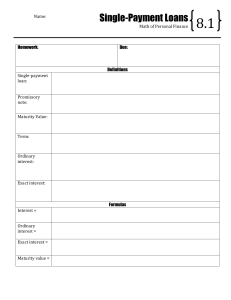

Define the following:

advertisement

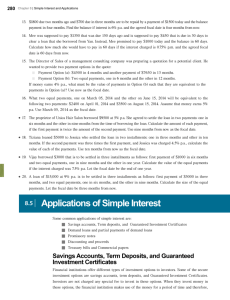

Chapter 8 Section 1 LOANS! NAME: ________________ Define the following: 1. Principal: 2. Interest: a. Formula (Simple Interest): 3. Single Payment Loan: 4. Maturity Value: a. Formula: 5. Term (of a loan): 6. Some people take loans from family members instead of from banks or institutions. How might loans from family members be different than loans from banks or other institutions? Complete the Following Examples: 7. Anita’s Bank granted her a single payment loan of $7,200 for 91 days at 12% interest. What is the maturity value of the loan? STEP 1: Find the interest owed Ordinary Interest = Principal x Rate x (Time 360 days) STEP 2: Find the maturity value Maturity value = Principal + Interest Owed Chapter 8 Section 1 LOANS! 8. Compute the interest and the maturity value: a. Loan: $600 Interest: 10% Time: 120 days b. Loan: Interest: Time: $3500 11.55% 40 weeks c. Loan: Interest: Time: $800 12% 10 months d. Loan: Interest: Time: $2000 8% 5 years e. Loan: Interest: Time: $950 5.5% year and a half f. Loan: Interest: Time: $7500 3.5% 18 months NAME: ________________