HFR INDICES - BASIC METHODOLOGY AND FAQ What

advertisement

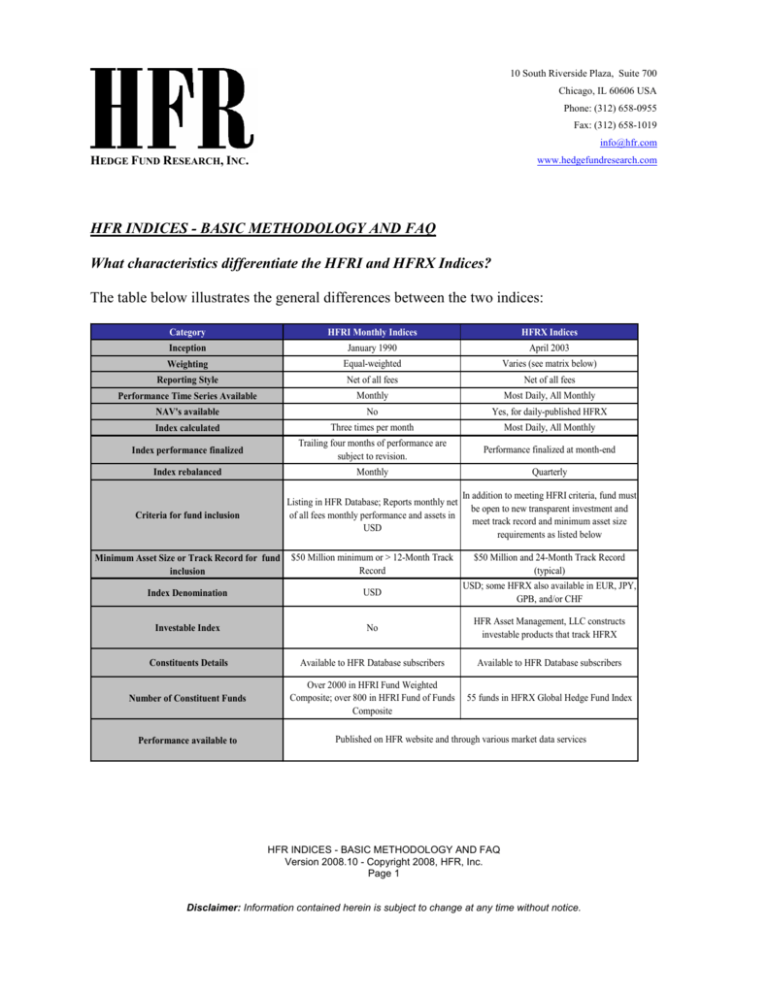

10 South Riverside Plaza, Suite 700 Chicago, IL 60606 USA Phone: (312) 658-0955 Fax: (312) 658-1019 info@hfr.com HEDGE FUND RESEARCH, INC. www.hedgefundresearch.com HFR INDICES - BASIC METHODOLOGY AND FAQ What characteristics differentiate the HFRI and HFRX Indices? The table below illustrates the general differences between the two indices: Category HFRI Monthly Indices HFRX Indices Inception January 1990 April 2003 Varies (see matrix below) Weighting Equal-weighted Reporting Style Net of all fees Net of all fees Performance Time Series Available Monthly Most Daily, All Monthly NAV's available No Yes, for daily-published HFRX Index calculated Three times per month Most Daily, All Monthly Index performance finalized Trailing four months of performance are subject to revision. Performance finalized at month-end Index rebalanced Monthly Quarterly Criteria for fund inclusion Listing in HFR Database; Reports monthly net of all fees monthly performance and assets in USD In addition to meeting HFRI criteria, fund must be open to new transparent investment and meet track record and minimum asset size requirements as listed below Minimum Asset Size or Track Record for fund inclusion $50 Million minimum or > 12-Month Track Record Index Denomination USD Investable Index No HFR Asset Management, LLC constructs investable products that track HFRX Constituents Details Available to HFR Database subscribers Available to HFR Database subscribers Number of Constituent Funds Over 2000 in HFRI Fund Weighted Composite; over 800 in HFRI Fund of Funds Composite 55 funds in HFRX Global Hedge Fund Index Performance available to $50 Million and 24-Month Track Record (typical) USD; some HFRX also available in EUR, JPY, GPB, and/or CHF Published on HFR website and through various market data services HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 1 Disclaimer: Information contained herein is subject to change at any time without notice. Describe the HFRX Indices methodology and construction The HFRX Indices (“HFRX”) are a series of benchmarks of hedge fund industry performance which are engineered to achieve representative performance of a larger universe of hedge fund strategies. Hedge Fund Research, Inc. (“HFR, Inc.”) employs the HFRX Methodology, a proprietary and highly quantitative process by which hedge funds are selected as constituents for the HFRX Indices. This methodology includes robust classification, cluster analysis, correlation analysis, advanced optimization and Monte Carlo simulations. More specifically, the HFRX Methodology defines certain qualitative characteristics, such as: whether the fund is open to transparent fund investment and the satisfaction of the index manager’s due diligence requirements. Production of the HFRX Methodology results in a model output which selects funds that, when aggregated and weighted, have the highest statistical likelihood of producing a return series that is most representative of the reference universe of strategies. Constituents of HFRX Indices are selected and weighted by the complex and robust process described above. The model output constitutes a sub-set of strategies which are representative of a larger universe of hedge fund strategies, geographic constituencies or groupings of funds maintaining certain specific characteristics. In order to be considered for inclusion in the HFRX Indices, a hedge fund must be currently open to new transparent investment, maintain a minimum asset size (typically $50 Million) and meet the duration requirement (generally, a 24 month track record). These criteria may vary slightly by index. Describe the HFRI Monthly Indices methodology and construction The HFRI Monthly Indices (“HFRI”) are a series of benchmarks designed to reflect hedge fund industry performance by constructing equally weighted composites of constituent funds, as reported by the hedge fund managers listed within HFR Database. The HFRI range in breadth from the industry-level view of the HFRI Fund Weighted Composite Index , which encompasses over 2000 funds, to the increasingly specific-level of the sub-strategy classifications. In order to be considered for inclusion in the HFRI, a hedge fund manager must submit a complete set of information to HFR Database (the listing of required fields for Database inclusion are available here). Funds are eligible for inclusion in the HFRI the performance a month after their addition to HFR Database. For instance, a fund that is added to HFR Database in June is eligible for HFRI inclusion starting with July performance. Additionally, all HFRI constituents are required to report monthly, net of all fees performance and assets under management U.S. dollars. Constituent funds must have either (a) $50 million under management or (b) a track record of greater than twelve (12) months. HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 2 Disclaimer: Information contained herein is subject to change at any time without notice. The HFRI are fund-weighted (equal-weighted) indices. Unlike asset-weighting, the equalweighting of indices presents a more general picture of performance of the hedge fund industry. Any bias towards the larger funds potentially created by alternative weightings is greatly reduced, especially for strategies that encompass a small number of funds. Are either of the HFRI or HFRX Indices investable? HFRI: The HFRI Indices are equally weighted performance composites and are not investable through Hedge Fund Research, Inc. or any affiliated companies. HFRX: The HFRX Indices not investable through Hedge Fund Research but are investable through Tracker Funds which are constructed by HFR Asset Management, LLC, a registered investment adviser and asset management company. Performance data on the investable products is only available through HFR Asset Management, LLC. Performance data available through Hedge Fund Research, Inc. is a model output and not the performance of the investable products. How do I obtain a list of constituents for the HFRI and HFRX Indices? The constituent funds of the HFRI Monthly Indices are currently available within the subscription-based HFR Database. Information on the underlying constituents of the HFRX Indices is currently available to investors of the HFRX Tracker products, as well as to HFR Database subscribers. How do I subscribe to the HFR Database? Contact HFR at 312-658-0955 or database@hfr.com How often is index performance updated? HFRI: Three-times-per-month: (1) The “Flash” update is published on the fifth business day of the month; (2) The “mid-month” update is published on 15th of the month (or nearest business day); and (3) the “month-end” update is published on the first business day of the following month. Additionally, the trailing four months of performance are subject to revision as HFR receives updates from lagged funds. HFRX: Daily performance is available for some, but not all, HFRX Indices. The update frequency of HFRX Index performance can vary by product but all HFRX Indices provide monthly performance returns. HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 3 Disclaimer: Information contained herein is subject to change at any time without notice. How often are funds added to the indices? HFRI: Funds are added to the HFRI on a regular basis as HFR identifies candidates for inclusion. HFRX: Funds are typically added to the HFRX on a quarterly basis as a result of the HFRX Methodology model. When is a fund removed from the HFRI or HFRX Index and how is survivorship bias taken into consideration? A fund will be removed from an Index when: (a) it liquidates, (b) the fund manager requests removal from the Database, or (c) it fails to satisfy the requirements for constituency (outlined above). However, a fund’s past performance will always remain in its respective index up until the point of liquidation or manager-requested removal from HFR Database. In an effort to limit survivorship bias, HFR exhausts all efforts to receive a fund’s performance until the point of final liquidation. This convention provides the most robust characterization of results possible. Likewise, when a new fund is added to either Index, the historical performance of the new constituent fund will not affect the finalized historical performance of either index. And while the HFRX are finalized upon the date reported, the HFRI are subject to revisions for the trailing four months, although index results are unlikely to be meaningfully impacted by submissions later than 30 days from the end of the performance month. If a non-liquidated fund does not report to HFR Database for three consecutive months, the fund is subject to removal from the HFRI. Is it possible for a fund to be a constituent of multiple indices? HFRI: Constituent funds are included in only one strategy-level index; however, all singlemanager constituents are included in the HFRI Fund Weighted Composite and all fund of funds are included in the HFRI Fund of Funds Composite Index. HFRX: Constituent funds are included in only one strategy-level index; however, most constituents are also included in the HFRX Global and HFRX Equal-Weighted composite indices. HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 4 Disclaimer: Information contained herein is subject to change at any time without notice. What are the limitations on references to and distribution of HFRI and HFRX Index data? The HFRI and HFRX are both produced as benchmarks of hedge fund industry performance and are intended to be utilized as points of reference for relevant hedge fund products. Specific guidelines are available in the HFR Terms of Use Agreement. Usage or distribution of the HFRI or the HFRX in a commercial format, for public distribution, or for inclusion in products (as a component of a commercially distributed research report, project or textbook) can only be made available with specific authorization from Hedge Fund Research, Inc. Please direct inquiries to info@hfr.com or call 312-658-0955. Does a commercial arrangement exist between HFR and the hedge fund managers which report performance of their funds? Reporting results to HFR Database is voluntary and managers are not compensated financially for their inclusion. Likewise, managers submit their fund and firm information to HFR Database and become visible to HFR Database subscribers at no charge. Are submissions of performance results audited? HFR makes every effort to ensure performance results are accurate and comply with reporting requirements. Although not required, many hedge fund managers voluntarily provide HFR with fund offering documents and audited financial statements as a testament to their integrity. Internal procedures that identify and correct infrequent data errors are utilized. Hedge fund managers are solely responsible for reporting accurate and timely information to HFR. Since participation in HFR Database is voluntary, as well as for practical reasons, HFR does not perform an independent financial audit of the funds contained in HFR Database. HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 5 Disclaimer: Information contained herein is subject to change at any time without notice. HFRX Indices Weighting Matrix HFRX Index Index Weighting HFRX GLOBAL INDICES HFRX Global Hedge Fund Index HFRX Equal Weighted Strategies Index Representative Optimization Equal-weighted HFRX Absolute Return Index Representative Optimization HFRX Market Directional Index Representative Optimization HFRX STRATEGY INDICES HFRX Convertible Arbitrage Index Representative Optimization HFRX Distressed Securities Index Representative Optimization HFRX Equity Hedge Index Representative Optimization HFRX Equity Market Neutral Index Representative Optimization HFRX Event Driven Index Representative Optimization HFRX Macro Index Representative Optimization HFRX Merger Arbitrage Index Representative Optimization HFRX Relative Value Arbitrage Index Representative Optimization HFRX Volatility Index (Monthly) Representative Optimization HFRX GLOBAL AND CURRENCY INDICES HFRX Global Hedge Fund EUR Index Representative Optimization HFRX Global Hedge Fund JPY Index Representative Optimization HFRX Global Hedge Fund CHF Index Representative Optimization HFRX Global Hedge Fund GBP Index Representative Optimization HFRX Equal Weighted Strategies EUR Index Equal-weighted HFRX Equal Weighted Strategies JPY Index Equal-weighted HFRX Equal Weighted Strategies CHF Index Equal-weighted HFRX Equal Weighted Strategies GBP Index Equal-weighted Representative Optimization defined as: Constituents weighted according to HFRX Methodology in order to achieve representative performance of a larger universe of hedge funds. HFR INDICES - BASIC METHODOLOGY AND FAQ Version 2008.10 - Copyright 2008, HFR, Inc. Page 6 Disclaimer: Information contained herein is subject to change at any time without notice.