Leuthold Market Outlook: Tracing Out a Top?

advertisement

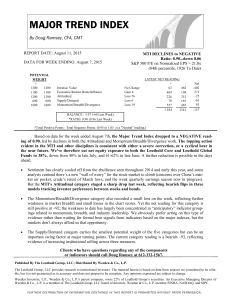

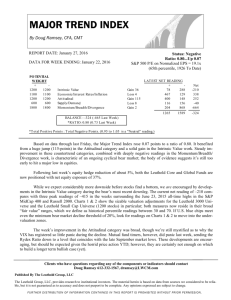

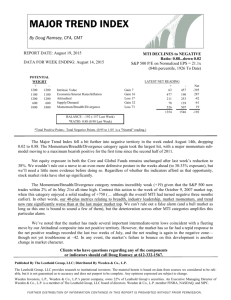

The Bull Market: Six Years Old… And Not Over April 22-24, 2015 FOR PROFESSIONAL USE ONLY. FURTHER DISTRIBUTION OF THE INFORMATION CONTAINED HEREIN IS PROHIBITED WITHOUT PRIOR PERMISSION. Disclosures This report is not a solicitation or offer to buy or sell securities. The Leuthold Group, LLC provides research to institutional investors. It is also a registered investment advisor that uses its own research, along with other data, in making investment decisions for its managed accounts. As a result, The Leuthold Group, LLC may have executed transactions for its managed accounts in securities mentioned prior to this publication. The information contained in The Leuthold Group, LLC research is not, without additional data and analysis, sufficient to form the basis of an investment decision regarding any one security. The research reflects The Leuthold Group, LLC’s views as of the date of publication, which are subject to change without notice. The Leuthold Group, LLC does not undertake to give notice of any change in its views regarding a particular industry prior to publication of their next research report covering that industry in the normal course of business. The Leuthold Group, LLC may make investment decisions for its managed accounts that are inconsistent with, or contrary to, the views expressed in current Leuthold Group, LLC reports. Weeden Investors, L.P., Weeden & Co., L.P.'s parent company, owns 22% of Leuthold Group’s securities. A Managing Director of Weeden & Co., L.P. is a member of The Leuthold Group, LLC board of directors. Weeden & Co., L.P. member FINRA, NASDAQ, and SIPC. 2 Major Trend Index remains mildly positive POTENTIAL WEIGHT + 1200 1200 1100 1100 1200 1200 600 600 1800 1800 THIS WEEK CURRENT NET READING + No Change 70 442 Gain 22 492 176 Gain 17 160 389 Loss 8 121 72 Loss 55 713 295 1556 1374 Intrinsic Value Economic/Interest Rates/Inflation Attitudinal Supply/Demand Momentum/Breadth/Divergence BALANCE : +182 (+206 Last Week) *RATIO: 1.13 (1.15 Last Week) *Total Positive Points : Total Negative Points. (0.95 to 1.05 is a "Neutral" reading.) 3 Net -372 316 -229 49 418 182 Market advance has been broad, which is near-term bullish NYSE Daily Advance/Decline Line - All Issues 10000 49000 48000 9500 New highs in mid-April 9000 47000 46000 8500 45000 8000 44000 7500 43000 NYSE Daily Advance/Decline Line Stocks Only 7000 42000 6500 41000 © 2015 The Leuthold Group x10 x10 S O N D 2014 4 M A M J J A S O N D 2015 M A M New high in breadth suggests bull market life expectancy has been pushed out… © 2015 The Leuthold Group No. Of Weeks S&P 500 Gain From Breadth From Breadth Date Of Bull Market Peak To Peak To Peak In S&P 500 Market Peak Market Peak Date Of Peak In NYSE Breadth (Daily A/D Line) A/D peaks 2 trading days after S&P A/D line and S&P 500 peak on same day A/D line peaks 10 months after S&P May 14, 1928 January 21, 1937 November 12, 1938 May 29, 1946 March 15, 1956 May 17, 1961 May 6, 1965 August 2, 1967 April 28, 1971 July 22, 1977 September 11, 1978 March 23, 1987 August 8, 1989 April 3, 1998 January 6, 1999 June 4, 2007 September 7, 1929 March 6, 1937 November 9, 1938 May 29, 1946 August 2, 1956 December 12, 1961 February 9, 1966 November 29, 1968 January 11, 1973 September 21, 1976 November 28, 1980 August 25, 1987 July 16, 1990 July 17, 1998 March 24, 2000 October 9, 2007 Median: 5 69 6 0 0 20 30 40 69 89 0 116 22 49 15 63 18 26 56.2 % 4.0 0.0 0.0 3.6 7.8 4.6 13.1 14.8 0.0 31.4 11.8 5.6 5.7 20.1 1.7 5.7 % The Taper Caper © 2015 The Leuthold Group Fed QE taper begins 21.0 185 S&P 500 Consumer Discretionary Total Return Relative Strength 180 175 20.5 20.0 (right scale) 170 19.5 165 19.0 160 Russell 2000/ S&P 500 Total Return Ratio 155 150 18.5 18.0 (right scale) 145 17.5 140 Taper ends A S O N D 2014 M A 6 M J J A S O N D 2015 M A M Transports’ weakness could be an early warning sign 61 60 S&P 500 2100 59 (right scale) 2050 58 2000 57 56 1950 55 1900 54 53 1850 52 51 1800 50 1750 49 48 1700 47 46 45 44 Dow Jones Transports/Industrials Relative Strength Ratio 1650 (left scale) 1600 © 2015 The Leuthold Group 2014 A M J J A S O N D 2015 7 A M J Spreads sniffing out trouble 2007: Credit Leads Stocks 2.0 2014-15: Credit Leads Stocks?? BofAML High Yield Spread (left scale - inverted) 2150 1600 3.0 2.4 2.8 3.2 1550 3.4 3.2 3.6 2100 2050 3.6 1500 4.0 4.4 1450 4.8 stock market peak (to date) on March 2nd credit peak on June 23, 2014 3.8 S&P 500 4.0 (right scale) 1950 4.2 5.2 5.6 6.0 S&P 500 6.4 (right scale) 4.4 1400 1900 4.6 4.8 1850 1350 6.8 2000 5.0 7.2 5.2 7.6 1300 1800 5.4 8.0 BofAML High Yield Option-Adjusted Spread 5.6 8.4 5.8 1250 8.8 © 2015 The Leuthold Group Nov Dec 2007 Mar Apr May Jun Jul 1750 (left scale - inverted) © 2015 The Leuthold Group Aug Sep Oct Nov Dec 2008 014 Mar Apr May Ju 8 Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2015 Mar Apr May The “hated” bull market? "Average" Sentiment Levels In 2014 Were The Second-Highest On Record © 2015 The Leuthold Group 85 80 75 Investor's Intelligence Bulls As A Percentage Of Bulls Plus Bears S&P 500 2600 2200 (Annual close - right scale) 1800 (Annual average - left scale) 2014 avg. = 76.3% 70 65 1400 1200 1000 800 600 400 60 55 200 50 45 61 1964 19671970 1970 1973 1976 1979 1991 1994 19972000 2000 2003 2006 2010 2009 2012 2015 A 1980 1982 1985 1988 1990 9 High Sentiment Years & Subsequent Market Action © 2015 The Leuthold Group Ten Highest Average Sentiment Years 1976 2014 1965 1964 1983 2013 1972 1971 2004 1986 Average Sentiment Reading 83.7 % 76.3 75.6 75.0 72.3 71.0 70.8 70.5 70.3 68.9 Average Return: 10 Subsequent Year Gain Or Loss In S&P 500 -11.5 % ? -13.1 9.1 1.4 11.4 -17.4 15.6 3.0 2.0 0.1 % Bull markets have frequently topped near current valuations… Date Of S&P 500 Bull Market Peak S&P 500 Normalized P/E At Bull Market Peak December 31, 1961 22.3 x February 28, 1966 23.0 November 29, 1968 20.6 January 31, 1973 20.8 September 29, 1976 13.6 November 29, 1980 11.3 August 31, 1987 22.3 July 31, 1990 18.4 July 31, 1998 27.7 March 31, 2000 32.1 October 31, 2007 20.9 April 29, 2011 20.5 Median At Modern Era Bull Market Peaks (1957 To Date): 20.8 x March 31, 2015 21.2 x © 2015 The Leuthold Group 11 Even forward P/E ratios look pricey… Forward P/Es Now Far Above Levels Seen At Last Bull Market Peak 18 18 Mar15 = 16.6x 17 16 16 Oct07 = 14.6x 15 17 15 14 14 MSCI World P/E on 12-Mo. Forward EPS 13 12 11 10 13 12 11 10 MSCI USA P/E on 12-Mo. Forward EPS 18 17 Feb15 = 17.3x 17 Oct07 = 15.4x 16 18 16 15 15 14 14 13 13 12 12 11 11 10 10 © 2015 The Leuthold Group 2003 2004 2005 2006 2007 2008 2009 2010 October 31, 2007 (month-end peak of 2002-2007 bull market) 12 2011 2012 2013 2014 2015 Stock market is “broadly” overvalued "Median" S&P 500 Stock Pricier Than At 2000 & 2007 Peaks P/E on 12-Mo. Trailing EPS 21.0x 28 26 24 22 20 18.8x 18 19.2x S&P 500 Median Net Profit Margin March 2000 6.9% October 2007 8.9% March 2015 10.1% 16 14 12 10 © 2015 The Leuthold Group 1990 2000 Mar 2000 13 2010 Oct 2007 “Earnings are phenomenal!” Oh, really? 150 120 100 80 150 120 100 80 Despite record-high profit margins and aggressive, price-insensitive share buybacks, S&P 500 Reported EPS remain about $30 below the level projected by their 1937-2007 trend. 60 50 40 60 50 40 30 30 20 20 10 10 S&P 500 Trailing 12-Month Reported EPS (latest = $102.32) © 2015 The Leuthold Group 1940 1950 1960 14 1970 1980 1990 2000 2010 Rest of world looks cheaper; Opportunity or value trap? 40 Normalized P/E Ratios: U.S. Vs. Rest Of World 35 30 MSCI USA Index 25 22.5x 20 17.0x (World Ex USA) 15 12.2x (Emerging Markets) 10 © 2015 The Leuthold Group 00 02 04 06 15 08 10 12 14 16 A pair of bullish time cycles are coinciding… The Stock Market's Annual & Presidential Cycles Combined: S&P 500 Annualized Total Returns, 1926 To Date Post-Election Year Mid-Term Year Pre-Election Year Election Year 24.7% Nov-Apr 12.9% 11.0% Nov-Apr 9.4% 8.4% Nov-Apr May-Oct 5.8% 8.7% May-Oct Nov-Apr May-Oct 1.1% © 2015 The Leuthold Group May-Oct We are here. 16 More stock market numerology… Dow Jones Industrials In Statistically Favored Years (1898 To Date) (DJIA Performance Figures Are Price Only) © 2015 The Leuthold Group Pre-Election Years 1899 1903 1907 1911 1915 1919 1923 1927 1931 1935 1939 1943 1947 1951 1955 1959 1963 1967 1971 1975 1979 1983 1987 1991 1995 1999 2003 2007 2011 2015 Average: 9.2 % -23.6 -37.7 0.4 81.7 30.5 -3.3 28.8 -52.7 38.1 -2.9 13.8 2.2 14.5 20.8 16.4 17.0 15.2 6.1 38.3 4.2 20.3 2.3 20.3 33.5 25.2 25.3 6.4 5.5 ? 12.3 % All Years (1898 2014) 7.6 % Years Ending In "5" 1905 1915 1925 1935 1945 1955 1965 1975 1985 1995 2005 2015 Average: 17 38.2 % 81.7 30.0 38.1 26.6 20.8 10.9 38.3 27.7 33.5 -0.6 ? 34.6 % Pre-Election Years Ending In "5" 1915 1935 1955 1975 1995 2015 Average: 81.7 % 38.1 20.8 38.3 33.5 ? 44.7 % Years Preceding A Bush/Clinton Election 1991 2015 2019 2023 Average: 20.3 % ? ? ? 20.3 % Recessions rarely catch the stock market by complete surprise… © 2015 The Leuthold Group 130 110 100 90 80 70 60 50 40 130 110 100 90 80 70 A Strong Stock Market Suggests Recession Risk Is Minimal... U.S. Industrial Production (Arrows/vertical lines highlight NBER business cycle peaks.) 60 50 40 30 30 20 20 10 10 12-Mo. Pct. Chg. In Real S&P 500 (Figures below show level in month of business cycle peak) 50 40 30 20 10 0 -10 -20 -30 -40 -50 Mar = +12% -6% 1940 -3% 1950 -9% -7% -18% -26% 1960 1970 0% -3% 1980 -2% 1990 -26% 2000 Avg. at last 11 business cycle peaks = -9% -1% 50 40 30 20 10 0 -10 -20 -30 -40 -50 2010 The year-over-year change in real stock prices has been either flat or negative at all post-WWII business cycle peaks. Near-term recession risk looks very low on this basis. 18 Simple economic gauge remains bullish 2600 2000 1600 1200 S&P 500 Vs. ISM "Liquidity" Index 2600 2000 1600 1200 800 600 800 600 400 400 200 200 ISM Liquidity Index = New Orders Index Minus Prices Paid Index 20 Percent Of Time 10 % 25 24 21 13 7 ISM Liquidity Index Above 10 Between 0 And 10 Between -10 And 0 Between -20 And -10 Between -30 And -20 Below -30 S&P 500 Annl. Returns 14.0 % 15.0 6.9 8.0 -1.3 -7.0 Analysis for February 1948 - October 2014 period. Above +10 = maximum bullish for stocks 20 10 0 10 0 -10 -20 -10 -20 -30 -30 Below -30 = maximum bearish for stocks -40 -40 © 2015 The Leuthold Group 1950 1960 1970 1980 19 1990 2000 2010 Commodities: The problem is supply. Leuthold 3000 2.5 Energy Sector: Capex/Depreciation Ratio 2.0 1.5 1.0 Leuthold 3000 Materials Sector: 1.8 1.7 1.6 1.5 1.4 1.3 1.2 1.1 1.0 0.9 0.8 0.7 Capex/Depreciation Ratio © 2014 The Leuthold Group 1980 1990 2000 Both series are weighted medians. 20 2010 Oil’s plunge in perspective Real Crude Oil Price 0.6 0.5 (Ratio, Monthly Avg. Crude Oil Price to Consumer Price Index) 0.6 0.5 0.4 0.4 1973 (OPEC Embargo)To-Date Median = 0.215 0.3 0.3 0.2 0.2 1946-To-Date Median = 0.133 0.1 0.1 © 2015 The Leuthold Group 1940 1950 1960 1970 21 1980 1990 2000 2010 Why “real” oil prices matter 0.70 0.65 0.60 75 Energy Stocks Track Real Oil Prices 0.55 0.50 0.45 70 65 60 55 0.40 50 0.35 45 0.30 40 WTI Crude Oil Deflated by CPI (left scale) 0.25 35 30 0.20 25 S&P Energy Sector Composite Relative to S&P 500 (right scale) 0.15 20 0.10 15 © 2015 The Leuthold Group 1970 1980 1990 22 2000 2010 Energy: Should you catch the falling knife? The "Cheapest Sector" Annual Strategy 1991-2014 S&P 500 Total Return 30.5 % 7.6 10.1 1.3 37.6 23.0 33.4 28.6 21.0 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.8 5.5 -37.0 26.5 15.1 2.1 16.0 32.4 13.7 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1991-2014 Annualized: Total Return Std. Deviation Last Year's Lowest P/E Sector Financials Financials Financials Financials Financials Financials Utilities Utilities Materials Utilities Telecom Services Energy Utilities Energy Energy Financials Energy Financials Energy Utilities Utilities Financials Industrials Financials Energy 10.2 % 18.4 % No. Yrs. Outperforming S&P 500: Correlation With S&P 500 (Annual Returns): Results assume annual rebalancing of S&P 500 sectors; numbers include dividends, but exclude transactions costs. © 2015 The Leuthold Group 23 Cheapest Sector Strategy Total Return 49.1 % 23.3 10.6 -3.5 54.1 35.2 24.7 14.8 25.3 57.2 -12.2 -11.1 26.3 31.5 31.4 19.2 34.4 -55.3 13.8 5.5 19.9 28.8 40.7 15.2 16.9 % 24.1 % 16/24 0.67 Long-term leadership from Technology? 95 65 90 60 85 S&P 500 Technology Sector 80 75 Relative Strength 70 65 (right scale) 55 50 45 40 60 55 35 50 30 45 25 40 35 20 30 AC World 25 Technology Relative to ACWI Index 20 (left scale) © 2015 The Leuthold Group 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 24 15 Technology bubble? Far from it… S&P 500 Techology Relative P/E on 5-Yr. Normalized EPS 5.0 4.5 4.0 3.5 5.0 4.5 4.0 3.5 3.0 3.0 2.5 2.5 2.0 2.0 1.5 1.5 1.0 1.0 © 2015 The Leuthold Group 1990 2000 2010 5.0 5.0 4.5 S&P 500 Techology Relative Price/Cash Flow 4.0 3.5 3.0 2.5 4.5 4.0 3.5 3.0 2.5 2.0 2.0 1.5 1.5 1.0 1.0 0.5 © 2015 The Leuthold Group 1990 0.5 2000 25 2010 Apple in perspective Companies To Have Reached A Four Percent Weight In The S&P 500, 1990 To Date (…and how long they were able to stay there) 5.0 5.0 5.0 5.0 4.5 4.51 month 4.5 4.5 4.0 4.0 4.0 4.0 3.5 3.5 3.5 3.5 3.0 3.0 3.0 3.0 2.5 2.5 2.5 2.5 15 months Microsoft 1990 2000 © 2015 The Leuthold Group 12 months 12 months above 4% 2010 2.0 General 1.5 Electric 1990 2.0 Cisco Systems Exxon Mobil 2.0 1.5 1.0 1.0 1.0 1.0 0.5 0.5 0.5 0.5 0.0 0.0 0.0 0.0 2010 1990 2000 2010 26 1990 2000 2010 1 mo. 4.5 4.0 3.5 Apple 3.0 3% 2.5 2.0 2% 1.5 1.5 1990 5.0 5% 4% 2.0 1.5 2000 10 months 1.0 1% 0.5 0.0 0% 2000 2010 Asset allocation: Beware of “bottom fishing” T O T A L 18 R E T U R N 10 (%) A Simple, Single-Asset Annual Allocation Strategy: Select From Among Seven Asset Classes Using Last Year's Performance Rank, 1973-2014 © 2015 The Leuthold Group 16 Assets Included In Analysis: S&P 500 Russell 2000 MSCI EAFE NAREIT Composite U.S. 10-Yr. Treasury Bonds S&P/GS Commodity Index Gold 14 12 8 6 S&P 500 = +10.3%/Yr. 4 2 in g tP er fo rm or s W 27 50 0 P S& A ss et B es th Si x h Fi ft t B es t B es t Fo ur th B es t rd Th i rid B B es t( Se co nd B es tP er fo rm in g es m ai d) A ss et 0 Asset allocation: Own last year’s runner-up asset class during the following year… 2015 Bridesmaid Year S&P 500 Total Return 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2014 Total Return REITs (NAREIT Index) 27.1 % S&P 500 13.7 10-Yr. U.S. Treasury Bonds 10.7 Russell 2000 4.9 Gold -0.2 MSCI EAFE -4.5 Commodities (GSCI) -33.1 © 2015 The Leuthold Group 1973-2014, Annualized Total Return Std. Deviation -14.7 % -26.5 37.2 23.8 -7.2 6.6 18.4 32.4 -4.9 21.4 22.5 6.3 32.2 18.5 5.2 16.8 31.5 -3.2 30.5 7.7 10.0 1.3 37.4 23.1 33.4 28.6 21.0 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.8 5.5 -37.0 26.5 15.1 2.1 16.0 32.4 13.7 Bridesmaid Asset Class Owned During Year Commodities Gold Commodities Large Caps REITs Gold EAFE Small Caps Large Caps Govt. Bonds REITs REITs REITs Large Caps Govt. Bonds Commodities Commodities Large Caps Govt. Bonds REITs REITs Small Caps Commodities Small Caps Commodities Small Caps EAFE EAFE REITs Govt. Bonds Gold EAFE EAFE Gold EAFE Gold Gold REITs REITs Gold EAFE Large Caps Large Caps 10.3 18.0 No. Years Matching Or Exceeding S&P 500: Correlation With S&P 500 Annual Returns: 28 Bridesmaid Strategy (Own Previous Year's Runner-Up Asset Class) Total Return 75.0 % 66.3 -17.2 23.8 19.1 37.0 6.2 38.6 -4.9 39.3 25.5 14.8 5.9 18.5 -2.2 27.9 38.3 -3.2 18.8 12.2 18.5 -1.8 20.3 16.5 -14.1 -2.5 27.4 -14.0 15.5 15.4 20.9 20.7 14.0 22.5 11.6 4.3 26.5 27.6 7.3 5.9 23.3 13.7 15.7 % 18.5 28/42 -0.10 “Bridesmaid” has been a winning sector strategy, too 2015 Bridesmaid S&P 500 Sectors Utilities Health Care Information Technology Consumer Staples Financials Industrials Consumer Discretionary Materials Telecom Services Energy S&P 500 © 2015 The Leuthold Group 2014 Total Return 29.0 % 25.3 20.1 16.0 15.2 9.8 9.7 6.9 3.0 -7.8 13.7 % S&P 500 Total Return 30.5 % 7.6 10.1 1.3 37.6 23.0 33.4 28.6 21.0 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.8 5.5 -37.0 26.5 15.1 2.1 16.0 32.4 13.7 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1991-2014 Annualized: Total Return Std. Deviation Bridesmaid Sector (Last Year's Second Best Sector) Consumer Staples Financials Consumer Discretionary Industrials Health Care Financials Financials Health Care Telecom Services Materials Health Care Consumer Discretionary Materials Materials Utilities Utilities Energy Materials Health Care Materials Industrials Consumer Staples Consumer Discretionary Health Care Health Care 10.2 % 18.4 % No. Yrs. Outperforming S&P 500: Correlation With S&P 500 (Annual Returns): Results assume annual rebalancing of S&P 500 sectors; numbers include dividends, but exclude transactions costs. 29 S&P 500 Sector Bridesmaid Strategy Total Return 41.7 % 23.3 14.6 -2.4 58.0 35.2 48.2 43.9 19.1 -15.7 -11.9 -23.8 38.2 13.2 16.8 21.0 34.4 -45.7 19.7 22.2 -0.6 10.8 42.9 25.3 14.9 % 24.8 % 15/24 0.94