The Long Run Impact of Cash Transfers to Poor Families

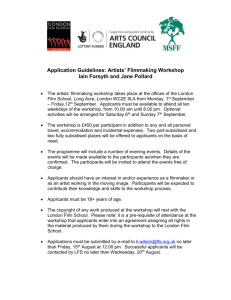

advertisement