ACCT 4023 Advanced Accounting Syllabus - University of Arkansas

advertisement

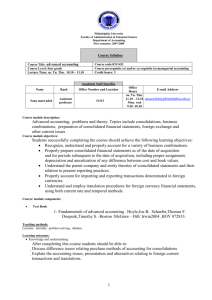

University of Arkansas − Fort Smith 5210 Grand Avenue P. O. Box 3649 Fort Smith, AR 72913−3649 479−788−7000 General Syllabus ACCT 4023 Advanced Accounting Credit Hours: 3 Lecture Hours: 3 Laboratory Hours: Prerequisite: ACCT 3013 Intermediate Accounting II and Admission to the College of Business or consent of instructor Effective Semester: Fall 2007 I. Course Information A. Catalog Description Advanced study of accounting concepts and problems in the areas of business combinations, partnerships, and international accounting. II. Student Learning Outcomes A. Subject Matter Upon successful completion of this course, the student will be able to: 1. Account for equity investments using the cost, fair value and equity methods of accounting. 2. Understand the differences in the financial statements between consolidations under the purchase method and the pooling-of-interest method. 3. Account for goodwill and the potential impairment of goodwill. 4. Prepare consolidated financial statements for related entities. 5. Understand the interim and segment reporting rules and the related disclosures that are required. 6. Account for foreign currency transactions and hedges and be able to restate financial information into the US dollar. 7. Be acquainted with standard setting processes and financial accounting and reporting requirements in other countries. 8. Understand financial accounting for partnerships. B. University Learning Outcomes This course enhances student abilities in the following areas: Communication Skills Read and comprehend information, express ideas effectively in written and spoken form, and listen effectively. Global and Cultural Perspectives Understand international accounting differences due to cultural differences. Analytical Skills Identify problems, isolate its components, organize information for decision making, establish criteria for evaluation and draw appropriate conclusions. Quantitative Reasoning Read and analyze numerical data, create models, draw inferences, and support conclusions. III. Major Course Topics A. B. C. D. E. F. G. H. I. J. K. L. M. The Equity Method of Accounting for Investments Consolidated Financial Information Consolidations – Subsequent to the Date of Acquisition Consolidated Financial Statements and Outside Ownership Intercompany Asset Transactions Variable Interest Entities, Intercompany Debt, and Consolidated Cash Flows Segment and Interim Reporting Foreign Currency Transactions and Hedging Foreign Exchange Risk Translation of Foreign Currency Financial Statements Worldwide Accounting Diversity and International Standards Financial reporting and the SEC Partnerships: Formation and Operations Partnerships: Termination and Liquidation