2007-State-MACRS

advertisement

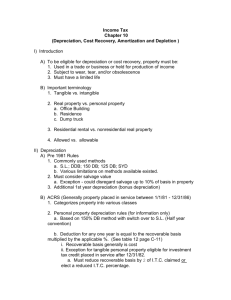

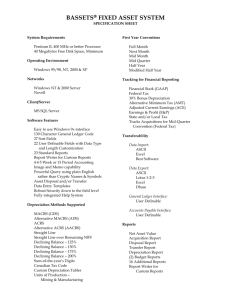

2007 State PROBLEM III -- Income Tax Management Use the tables at the end of this exam to calculate depreciation on the following item. On May 1, 2006, Mary bought a new hay baler. Mary traded her old baler which had a remaining book value of $2,610. Mary paid $5,000 "down" and financed the remaining $15,000 over 3 years at 8% interest. She elected to roll the remaining basis of her old baler into the new one. 17. The baler is A. 3-year property B. 5-year property C. 7-year property D. 10-year property E. None of the above 18. If Mary does not expense any of the cost of the baler, then 2006 depreciation will be (use regular MACRS and mid-year convention) A. $535.70 B. $815.34 C. $2,142.80 D. $2,422.44 E. None of the above 19. If Mary expenses $5,000 of the baler cost and uses the midquarter convention and regular MACRS, then 2006 depreciation will be A. $349.56 B. $1,019.21 C. $2,358.51 D. $3,028.16 E. None of the above 20. If Mary expenses the maximum allowable on the baler and uses regular MACRS with the mid-year convention, then 1/1/07 remaining book value will be A. $0 B. $1,886.74 C. $2,330.36 D. $20,723.26 E. None of the above 21. If Mary does not claim an expense deduction and uses the mid-year convention and straight line depreciation over the alternate MACRS life, her 2006 depreciation will be A. $380.50 B. $1,000.00 C. $1,130.50 D. $2,261.00 E. None of the above 22. Under MACRS, a single purpose agricultural structure is classified as A. 7-year property B. 10-year property C. 15-year property D. 20-year property E. None of the above ANNUAL DEPRECIATION PERCENTAGES FOR 5-YR PROPERTY, 150% DB _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 15.000% 26.250% 18.750% 11.250% 3.750% 2 25.500 22.125 24.375 26.625 28.875 3 17.850 16.520 17,062 18.637 20.212 4-5 16.660 16.520 16.763 16.567 16.404 6 8.330 2.065 6.287 10.354 14.355 Total 100.000 100.000 100.000 100.000 100.000 _________________________________________________________________ ANNUAL DEPRECIATION PERCENTAGES FOR 7-YR PROPERTY, 150% DB _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 10.714% 18.750% 13.393% 8.036% 2.679% 2 19.133 17.411 18.559 19.707 20.854 3 15.033 13.680 14.582 15.484 16.386 4 12.249 12.160 12.221 12.275 12.874 5-7 12.249 12.160 12.221 12.275 12.182 8 6.124 1.520 4.582 7.673 10.661 Total 100.000 100.000 100.000 100.000 100.000 _________________________________________________________________ ANNUAL FRACTIONS FOR STRAIGHT LINE OVER N YEARS (N less than 26) _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 1/2 7/8 5/8 3/8 1/8 2-N 1 1 1 1 1 N+1 1/2 1/8 3/8 5/8 7/8 _________________________________________________________________ Depreciation formula: Basis divided by N times number from above table. ANNUAL FRACTIONS FOR 27 1/2 YEAR PROPERTY, REGULAR MACRS _________________________________________________________________ Tax Month Placed in Service -Year 1 2 3 4 5 6 7 8 9 10 11 12 1 11.5 10.5 9.5 8.5 7.5 6.5 5.5 4.5 3.5 2.5 1.5 0.5 2-27 12 12 12 12 12 12 12 12 12 12 12 12 28 6.5 7.5 8.5 9.5 10.5 11.5 12 12 12 12 12 12 29 ------- 0.5 1.5 2.5 3.5 4.5 5.5 _________________________________________________________________ Depreciation formula: Basis divided by 27 1/2 divided by 12 times number from above table. ANNUAL FRACTIONS FOR 39 YEAR PROPERTY, REGULAR MACRS _________________________________________________________________ Tax Month Placed in Service -Year 1 2 3 4 5 6 7 8 9 10 11 12 1 11.5 10.5 9.5 8.5 7.5 6.5 5.5 4.5 3.5 2.5 1.5 0.5 2-39 12 12 12 12 12 12 12 12 12 12 12 12 40 0.5 1.5 2.5 3.5 4.5 5.5 6.5 7.5 8.5 9.5 10.5 11.5 _________________________________________________________________ Depreciation formula: Basis divided by 39 divided by 12 times number from above table.