Solutions to Questions and Problems

advertisement

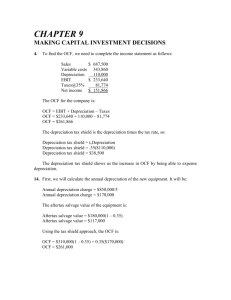

Topic 10 CAPITAL BUDGETING: NPV & CAPITAL DECISIONS (Part 1) Solutions to Questions and Problems NOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem. Q8.3 Calculating Payback. Kleimner Manufacturing N.V. imposes a payback cutoff of three years for its international investment projects. If the company has the following two projects available, should it accept either of them? Year Cashflow ($) A Cashflow ($) B -45,000 17,000 23,000 19,000 100,000 -90,000 19,000 24,000 35,000 5,000 0 1 2 3 4 Project A has cash flows of: Cash flows = $17,000 + 23,000 Cash flows = $40,000 during the first two years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project A is: Payback = 2 + ($5,000 / $19,000) Payback = 2.26 years Project B has cash flows of: Cash flows = $19,000 + 24,000 + 35,000 Cash flows = $78,000 during the first three years. The cash flows are still short by $12,000 of recapturing the initial investment. Since the project’s cash flow in the fourth year is less than $12,000 the payback for Project B is never. Using the payback criterion and a cutoff of 3 years, accept project A and reject project B. 2 Q8.4 Calculating AAR. You're trying to determine whether or not to expand your business by building a new manufacturing plant. The plant has an installation cost of $17 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,735,000, $2,105,000, $1,945,000, and $1,342,000 over these four years, what is the project's average accounting return (AAR)? Our definition of AAR is the average net income divided by the average book value. The average net income for this project is: Average net income = ($1,735,000 + 2,105,000 + 1,945,000 + 1,342,000) / 4 Average net income = $1,781,750 And the average book value is: Average book value = ($17,000,000 + 0) / 2 Average book value = $8,500,000 So, the AAR for this project is: AAR = Average net income / Average book value AAR = $1,781,750 / $8,500,000 AAR = .2096 or 20.96% Q8.5 Calculating IRR. A firm evaluates all of its projects by applying the IRR rule. If the required return is 13 percent, should the firm accept the following project? Year 0 1 2 3 Cashflow ($) -4,550 1,750 2,550 540 The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equation that defines the IRR for this project is: 0 = – $4,550 + $1,750/(1+IRR) + $2,550/(1+IRR)2 + $540/(1+IRR)3 Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that: IRR = 3.61% Since the cash flows are conventional and the IRR is less than the required return, we would reject the project. 3 Topic 10 CAPITAL BUDGETING: NPV & CAPITAL DECISIONS (Part 2) Answers to Concepts Review and Critical Thinking Questions Q9.5 Cash Flow and Depreciation. “When evaluating projects, we're only concerned with the relevant incremental aftertax cash flows. Therefore, because depreciation is a noncash expense, we should ignore its effects when evaluating projects.” Critically evaluate this statement. Depreciation is a non-cash expense, but it is tax-deductible on the income statement. Thus depreciation causes taxes paid, an actual cash outflow, to be reduced by an amount equal to the depreciation tax shield TCD. A reduction in taxes that would otherwise be paid is the same thing as a cash inflow, so the effects of the depreciation tax shield must be added in to get the total incremental aftertax cash flows. Solutions to Questions and Problems NOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem. Q9.2 Relevant Cash Flows. Chinco Ltd., currently sells 28,000 motor homes per year at $73,000 each, and 7,000 luxury motor coaches per year at $115,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 23,000 of these campers per year at $19,000 each. An independent consultant has determined that if Chinco introduces the new campers, it should boost the sales of its existing motor homes by 2,600 units per year, and reduce the sales of its motor coaches by 850 units per year. What is the amount to use as the annual sales figure when evaluating this project? Why? Sales due solely to the new product line are: 23,000($19,000) = $437,000,000 Increased sales of the motor home line occur because of the new product line introduction; thus: 4 2,600($73,000) = $189,800,000 in new sales is relevant. Erosion of luxury motor coach sales is also due to the new mid-size campers; thus: 850($115,000) = $97,750,000 loss in sales is relevant. The net sales figure to use in evaluating the new line is thus: Net sales = $437,000,000 + 189,800,000 – 97,750,000 Net sales = $529,050,000 Q9.4 Calculating OCF. Consider the following income statement: Sales Variable costs Depreciation EBIT Taxes@35% Net income $62,000 39,500 76,000 ? ? ? Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? To find the OCF, we need to complete the income statement as follows: Sales $ 62,000 Variable costs (39,500) Depreciation (76,000) EBIT $ (53,500) Taxes@35% 0 Net income / loss $(53,500) The OCF for the company is: OCF = EBIT + Depreciation – Taxes OCF = -$53,500+ 76,000 – (0) OCF = $22,500 The depreciation tax shield is the depreciation times the tax rate, so: Depreciation tax shield = Depreciation(T) Depreciation tax shield = .35($76,000) Depreciation tax shield = $26,600 In the example above where the company has a loss (negative EBIT), the full benefit of the depreciation tax shield could not be utilized. However for a company with positive EBIT, the depreciation tax shield shows us an increase in OCF by being able to expense depreciation. 5 Q9.13 Project Evaluation. Agro Foods is looking at a new sausage system with an installed cost of $625,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $95,000. The sausage system will save the firm $183,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $41,000. If the tax rate is 34 percent and the discount rate is 8 percent, what is the NPV of this project? First, we will calculate the annual depreciation of the new equipment. It will be: Annual depreciation = $625,000/5 Annual depreciation = $125,000 Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so: Aftertax salvage value = MV + (BV – MV)T Very often, the book value of the equipment is zero, as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes: Aftertax salvage value = MV + (0 – MV)T Aftertax salvage value = MV(1 – T) We will use this equation to find the aftertax salvage value since we know the book value is zero. So, the aftertax salvage value is: Aftertax salvage value = $95,000(1 – 0.34) Aftertax salvage value = $62,700 Using the tax shield approach, we find the OCF for the project is: OCF = $183,000(1 – 0.34) + 0.34($125,000) OCF = $163,280 Now we can find the project NPV. Notice we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value. NPV = –$625,000 – 41,000 + $163,280(PVIFA8%,5) + [($62,700 + 41,000) / 1.085] NPV = $56,506.17