ACCT641 Corpora porting.Sheila Bedford

advertisement

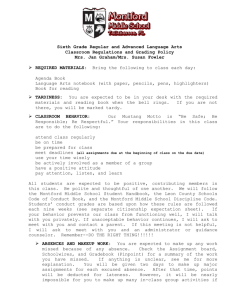

COURSE NUMBER: TERM: COURSE TITLE: CLASS TIME: CLASS LOCATION: ACCT 641 Spring 2009 Corporate Financial Reporting Wednesday 8:10-10:40 p.m. KSB 118 INSTRUCTOR: OFFICE: PHONE: EMAIL: OFFICE HOURS: Sheila Bedford, CPA, MBA Hurst 9 202-885-3910 bedford@american.edu (Preferred method of communication) Tuesday 3:15-5:15 p.m. Wednesday 1:00-5:00 p.m. And by appointment CLASS MATERIALS: Required Text Intermediate Accounting, Fifth Edition, by David Spiceland, James Sepe, Mark Nelson and Lawrence Tomassini, McGraw-Hill, 2009. ISBN: 0073526878 Supplemental Resources Students will have access to the Online Learning Center for the text at www.mhhe.com/spiceland5e. PowerPoint presentations, online quizzes, key figure checklists and other resources are available at this site. Students will be required to register for the FASB Accounting Standards Codification at http://asc.fasb.org/home COURSE DESCRIPTION & OBJECTIVES: Corporate Financial Reporting will focus on accounting standards governing the form and content of the major financial statements and the measurement of assets, liabilities, equities and income. Throughout the course, we will emphasize the application and use of financial accounting in a decision making framework. Students will focus on the preparation of financial statements by internal management as well as the interpretation of financial statements by external users. PREREQUISITE: ACCT 607 Accounting Concepts and Applications 1 COURSE REQUIREMENTS AND GRADING SCALE: As a general guideline, course requirements are weighted as follows: Course Requirements Exam #1 Exam #2 Final Exam Financial Reporting Case Quizzes Graded Assignments Class Discussion 25% 25% 25% 10% 5% 5% 5% 100% Grading Scale A = 100-93 C+ = 77-75 A- = 92-89 C = 74-70 B+ = 88-86 B = 85-80 C- = 69-67 D = 66-60 B- = 79-78 F = Below 60 EXAMS: During the course, two exams will be administered. Exam #1 will focus on material covered in Chapters 14, 5B and 21 and will be administered in class. Exam #2 will focus on material covered in Chapters 5A and 7-12. The Final Exam will be a comprehensive exam administered in class based on the Final Examination Schedule. Exams will include conceptual and computational multiple choice questions, problems, and discussion questions. Notification of an absence prior to either of the mid-term exams may warrant the final exam score being substituted for the missed exam with instructor approval. The tentative exam dates are subject to change. Consult the Blackboard site for possible changes. Exams will account for a total of 75% of the course grade. FINANCIAL REPORTING CASE: Teams will be assigned to research a current issue in financial reporting. Teams will complete a case analysis and present findings to the class. The project will account for 10% of the course grade. QUIZZES, GRADED ASSIGNMENTS AND CLASS DISCUSSION: The student is responsible for preparing solutions to assigned problems, cases and research as well as completing chapter and supplemental readings as noted on the Course Assignment Schedule. Chapter quizzes will be given regularly throughout the semester. Typically quizzes will consist of 4-5 conceptual and/or computational questions. Missed quizzes may not be made up. Your lowest quiz grade will be dropped in determining your final course grade. Graded assignments will be collected for grading randomly throughout the semester. If a student must miss class, the completed assignments should be submitted for grading prior to the missed class to receive credit for assignments. Late assignments will not be accepted. Note that any changes to the Course Assignment Schedule will be posted in Blackboard. 2 Participation in class discussion is essential. Please come to class prepared with chapter readings, supplemental readings, and case assignments. Also, bring copies of Bb handouts with you to class so that you may fully participate in class discussions and in-class examples. Furthermore, demonstration problems are included on the assignment schedule to help the student in applying the chapter concepts, but will not be collected for grading. Solutions to demonstration problems will be posted in Blackboard. Quizzes, graded assignments, and class discussion will account for 15% of the course grade. STUDENT RESPONSIBILITIES: Students are responsible for learning the assigned body of accounting and financial analysis knowledge, demonstrating their knowledge on course examinations, being prepared to discuss assignments in class, and submitting required work in good form on a timely basis. Prepare solutions for assigned problems and cases for discussion in class. Attend class and actively participate in class. Review and correct assignments after class as necessary. Additional problems and cases may be completed at the student’s discretion to help with the application of course material. BLACKBOARD SITE: A Blackboard site is available for this course. All students registered for the course are automatically registered for the site. Please check the Bb site each week prior to class to see if there are any handouts, cases or in-class problems that will be necessary to bring to class. Revisions to the course assignment schedule will be posted as necessary. ACADEMIC INTEGRITY: Academic integrity is paramount in higher education and essential to effective teaching and learning. As a professional school, the Kogod School of Business is committed to preparing our students and graduates to value the notion of integrity. In fact, no issue at American University is more serious or addressed with greater severity than a breech of academic integrity. Standards of academic conduct are governed by the University’s Academic Integrity Code. By enrolling in the School and registering for this course, you acknowledge your familiarity with the Code and pledge to abide by it. All suspected violations of the Code will be immediately referred to the Office of the Dean. Disciplinary action, including failure for the course, suspension, or dismissal, may result. Additional information about the Code (i.e. acceptable forms of collaboration, definitions of plagiarism, use of sources including the Internet, and the adjudication process) can be found in a number of places including the University’s AcademicRegulations, Student Handbook, and website at <http://www.american.edu/academics/integrity>. If you have any questions about academic integrity or standards of conduct in this course, please discuss them with your instructor. STUDENT PLEDGE: Because academic integrity is important to the quality of your work and to your responsibilities to the University and fellow students, all of your assignments, cases, and examinations will include the following statement with your signature: ”On my honor, I have neither given nor received unauthorized aid on this assignment.” Absence of the statement from an assignment does not preclude your obligation to observe the University’s Academic Integrity Code. 3 ACCT 641: CORPORATE FINANCIAL REPORTING Tentative Course Assignment Schedule 01/14/09 Introduction to Course CH 2: Review of the Accounting Cycle ASSIGNMENTS Read: Chapter2 Class Discussion: F H&B-November (Blackboard) Demonstration Problems: E2-1,2,3,9,11 Graded Assignments: None Due Today 01/21/09 CH 1: Environmental and Theoretical Structure of Financial Accounting CH 3: The Balance Sheet and Financial Disclosures ASSIGNMENTS Read: Chapter 1and Chapter 3 Class Discussion: Read “Periodic Financial Reporting-A Relic of the Past”, Erick D. Prohs, Journal of Corporation Law, Spring 2002. Register as a User for the FASB Accounting Standards Codification and complete the online Tutorial at www.FASB.org Demonstration Problems: E1-8, 9, 10 E3-1,2,5,7,13,14 Graded Assignments: FH&B November and December (Bb) 01/28/09 CH 4: The Income Statement and Comprehensive Income (Part A) CH 5: Income Measurement-Profitability Ratios (Part B) ASSIGNMENTS Read: Chapter 4 (Part A) and Chapter 5 (Part B) Class Discussion: Bring Income Statement Handouts (Bb) Demonstration Problems: E4-2,3,4,5,6, P5-10 Graded Assignments: P3-3 Excel, Judgment Case 3-10 02/04/09 CH 4: Statement of Cash Flow (Part B) CH 21: Statement of Cash Flow Revisited (Part A) ASSIGNMENTS Read: Chapter 4 (Part B) and Chapter 21 (Part A) Class Discussion: Bring SOCF Handouts (Bb) Bring Copy of Deloitte Case “Go with the Flow, Inc.” & Preliminary Response (Case 08-1) Demonstration Problems: E4-15, 16, 19 Graded Assignments: P4-1 Excel, P5-12, and Communication Case 4-6 02/11/09 EXAM #1 Graded Assignments: P4-11 4 02/18/09 CH 5: Income Measurement (Part A) CH 7: Cash and Receivables ASSIGNMENTS Read: Chapter 5 (Part A) and Chapter 7 Class Discussion: Prepare “How are Earnings Managed?” Article Research Case 5-7 Bring Copy of Deloitte Case “Check Mate”& Preliminary Response (Case 06-10) Bring Revenue Recognition Handouts (Bb) Demonstration Problems: E5-4,10,11,12,16 and E7-1,6,7,8,12 Graded Assignments: None due today 02/25/09 CH 8: Inventories: Measurement CH 9: Inventories: Additional Issues ASSIGNMENTS Read: Chapter 8 and Chapter 9 Class Discussion: Bring Inventory Handouts (Bb) Financial Reporting Case: Teams and Case Studies Assigned Demonstration Problems:E8-1,2,3,11,14,17,19 and E9-1,2,3,20,23 Graded Assignments: P5-5 Excel, P7-4 Excel, Communication Case 7-2 03/04/09 CH 10: Operational Assets: Acquisition and Disposition CH 11: Operational Assets: Utilization and Impairment (Part A&B) ASSIGNMENTS Read: Chapter 10 and Chapter 11 Class Discussion: Bring Fixed Asset Handouts (Bb) Demonstration Problems: E10-1, 3, 5, 6, 13, 14, 15, 22, 23 and E11-2, 3, 8, 15, 17, 19, 20, 21 Graded Assignments: P8-7 Excel, P8-8, P8-13, P9-2 03/11/09 SPRING BREAK 03/18/09 CH 11: Operational Assets: Subsequent Expenditures (Part C) CH 12: Investments ASSIGNMENTS Read: Chapter 12 Class Discussion: Prepare Real World Case 12-7 Bring Deloitte Case “Sell Soon, Inc.” & Preliminary Response (Case 06-08) Demonstration Problems: E11-24, E12-1, 9, 19 Graded Assignments: P10-9 Excel, Communication Case 10-12, Communication Case 11-2 03/25/09 EXAM #2 Graded Assignments: P11-2 Excel, Real World Case 12-1 04/01/09 CH 13: Current Liabilities and Contingencies 5 CH 14: Bonds and Long Term Notes ASSIGNMENTS Read: Chapter 13 and Chapter 14 Class Discussion: Prepare Communication Cases 13-7 Part #1 and 14-3 Part #1 Bring Current Liability and Bond Handouts (Bb) Demonstration Problems:E13-10, 15, 17 and E14-3, 5 Graded Assignments: None due today 04/08/09 CH 15: Leases ASSIGNMENTS Read: Chapter 15 Class Discussion: Bring Lease Handouts (Bb) Demonstration Problems: E15-1, 3, 4, 5, 8, 16 Graded Assignments: Communication Case 13-8, P14-1, P14-3 04/15/09 CH 18: Shareholder’s Equity CH 19: Share Based Compensation and Earnings Per Share ASSIGNMENTS Read: Chapter 18 and Chapter 19 Class Discussion: Prepare Communication Case 18-3 Part #1 Bring Shareholder’s Equity and EPS Handouts (Bb) Demonstration Problems: E18-3, 6,8, 10, 14 and E9-5, 10, 13 Graded Assignments: P15-5 and P15-8 Excel 04/22/09 Financial Reporting Case Presentations Final Examination Review Graded Assignments: P18-7 Excel and P19-7 Excel 04/29/09 Study Day 05/06/09 Comprehensive Final Examination: 8:10-10:40 p.m. 6 7