Bond price - valuation of bonds

advertisement

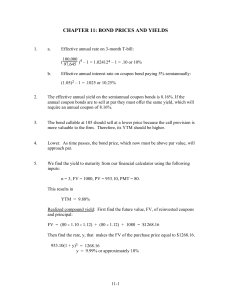

Valuation of Bonds 1. What is the price today of a 2-year 9% coupon bond that has a par value of $1,000 and a required rate of return of 9%? We need to calculate how much the bonds have been issued by using the formula as follows: - 1 1 (1 r ) n B C r Face n (1 r ) where B is the issued price/current price C is the coupon payment r is the current interest rate n is the period Assume it is paying annual coupon. Coupon payment is equal to $1,000 x 9% = 90 B = 90 x [1 - 1 ] + 2 (1.09) 0.09 1,000 (1.09)2 B = 1,000 2. You have invested in a bond that pays semiannual coupon payments of $40 and has a par value of $1,000. The bond matures in 1 year, and its required rate of return is 10% compounded semiannually. Determine the bond's present value. Coupon payment is equal to $1,000 x 8% =80/2 = 40 B = 40 x [1 - 1 ] + 2 (1.05) 0.05 B = 981.41 1,000 (1.05)2 3. A $1,000 par value bond with an 8.5% coupon and 2 years until maturity is priced at $1,008.91. a. What is the bond’s yield to maturity using annual coupons and annual compounding and Because we need to find the yield to maturity, we need to replace the information given into the equation and calculate for the yield to maturity. C, which is the annual coupon payment, can be calculated by multiplying $1,000 with 8.5%. We will get $85 coupon payment. The yield to maturity of the bond is equal to 1,008.91 = 85 x [1 - 1 ] + (1 + r)2 1,000 (1 + r)2 r Then, you could substitute values for r until you find a value that works and forces the sum of the present value on the right side of the equal sign equal $1,008.91. However, finding yield to maturity by trial and error would be a tedious, time-consuming process. It would be easier to use a financial calculator. Here is the set up. Inputs N 2 Output I PV -1,008.91 PMT 85 FV 1,000 = 8.000352% http://www.arachnoid.com/lutusp/finance.html b. also using semiannual coupons and semiannual compounding? 1,008.91 = 42.50 x [1 - 1 ] + 1,000 4 (1 + r/2) (1 + r/2)4 r/2 Then, you could substitute values for r until you find a value that works and forces the sum of the present value on the right side of the equal sign equal $1,008.91. However, finding yield to maturity by trial and error would be a tedious, time-consuming process. It would be easier to use a financial calculator. Here is the set up. Inputs Output N 4 I PV PMT -1,008.91 42.50 = 4.004512% x 2 = 8.009024% FV 1,000