Advanced Accounting Chapter 7: Accounting for Uncollectible

advertisement

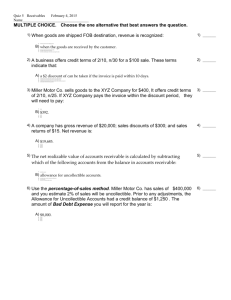

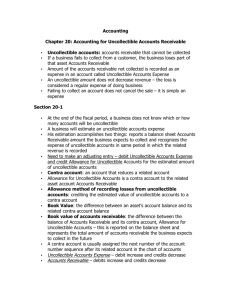

Advanced Accounting Chapter 7: Accounting for Uncollectible Accounts • • • • • • • • Many business transactions are completed on account (charged) instead of in cash Offer credit to: attract new customers, increase sales to current customers, encourage customer loyalty BUT before offer credit should investigate creditworthiness – run a credit report Some customers won’t pay when account due – uncollectible accounts or bad debts The amount owed remains recorded in the Account Receivable asset account until it is paid or specifically known to be uncollectible When a customer account is believed to by uncollectible, it is no longer as asset An uncollectible account should be cancelled and removed from the assets of the business – writing off an account Sometimes a written off account is collected, so the balance is restored and the receipt of cash is recorded Section 1: Direct Write-off method of Recording Uncollectible Accounts • • • • An amount owed by a specific customer is part of the accounts receivable account balance until it is paid or written off as uncollectible An uncollectible account is closed by transferring the balance to a general ledger account – Uncollectible Accounts Expense Direct Write-off Method of recording losses from uncollectible accounts: recording uncollectible accounts expense only when an amount is actually known to be uncollectible o In General Journal, debit Uncollectible Accounts Expense, and credit both Accounts Receivable and the individual customer account. o When posting, need to post to both AR and the customer account, in the customer account need to put the words “written off” in the description area Sometimes a person who has been written-off will pay later – so the amount is recorded as Other Revenue • • Collecting a written-off account using the direct write-off method o Record an entry in the general journal to debit Accounts Receivable/customer name and credit Collection of Uncollectible Accounts for the amount of the receipt o Record an entry on the cash receipts journal to debit Cash and credit Accounts Receivable for the amount of the receipt. The account Collection of Uncollectible Accounts is closed to Income Summary at eh end of the fiscal period and is reported on an income statement as part of Other Revenue Section 2: Allowance Method of Recording Uncollectible Accounts Expense • • • • • • • • • • Problem with direct write-off method is that an expense may be recorded in a fiscal period different from the fiscal period of the sale Uncollectible accounts expense should be recorded in the same fiscal period in which the ales revenue is recorded But, until an account is known to be bad, don’t really know how many are going to go bad As a result will use an estimation based on previous years experience with uncollectible accounts Two methods: percentage of sales method or percentage of accounts receivable method Percentage of sales method assumes that a percentage of each sales dollar will become an uncollectible account Percentage of accounts receivable method assumes that a percentage of accounts receivable at the end of the fiscal period will become uncollectible Either way, the amount calculated is charged to Uncollectible Accounts Expense Estimating Uncollectible Accounts Expense by using the Percentage of Sales method o Compute the estimated uncollectible accounts expense by multiplying net sales by the percentage estimate o Record an adjustment on the work sheet, recording a debit to Uncollectible Accounts Expense and a credit to Allowance for Uncollectible Accounts Percentage of Accounts Receivable Method utilizes a concept called aging accounts receivable The older the account the less likely it will be collected o Each time period used is given a percentage of unlikelihood of collection and each must be calculated separately then added together to determine the amount deemed uncollectible Estimating the balance of uncollectible accounts expense using the percentage of accounts receivable method o Compute the estimate for each age group. Multiply the amount of each age group by the percentage estimate o Compute the total of the uncollectible estimates o Subtract the current balance from the total estimate to determine the addition to the allowance account. (If the allowance account has a debit balance, add the current balance to the total estimate) Procedures for writing off an account are the same regardless of the allowance method used When a specific customer account is thought to be uncollectible, the account balance is written off by: o In the General Journal: debit Allowance for Uncollectible Accounts and credit both Accounts Receivable and the Customer Account The balance is no longer estimated to be uncollectible it is actually determined to be uncollectible Uncollectible Accounts Expense is not affected when a business writes off an account using the allowance method. Journalizing the collection of a written-off account – allowance method o Reopen the account by debiting Accounts Receivable and Customer account and credit Allowance for Uncollectible Accounts o Record an entry in the cash receipts journal to debit cash and credit Accounts Receivable and the customer account for the amount of the receipt o • • • • • • Section 3: Accounts Receivable Turnover Ratio • • If a business does not collect amounts due from customers promptly, too large a share of the assets are tied up in Accounts Receivable and not usable Accounts Receivable Turnover Ratio: the number of times the average amount of accounts receivable is collected during a specified period • • • • • Book value of accounts receivable: the difference between the balance of Accounts Receivable and its contra account, Allowance for Uncollectible Accounts Average days required to pay: 365/accounts turnover ratio Calculating the accounts receivable turnover ratio and average number of days for payment o Compute the beginning and ending book value of accounts receivable o Compute the average book value of accounts receivable by adding the beginning book value to the ending book value and dividing the total by 2 o Compute the accounts receivable turnover ratio by dividing net sales on account by the average book value of accounts receivable o Computer the average number of days for payment by dividing 365 days by the accounts receivable turnover ratio Steps to take to create a more favorable accounts receivable turnover ratio o Send statements out more often, with requests from prompt payment o Not sell on account to anyone who has an account more than 30 days past due o Encourage more cash sales and fewer sales on account o Conduct more rigorous credit checks on new customers Sometimes the demand for quicker payment can result in the loss of customers, so need to balance service with payment demands