Ag Decision Maker File B2-40

advertisement

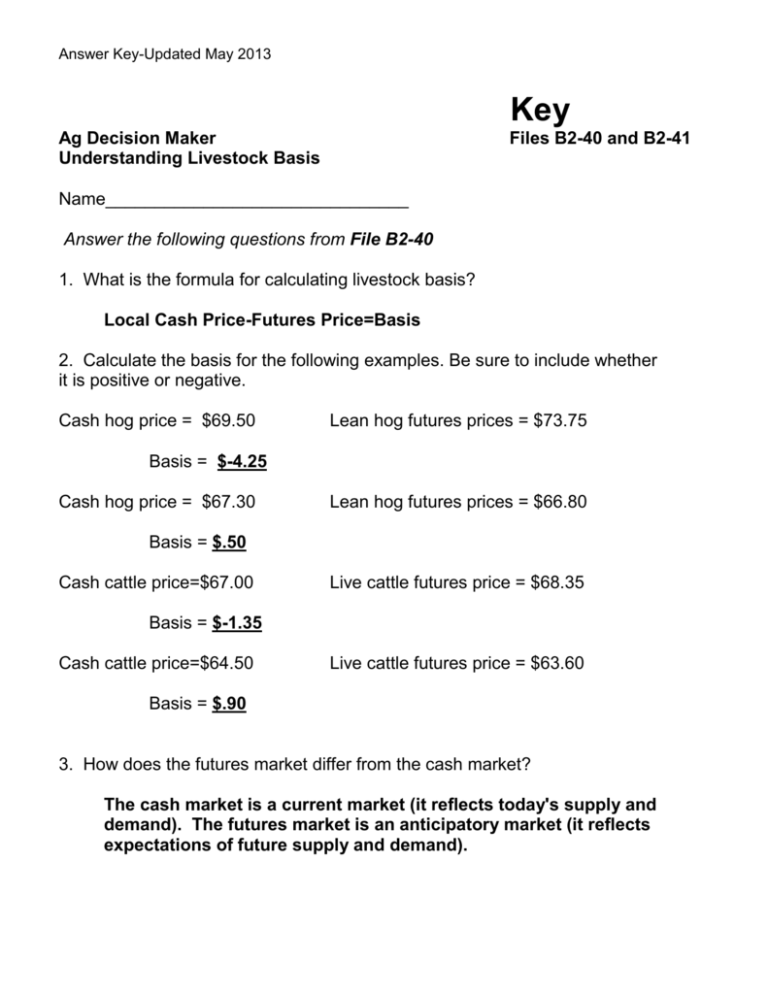

Answer Key-Updated May 2013 Key Ag Decision Maker Understanding Livestock Basis Files B2-40 and B2-41 Name_______________________________ Answer the following questions from File B2-40 1. What is the formula for calculating livestock basis? Local Cash Price-Futures Price=Basis 2. Calculate the basis for the following examples. Be sure to include whether it is positive or negative. Cash hog price = $69.50 Lean hog futures prices = $73.75 Basis = $-4.25 Cash hog price = $67.30 Lean hog futures prices = $66.80 Basis = $.50 Cash cattle price=$67.00 Live cattle futures price = $68.35 Basis = $-1.35 Cash cattle price=$64.50 Live cattle futures price = $63.60 Basis = $.90 3. How does the futures market differ from the cash market? The cash market is a current market (it reflects today's supply and demand). The futures market is an anticipatory market (it reflects expectations of future supply and demand). Answer Key-Updated May 2013 Ag Decision Maker Continued… Understanding Livestock Basis Files B2-40 and B2-41 4. What are the three ways that you can use basis information? 1. Placing a hedge 2. Lifting a hedge 3. Evaluating forward contract bids 5. Why must you estimate the basis when placing a hedge? Because the basis translates the futures price into a local cash price. 6. Explain how to calculate the estimated net selling price when placing a hedge. The estimated net selling price can be calculated by adding the estimated basis to the futures price. 7. Assume future price is $70.00 and the estimated basis is $-1.50, what is the estimated net selling price (do not include interest on margin and transaction fees)? $70.00 -1.50 $68.50 8. How can you use basis information to evaluate a forward contract offered by a packer? You can look up the estimated basis and calculate an estimated net selling price for a hedge. You can then compare this price to the bid that the packer is offering. You also need to consider the costs of hedging (commissions and interest on margin money). Also consider the fact that the actual net selling price of the hedge may be different than the actual hedge price because the actual basis may be different than the estimated basis.