theme: depreciation - Real Life Accounting

advertisement

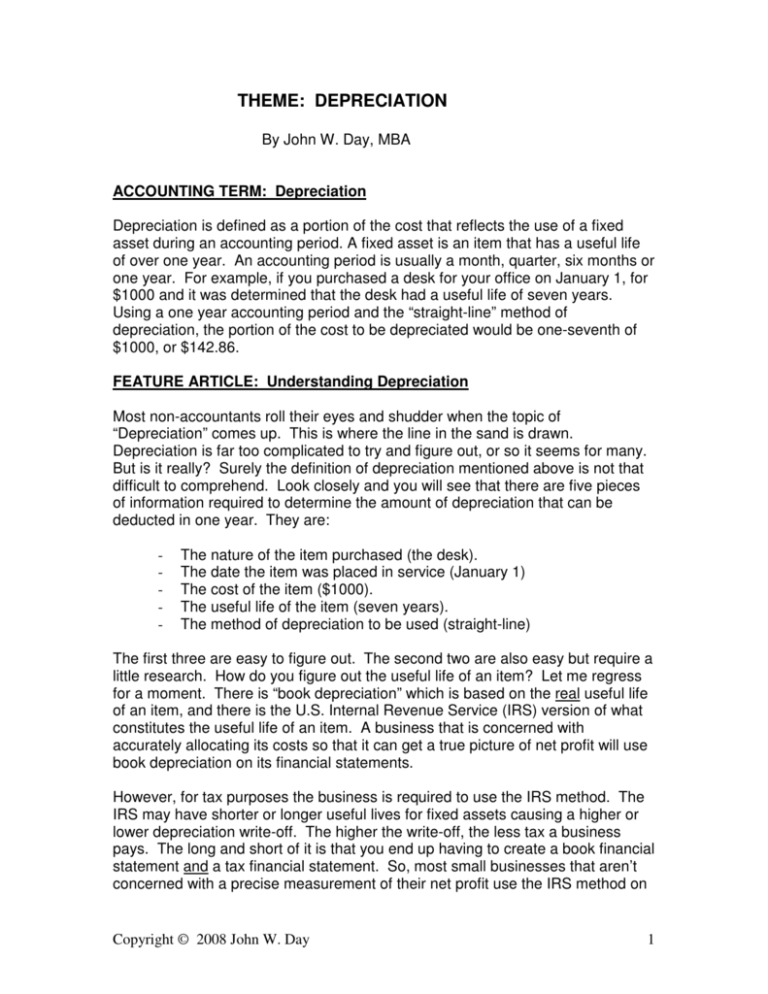

THEME: DEPRECIATION By John W. Day, MBA ACCOUNTING TERM: Depreciation Depreciation is defined as a portion of the cost that reflects the use of a fixed asset during an accounting period. A fixed asset is an item that has a useful life of over one year. An accounting period is usually a month, quarter, six months or one year. For example, if you purchased a desk for your office on January 1, for $1000 and it was determined that the desk had a useful life of seven years. Using a one year accounting period and the “straight-line” method of depreciation, the portion of the cost to be depreciated would be one-seventh of $1000, or $142.86. FEATURE ARTICLE: Understanding Depreciation Most non-accountants roll their eyes and shudder when the topic of “Depreciation” comes up. This is where the line in the sand is drawn. Depreciation is far too complicated to try and figure out, or so it seems for many. But is it really? Surely the definition of depreciation mentioned above is not that difficult to comprehend. Look closely and you will see that there are five pieces of information required to determine the amount of depreciation that can be deducted in one year. They are: - The nature of the item purchased (the desk). The date the item was placed in service (January 1) The cost of the item ($1000). The useful life of the item (seven years). The method of depreciation to be used (straight-line) The first three are easy to figure out. The second two are also easy but require a little research. How do you figure out the useful life of an item? Let me regress for a moment. There is “book depreciation” which is based on the real useful life of an item, and there is the U.S. Internal Revenue Service (IRS) version of what constitutes the useful life of an item. A business that is concerned with accurately allocating its costs so that it can get a true picture of net profit will use book depreciation on its financial statements. However, for tax purposes the business is required to use the IRS method. The IRS may have shorter or longer useful lives for fixed assets causing a higher or lower depreciation write-off. The higher the write-off, the less tax a business pays. The long and short of it is that you end up having to create a book financial statement and a tax financial statement. So, most small businesses that aren’t concerned with a precise measurement of their net profit use the IRS method on Copyright © 2008 John W. Day 1 their books. This means that all you have to do is look in IRS Publication 946 to find the useful life of a particular item. The last piece of information is found by determining the method of depreciation to use. Most often it will be one of two methods; the “straight-line” method or an accelerated method called the “double-declining balance” method. Let’s briefly discuss these two methods: - Straight-line – This is the simple method mentioned in the definition above. Just take the cost of the item, divide it by the useful life and you’ve got the answer. Yes, you will have to adjust the depreciation for the first year you placed the item in service and for the last year when you remove the item from service. For instance, if your depreciation for one year was $150 and you placed the item in service on April 1 then divide $150 by 12 (months) and multiply $12.50 by 9 (months) to get $112.50. If you removed the item on February 28 then your deduction will only be $25.00 (2 x $12.50). - Double-declining balance – The idea behind this method is that when an item is purchased new, you will use up more of it in the earlier years of its life, therefore, justifying a higher depreciation deduction in the earlier years. With this method, simply divide the cost of the item by the useful life years as in the straight-line method. Then, multiply that result by 2 (double) in the first year. The second year, take the cost of the item and subtract the accumulated depreciation. Next, divide that result by the useful life and multiply that result by 2, and so on for each remaining year. But, wait! You don’t have to do this. The IRS provides tables that have the percentages worked out for each year of the two different methods. Not only that, they have set up special first year “conventions” that assume you purchased your depreciable fixed assets on June 30. This is called the one-half year convention. The idea behind this is that you may have bought some items earlier than June 30 and some after that date. So, to make it easy to figure out, they assume the higher and lower depreciation amounts will all average out. Actually, the IRS doesn’t even call it depreciation anymore. They call it “cost recovery”. Let’s face it. This is a political tool. Congress giveth and taketh away. They have been playing with this system for years. If they want to stimulate growth in business they will shorten the useful life of assets so businesses can attain a higher write-off. If they are not in the mood, they will extend the useful life of an item. A good example is the thirty-nine years set for the useful life of commercial property. This meant that if you leased a building for your business and made improvements, those improvements had to be depreciated over thirtynine years. Then the mood changed and as of October 22, 2004 you can now Copyright © 2008 John W. Day 2 depreciate leasehold improvements over fifteen years. You still have to depreciate the non-residential commercial building over thirty-nine years. Before December 31, 1986 we had ACRS or Accelerated Cost Recovery System. Currently, we have MACRS or Modified Accelerated Cost Recovery System. Every time congress tweaks the rules they give it a different name. (These rules can change so be sure to verify that they are still in place. ) Keep in mind there are different schedules for different properties. For instance, residential real property is depreciated over twenty-seven and one-half years and non-residential real property is depreciated over thirty-nine years. In addition, if more than forty percent of your total fixed asset purchases occurred in the last quarter of the year, then, you must use a mid-quarter convention. This convention assumes that your purchases made in the last quarter of the year were made on November 15. This limits the amount of depreciation you can claim in one year. It prevents someone from waiting until the end of the year to purchase assets but then getting a full half-year depreciation. However, there is a loophole around that restraint we will discuss in the TIP later on. QUESTION: How Is Asset “Book Value” Established? Book value is the original cost of a fixed asset less accumulated depreciation. Here is an example: Desk - Purchased 1/1/97 Accumulated Depreciation: 1997 1998 1999 2000 Total Accumulated Depreciation Book Value 12/31/00 Cost $1000.00 142.86 142.86 142.86 142.86 -571.44 $ 428.56 Book value of fixed assets is what is found on the Balance Sheet of your financial statements. Book value, as you can see, is not fair market value (FMV). Fair market value is what another party might pay you to acquire the fixed asset. It may be more or less than book value. Why is it important for you to know the difference between book value and fair market value? Suppose the FMV of the desk was $600 and you sold the desk for that amount. Do you report income of $600 when you sell the desk? No, you only report the “gain” on the sale of the asset. To figure out gain you have to subtract book value from the sale price. In our example, that would be $600 less $428.56 or $171.44. I would much rather report income of $171.44 than $600.00. I think you can now see why understanding this concept can prove to be valuable. Copyright © 2008 John W. Day 3 TIP: How To Maximize Your Tax Depreciation Deduction Each Year. Perhaps you have heard of the IRS section 179 election to expense up to $102,000 in 2004 of tangible depreciable property in the year it is first placed in service. This high amount has been extended for 2005 through 2007 and will be indexed to include inflation. If you haven’t heard of Section 179, you should be aware that this opportunity exists. It is not a good idea to buy property such as machines, equipment, furniture, etc., just for the write-off. If your business has a need for such items then you should factor the 179 election into your tax planning. Even if you borrow the money to purchase the assets, you can deduct the full amount of the purchase in one year if it is not over $102,000. If you purchase over $410,000 of depreciable assets in one year, the 179 deduction is limited. For every dollar purchased over the investment limit of $410,000, the 179 deduction is decreased by a dollar. These values change based on indexing and the whims of congress. Therefore, you should consult a tax professional before relying on any numbers in this article. The loophole I mentioned in the feature article is that if you bought $102,000 of equipment on December 31, you are not constrained by any mid-quarter convention rules. You can write off the entire amount. In addition, there is a rule that says you can’t create a loss with a 179 election expense. In other words, the 179 election is limited to “taxable income derived from a trade or business”. If the election is not allowed, you can opt to have the deduction carried over to the following year. However, the IRS considers income derived as an employee to qualify as coming from a trade or business. Therefore, if you or your spouse has employee income it may be able to be offset by a business (Schedule C) loss created by a 179 election. Be aware that if you use this deduction, you have to keep the equipment purchased for a certain length of time. If the property is disposed of early, you may be subject to “recapture”. This means the gain on the disposition has to be reported as ordinary income on your tax return. If you are a sole proprietor, the 179 election could have a major impact on lowering your tax bill. Let’s say you are in a 28% federal income tax bracket and a 9% income tax bracket for the state (some states don’t have income tax). Plus, the net profit of your business is subject to self-employment tax (social security) of 15.3%. Those add up to 52.3%. Suppose your net profit was $20,000. Your tax bill on that amount is $10,460. You can see how much a $20,000 179 election write-off would help. For every dollar you spend on tangible depreciable property, you are saving 52.3 cents. Remember, that the 179 election does not apply to leasehold improvements, but it does now cover off-the-shelf computer software. Copyright © 2008 John W. Day 4 Another tip to be aware of is that when adding leasehold improvements to your building, it is important be careful how you categorize expenditures. Leasehold improvements have to be written off over fifteen years. Items that qualify as fixtures might be able to be written off in one year if the 179 election is chosen. Any items that can reasonably be removed and taken to another building might be considered a fixture. Notice I use the word “might”. These are potential opportunities worth looking into. John W. Day, MBA is the author of two courses in accounting basics: Real Life Accounting for Non-Accountants (20hr online) and The HEART of Accounting (4-hr PDF). Visit his website at http://www.reallifeaccounting.com to download his FREE e-book pertaining to small business accounting and his monthly newsletter on accounting issues. Ask John questions directly on his Accounting for Non-Accountants blog. Copyright © 2008 John W. Day 5