MBA 540 Corporate Finance

advertisement

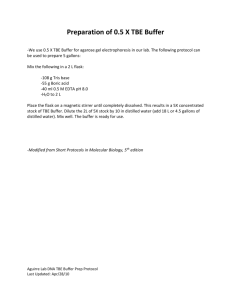

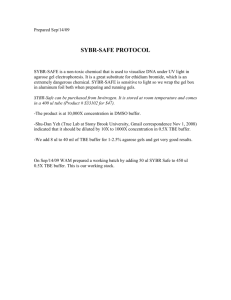

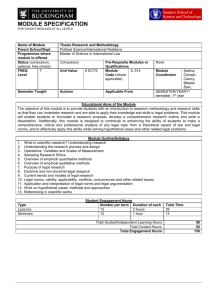

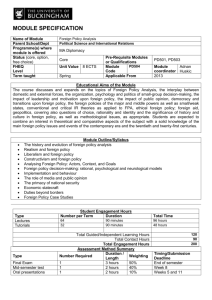

MODULE SPECIFICATION Name of Module Parent School/Dept Programme(s) where module is offered Status (core, option, free choice) FHEQ 7 Level Term taught Corporate Finance TBE Master of Business Administration (MBA) Compulsory Unit Value TBE 15 Pre-Requisite Modules or Qualifications Module TBE Code Applicable From None Module TBE coordinator TBE Educational Aims of the Module This module introduces students to the complexity and variety of financial decisions that are made by corporations. The focus of the module is on finance at the level of the firm, and issues are examined primarily from a managerial point of view. Students engage in topical group discussion and case-study analysis to gain a core understanding of capital markets and the financial environment. Module Outline/Syllabus Understand financial statements and ratio analysis The financial environment, capital markets and market efficiency Valuation Risk and Return: Including Portfolio Theory and capital asset pricing model Cost of capital, capital structure and investment appraisal techniques Dividend policy Mergers and acquisitions Type Lectures Seminars / Workshops Student Engagement Hours Number per Term Duration 10 2 hours 10 1 hour Total Time 20 hours 10 hours Total Guided/Independent Learning Hours 120 hours Total Contact Hours 30 hours Total Engagement Hours 150 hours Type Written Assignment Group presentation on corporate performance Written examination Assessment Method Summary Duration / Number Required Weighting Length 1 2000 20% words 1 20 mins 20% 1 3 hours 60% Timing/Submission Deadline TBE TBE Next exam diet Intended Learning Outcomes: Module Outcomes Teaching and Learning Strategy: On successful completion of the module students should be able to: 1. Apply theoretical concepts to a range of financial decisions 2. Critically analyse investment opportunities using a variety of techniques 3. Critically evaluate corporate performance 4. Demonstrate an in-depth understanding of the capital markets and market efficiency theories 5. Evaluate the impact of alternative capital structures → 1. Lectures will provide the framework for this module in which major concepts, theories and techniques will be introduced.(ILO: 2,4,5) 2. The seminars/workshops will provide the opportunity to develop selected areas introduced in the lecturers in greater depth. Case studies will be use to illustrate the relevance of the theoretical concepts.(ILO: 15) 3. Tutors will set assignments and guide students through independent study and research. (ILO: 1-5) Assessment Strategy → 1. Examinations (ILO: 1,2,4,5) 2. Presentation (ILO: 3,5) 3. Written assignment (ILO: 2,3,5) Practical Skills Teaching and Learning Strategy: On successful completion of the module students should be able to: 1. Interpret and accurately apply the capital asset pricing model 2. Interpret and critique financial statements 3. Critically evaluate and understand dividend policy 1. The seminars/workshops.(PS: 1-3) 2. Tutors will set assignments and guide students through independent study and research (PS:1-3) → Assessment Strategy → 1. Examinations (PS: 1-3) 2. Set assignment (PS: 1-3) Transferable Skills Teaching and Learning Strategy: On successful completion of the module students should gained the following: 1. Analytical skills 2. Problem solving skills 3. Decision making skills 4. Communication and interpersonal skills 5. Numeracy and problem-solving skills 6. Research skills 1. Lectures will provide the framework for this module in which major concepts and techniques will be introduced.(TS: 2,3) 2. The seminars/workshops.(TS: 1,3,4,5,6) 3. Tutors will set assignments and guide students through independent study and research (TS: 1-6) → Assessment Strategy → 1. Examinations (TS: 1-6) 2. Presentation (TS: 3,4,6) 3. Written assignment (TS: 1-6) . Key Texts and/or other learning materials G. Arnold, G. (2012) Corporate Financial Management, 5th Edition, Pearson Berk, J. and DeMarzo, P. (2013) Corporate Finance, 3rd Edition, Pearson Supplementary Texts and other learning materials D. Watson, D. and Head, A. (2013) Corporate Finance: Principles and Practice, 6th Edition, Pearson R. Brealey, R., Myers, S. Allen, F. (2013) Principles of Corporate Finance, 11th Edition, Global Edition, McGraw-Hill Hillier, D., (2013) Corporate Finance, European Edition, 2nd Edition, McGraw-Hill Brealy, R., Myers, S.C., and Marcus, S.C. (2011) Fundamentals of Corporate Finance, McGraw Hill Corporate Finance lecture: Professor Aswath Damodaran https://www.youtube.com/watch?v=f8UMSWAihnc Journal of Corporate Finance http://www.journals.elsevier.com/journal-of-corporate-finance/ Financial Times www.ft.com International Journal of Financial Studies http://www.mdpi.com/journal/ijfs Journal of Finance http://onlinelibrary.wiley.com/journal/10.1111/(ISSN)1540-6261 University of Oxford Podcasts http://podcasts.ox.ac.uk/keywords/finance The Economist www.economist.com Please note: This specification provides a concise summary of the main features of the module and the learning outcomes that a typical student might reasonably be expected to achieve and demonstrate if he/she takes full advantage of the learning opportunities that are provided. More detailed information on the learning outcomes, content and teaching, learning and assessment methods of each module and programme can be found in the departmental or programme handbook. The accuracy of the information contained in this document is reviewed annually by the University of Buckingham and may be checked by the Quality Assurance Agency. Date of Production Date approved by School Learning and Teaching Committee Date approved by School Board of Study Date approved by University Learning and Teaching Committee Date of Annual Review