assignment3

advertisement

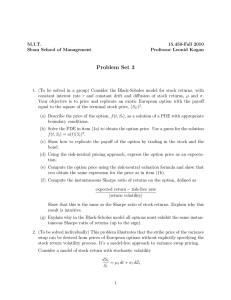

MGT 821/ECON 873: FINANCIAL DERIVATIVES Winter 2008 Assignment 3 Due: April 8 (no exception) 1. The formula for the price of a European call futures option in terms of the futures price 𝐹0 is given as 𝑐 = 𝑒 −𝑟𝑇 [𝐹0 𝑁(𝑑1 ) − 𝐾𝑁(𝑑2 )] where 𝑑1 = ln(𝐹0 /𝐾)+𝜎𝑇 2 /2 𝜎√𝑇 , 𝑑2 = 𝑑1 − 𝜎√𝑇 and 𝐾, 𝑟, 𝑇 and 𝜎 are the strike price, interest rate, time to maturity, and volatility, respectively a. Prove that 𝐹0 𝑁 ′ (𝑑1 ) = 𝐾𝑁 ′ (𝑑2 ). b. Prove that the delta of the call price with respect to the futures price is 𝑒 −𝑟𝑇 𝑁(𝑑1 ). c. Prove that the vega of the call price is 𝐹0 √𝑇𝑁 ′ (𝑑1 )𝑒 −𝑟𝑇 . d. Prove the formula for the rho of a call futures option given by 𝑟ℎ𝑜 = −𝑐𝑇 where 𝑐 is the call price. 2. A company has issued 3- and 5- year bonds with a coupon of 4% per year payable annually. The yields on the bonds (expressed with continuous compounding) are 4.5% and 4.75%, respectively. Risk-free rates are 3.5% with continuous compounding for all maturities. The recovery rate is 40%. Default can take place halfway through each year. The risk-neutral default rates per year are 𝑄1for years 1 to 3 and 𝑄2 for years 4 and 5. Estimate 𝑄1and 𝑄2 . 3. The value of a company’s equity is $4 million and the volatility of its equity is 60%. The debt that will have to be repaid in 2 years is $15 million. The risk-free interest rate is 6% per annum. Use Merton’s model to estimate the expected loss from default, the probability of default. And the recovery rate in the event of default. 4. A 3-year convertible bond with a face value of $100 has been issued by company ABC. It pays a coupon of $5 at the end of each year. It can be converted into ABC’s equity at the end of the first year or at the end of the second year. At the end of the first year, it can be exchanged for 3.6 shares immediately after the coupon date. At the end of the second year, it can exchange for 3.5 shares immediately after the coupon date. The current stock price is $25 and the stock price volatility is 25%. No dividends are paid on the stock. The risk-free interest rate is 5% with continuous compounding. The yield on bonds issued by ABC is 7% with continuous compounding and the recovery rate is 30%. a. Use a three step tree to calculate the value of the bond b. How much is the conversion option worth c. What difference does it make to the value of the bond and the value of the conversion option if the bond is callable any time within the first 2 years for $115? d. Explain how your analysis would change if there a dividend payment of $1 on the equity at the 6-month, 18-month points. Detailed calculations are not required. 5. Show that when 𝑓and 𝑔provide income at rates 𝑞𝑓 and 𝑞𝑔 , respectively, equation (25.15) in the textbook becomes 𝑓𝑇 𝑓0 = 𝑔0 𝑒 (𝑞𝑓 −𝑞𝑔)𝑇 𝐸𝑔 ( ) 𝑔𝑇 6. The variable 𝑆 is an investment asset providing income at rate 𝑞 measured in currency 𝐴. It follows the process 𝑑𝑆 = 𝜇𝑆 𝑆𝑑𝑡 + 𝜎𝑆 𝑆𝑑𝑧 in the real world. Defining new variables as necessary, give the process followed by 𝑆 and the corresponding market price of risk, in a. A world that is the traditional risk-neutral world for currency 𝐴 b. A world that is the traditional risk-neutral world for currency 𝐵 c. A world that is forward risk-neutral with respect to a zero coupon currency 𝐴bond maturing at time 𝑇 d. A world that is forward risk-neutral with respect to a zero coupon currency 𝐵 bond maturing at time 𝑇 7. A call option provides a payoff at time 𝑇 of max(𝑆𝑇 − 𝐾, 0) in US dollars, where 𝑆 is foreign equity index paying a dividend yield of 𝑞, quoted in the foreign currency. Calculate the value of the contract. 8. 9.