce costs) Evaluate if future (after-tax) cost savings of a new equipment are larger than the expense for the equipment After-tax because EBIT is larger if lower costs, pay more taxes The after-tax cost saving plus the depreciation tax shield is your operating income Everything else stays the same Change in NWC if there is any and capital spending (-investment & after tax salvage). b) top p.320 setting the bid-price (your customer wants to by a product; receives bids from different competitors) firm has to put in a bid what is lowest price it can charge and still be profitable? Find the price that will make operating CF and therefore CF from assets so large that the NPV is zero at a given discount rate. Then calculate the break even price. Calculate everything backwards 1. calculate OCF every year that will set the NPV = zero or the PV of future CFs equal to cost. p. 320 PV = -cost + PV of last year NWC and after tax salvage R = rate N= time CPT PMT 4 Example: on page 324: Year 0 1 2 3 4 -$79,239 OCF OCF OCF OCF -79,239 PV 20% I/Y 4N CPT PMT: 30,609.16 Knowing the OCF and depreciation, calculate the NI NI = OCF - Depr Knowing NI and costs calculate the Sales NI = (sales – cost – depr) x (1-t) solve for sales Knowing sales and how many units need to be produced: Sales/units = unit price c) evaluating projects with different economic lives. which equipment is the most cost effective? Using the NPV rule does not work: THIS IS THE ONLY EXCEPTION! Comparing oranges to apples Assumption: We need the equipment indefinitely, when it wears out we need to buy a new one. One piece of equipment costs less to operate than the other but is wears out faster. How to we compare the two? equivalent annual cost, EAC what is amount that if paid every year would be equal to the NPV of the equipment what is the payment of an annuity that has a PV equal to the NPV PMT = EAC = equivalent annual cost chose the one with the lowest PV of cost example P. 325: A: 0 1 -100 -10 2 -10 0 1 2 3 ignore taxes, r = 10% B: -140 -8 -8 -8 NPV & PV of costs for project A: -$117.36, I/Y=10, N=2, CPT PMT = -$67.62 NPV & PV of costs for project B: -$159.89, I/Y=10, N=3, CPT PMT = -$64.29 Compare PMT: -$67.62 project A vs. -$64.29 project B Chose the lower cost project: B 5 Review: Chapters 7, 8, 9, 10 50 multiple choice formula sheet given on web-page, course materials, exams Ch 7: Bond Valuation & Interest Rates Know the terminology for bonds discount (price < face) vs. premium (price > face) understand the valuation formula for bonds semiannual vs. annual (adjust YTM & coupon by dividing by 2, multiply tx2) interest rate risk (time to maturity (direct) coupon rate (indirect) Reporting of bonds in the press: current yield = coupon/current price indenture (what is covered in it), callable, protective covenants, diff between bonds and equity know the different types of bonds inflation (fisher effect) & term structure, calculate the variables in the formula Ch 8: Stocks & Stock Valuation Use dividends valuation under three scenarios a) zero growth (perpetuity), b) constant growth (dividend growth model) what is it comprised of? c) non-constant growth understand dividends and their tax deductibility reporting of stocks in press (dividend yield), what is reported voting procedures (cumulative and straight: # of total votes, # shares needed to guarantee a seat) read over the parts of how the OTC and the NYSE works, the players primary and secondary markets Ch. 9 Investment Criteria: NPV (best) Payback Rule Not the AAR! IRR (ranking conflict and cannot be used for non-conventional CFs) PI know how to calculate, advantages and disadvantages of each crossover rate mutually exclusive projects 6 Ch. 10 Making Capital Investment Decisions calculate CFs = cash flows from assets which costs are/are not included? op. cash flow - add. to NWC - add to net cap. Spending at what time do they occur? special situations (cost-cutting, setting bid-price, different economic lives) know the concepts) cost cutting: project has initial cost and then reduces cost by a certain amount (after-tax cost savings). what is a pro-forma statement? Example: Calculate the NPV given the following information: Straight-line depreciation OCF per year = 2000 Life = 3 years Initial investment = 5,000 Initial investment in NWC = 3,000 Salvage value at the end of year 3 = 3500 Tax rate = 35%, interest rate = 12% Year 0 OCF - add in Cap sp. - add to NWC -5,000 -3000 -8000 1 2000 2000 2 2000 3 2000 3500(.65)=2275 3000 2000 7275 NPV = 558.30 7