Coca-Cola Co. Financial Statements, 2012 - it

advertisement

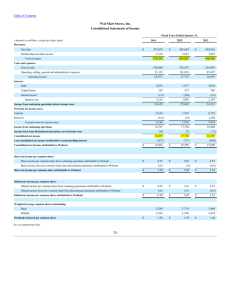

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Year Ended December 31, 2012 2011 $ NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses Other operating charges OPERATING INCOME 48,017 19,053 28,964 447 10,779 471 397 819 137 INCOME BEFORE INCOME TAXES 11,809 Income taxes 2,723 CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 9,086 67 46,542 18,215 28,327 17,422 $ 732 10,173 35,119 12,693 22,426 13,194 819 8,413 483 317 417 733 690 529 11,458 2,812 8,646 62 1,025 5,185 14,207 2,370 11,837 50 $ 9,019 $ 8,584 $ 11,787 $ 2.00 $ 1.88 $ 2.55 1.97 $ 1.85 4,568 78 4,646 $ 2.53 4,616 51 4,667 1 DILUTED NET INCOME PER SHARE 1 $ AVERAGE SHARES OUTSTANDING Effect of dilutive securities AVERAGE SHARES OUTSTANDING ASSUMING DILUTION 1 $ 17,738 Interest income Interest expense Equity income (loss) — net Other income (loss) — net BASIC NET INCOME PER SHARE 2010 As Adjusted (In millions except per share data) 4,504 80 4,584 Calculated based on net income attributable to shareowners of The Coca-Cola Company. Refer to Notes to Consolidated Financial Statements. 79 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Ended December 31, 2012 2011 2010 As Adjusted (In millions) $ CONSOLIDATED NET INCOME Other comprehensive income: Net foreign currency translation adjustment Net gain (loss) on derivatives Net unrealized gain (loss) on available-for-sale securities Net change in pension and other benefit liabilities 9,086 $ (182) 178 (668) 8,513 105 $ Refer to Notes to Consolidated Financial Statements. 80 8,408 $ (692) 145 (7) (763) 7,329 99 TOTAL COMPREHENSIVE INCOME Less: Comprehensive income (loss) attributable to noncontrolling interests TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 8,646 (947) (120) 102 282 11,154 38 10 $ 7,319 11,837 $ 11,116 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2012 December 31, 2011 As Adjusted (In millions except par value) ASSETS CURRENT ASSETS Cash and cash equivalents $ Short-term investments TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $53 and $83, respectively 8,442 5,017 $ 13,459 3,092 4,759 3,264 2,781 2,973 Inventories Prepaid expenses and other assets Assets held for sale TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS, PRINCIPALLY BOTTLING COMPANIES OTHER ASSETS PROPERTY, PLANT AND EQUIPMENT — net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES 144 30,328 9,216 1,232 3,585 14,476 6,527 7,405 12,255 1,150 GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; Authorized — 11,200 shares; Issued — 7,040 and 7,040 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost — 2,571 and 2,514 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Refer to Notes to Consolidated Financial Statements. 81 $ $ 86,174 $ 8,680 $ 4,920 3,092 3,450 — 25,497 7,233 1,141 3,495 14,939 6,430 7,770 12,219 1,250 79,974 4,981 9,009 12,871 2,041 362 — 24,283 13,656 5,420 4,694 1,760 11,379 10,332 16,297 1,577 471 796 27,821 14,736 5,468 1,760 58,045 (3,385) (35,009) 32,790 378 33,168 $ 12,803 1,088 13,891 86,174 $ 53,621 (2,774) (31,304) 31,635 286 31,921 79,974 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended December 31, 2012 2011 2010 As Adjusted (In millions) OPERATING ACTIVITIES Consolidated net income Depreciation and amortization Stock-based compensation expense $ 9,086 $ 1,982 259 632 Deferred income taxes Equity (income) loss — net of dividends Foreign currency adjustments Significant (gains) losses on sales of assets — net Other significant (gains) losses — net Other operating charges Other items Net change in operating assets and liabilities (98) — 254 (1,080) (1,893) 9,474 10,645 (9,590) (5,266) 2,189 (2,780) 143 (187) (11,404) (3,347) 27,495 (22,530) 1,569 (4,513) (4,300) 45 (2,234) (255) (430) 42,791 (38,573) 1,489 (4,559) (4,595) 100 (4,361) 12,803 Refer to Notes to Consolidated Financial Statements. 82 8,442 370 9,532 (4,057) 5,647 (977) (787) 562 (2,920) 101 (93) (2,524) 5,622 (1,535) $ (671) 151 (645) (4,713) 264 512 214 (354) 166 $ 4,286 8,517 12,803 11,837 1,443 380 604 1,035 (269) 7 (220) — (130) INVESTING ACTIVITIES Purchases of short-term investments Proceeds from disposals of short-term investments Acquisitions and investments Purchases of other investments Proceeds from disposals of bottling companies and other investments Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Other investing activities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities Net cash provided by (used in) financing activities EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS Net increase (decrease) during the year Balance at beginning of year Balance at end of year $ 354 (426) Net cash provided by operating activities 8,646 1,954 (4,579) 4,032 (2,511) (132) 972 (2,215) 134 (106) (4,405) 15,251 (13,403) 1,666 (2,961) (4,068) 50 (3,465) (166) $ 1,496 7,021 8,517 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY Year Ended December 31, 2012 2011 2010 As Adjusted (In millions except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NUMBER OF COMMON SHARES OUTSTANDING 4,583 4,526 Balance at beginning of year (121) Purchases of treasury stock Treasury stock issued to employees related to stock compensation plans Balance at end of year COMMON STOCK $ 4,605 (98) (127) 64 70 76 4,469 4,526 4,583 1,760 $ 1,760 $ 1,760 CAPITAL SURPLUS Balance at beginning of year Stock issued to employees related to stock compensation plans 10,332 9,177 640 724 7,657 855 237 — — Tax benefit (charge) from employees' stock option and restricted stock plans 144 79 48 Stock-based compensation 259 354 380 Replacement share-based awards issued in connection with an acquisition 4 Other activities Balance at end of year — (2) 11,379 10,332 9,177 53,621 9,019 49,337 (4,595) 8,584 (4,300) 41,618 11,787 (4,068) 58,045 53,621 49,337 (2,774) (1,509) (1,265) (838) (611) (3,385) (2,774) (1,509) (31,304) (27,762) REINVESTED EARNINGS Balance at beginning of year Net income attributable to shareowners of The Coca-Cola Company Dividends (per share — $1.02, $0.94 and $0.88 in 2012, 2011 and 2010, respectively) Balance at end of year ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Balance at beginning of year Net other comprehensive income (loss) Balance at end of year (671) TREASURY STOCK Balance at beginning of year (4,491) (4,372) (25,398) 824 (3,188) (35,009) (31,304) (27,762) 830 786 Stock issued to employees related to stock compensation plans Purchases of treasury stock Balance at end of year TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY $ 32,790 $ 31,635 $ 31,003 $ 286 $ 314 $ 547 EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Balance at beginning of year Net income attributable to noncontrolling interests 67 62 50 Net foreign currency translation adjustment 38 (52) (12) Dividends paid to noncontrolling interests (48) (38) (32) Acquisition of interests held by noncontrolling owners (15) — — — — — Contributions by noncontrolling interests — Increase due to business combinations 50 — Deconsolidation of certain variable interest entities TOTAL EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Refer to Notes to Consolidated Financial Statements. 83 $ 378 $ 286 1 13 (253) $ 314