Investments & Receivables: Accounting Methods

advertisement

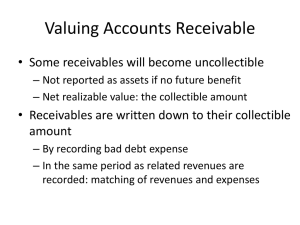

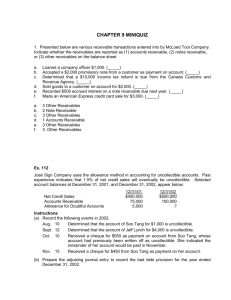

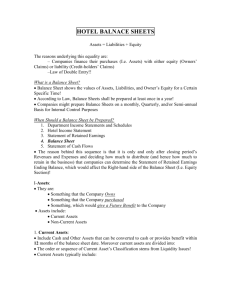

Ch.7 Investments & Receivables Chapter 7, Slide #1 Part I Investments (FYI only) Chapter 7, Slide #2 Types of Investments • • • • Investment in treasury bills Investment in a CD Investment in other companies’ bonds Investment in other companies’ stocks Chapter 7, Slide #3 Investment in a CD Example: On October 2, Apple invests $100,000 in a 120day CD. Principal plus interest @ 6% due upon investment maturity. Purchase of investment: Short-Term Investments—CD Cash 100,000 100,000 LO1 Investment in a CD Year-end adjusting entry: Interest Receivable Interest Revenue 1,500 1,500 Interest (I) = Principal (P) × Rate (R) × Time (T) $1,500 = $100,000 × 6% × 90/360 October – 29 days November – 30 days December – 31 days 90 days Investment in a CD Upon investment maturity: Cash Short-Term Investments—CD Interest Receivable Interest Revenue* 102,000 *Interest earned in January: $100,000 × 6% × 30/360 = $500 100,000 1,500 500 Reasons Companies Invest in Other Companies’ stocks Short-term cash excesses Long-term investing for future cash needs Exert influence over investee Obtain control of investee Chapter 7, Slide #7 Accounting for Common-Stock Investments Fair Value Method 0% Equity Method 20% No significant influence Our focus Appendix Chapter in 7, Slide #8 Significant influence Consolidated Financial Statements 100% 50% Control Part II Receivables Chapter 7, Slide #9 Credit Sales An effort to increase sales Slows inflow of cash Risk of uncollectible accounts Chapter 7, Slide #10 LO2 Apple’s Consolidated Balance Sheets (Partial) (amounts in millions) Accounts receivables, less allowances of $47 and $49, respectively 2004 2003 $774 $766 Net Realizable Value Chapter 7, Slide #11 Two accounting methods for bad debts • Direct write-off method • Allowance method Chapter 7, Slide #12 Direct Write-off Method Period of sale 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Future period charged with expense of bad debt write-off 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Journal entry to record write-off in period determined to be uncollectible: Bad Debts Expense XXX Accounts Receivable—Dexter XXX Chapter 7, Slide #13 Allowance Method (acceptable under GAAP) Estimated bad debt expense (and allowance account) recorded in the same period Period of sale Chapter 7, Slide #14 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Accounting for Bad Debts: Allowance Method Journal entry to record estimated bad debt expense in period of sale: Bad Debts Expense 6,000 Allowance for Doubtful Accounts 6,000 I estimate... Chapter 7, Slide #15 Balance Sheet Presentation – Allowance Method Roberts Corp. Partial Balance Sheet Accounts receivable Less: Allowance for doubtful accounts Net accounts receivable Chapter 7, Slide #16 $250,000 6,000 $244,000 Accounting for Bad Debts: Allowance Method Journal entry to record bad debt write-off of customer John’s account for $320 in period determined uncollectible: Allowance for Doubtful Accounts 320 Accounts Receivable—Dexter Bankrupt Chapter 7, Slide #17 320 Approaches to Allowance Method % of Net Credit Sales Income Statement Approach % of Accounts Receivable – Aging Method Chapter 7, Slide #18 Balance Sheet Approach Percentage of Net Credit Sales Method Example: 2007 Net credit sales Bad debt percentage Bad debts expense $2,340,000 (given) 2% $ 46,800 Journal entry: Bad Debts Expense 46,800 Allowance for Doubtful Accounts 46,800 Chapter 7, Slide #19 Aging Method Category Amount Current $ 85,600 Past due: 1–30 days 31,200 31–60 days 24,500 61–90 days 18,000 90+ days 9,200 Totals $168,500 Estimated Percent Estimated Amount Uncollectible Uncollectible 1% $ 856 4% 10% 30% 50% 1,248 2,450 5,400 4,600 $14,554 Aging Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $1,230: Credit balance required in allowance account after adjustment Less: Credit balance in allowance account before adjustment Amount for bad debt expense entry Chapter 7, Slide #21 $14,554 1,230 $13,324 Aging Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $1,230: Journal entry: Bad Debts Expense 13,324 Allowance for Doubtful Accounts 13,324 To record estimated bad debts. Chapter 7, Slide #22 Aging Method The net realizable value of accounts receivable would be determined as follows: Accounts receivable $168,500 Less: Allowance for doubtful accounts 14,554 Net realizable value $153,946 Chapter 7, Slide #23 Part III Notes receivables Chapter 7, Slide #24 Interest-Bearing Promissory Note Principal On Dec. 13, 2006, High Tech Company sold merchandise inventory to Baker Corporation in exchange for a $15,000,12% promissory note which matures on March 13, 2007. Interest Date: December 13, 2007 Baker Corporation Signed:_________ Chapter 7, Slide #25 Maturity Date LO4 Interest-Bearing Promissory Note Journal entry to record the receipt of the note on December 13: Notes Receivable 15,000 Sales Revenue 15,000 Chapter 7, Slide #26 Interest-Bearing Promissory Note Adjusting entry to record interest: Interest Receivable 90 Interest Revenue *Interest = $15,000 × 12% × 18/360 Chapter 7, Slide #27 90* Interest-Bearing Promissory Note Journal entry to record the collection of the note on March 13, 2008: Cash 15,450 Notes Receivable 15,000 Interest Revenue 360* Interest Receivable 90 *15,000 × 12% × 72/360 Chapter 7, Slide #28