Accounting Chapter 20: Accounting for Uncollectible Accounts

advertisement

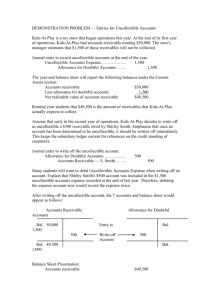

Accounting Chapter 20: Accounting for Uncollectible Accounts Receivable • • • • • Uncollectible accounts: accounts receivable that cannot be collected If a business fails to collect from a customer, the business loses part of that asset Accounts Receivable Amount of the accounts receivable not collected is recorded as an expense in an account called Uncollectible Accounts Expense An uncollectible amount does not decrease revenue – the loss is considered a regular expense of doing business Failing to collect an account does not cancel the sale – it is simply an expense Section 20-1 • • • • • • • • • • • • At the end of the fiscal period, a business does not know which or how many accounts will be uncollectible A business will estimate an uncollectible accounts expense His estimation accomplishes two things: reports a balance sheet Accounts Receivable amount the business expects to collect and recognizes the expense of uncollectible accounts in same period in which the related revenue is recorded Need to make an adjusting entry – debit Uncollectible Accounts Expense and credit Allowance for Uncollectible Accounts for the estimated amount of uncollectible accounts Contra account: an account that reduces a related account Allowance for Uncollectible Accounts is a contra account to the related asset account Accounts Receivable Allowance method of recording losses from uncollectible accounts: crediting the estimated value of uncollectible accounts to a contra account Book Value: the difference between an asset’s account balance and its related contra account balance Book value of accounts receivable: the difference between the balance of Accounts Receivable and its contra account, Allowance for Uncollectible Accounts – this is reported on the balance sheet and represents the total amount of accounts receivable the business expects to collect in the future A contra account is usually assigned the next number of the account number sequence after its related account in the chart of accounts Uncollectible Accounts Expense – debit increase and credits decrease Accounts Receivable – debits increase and credits decrease • • • • Allowance for Uncollectible Accounts – debits decrease and credits increase Use a percentage of total sales on account to estimate uncollectible accounts expense – assumes a portion of every sales on account dollar will become uncollectible o Total sales on account x percentage (based on past experience) = estimated uncollectible accounts expense Analyzing and journalizing an adjustment for uncollectible accounts o Enter estimated uncollectible amount in adjustments credit column in the Allowance for Uncollectible Accounts line and label with a small letter o Enter same amount in debit column of Uncollectible Accounts Expense line in adjustments columns and label o Use debit and credit amounts to record in general journal and then post to general ledger accounts To determine book value of Accounts Receivable o Accounts Receivable – balance of Allowance for Uncollectible Accounts = book value of Accounts Receivable Section 20-2 • • • • Writing off an account – canceling the balance of a customer account because the customer does not pay Journal entry to write off in General Journal o Debit Allowance for Uncollectible Accounts o Credit Accounts Receivable and individual customer account o Post the debits an credits and also write “Written Off” on line of customer account Reopen an account that was written off in General Journal o Debit Accounts Receivable and individual customer account o Credit Allowance for Uncollectible Accounts o Also need to record the cash received in the Cash Receipts Journal – need to credit Accounts Receivable and debit cash with customer’s name entered in account title Post entries for collecting a previously written off account receivable o Post General Journal entry to general ledger o Post debit of General Journal entry to customer account o Write “Reopen account” in customer account o Post cash receipts journal to customer account