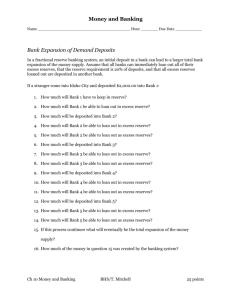

Homework # 7, due Friday, October 31

advertisement

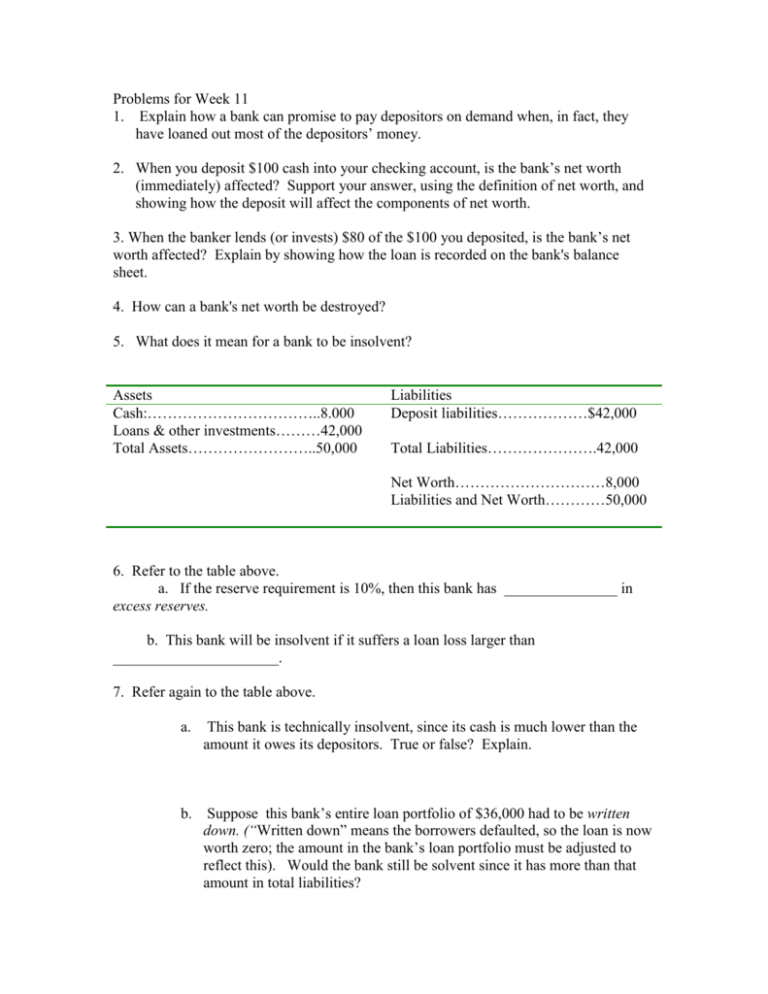

Problems for Week 11 1. Explain how a bank can promise to pay depositors on demand when, in fact, they have loaned out most of the depositors’ money. 2. When you deposit $100 cash into your checking account, is the bank’s net worth (immediately) affected? Support your answer, using the definition of net worth, and showing how the deposit will affect the components of net worth. 3. When the banker lends (or invests) $80 of the $100 you deposited, is the bank’s net worth affected? Explain by showing how the loan is recorded on the bank's balance sheet. 4. How can a bank's net worth be destroyed? 5. What does it mean for a bank to be insolvent? Assets Cash:……………………………..8.000 Loans & other investments………42,000 Total Assets……………………..50,000 Liabilities Deposit liabilities………………$42,000 Total Liabilities………………….42,000 Net Worth…………………………8,000 Liabilities and Net Worth…………50,000 6. Refer to the table above. a. If the reserve requirement is 10%, then this bank has _______________ in excess reserves. b. This bank will be insolvent if it suffers a loan loss larger than ______________________. 7. Refer again to the table above. a. This bank is technically insolvent, since its cash is much lower than the amount it owes its depositors. True or false? Explain. b. Suppose this bank’s entire loan portfolio of $36,000 had to be written down. (“Written down” means the borrowers defaulted, so the loan is now worth zero; the amount in the bank’s loan portfolio must be adjusted to reflect this). Would the bank still be solvent since it has more than that amount in total liabilities? 8. For each of the following, indicate whether the money supply will increase, decrease, or remain unchanged. Explain your answer. a. The public collectively withdraws money from their checking accounts and holds it as cash instead. The initial effect on M1 is (expansionary; neutral; contractionary); Once the banks adjust their lending to reflect this new reality, though, M1 will (expand; not change; shrink). b. Assume the banking system starts out from a position where it is “fully loaned up”. Normally, as loans are repaid, new loans are immediately extended. Otherwise, the bank would have excess reserves, and would not be making as much profit as possible. Suddenly, however, an atmosphere of pessimism and uncertainty grips the financial markets, and bankers start to worry about the credit-worthiness of their customers. In response, they decide to accumulate excess reserves by restricting lending. 9. If the banking system is fully loaned up, the reserve requirement is 20%, and Reserves of the banking system = $400 billion, what is the dollar value of the demand deposits in the banking system? 10. A banking system with a reserve requirement of 25% loses $10,000 of reserves as customers collectively decide to hold more of their wealth in the form of currency instead of checking account deposits. Analyze the ultimate change in M1, taking into account the fact that banks will have to allow their loan portfolios to shrink. 11. Which account(s) in the balance sheet above would be included in M1?