Banks and Credit ppt

advertisement

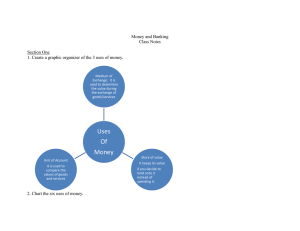

m __ F __ __l o __ e __ o __ n __ d __ a __ e __ y __ e __ r __ a __ l R __ e __ s __ e __ r __ v __ e __ __ n __ s __ The Economy c __ b __ l __ u __ r __ e __ n __ c __ y r __ __ a __ c __ c __ o __ u __ n __ t a __ n __ k __ __ o __ a __ n __ s __ Word Bank bank account banks interest rates b __ a __ n __i __ m __ o __ n __ t __ n __ k __ e __ e __ s __ r __ e __ s __ t __ y __ loans r __ a __ t __ e __ s __ money currency Federal Reserve A “note” is an I.O.U. Paper money in the U.S. is referred to as Federal Reserve Notes. That means the Fed owes you $1 in exchange for this bill. Click the coins to take a virtual tour of the U.S. Mint: Do they make $10,000 bills? Click Ben Franklin to find out: If you kept going, you’d find out that Mary’s $100 will add $1,000 to the money supply. Click to watch a video about the Federal Reserve: When I was a kid, candy bars cost 5 cents! Ever heard anyone say something like this? Inflation makes prices go up over time. Think about something you bought recently. How much did you pay? How much might it have cost years ago? Click the calculator to access the inflation calculator at the U.S. Bureau of Labor Statistics: Click to view Hands On Banking’s tutorial about credit: Click for Financial Literacy Videos 1) Can you exchange money for goods and services? Yes No Money is the “medium of exchange” that people use to pay for things. 2) Does “money” ONLY refer to currency? Yes No Money includes currency and bank account balances, which can be turned into currency. 3) Can you make unlimited withdrawals from a savings account? Yes No Federal law limits the number of certain kinds of withdrawals you can make each month. 4) Is it safe to keep your money in the bank? Yes No The federal government insures bank deposits up to a certain amount of money. 5) Do banks pay people more for savings accounts than they charge for loans? Yes No Savings accounts pay a TINY amount of interest. Interest you pay on loans is much higher. 6) Could most people start a business without a loan? Yes No Starting a business can be expensive. Loans provide money for equipment and startup costs. 7) Does lending make more money available to spend? Yes No Lending actually multiplies the amount of money out in the community. 8) Are banks required to keep some money in reserve? Yes No Banks must keep a certain percent of deposits in reserve. 9) Does anyone supervise the banking industry? Yes No The Federal Reserve and other federal agencies supervise the banking industry. 10) Does the Fed want the economy to swing wildly up and down? Yes No The Fed’s goal is to keep the economy in balance. 11) Does increased lending make the economy slow down? Yes No Increased lending = more spending, which helps fire up the economy. 12) Do some loans help you increase your ability to produce? Yes No A loan to start or expand a business, or a loan to get an education, can help you earn more. 13) Is an entrepreneur likely to start his or her own business? Yes No “Entrepreneurs” take risks to start new businesses. 14) Does paying for something with a loan cost less than paying for it outright? Yes No Paying with a loan always costs MORE than paying for something outright! 15) Does anyone keep track of your credit history? Yes No Lenders report your credit history to the three credit reporting bureaus.