Chapter 1 Objectives, Vocabulary and Key Points

advertisement

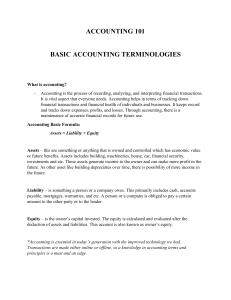

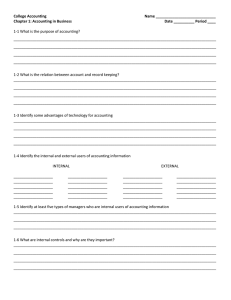

CP ACCOUNTING Introduction to Accounting PERFORMANCE OBJECTIVES 1. 2. 3. 4. Define accounting. Explain the importance of accounting information. Describe the various career opportunities in accounting. Define ethics. KEY POINTS 1. Accounting is the language of business. 2. The study of accounting gives a person the necessary background and understanding of the scope, functions, and policies of an organization. 3. Ethics, as it relates to accounting, is the way keepers of financial information conduct the business of accounting according to laws of the state and their own personal system of morality. Introduction to Accounting Vocabulary (page 10): Accountant Accounting Economic Unit Ethics Financial Accounting Standards Board (FASB) Generally Accepted Accounting Principles (GAAP) International Accounting Standards Board (IASB) International Financial Reporting Standards (IFRS) Paraprofessional Accountants Sarbanes-Oxley Act Securities & Exchange Commission (SEC) Transaction Chapter 1: Asset, Liability, Owner’s Equity, Revenue and Expense Accounts PERFORMANCE OBJECTIVES 1. Define and identify asset, liability and owner’s equity accounts. 2. Record, in column form, a group of business transactions involving changes in assets, liabilities and owner’s equity. 3. Define and identify revenue and expense accounts. 4. Record, in column form, a group of business transactions involving all five elements of the fundamental accounting equation. Introduction to Accounting/Chapter 1 olivo CP ACCOUNTING KEY POINTS 1. There are five classifications of accounts: assets, liabilities, owner’s equity, revenue and expenses. 2. After each transaction has been recorded, the total of one side of the fundamental accounting equation must equal the total of the other side. Chapter 1 Vocabulary (page 36) Account Numbers Accounts Accounts Payable Accounts Receivable Assets Business Entity Capital Chart of Accounts Creditor Double-entry Accounting olivo Equity Expenses Fair Market Value Fundamental Accounting Equation Liabilities Owner’s Equity Revenues Separate Entity Concept Sole Proprietorship Withdrawal 04/10/13