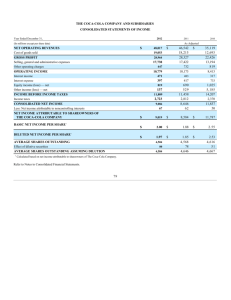

Annual Report 2012 - Coca

advertisement