Deposit creation

advertisement

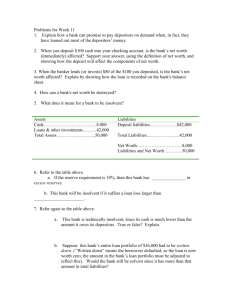

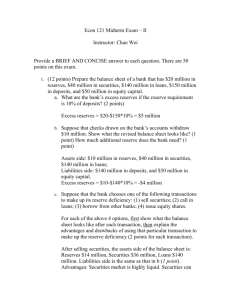

START Reserves Loans Gov't securities Total Assets 100 Deposits 500 400 1000 Total Liabilities 1000 1000 required reserve ratio = 10%, bank holds no excess reserves SCENARIO: New deposit by bank customer of 200 Reserves Loans New Loans Gov't securities Total Assets 120 Deposits 500 180 400 1200 Total Liabilities 1200 1200 Deposits increase by 200; required reserves increase by 20 (10%); New loans created (200 - 20 = 180) New loans then become a new deposit at another bank and the multiple deposit multiplier continues. SCENARIO: What if new loan of 180 above is extended to existing bank customer (i.e. new loan isn't deposited at another bank but same bank)? Reserves Loans New Loans Gov't securities Total Assets 138 Deposits 680 162 400 1380 Total Liabilities 1380 1380 Answer: the same process unfolds whether the new loan is deposited at the existing bank or at a new bank. Deposits increase by 180; required reserves increase by 18; New loans created (180 - 18 = 162). SCENARIO: The Fed buys bonds directly from a private individual. That person gives up the bond and receives a payment from the Fed. That person will likely then deposit the payment into a bank and the multiple deposit process is started as outlined above. SCENARIO: The Fed buys bonds directly from a bank. Example: Fed buys 100 bond from bank. Reserves Loans Gov't securities Total Assets 200 Deposits 500 300 1000 Total Liabilities 1000 1000 The bank gives up the bond in exchange for reserves. The bank now has excess reserves because nothing has happened to deposits. The bank will extend a new loan and the multiple deposit process is started again.