2007-District-Income-Tax

advertisement

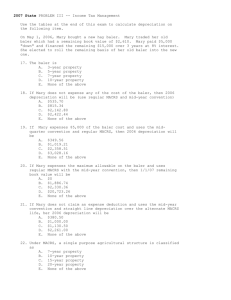

2007 District PROBLEM III -- Income Tax Management Use the tables at the end of this exam to calculate depreciation on the following item. On April 15, 2006, Steve bought a new tractor. Steve traded his old tractor which had a remaining book value of $2,610. Steve paid $10,000 "down" and financed the remaining $25,000 over 5 years at 8% interest. He elected to roll the remaining basis of his old tractor into the new one. 17. The tractor is A. 3-year property B. 5-year property C. 7-year property D. 10-year property E. None of the above 18. If Steve does not expense any of the cost of the tractor, then 2006 depreciation will be (use regular MACRS and mid-year convention) A. $1,351.04 B. $4,029.54 C. $10,714.00 D. $12,065.04 E. None of the above 19. If Steve expenses $10,000 of the tractor cost and uses the midquarter convention and regular MACRS, then 1/1/07 remaining book value will be A. $17,895.55 B. $20,160.29 C. $23,912.19 D. $27,610.00 E. None of the above 20. If Steve expenses the maximum allowable on the tractor and uses regular MACRS with the mid-year convention, then 1/1/07 remaining book value will be A. $0 B. $2,330.36 C. $13,147,52 D. $24,651.86 E. None of the above 21. If Steve does not claim an expense deduction and uses the mid-year convention and straight line depreciation over the alternate MACRS life, his 2006 depreciation will be A. $630.50 B. $1,880.50 C. $5,000.00 D. $5,630.50 E. None of the above 22. Under MACRS, a computer is classified as A. 3-year property B. 5-year property C. 7-year property D. not depreciable E. None of the above 2007 District ANNUAL DEPRECIATION PERCENTAGES FOR 5-YR PROPERTY, 150% DB _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 15.000% 26.250% 18.750% 11.250% 3.750% 2 25.500 22.125 24.375 26.625 28.875 3 17.850 16.520 17,062 18.637 20.212 4-5 16.660 16.520 16.763 16.567 16.404 6 8.330 2.065 6.287 10.354 14.355 Total 100.000 100.000 100.000 100.000 100.000 _________________________________________________________________ ANNUAL DEPRECIATION PERCENTAGES FOR 7-YR PROPERTY, 150% DB _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 10.714% 18.750% 13.393% 8.036% 2.679% 2 19.133 17.411 18.559 19.707 20.854 3 15.033 13.680 14.582 15.484 16.386 4 12.249 12.160 12.221 12.275 12.874 5-7 12.249 12.160 12.221 12.275 12.182 8 6.124 1.520 4.582 7.673 10.661 Total 100.000 100.000 100.000 100.000 100.000 _________________________________________________________________ ANNUAL FRACTIONS FOR STRAIGHT LINE OVER N YEARS (N less than 26) _________________________________________________________________ MID-QUARTER CONVENTION Tax MID-YEAR Quarter placed in service -Year CONVENTION 1 2 3 4 1 1/2 7/8 5/8 3/8 1/8 2-N 1 1 1 1 1 N+1 1/2 1/8 3/8 5/8 7/8 _________________________________________________________________ Depreciation formula: Basis divided by N times number from above table. ANNUAL FRACTIONS FOR 27 1/2 YEAR PROPERTY, REGULAR MACRS _________________________________________________________________ Tax Month Placed in Service -Year 1 2 3 4 5 6 7 8 9 10 11 12 1 11.5 10.5 9.5 8.5 7.5 6.5 5.5 4.5 3.5 2.5 1.5 0.5 2-27 12 12 12 12 12 12 12 12 12 12 12 12 28 6.5 7.5 8.5 9.5 10.5 11.5 12 12 12 12 12 12 29 ------- 0.5 1.5 2.5 3.5 4.5 5.5 _________________________________________________________________ Depreciation formula: Basis divided by 27 1/2 divided by 12 times number from above table. ANNUAL FRACTIONS FOR 39 YEAR PROPERTY, REGULAR MACRS _________________________________________________________________ Tax Month Placed in Service -Year 1 2 3 4 5 6 7 8 9 10 11 12 1 11.5 10.5 9.5 8.5 7.5 6.5 5.5 4.5 3.5 2.5 1.5 0.5 2-39 12 12 12 12 12 12 12 12 12 12 12 12 40 0.5 1.5 2.5 3.5 4.5 5.5 6.5 7.5 8.5 9.5 10.5 11.5 _________________________________________________________________ Depreciation formula: Basis divided by 39 divided by 12 times number from above table.