Derivative Markets Project: Futures & Arbitrage

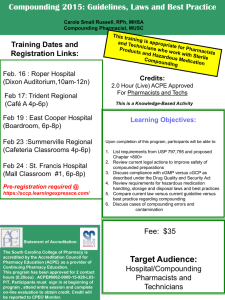

advertisement

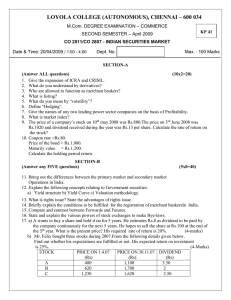

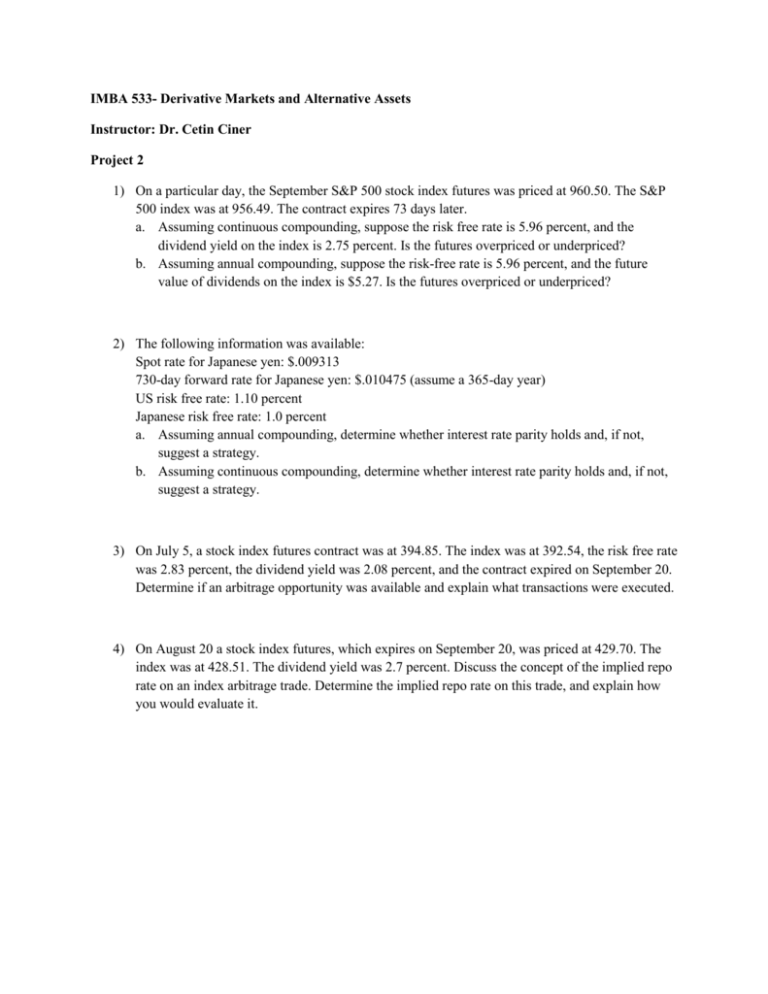

IMBA 533- Derivative Markets and Alternative Assets Instructor: Dr. Cetin Ciner Project 2 1) On a particular day, the September S&P 500 stock index futures was priced at 960.50. The S&P 500 index was at 956.49. The contract expires 73 days later. a. Assuming continuous compounding, suppose the risk free rate is 5.96 percent, and the dividend yield on the index is 2.75 percent. Is the futures overpriced or underpriced? b. Assuming annual compounding, suppose the risk-free rate is 5.96 percent, and the future value of dividends on the index is $5.27. Is the futures overpriced or underpriced? 2) The following information was available: Spot rate for Japanese yen: $.009313 730-day forward rate for Japanese yen: $.010475 (assume a 365-day year) US risk free rate: 1.10 percent Japanese risk free rate: 1.0 percent a. Assuming annual compounding, determine whether interest rate parity holds and, if not, suggest a strategy. b. Assuming continuous compounding, determine whether interest rate parity holds and, if not, suggest a strategy. 3) On July 5, a stock index futures contract was at 394.85. The index was at 392.54, the risk free rate was 2.83 percent, the dividend yield was 2.08 percent, and the contract expired on September 20. Determine if an arbitrage opportunity was available and explain what transactions were executed. 4) On August 20 a stock index futures, which expires on September 20, was priced at 429.70. The index was at 428.51. The dividend yield was 2.7 percent. Discuss the concept of the implied repo rate on an index arbitrage trade. Determine the implied repo rate on this trade, and explain how you would evaluate it.