10.8.8.30

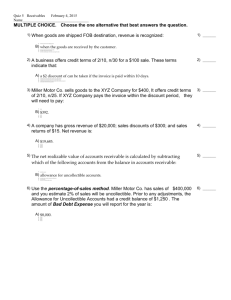

advertisement

Before Class starts….(make sure your name is on all submissions) Third Homework due 10/20(MW) or 10/21(TR) before class. Help Session 10/19 1:00-3:30pm in GBS130. Fourth Homework due 10/27(MW) or 10/28(TR) before class. Help session 10/26 1:00-3:30pm in GBS130 What questions do you have for me? – TA Office Hours 6-7 T&R in GBS401 & Accounting Lab Hours on http://bus.emory.edu/scrosso – File cabinet downstairs contains your mail folder. Your homework and exams returned there. BUS210 Cash and Accounts Receivable Percentage of Sales Method • Usually based on credit sales, but may use total sales or net sales as basis. • Calculation: Sales x % = Bad Debt Expense (focus on the debit side of the AJE) • Called the Income Statement approach, because: revenues x % = expense. • After making entry find the resulting ending balance in the Allowance account. P6-3 Bad debts over time The company estimates bad debts at 3% of credit sales. The beginning balance in the Allowance for doubtful accounts as of the beginning of 2013 was $10,000. Credit sales Actual bad debt write-offs 2015 2014 2013 $205,000 $200,000 $180,000 11,000 10,000 6,000 a. Provide the journal entries related to the Allowance account for all three years. P6-3 Bad debts over time The company estimates bad debts at 3% of credit sales. The beginning balance in the Allowance for doubtful accounts as of the beginning of 2013 was $10,000. Credit sales Actual bad debt write-offs 2015 2014 2013 $205,000 $200,000 $180,000 11,000 10,000 6,000 b. Compute the balance in the allowance account at 12/31/15. c. Comment on the sufficiency of the bad debts expense and the allowance over the 3 years. P6-4 Uncollectibles over two periods Company uses the percentage-of-net-sales method to account for bad debts. Historically, 3% of net sales have proven to be uncollectible. During 2014 and 2015: Gross sales Sales discounts Sales returns 2015 2014 $1,500,000 $1,800,000 100,000 130,000 50,000 20,000 a. Prepare the necessary adjusting entries on 12/31/14 to record the estimated bad debt expense. b. Assume the 1/1/2014 Allowance account balance was $65,000(credit) and that $70,000 in bad debts were written off during year. What is the 12/31/14 balance after adjustments. P6-4 Uncollectibles over two periods Company uses the percentage-of-net-sales method to account for bad debts. Historically, 3% of net sales have proven to be uncollectible. During 2014 and 2015: Gross sales Sales discounts Sales returns 2015 2014 $1,500,000 $1,800,000 100,000 130,000 50,000 20,000 c. Prepare the necessary adjusting entries on 12/31/15 to record the estimated bad debt expense. d. What is the 12/31/2015 Allowance balance? Assume that $85,000 in bad debts was written off during the year. Aging Method: Percentages of A/R • Based on ending A/R and ending Allowance account. • Calculation: Ending A/R x % = Ending Allowance (focus on the credit side of the AJE) • Called Balance Sheet approach, because: ending asset x % = ending contra asset. • Requires the analysis of the Allowance account and A/R before preparing the AJE. • An aging schedule of A/R is the most accurate way to estimate uncollectibles (see Figure 6-11). E6-10 Aging schedule preparation Compute the total receivables and expected bad debts as of the end of the year based on the following: Account age Balance Noncollection Probability $290,000 2% 1-45 days past due 110,000 5% 46-90 days past due 68,000 8% Over 90 days past due 40,000 15% Current Aging of AR Emory Company uses the accounts receivable aging method to estimate uncollectible accounts. At the beginning of the year, the balance of the Accounts Receivable account was a debit of $90,430, and the balance of Allowance for Uncollectible Accounts as a credit of $8,100. During the year, the company had sales on account of $475,000, sales returns and allowances of $6,200, worthless accounts written off of $8,800, and collections from customers of $452,730. At the end of year (December 31, 2015), a junior accountant for Emory Company was preparing an aging analysis of accounts receivable. At the top of page 5 of the report, the following totals appeared: Customer Account Total Balance Forward $89,640 Not Yet Due 1–30 Days Past Due 31–60 Days Past Due 61–90 Days Past Due Over 90 Days Past Due $49,030 $24,110 $9,210 $3,990 $3,300 To finish the analysis, the following accounts need to be classified: From past experience, the company has found that the following rates are realistic for estimating uncollectible accounts: Time Percentage Considered Uncollectible Not yet due 2 1–30 days past due 5 31–60 days past due 15 61–90 days past due 25 Over 90 days past due 50 Required Complete the aging analysis of accounts receivable. Compute the end-of-year balances (before adjustments) of Accounts Receivable and Allowance for Uncollectible Accounts. Prepare an analysis computing the estimated uncollectible accounts. Calculate Emory Company's estimated uncollectible accounts expense for the year (round the amount to the nearest whole dollar). What role do estimates play in applying the aging analysis? What factors might affect these estimates? Year-end Entries: Bad Debts • During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. • Omega Company's management uses two methods of estimating uncollectible accounts expense: the percentage of net sales method and the accounts receivable aging method. The percentage of uncollectible sales is 1.5 percent of net sales, and based on an aging of accounts receivable, the endof-year uncollectible accounts total $140,000. 1. Prepare the end-of-year adjusting entry to record the uncollectible accounts expense under each method. 2. What will the balance of Allowance for Uncollectible Accounts be after each adjustment? During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. Omega Company's management uses two methods of estimating uncollectible accounts expense: the percentage of net sales method and the accounts receivable aging method. The percentage of uncollectible sales is 1.5 percent of net sales, and based on an aging of accounts receivable, the end-ofyear uncollectible accounts total $140,000. 1. Prepare the end-of-year adjusting entry to record the uncollectible accounts expense under each method. 2. What will the balance of Allowance for Uncollectible Accounts be after each adjustment? 3. 4. Why are the results different? Which method is likely to be more reliable? Why? Write-off of Accounts Receivable Colby Company, which uses the allowance method, has Accounts Receivable of $65,000 and an allowance for uncollectible accounts of $6,400 (credit). The company sold merchandise to Irma Hegerman for $7,200 and later received $2,400 from Hegerman. The rest of the amount due from Hegerman had to be written off as uncollectible. Using T accounts, show the beginning balances and the effects of the Hegerman transactions on Accounts Receivable and Allowance for Uncollectible Accounts. What is the amount of net accounts receivable before and after the write-off? E6-8 Write-offs and Entries The company estimates bad debts each year at 2% of credit sales. End of the year amounts from the annual report are: 2015 2014 Credit sales $75,300 $61,500 Accounts receivable 9,400 9,200 Allowance for bad debts 1,300 1,000 55 70 Bad debt recoveries a. Compute the actual amount of write-offs during year. b. Infer the journal entries that explain the accounts receivable and the related allowance accounts activity during the year. Liquidity Ratios • Working Capital =CA-CL • Current Ratio = CA/CL • Quick Ratio or Acid Test Ratio = (CA-Inv & Prepaids)/CL How are these ratios affected by the journal entries you will learn this chapter? Sale on Account: Cash Collection: AR Writeoff: AR Recovery: Bad Debt AJE: P6-7 Ignoring Potential Bad Debts Income Statement Sales Cost of goods sold Balance Sheet $200,000 Cash 102,000 Accounts receivable Gross profit 98,000 Other assets Expenses 65,000 Total assets Net income $33,000 Current liabilities $5,000 85,000 40,000 $130,000 13,000 Long-term NP 80,000 SHE 37,000 Total L + SHE $130,000 The above financial information is for the Hadley Company’s first year of operation. The income statement was not adjusted for bad debt expense. A large percentage of sales were to 3 customers, one of which, Litzenberger Supply is in questionable financial health, although still in business. Litzenberger owes Hadley $50,000 as of the end of first year. P6-7 continued Required: a. Adjust the financial statements of Hadley Company to reflect a more conservative reporting with respect to bad debts, i.e. set up a provision. Recompute net income. How does this adjustment affect your assessment of Hadley’s first year of operations? b. Why would auditors probably require that Hadley choose the more conservative reporting? c. Hadley’s CFO claims that no bad debt expense should be recorded because Litzenberger is still conducting operations as of the end of year. How would you respond to this claim?