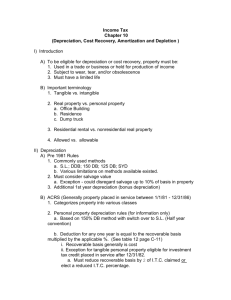

Chapter 8 - Depreciation

advertisement

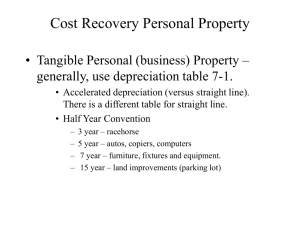

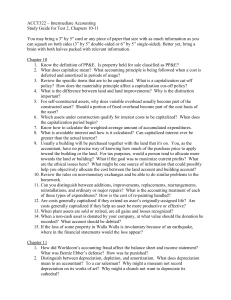

Chapter 8 – Depreciation Cost recovery (depreciation, amortization and depletion) is how a taxpayer gets a deduction for the “using up” of an asset over its useful life. MACRS is the current method prescribed by tax law to calculate depreciation. Tangible Personal Property (TPP) The class of a property is determined by its attributes. See Exhibit 8-1 for examples of 3/5/7/10/15/20 year class tangible personal property. Once you determine the appropriate class of property, then you go to the depreciation tables to find the appropriate depreciation percentage to apply to the basis. These tables begin on page 8-29 of your text. The half year convention is applied for TPP---you take a half year’s depreciation in the first and last years. For example, the deprecation for a three year property is actually spread over 4 years. Look at Table 8-1 on page 8-30. Notice that under 3 year property column there are percentages for Years 1-4. If you don’t sell the asset early, the tables take care of the half year convention for you. However, if you dispose of an asset before the end of its class life, you will have to adjust the table percentage (i.e., take ½ of the applicable % for the year of disposal). Mid-quarter convention, rather than half year convention, applies if more than 40% of value of property is placed in service during the last quarter of the year. Table 82 is based on the mid-quarter convention. TP has the option of using MACRS or straight line depreciation Additional First Year Depreciation - apply additional dep first, reduce basis, and then apply MACRS %;. Bonus is 30% or 50% depending on date acquired and placed in service (p. 8-7). Real Property 27.5, 31.5 or 39 year property. See Table 8-8 Uses mid-month convention (which is incorporated into Table 8-8). If you dispose of the property before the end of its useful life, you will have to adjust the table %. Election to Expense Assets (Section 179) TP can write off up to $105,000 (2005) of TPP each year. Deduction is reduced dollar-for-dollar when property placed in service during the year exceeds $420,000 (2005). Reduce the depreciable basis by the deduction. Section 179 cannot produce a loss for the TP. Excess can be carried forward but is limited. Take Sec. 179 before the additional first year depreciation. Listed Property Limits exist for listed property that is used for both personal and business purposes. If the property is used predominantly for business (business usage >50%), the TP can use MACRS. If not, then TP must use straight line. Listed property includes cars, computers, cell phones (complete list on p. -13) If used predominantly for business (which takes into consideration only business usage), you can use the % business usage plus the % usage for production of income to determine the percentage used to compute the depreciation. (See example 18) If change from predominantly business to predominately personal (business usage falls below 50%), TP will have excess cost recovery (see Example 25). Special Rules for Automobiles Deprepreciation limits apply to autos whose gross vehicle weight is 6,000 pounds or less (see p. 8-14) for limits. The limits are indexed and vary by year. Excludes cars that are used in a taxi or limo service Limits are imposed before you apply the reduction for % personal use. Limits include the Section 179 amount See Example 19 There is a $25,000 limitation on the Section 179 deduction for vehicles not subject to the depreciation limits (SUV with GVW >6,000 lbs and not more than 14,000 lbs) TP who lease automobiles must report an inclusion amount in their gross income related to the lease Amortization Cost recovery for intangible assets, similar to depreciation on tangible assets Includes goodwill, going-concern value, franchises, trademarks and trade names Amortize over 15 years regardless of the actual useful life of the intangible. Depletion Cost recovery for natural resources is termed depletion (doesn’t apply to land but to the oil, gas, mineral in the land) Intangible drilling and development costs are either expenses in year incurred (usually more advantageous) or capitalized and depleted. Cost Depletion is one depletion method and can be used on wasting assets (e.g., timber). Divide basis of asset by the estimated recoverable units to get depletion per unit amount. Multiply this unit amount by the number of units sold (not produced) during the year. Percentage depletion takes a statutory percentage and multiples it by the gross income from the property. Percentage depletion can’t exceed 50% of the taxable income from the property before the allowance for depletion. Reduce basis by the depletion expense.