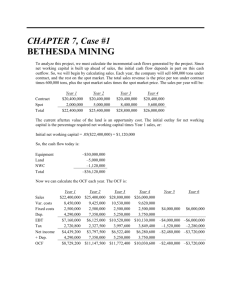

PROBLEM: BETHESDA MINING COMPANY Considering the price per ton is $86, the total value to be sold under the contract is 500,000 tons multiplied by SPOT Value: The projected coal for the next 4 years is as follows: Year Production 1st year 620,000 tons 2nd year 680,000 tons 3rd year 730,000 tons 4th year 590,000 tons Contract call for delivery of 500,000 tons of coal per year. The excess production will be sold in the spot market Year 1st year 2nd year 3rd year 4th year Production 620,000 tons 680,000 tons 730,000 tons 590,000 tons Total sales for the next four years: is addition of contract value and spot production value calculation. Year Contract 1st year $43.000.000,00 2nd year $43.000.000,00 3rd year $43.000.000,00 4th year $43.000.000,00 Solution: Cash Flow: The initial NWC is required to calculate the total cash flow. Formula for NWC = Sales tax X Total sales Sales tax is 5% i.e. 0.05 Total sales Sales tax $52.240.000 0,05 $56.860.000 0,05 $60.710.000 0,05 $49.930.000 0,05 To find the current cash flow today, add the provided equipment cost of $ 95 million, the land cost of $6.5 million and NWC which totals to (-$ 104,112,000) Net working capital cash flow: The net working capital cash flow (NWC CF) is determined by the value of 5% of next year’s sales. Using the formula, the yearly NEWC CF is: Year 1st year Starting $2.612.000,00 Ending NWC Cash flow $2.843.000,00 ($231.000,00) Book Value: Book value is the total equipment value minus the depreciation value. MACRS 7-year depreciation rate is as foll Year 1 2 3 4 7-year depreciation rate 14,29% 24,49% 17,49% 12,49% Based on the MACRS schedule and a contract and salvage rate of 4 years, the depreciation value are shown in the table: Year 1st year Sales $52.240.000,00 Variable $19.220.000,00 Fixed $4.100.000,00 Depreciation $13.575.500,00 Variable cost is the total projected coal production times $31 per ton. The fixed cost is $41000000. And the depreciation cost is calculated $95 million times the MACRS value per year respectively. Considering the original equipment cost is $95 million, the formula used to find the book value is: Book value= $95000000- $13575500-$23265500-$16615500-$11865500 = 29678000,00 Net cash Flow: NWC= OCF+NWC CF+ Salvage Value We need to determine the EBT to calculate the OCF. Year 1st year Sales $52.240.000 Variable $19.220.000 Fixed $4.100.000 Depreciation $13.575.500 EBT $15.344.500 OCF can be calculated as follows: OCF=EBT-Tax+Depreciation Year EBT Tax Net Income Depreciation OCF Salvage Value 1st year $15.344.500 $5.830.910 $9.513.590 $13.575.500 $23.089.090 Salvage value is the equipment value minus the equipment sales tax value. The sales tax value is the book value minus the equipment value total, minus the tax value. The calculation is as follows: Equipment value= 95million times 60%= 57000000 Equipment sales taxes= ($ 29,678,000.00- $ 57000, 000.00) X .38 = $ (- 10,382,360.00) Salvage value= ($ 57000000-10,382,360.00) = $ 46,617,640.00 Net Cash Flow Years Capital Spending Opportunity Cost NWC OCF Total Project Cash Flow 0 ($95.000.000) ($6.500.000) ($2.612.000) ($104.112.000) So, the capital budgeting analysis for the project is: Payback period = 3 + ($104112000-$ (22,858,090+$28289990+$27920490)) /$70697830 =3+0.71= 3.71 years Profitability Index= $104,930,077.79 / $104,112,000= 1.0079 IRR = -$104,112,000/ (1+IRR)^0 + $ 22,858,090/(1+IRR)^1 + $28,289,990/(1+IRR)^2 + $27,920,490/ (1+IRR)^3 + $70,697,830/(1+IRR)^4 + -$1,674,000/(1+IRR)^5 + -$3,720,000/(1+IRR)^6 12% NPV Year 0 OCF ($104.112.000) PV Factor (@12%) 1 PV -104112000 NPV $818.664,74 Based on the results and as the NPV is positive, it is advisable that the company should accept the project l value to be sold under the contract is 500,000 tons multiplied by $86 i.e. $43000000. coal per year. The excess production will be sold in the spot market at an average of $77 per ton Spot production Value Calculation (620000-500000) X 77 (680000-500000) X 77 (730000-500000) X 77 (590000-500000) X 77 Spot production Value $9.240.000,00 $13.860.000,00 $17.710.000,00 $6.930.000,00 n of contract value and spot production value calculation. Spot production Value Calculation Total Sales $9.240.000,00 $52.240.000,00 $13.860.000,00 $56.860.000,00 $17.710.000,00 $60.710.000,00 $6.930.000,00 $49.930.000,00 otal cash flow. NWC $2.612.000,00 $2.843.000,00 $3.035.500,00 $2.496.500,00 provided equipment cost of $ 95 million, the land cost of s determined by the value of 5% of next year’s sales. 2nd year $2.843.000,00 3rd year $3.035.500,00 4th year $2.496.500,00 $3.035.500,00 ($192.500,00) $2.496.500,00 $539.000,00 0 $2.496.500,00 us the depreciation value. MACRS 7-year depreciation rate is as follows: t and salvage rate of 4 years, 2nd year $56.860.000,00 $21.080.000,00 $4.100.000,00 $23.265.500,00 3rd year $60.710.000,00 $22.630.000,00 $4.100.000,00 $16.615.500,00 4th year $49.930.000,00 $18.290.000,00 $4.100.000,00 $11.865.500,00 2nd year $56.860.000 $21.080.000 $4.100.000 $23.265.500 $8.414.500 3rd year $60.710.000 $22.630.000 $4.100.000 $16.615.500 $17.364.500 4th year $49.930.000 $18.290.000 $4.100.000 $11.865.500 $15.674.500 2nd year $8.414.500 $3.197.510 $5.216.990 $23.265.500 $28.482.490 3rd year $17.364.500 $6.598.510 $10.765.990 $16.615.500 $27.381.490 4th year $15.674.500 $5.956.310 $9.718.190 $11.865.500 $21.583.690 uction times $31 per ton. The fixed cost is $41000000. million times the MACRS value per year respectively. 95 million, the formula used to find the book value is: 500-$16615500-$11865500 5th year $2.700.000 ($2.700.000) 5th year ($2.700.000) ($1.026.000) ($1.674.000) ($1.674.000) the equipment sales tax value. he equipment value total, minus the tax value. 57000, 000.00) X .38 = $ 46,617,640.00 1st year $0 2nd year $0 3rd year $0 4th year $46.617.640 ($231.000) $23.089.090 $22.858.090 ($192.500) $28.482.490 $28.289.990 $539.000 $27.381.490 $27.920.490 $2.496.500 $21.583.690 $70.697.830 2nd year $28.289.990 0,8 $22.631.992,00 3rd year $27.920.490 0,71 $19.823.547,90 4th year $70.697.830 0,64 $45.246.611,20 8,090+$28289990+$27920490)) /$70697830 112,000= 1.0079 90/(1+IRR)^1 + $28,289,990/(1+IRR)^2 + R)^4 + -$1,674,000/(1+IRR)^5 + -$3,720,000/(1+IRR)^6 1st year $22.858.090 0,89 $20.343.700,10 ive, it is advisable that the company should accept 6th year $6.000.000 ($6.000.000) 6th year ($6.000.000) ($2.280.000) ($3.720.000) ($3.720.000) 5th year $0 6th year $0 ($1.674.000) ($1.674.000) ($3.720.000) ($3.720.000) 5th year ($1.674.000) 0,57 -954180 6th year ($3.720.000) 0,51 ($1.897.200,00)