Acct 202-01 and -02 Spring 2016

Financial Statement Analysis Project

Overview:

Each project team analyzes a U.S.-headquartered publicly traded company of its choice. Teams

prepare Excel spreadsheets with calculations and supporting data for classmates to study. In

consideration of this information, each team recommends the company that would be the best

investment. Work is due at the start of class on the dates indicated.

Part 1 (due January 21 and 26):

(a) Each team will send me the name of the company it wants to analyze. I must approve your

choice BEFORE THE START OF CLASS ON JANUARY 21. Please make every effort to choose

companies other than the usual, famous companies everyone knows and wants to study.

Treat this project as an opportunity to explore an interesting, lesser-known business.

(b) BY THE START OF CLASS ON JANUARY 26, you will locate your company’s most recent

annual report or SEC Form 10-K. Depending on its year end date, it could be the fiscal 2014 or

2015 annual report. The report will be available as a PDF file on your company’s investor

relations website. Save the file for yourself and send me a copy of the PDF file. In your e-mail

message, please tell me the fiscal year end date for your company. Also identify the names of

the reportable business segments for your company. These will be identified in the MD&A

section and/or the notes accompanying the financial statements – you have to read and

discover this on your own.

Part 2:

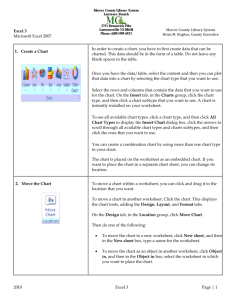

From your company’s most recent annual report, prepare an Excel spreadsheet with the amount

of the items below for the two most recent years in your annual report. Show the dollar amounts

and percentage changes for all items (use formulas for your calculation cells). Label the

worksheet tab “Part 2”.

Current assets

Total revenue

Total assets

Gross profit

Current liabilities

Operating income

Total liabilities

Net income

Total stockholders’ equity

Basic earnings per share (EPS)

Part 3:

On the next worksheet in your spreadsheet, calculate the following ratios for the most recent year

in your annual report. Label this worksheet tab “Part 3”.

Return on assets (ROA)

Current ratio

Return on equity (ROE)

Gross margin percentage

Debt ratio

Operating margin percentage

Debt-to-equity ratio

Net margin percentage (return on sales)

You can obtain the ratios from Chapter 12 and this Inc. Magazine website. Your worksheet must

show the actual data from the financial statements and the ratio cells need to use Excel formulas for

the calculations. When you click on cell C3, for example, the formula =12736+946 appears:

1|Page

Updated

15-December-2015

Ratios for Procter & Gamble - FY 2015

Amounts in millions

Return on assets

$

$

Net income

Total assets

13,682

131,503

Ratio

10.4%

Part 4:

(a) From the annual report or 10-K, provide the following information for the current year:

Inventory method used

Depreciation method used

Name of the firm that audited the company’s financial statements

Net cash from (or used for) operating activities for each of the past 3 years

Total (not per share) common dividends paid each year for the past 3 years

Please provide the PDF file page number (page # appearing in the Acrobat toolbar) where you found

each of the above items.

(b) Prepare (customize, then copy and paste) the following three graphs for your company:

Daily stock price for January 2016.

Weekly stock price (usually expressed as %s) for the trailing twelve months compared to the

Dow Jones Industrial Average (DJIA).

Monthly stock price (usually expressed as %s) for the past five years compared to one of its

industry competitors.

For this task, you can use charting features available through the online Wall Street Journal or

Yahoo! Finance. Label the worksheet tab “Part 4”.

Part 5 (due March 1):

(a) Compile a professional looking Excel spreadsheet that includes all of the previously prepared

information. This is to be prepared in a single Excel file using appropriately labeled and

professional organized/prepared worksheets. Each team will send its file to me, which I will

share with classmates. Please remember to use the “print preview” function to see how each

page in the file will print. Be sure you adjust the settings so that each tab is printable on one

sheet of paper AND will not render in tiny font.

(b) Each individual will prepare a one to two page reflection paper about the project. Please tell me

what skills you learned and developed as a result of working on this project. In addition,

describe the changes I could make to the project to improve it for future semesters.

Part 6 (due March 29):

(a) Each student nominates one project team to receive a merit award (8 points) for the most

professional looking spreadsheet file.

(b) Each team submits a three to four page report analyzing the information presented and selecting

the company (from among a smaller number of companies that I will choose) that would be the

best investment. Each team’s recommendation should present comparative results of all

information provided in the Excel files.

2|Page

Updated

15-December-2015

0

0