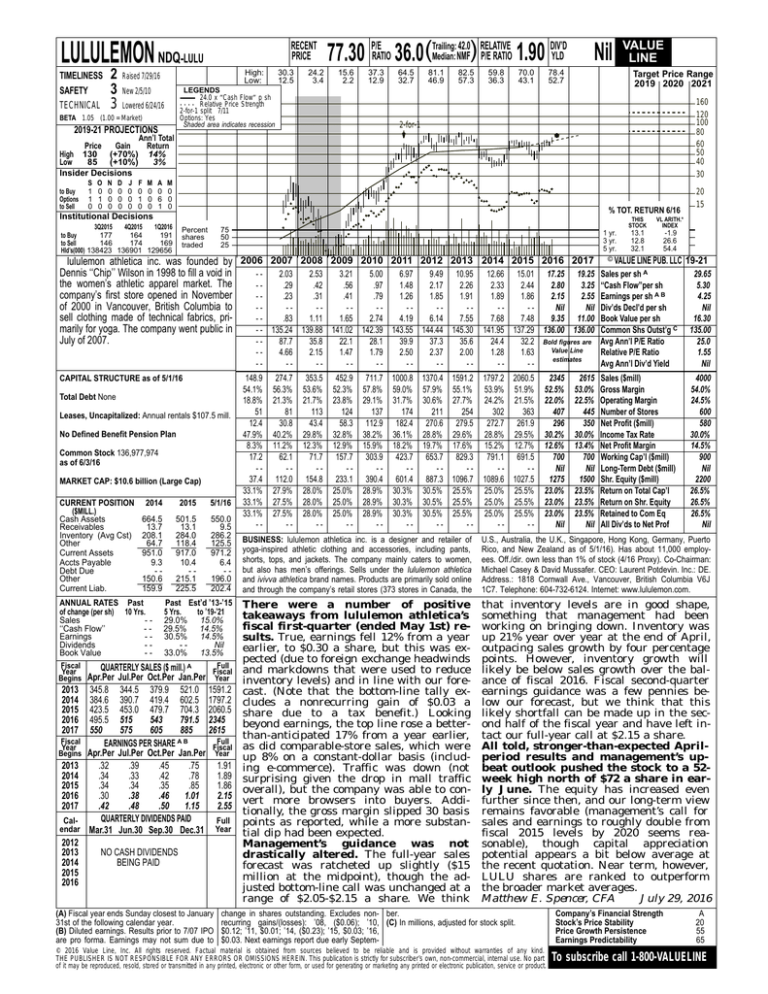

LULULEMON NDQ-LULU

TIMELINESS

SAFETY

TECHNICAL

2

3

3

RECENT

PRICE

High:

Low:

Raised 7/29/16

30.3

12.5

24.2

3.4

42.0 RELATIVE

DIV’D

Median: NMF) P/E RATIO 1.90 YLD

77.30 P/ERATIO 36.0(Trailing:

15.6

2.2

37.3

12.9

LEGENDS

24.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

2-for-1 split 7/11

Options: Yes

Shaded area indicates recession

New 2/5/10

Lowered 6/24/16

BETA 1.05 (1.00 = Market)

2019-21 PROJECTIONS

64.5

32.7

81.1

46.9

82.5

57.3

59.8

36.3

70.0

43.1

Nil

78.4

52.7

VALUE

LINE

Target Price Range

2019 2020 2021

160

120

100

80

60

50

40

30

2-for-1

Ann’l Total

Price

Gain

Return

High 130 (+70%) 14%

Low

85 (+10%)

3%

Insider Decisions

to Buy

Options

to Sell

S

1

1

0

O

0

1

0

N

0

0

0

D

0

0

0

J

0

0

0

F

0

1

0

M

0

0

0

A

0

6

1

M

0

0

0

% TOT. RETURN 6/16

Institutional Decisions

3Q2015

4Q2015

1Q2016

177

164

191

to Buy

to Sell

146

174

169

Hld’s(000) 138423 136901 129656

Percent

shares

traded

75

50

25

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

13.1

12.8

32.1

-1.9

26.6

54.4

20

15

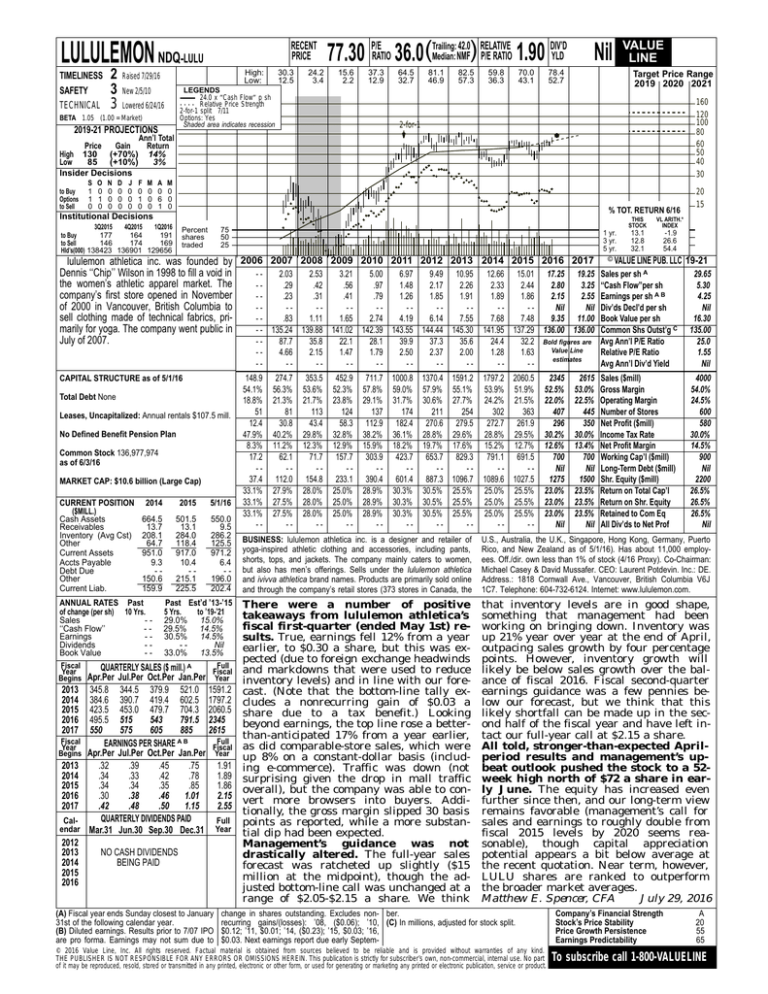

lululemon athletica inc. was founded by 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 © VALUE LINE PUB. LLC 19-21

Dennis ‘‘Chip’’ Wilson in 1998 to fill a void in

-2.03

2.53

3.21

5.00

6.97

9.49 10.95 12.66 15.01 17.25 19.25 Sales per sh A

29.65

the women’s athletic apparel market. The

-.29

.42

.56

.97

1.48

2.17

2.26

2.33

2.44

2.80

3.25 ‘‘Cash Flow’’per sh

5.30

company’s first store opened in November

-.23

.31

.41

.79

1.26

1.85

1.91

1.89

1.86

2.15

2.55 Earnings per sh A B

4.25

of 2000 in Vancouver, British Columbia to

----------Nil

Nil Div’ds Decl’d per sh

Nil

sell clothing made of technical fabrics, pri-.83

1.11

1.65

2.74

4.19

6.14

7.55

7.68

7.48

9.35 11.00 Book Value per sh

16.30

marily for yoga. The company went public in

- - 135.24 139.88 141.02 142.39 143.55 144.44 145.30 141.95 137.29 136.00 136.00 Common Shs Outst’g C 135.00

July of 2007.

-87.7

35.8

22.1

28.1

39.9

37.3

35.6

25.0

24.4

32.2 Bold figures are Avg Ann’l P/E Ratio

CAPITAL STRUCTURE as of 5/1/16

Total Debt None

Leases, Uncapitalized: Annual rentals $107.5 mill.

No Defined Benefit Pension Plan

Common Stock 136,977,974

as of 6/3/16

MARKET CAP: $10.6 billion (Large Cap)

CURRENT POSITION

($MILL.)

Cash Assets

Receivables

Inventory (Avg Cst)

Other

Current Assets

Accts Payable

Debt Due

Other

Current Liab.

2014

2015

5/1/16

664.5

13.7

208.1

64.7

951.0

9.3

-150.6

159.9

501.5

13.1

284.0

118.4

917.0

10.4

-215.1

225.5

550.0

9.5

286.2

125.5

971.2

6.4

-196.0

202.4

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Sales

-‘‘Cash Flow’’

-Earnings

-Dividends

-Book Value

-Fiscal

Year

Begins

2013

2014

2015

2016

2017

Fiscal

Year

Begins

2013

2014

2015

2016

2017

Calendar

2012

2013

2014

2015

2016

Past Est’d ’13-’15

5 Yrs.

to ’19-’21

29.0% 15.0%

29.5% 14.5%

30.5% 14.5%

-Nil

33.0% 13.5%

Full

QUARTERLY SALES ($ mill.) A

Fiscal

Apr.Per Jul.Per Oct.Per Jan.Per Year

345.8 344.5 379.9 521.0 1591.2

384.6 390.7 419.4 602.5 1797.2

423.5 453.0 479.7 704.3 2060.5

495.5 515

543

791.5 2345

550

575

605

885

2615

Full

EARNINGS PER SHARE A B

Fiscal

Apr.Per Jul.Per Oct.Per Jan.Per Year

.32

.39

.45

.75

1.91

.34

.33

.42

.78

1.89

.34

.34

.35

.85

1.86

.30

.38

.46

1.01

2.15

.42

.48

.50

1.15

2.55

QUARTERLY DIVIDENDS PAID

Full

Mar.31 Jun.30 Sep.30 Dec.31 Year

NO CASH DIVIDENDS

BEING PAID

(A) Fiscal year ends Sunday closest to January

31st of the following calendar year.

(B) Diluted earnings. Results prior to 7/07 IPO

are pro forma. Earnings may not sum due to

---

4.66

--

2.15

--

1.47

--

148.9

54.1%

18.8%

51

12.4

47.9%

8.3%

17.2

-37.4

33.1%

33.1%

33.1%

--

274.7

56.3%

21.3%

81

30.8

40.2%

11.2%

62.1

-112.0

27.9%

27.5%

27.5%

--

353.5

53.6%

21.7%

113

43.4

29.8%

12.3%

71.7

-154.8

28.0%

28.0%

28.0%

--

452.9

52.3%

23.8%

124

58.3

32.8%

12.9%

157.7

-233.1

25.0%

25.0%

25.0%

--

1.79

--

2.50

--

2.37

--

2.00

--

711.7 1000.8 1370.4 1591.2

57.8% 59.0% 57.9% 55.1%

29.1% 31.7% 30.6% 27.7%

137

174

211

254

112.9 182.4 270.6 279.5

38.2% 36.1% 28.8% 29.6%

15.9% 18.2% 19.7% 17.6%

303.9 423.7 653.7 829.3

----390.4 601.4 887.3 1096.7

28.9% 30.3% 30.5% 25.5%

28.9% 30.3% 30.5% 25.5%

28.9% 30.3% 30.5% 25.5%

-----

1.28

--

Value Line

estimates

1.63

--

1797.2 2060.5

53.9% 51.9%

24.2% 21.5%

302

363

272.7 261.9

28.8% 29.5%

15.2% 12.7%

791.1 691.5

--1089.6 1027.5

25.0% 25.5%

25.0% 25.5%

25.0% 25.5%

---

2345

52.5%

22.0%

407

296

30.2%

12.6%

700

Nil

1275

23.0%

23.0%

23.0%

Nil

2615

53.0%

22.5%

445

350

30.0%

13.4%

700

Nil

1500

23.5%

23.5%

23.5%

Nil

Relative P/E Ratio

Avg Ann’l Div’d Yield

Sales ($mill)

Gross Margin

Operating Margin

Number of Stores

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

1.55

Nil

4000

54.0%

24.5%

600

580

30.0%

14.5%

900

Nil

2200

26.5%

26.5%

26.5%

Nil

BUSINESS: lululemon athletica inc. is a designer and retailer of

yoga-inspired athletic clothing and accessories, including pants,

shorts, tops, and jackets. The company mainly caters to women,

but also has men’s offerings. Sells under the lululemon athletica

and ivivva athletica brand names. Products are primarily sold online

and through the company’s retail stores (373 stores in Canada, the

U.S., Australia, the U.K., Singapore, Hong Kong, Germany, Puerto

Rico, and New Zealand as of 5/1/16). Has about 11,000 employees. Off./dir. own less than 1% of stock (4/16 Proxy). Co-Chairman:

Michael Casey & David Mussafer. CEO: Laurent Potdevin. Inc.: DE.

Address.: 1818 Cornwall Ave., Vancouver, British Columbia V6J

1C7. Telephone: 604-732-6124. Internet: www.lululemon.com.

There were a number of positive

takeaways from lululemon athletica’s

fiscal first-quarter (ended May 1st) results. True, earnings fell 12% from a year

earlier, to $0.30 a share, but this was expected (due to foreign exchange headwinds

and markdowns that were used to reduce

inventory levels) and in line with our forecast. (Note that the bottom-line tally excludes a nonrecurring gain of $0.03 a

share due to a tax benefit.) Looking

beyond earnings, the top line rose a betterthan-anticipated 17% from a year earlier,

as did comparable-store sales, which were

up 8% on a constant-dollar basis (including e-commerce). Traffic was down (not

surprising given the drop in mall traffic

overall), but the company was able to convert more browsers into buyers. Additionally, the gross margin slipped 30 basis

points as reported, while a more substantial dip had been expected.

Management’s guidance was not

drastically altered. The full-year sales

forecast was ratcheted up slightly ($15

million at the midpoint), though the adjusted bottom-line call was unchanged at a

range of $2.05-$2.15 a share. We think

that inventory levels are in good shape,

something that management had been

working on bringing down. Inventory was

up 21% year over year at the end of April,

outpacing sales growth by four percentage

points. However, inventory growth will

likely be below sales growth over the balance of fiscal 2016. Fiscal second-quarter

earnings guidance was a few pennies below our forecast, but we think that this

likely shortfall can be made up in the second half of the fiscal year and have left intact our full-year call at $2.15 a share.

All told, stronger-than-expected Aprilperiod results and management’s upbeat outlook pushed the stock to a 52week high north of $72 a share in early June. The equity has increased even

further since then, and our long-term view

remains favorable (management’s call for

sales and earnings to roughly double from

fiscal 2015 levels by 2020 seems reasonable), though capital appreciation

potential appears a bit below average at

the recent quotation. Near term, however,

LULU shares are ranked to outperform

the broader market averages.

Matthew E. Spencer, CFA

July 29, 2016

change in shares outstanding. Excludes non- ber.

recurring gains/(losses): ’08, ($0.06); ’10, (C) In millions, adjusted for stock split.

$0.12; ’11, $0.01; ’14, ($0.23); ’15, $0.03; ’16,

$0.03. Next earnings report due early Septem-

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A

20

55

65

To subscribe call 1-800-VALUELINE