Forward, Futures and Swap – Practice

advertisement

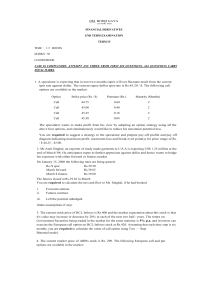

Forward, Futures and Swap – Practice 1. If the current Canadian foreign exchange rate is $0.805/Can$ (that is U.S dollars per Canadian dollar) and the six-month futures exchange rate is $0.80/Can$, what is the implied difference in interest rate between United States and Canada? 2. Suppose the NASDAQ Index closed at 2,000 points. If the dividend yield is 4% for six months and the annual interest rate is 6%, what is the equilibrium value of a six-month futures contract on the NASDAQ Index? 3. The price of three-month futures on the British Pound is $1.882 and the spot price is $1.902. The annual interest rate in the U.S. is 2.5%. Use the futures price and the spot price to estimate the annual interest rate in U.K. 4. The U.S. yield curve is flat at 4% and the U.K. yield curve is flat at 5%. The current exchange rate is 1.85$/£. What will be the swap rate on an agreement to exchange currency over three-year period? The swap will call for £1M for a given number of dollars in each year. 5. Consider two firms A and B that can raise funds either at fixed or floating rates, $10M over 10 years. A want to raise floating and B want to raise fixed. The following table displays capital costs. Firm Fixed Floating A 8% LIBOR+0.2% B 10% LIBOR+1.2% a. What will be the total cost if both firms directly issue fund at their final desired market? b. What should be the interest rate swap contract that splits the benefit equally between the two firms? 6. Consider the following yield curve: Year Yield (%) 1 3 2 4 3 5 4 6 What should be the fixed rate in a 4-year IRS contract?