Understand This Depreciation Rule When Buying Assets

advertisement

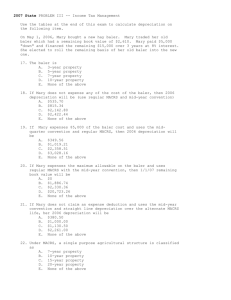

UNDERSTAND THIS DEPRECIATION RULE WHEN BUYING ASSETS You’re already aware that depreciation expensing techniques help reduce federal taxes when you purchase business assets such as autos, machinery, equipment, and furniture at year-end. But did you know that might not be as true this year as it once was? Here’s why. Some immediate expensing depreciation tax breaks have been reduced for 2015. For example, the Section 179 election is $25,000 this year, down from $500,000, and the “first-year bonus” 50% depreciation deduction was eliminated. Congress could retroactively restore more generous depreciation rules and limits before year-end, so you’ll want to plan with flexibility in mind, while taking note of some older rules that could affect your deductions. For example, as you contemplate asset purchases, think about the “midquarter” depreciation convention. This rule is designed to prevent a more generous standard depreciation deduction when you purchase a majority of a year’s assets during the final months of that year. You’re generally required to use the mid-quarter convention if more than 40% of the total assets you buy (with certain exceptions) are purchased within the last three months of the tax year. Here’s how it works. Under the mid-quarter convention, assets you acquire are treated for depreciation purposes as though you bought them in the middle of a quarter instead of the more usual rule of midyear. The result? A lower deduction for 2015. How can you avoid this result? Assets you choose to expense under Section 179 are taken out of the equation and can help keep your total purchases for purposes of the mid-quarter convention below 40%. In addition, real property is excluded from the mid-quarter calculation. Call us for more information about current depreciation rules and how your year-end planning could be affected.