8.5 | Applications of Simple Interest

advertisement

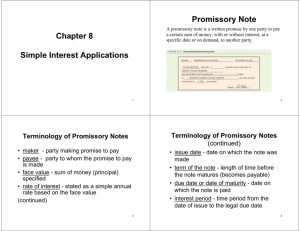

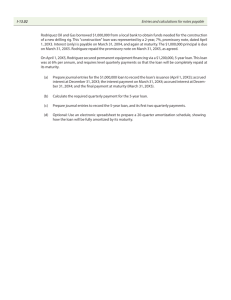

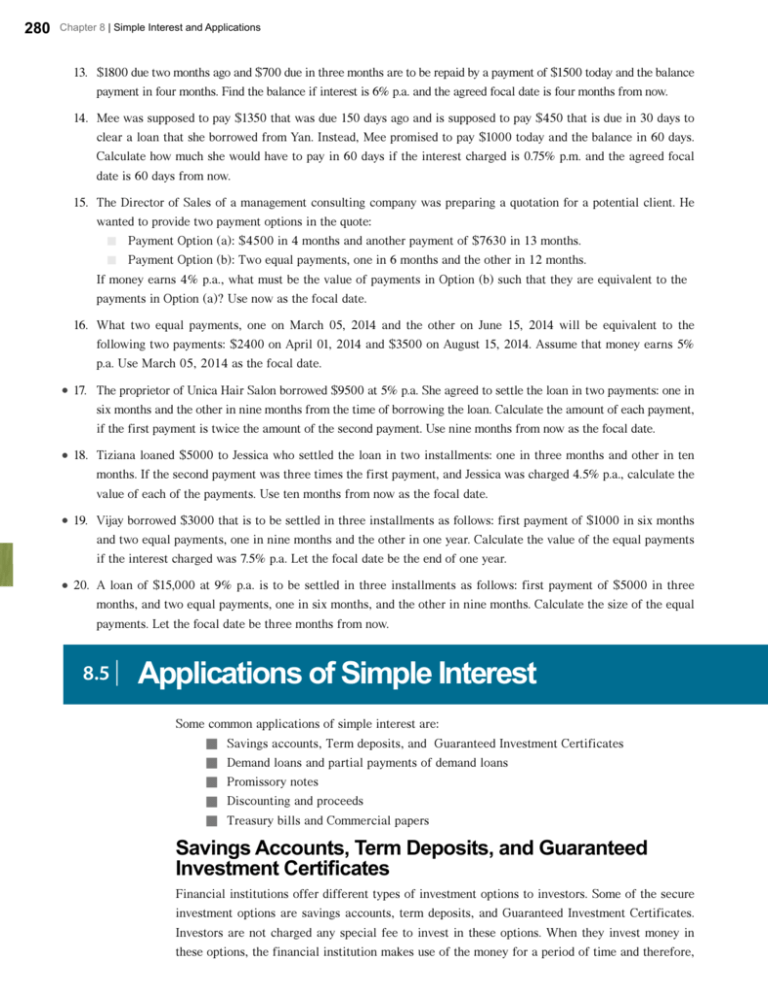

280 Chapter 8 | Simple Interest and Applications 13. $1800 due two months ago and $700 due in three months are to be repaid by a payment of $1500 today and the balance payment in four months. Find the balance if interest is 6% p.a. and the agreed focal date is four months from now. 14. Mee was supposed to pay $1350 that was due 150 days ago and is supposed to pay $450 that is due in 30 days to clear a loan that she borrowed from Yan. Instead, Mee promised to pay $1000 today and the balance in 60 days. Calculate how much she would have to pay in 60 days if the interest charged is 0.75% p.m. and the agreed focal date is 60 days from now. 15. The Director of Sales of a management consulting company was preparing a quotation for a potential client. He wanted to provide two payment options in the quote: ■■ Payment Option (a): $4500 in 4 months and another payment of $7630 in 13 months. ■■ Payment Option (b): Two equal payments, one in 6 months and the other in 12 months. If money earns 4% p.a., what must be the value of payments in Option (b) such that they are equivalent to the payments in Option (a)? Use now as the focal date. 16. What two equal payments, one on March 05, 2014 and the other on June 15, 2014 will be equivalent to the following two payments: $2400 on April 01, 2014 and $3500 on August 15, 2014. Assume that money earns 5% p.a. Use March 05, 2014 as the focal date. 17. The proprietor of Unica Hair Salon borrowed $9500 at 5% p.a. She agreed to settle the loan in two payments: one in six months and the other in nine months from the time of borrowing the loan. Calculate the amount of each payment, if the first payment is twice the amount of the second payment. Use nine months from now as the focal date. 18. Tiziana loaned $5000 to Jessica who settled the loan in two installments: one in three months and other in ten months. If the second payment was three times the first payment, and Jessica was charged 4.5% p.a., calculate the value of each of the payments. Use ten months from now as the focal date. 19. Vijay borrowed $3000 that is to be settled in three installments as follows: first payment of $1000 in six months and two equal payments, one in nine months and the other in one year. Calculate the value of the equal payments if the interest charged was 7.5% p.a. Let the focal date be the end of one year. 20. A loan of $15,000 at 9% p.a. is to be settled in three installments as follows: first payment of $5000 in three months, and two equal payments, one in six months, and the other in nine months. Calculate the size of the equal payments. Let the focal date be three months from now. 8.5 | Applications of Simple Interest Some common applications of simple interest are: Savings accounts, Term deposits, and Guaranteed Investment Certificates Demand loans and partial payments of demand loans Promissory notes Discounting and proceeds Treasury bills and Commercial papers ■■ ■■ ■■ ■■ ■■ Savings Accounts, Term Deposits, and Guaranteed Investment Certificates Financial institutions offer different types of investment options to investors. Some of the secure investment options are savings accounts, term deposits, and Guaranteed Investment Certificates. Investors are not charged any special fee to invest in these options. When they invest money in these options, the financial institution makes use of the money for a period of time and therefore, Chapter 8 | Simple Interest and Applications pays an interest to the investors. At the same time, the financial institution charges a higher interest rate to those borrowing money from them. Even though there is no fee when money is invested in these accounts, financial institutions make money on the difference between the interest it pays investors and the interest it charges borrowers. Savings Accounts A savings account provides people with a safe place to deposit their money. It is an option where funds are usually easily accessible; i.e., people can deposit and withdraw money from a savings account at any convenient time. In a savings account, the interest is often calculated on the daily balance and posted monthly. For example, if you have invested $1000 in a savings account for the month of March at a bank that is offering you an interest of 1% p.a., 1 Interest rate per day = % 365 0.01 # $1000 = $0.03 Interest amount per day = 365 Interest paid at the end of March = $0.03 × 31 days = $0.93 Term Deposits Term deposits, also known as fixed deposits or time deposits, are investment options where money is invested for a fixed period of time. If investors want to withdraw their money from a term deposit prior to the end of the term, they may have to pay a penalty as determined by the financial institution. As this investment is fixed for a period of time, the interest rate is higher than that of a savings account. Guaranteed Investment Certificates (GIC) The interest earned from savings accounts, term deposits, and GICs are taxable income. Purchasing a GIC refers to investing a sum of money for a specific period of time. It is similar to a term deposit or fixed deposit. The investor is guaranteed to receive the full principal investment plus interest at the end of the specified time period. The time period for a GIC can range from a few days to five years or even ten years. The interest rate for a longer investment period or a larger amount of investment will be higher than that of a shorter period or smaller amount of investment. GICs can also be redeemable or non-redeemable. In a redeemable GIC, the deposit may be withdrawn in whole or in part before the maturity date. In a non-redeemable GIC, the deposit usually cannot be redeemed or withdrawn before the maturity date. As redeemable GICs offer the option to withdraw before maturity, their interest rate is less than that offered on non-redeemable GICs. Example 8.5(a) Comparing GICs A bank offers 1.75% p.a. on investments of $5000 to $99,999 and 1.95% on investments of $100,000 to $249,000 for three-year GICs. What additional amount will Harold earn from a $160,000, three-year GIC than from two $80,000, three-year GICs? Solution Calculating the earnings from the $160,000, three-year GIC I = Prt = 160,000 # 0.0195 # 3 = $9360.00 Calculating the earnings from two $80,000, three-year GICs I = Prt = 80,000 # 0.0175 # 3 = $4200.00 Total earnings from two $80,000, three-year GICs = 4200.00 # 2 = $8400.00 Additional earnings = 9360.00 - 8400.00 = $960.00 Therefore, he will earn $960.00 more from the $160,000 three-year GIC. 281 282 Chapter 8 | Simple Interest and Applications Demand Loans A demand loan is a loan that is payable when it is demanded by the lender who issues the loan. The borrower signs a demand note agreeing to pay the interest and the principal on demand. Once the borrower signs the demand note, the lender has the right to ask for full payment at any time for any reason. A demand loan requires no regular repayments of the principal amount, but the lender may request for regular payments to cover the interest on the loan. The borrower has an option to make a payment to settle the loan either in part (partial payment) or in full anytime without paying a penalty. The interest rate on a demand loan is generally a few percent points above the prime rate. Prime rate is the lowest lending interest rate that is set by the Bank of Canada. The Bank of Canada changes the prime rate periodically. The rate on a demand loan will change when the prime rate changes. A demand loan is usually not a secured loan; i.e., no protection (collateral) is required with assets to obtain the loan. Therefore, it is a high risk loan and the borrower will pay a high interest rate for the loan. Note: Calculating the interest paid on a demand loan with a varying interest rate is similar to Example 8.3 (f). Partial Payments of Demand Loans When partial payments (more than one payment) are made to reduce a loan, each payment amount is first used to reduce the interest on the loan and the remainder is used to reduce the amount of principal. This method of dealing with repayments is called the declining balance method. Example 8.5(b) Partial Payments Using the Declining Balance Method A demand loan of $18,500 on March 10, 2014 at 18% p.a. simple interest was settled by a payment of $800 on May 15, 2014, another payment of $200 on June 18, 2014, and the outstanding balance on August 20, 2014. Using the declining balance method, calculate the amount of the last payment. Solution Calculating the balance after the first payment of $800.00 on May 15, 2014 March 10, 2014 to May 15, 2014 = 66 days = 66 years 365 The interest accumulated on the principal of $18,500.00 for the above period at 18% p.a.: Using the formula, I = Prt, I = 18,500.00 # 0.18 # 66 = $602.14 365 The partial payment of $800.00 is first used to clear the interest. Amount left after clearing interest = 800.00 - 602.14 = $197.86 This balance amount from the partial payment is used to reduce the principal. Therefore, Principal Balance = $18,500.00 - $197.86 = $18,302.14 Calculating the balance after the second payment of $200.00 on June 18, 2014 34 May 15, 2014 to June 18, 2014 = 34 days = years 365 The interest accumulated on the principal of $18,302.14 for the above period at 18% p.a.: 34 Using the formula, I = Prt , I = 18,302.14 # 0.18 # = $306.87 365 Chapter 8 | Simple Interest and Applications Solution continued The partial payment of $200.00 is first used to clear the interest. Now, as the partial payment is less than the accumulated interest, there will be an interest balance. Interest Balance = 306.87 - 200.00 = $106.87 Principal Balance will remain the same = $18,302.14 Last payment on August 20, 2014 63 years 365 The interest accumulated on the principal of $18,302.14 for the above period at 18% p.a.: 63 Using the formula, I = Prt , I = 18,302.14 # 0.18 # = $568.62 365 Calculating the balance to be paid on August 20, 2014 June 18, 2014 to August 20, 2014 = 63 days = Interest balance as on June 18, 2014 = $106.87 Interest accumulated from June 18, 2014 to August 20, 2014 = $568.62 Principal amount remaining on August 20, 2014 = $18,302.14 Total = 106.87 + 568.62 + 18,302.14 = $18,977.63 Therefore, the amount of the last payment is $18,977.63. Note: Partial payments can be greater or less than the interest that is due at the time of making the payment. ■■ If the partial payment is greater than the interest due at the time of the payment, we reduce the interest on the loan and the remainder of the partial payment is used to reduce the principal. ■■ If the payment is less than the interest due at the time of the payment, the payment is held (without interest) until another partial payment is made whose sum exceeds the interest due at the time of the new partial payment. Promissory Notes A promissory note is a written promise to repay a borrowed amount of money to the lender on an agreed date. The borrower of the amount is called the 'maker' of the note (as the borrower is making a promise to pay the amount) and the lender is called the 'payee' (as the borrower promises to pay the lender the amount). The amount shown on the promissory note is called the 'face value' of the note. The time period negotiated is known as the 'term or the maturity date', which may be in days, months, or years. Interest period is the time period from the date of issue of the note to the legal due date. The maturity value is the amount payable on the legal due date. As per the Canadian Law (Bill of Exchange Act, Section 41), the legal due date is three days after the maturity date. This extension period is known as the 'grace period'. If a promissory note is issued with 'No Grace Period' marked on it, then the maturity date and the legal due date will be the same. The interest period is the time period from the date of issue to the legal due date. Note: In the solved examples, we will assume that 'No Grace Period' is marked on all notes, so the legal due date and the maturity date will be the same. There are two types of promissory notes: interest-bearing notes and non-interest-bearing notes. Interest-Bearing Promissory Note The face value of the note is the amount of loan that must be repaid with the interest calculated based on the interest rate specified on the note. Therefore, the maturity value (S) is the amount to be repaid and is calculated using Formula 4.3(b): S = P (1 + rt). 283 284 Chapter 8 | Simple Interest and Applications The face value of an interest-bearing promissory note is the principal amount. Exhibit Exhibit4.5(a): 8.5(a):Sample SampleInterest-Bearing Interest-BearingPromissory PromissoryNote Note Example 8.5(c) Calculating the Maturity Date and Maturity Value of an Interest-Bearing Promissory Note Tony signs an interest-bearing promissory note for $100,000 at an interest rate of 6% p.a. The date of the note is April 15, 2014 and the term is 60 days. Find the maturity date and the maturity value. Solution Calculating the Maturity Date Using the date worksheet on the financial calculator, April 15, 2014 + 60 days = June 14, 2014 Calculating the Maturity Value P = $100,000 Using Formula 4.3(b), S = P (1 + rt) Substituting values, S = 100,000 `1 + 0.06 # 60 j 365 = 100,986.3014 = $100,986.30 Therefore, the maturity value is $100,986.30. Example 8.5(d) Calculating the Face Value of an Interest-Bearing Promissory Note Compute the face value of a 90-day promissory note dated October 25, 2014 that has a maturity value of $76,386.99 and an interest rate of 7.5% p.a. Solution The face value is the principal amount of the maturity value. The maturity date is 90 days from October 25, 2014. -1 Using Formula 4.3(c), P = S (1 + rt) Substituting values, 90 - 1 P = 76,386.99 `1 + 0.075 # j 365 = 75,000.00363... = $75,000.00 Therefore, the face value of the promissory note is $75,000.00. Chapter 8 | Simple Interest and Applications Non-Interest-Bearing Promissory Note The face value of a non-interest-bearing promissory note is the maturity value of the note; i.e., interest is calculated and included in the face value. The interest rate may not be specified on the note and the lender usually agrees on the interest rate on the loan. The loan amount is calculated -1 using the formula: P = S (1+ rt) . The face value of a non-interest-bearing promissory note is the maturity value. Also observe that there is no interest rate given on the promissory note. Example 8.5(e) Exhibit 8.5(b): Sample Non-Interest-Bearing Promissory Note Calculating the Loan Amount of a Non-Interest-Bearing Promissory Note A 90-day non-interest-bearing promissory note dated March 25, 2014 has a face value of $40,000. If the note is discounted at 5.5% p.a. on the date of issue, calculate the amount of the loan. Solution The maturity date is 90 days from March 25, 2014. Using Formula 4.3(c), P = S (1 + rt) -1 -1 Substituting values, P == 40,000 `1 + 0.055 # 90 j 365 = 39,464.79254... = $39,464.79 Therefore, the amount of the loan is $39,464.79. Discounting and Proceeds Discounting a promissory note refers to the process of finding the value of a note on a specific date before its specific legal due date. Sometimes notes and bills are resold before their maturity dates for various reasons. For example, the owner of the note may want to repay the loan earlier than the maturity date or the owner may require cash on the bill before its maturity date. Proceeds: the amount of money for which a promissory note is bought or sold at the discounting date. The amount received by the owner of the note at the time of the discount is called "proceeds" and the interest rate used or agreed to calculate the proceeds is called the"discount rate". The discount rate may not be the same as the rate of interest on the note at the time of purchase. The notes and bills are legal contracts. Therefore, it is necessary to find its maturity value first before calculating the proceeds. For non-interest-bearing notes (T-bills and commercial papers), the face value is the maturity value. The maturity value is discounted using the discount rate to calculate the proceeds. 285 286 Chapter 8 | Simple Interest and Applications For interest-bearing notes, the face value is the amount of loan and the maturity value is to be calculated using S = P (1 + rt). The maturity value is discounted using the discount rate to calculate the proceeds. Example 8.5(f) Calculating the Proceeds and Discount of a Non-Interest-Bearing Note A non-interest-bearing note with a face value of $30,000 is due in 120 days. If the note is discounted 30 days from the date of issue at a rate of 9% p.a., calculate the amount of proceeds and the amount of discount. Solution Since it is a non-interest-bearing note, the face value is the maturity value. The maturity date is 120 days from the date of issue. The time remaining is 120 - 30 = 90 days. Using Formula 4.3(c), P = S (1 + rt) -1 -1 + 30,000 `1 + 0.09 # 90 j Proceeds = 365 = 29,348.70008... = $29,348.70 The amount of proceeds is $29,348.70. The amount of discount = 30,000.00 - 29,348.70 = $651.30. Example 8.5(g) Calculating the Proceeds and Discount of an Interest-Bearing Note An interest-bearing note for 90 days at 8% p.a. has a face value of $80,000. If the note is discounted 20 days at a rate of 10% p.a., calculate the proceeds. Solution Since it is an interest-bearing note, the face value is the principal. The maturity date is 90 days from the date of issue. First calculate the maturity value of the note. S = 80,000 `1 + 0.08 # 90 j = 81,578.08219... 365 Now, since it is discounted in 20 days, 70 years 365 -1 P = S (1 + rt) t = 90 - 20 = 70 days = Using Formula 4.3(c), -1 70 j Proceeds = 81,578.08219... `1 + 0 .10 # 365 = $80,043.01 Therefore, the proceeds will be $80,043.01. Treasury Bills and Commercial Papers Treasury bills, also known as T-bills, are written agreements or contracts issued to individuals, institutions, or corporate investors for a short term (less than a year) and are issued by the federal or provincial government on every other Tuesday through major financial institutions as their agents. The maturity period of T-bills are usually 13, 26, or 52 weeks (91, 182, or 364 days). Some provincial governments also issue T-bills, but on irregular dates or intervals. T-bills are generally available in denominations of $1000, $5000, $25,000, $100,000, and $1,000,000. Chapter 8 | Simple Interest and Applications T-bills are considered very safe (riskfree) investments because they are fully guaranteed by the issuing government; however, they offer considerably lower returns than most other investments. T-bills are similar to non-interest-bearing promissory notes. The face value of a T-bill is the amount shown on it and it is the maturity value that the government guarantees to pay on the maturity date. Therefore, the purchase price of a T-bill is calculated as a principal amount of the face value shown (maturity value) using the interest rate (called discount rate) offered at the time of purchase, which is based on market conditions. T-bills are transferable and its value at the time of selling or buying is determined by the market rate for the time remaining until maturity. Commercial papers are similar to T-bills, except that they are issued by large corporations. The maturity period of commercial papers is generally 1, 3, or 6 months (30, 90, or 180 days). Example 8.5(h) Calculating the Purchase Price of a T-bill Benjamin, an investor, purchased a 182-day T-bill that had an interest rate of 3.5% p.a. and face value of $25,000. Calculate the price he paid for the T-bill. Solution S = $25,000, r = 0.035, t = 182 years 365 -1 Using Formula 8.3(c), P = S (1 + rt) Substituting values, -1 25000 `1 + 0.035 # 182 j P = 25,000 365 = $24,571.18 Therefore, he paid $24,571.18 for the T-bill. Example 8.5(i) Calculating the Purchase Price of a T-bill An investor purchased a 91-day T-bill with a face value of $5000 discounted at 3% p.a. (i) Calculate the purchase price of the T-bill. (ii) In 30 days, he needed the money and therefore, sold the T-bill to another investor. The rate for this investment in the market was 2.8% p.a at the time of the sale. Calculate his selling price and profit or loss on the transaction. (iii)What rate of return did he realize while holding the T-bill? Solution (i) S = $5000, r = 3% p.a. = 0.03, t = Using Formula 8.3(c), Substituting values, 91 years 365 -1 P = S (1 + rt) 91 - 1 P= = 5000 `1 + 0.03 # j 365 = $4962.88 Therefore, the purchase price was $4962.88. (ii) Days remaining on T-bill = 91 days - 30 days passed = 61 days Using Formula 8.3(c), -1 P = S (1 + rt) 61 - 1 P1 = 5000 `1 + 0.028 # j = $4976.71 365 Therefore, he sold it for $4976.71. He sold it for more; hence, he made a profit. His profit on the sale of the T-Bill was P1 - P = 4976.71 - 4962.88 = $13.83 Substituting values for, 287 288 Chapter 8 | Simple Interest and Applications Solution continued (iii)Since he held it for 30 days, rr== I Pt 13.83 = 0.033904... = 3.39% p.a. Substituting values, r == 4962.88 ` 30 j 365 Therefore, he realized a rate of return of 3.39% p.a. while holding the T-bill. Rearranging Formula 8.2, 8.5 | Exercises Answers to the odd-numbered problems are available at the end of the textbook For the following problems, express the answers rounded to two decimal places and assume that 'No Grace Period' is marked on all promissory notes. 1. Lea's bank offers interest rates of 1.50% p.a. for one-year GICs and 1.85% p.a. for two-year GICs for investments of $5000 to $99,000. Lea was considering the following two investment options: a. Invest $50,000 in a two-year GIC. b. Invest $50,000 in a one-year GIC then invest the maturity amount in a second one-year GIC, assuming that the interest rate remains constant over the second one-year period. In which of the above two options will she earn more and by how much? 2. A bank offers interest rates of 1.25% p.a. for 60-day GICs and 1.50% p.a. for 120-day GICs for investments of $100,000 to $249,999. Chang was considering the following two investment options at this bank: a. Invest $150,000 in a 120-day GIC. b. Invest $150,000 in a 60-day GIC then invest the maturity amount in a second 60-day GIC, assuming that the interest rate remains constant over the second 60-day period. In which of the above two options will he earn more and by how much? 3. Isabel received a demand loan from her bank for $8500 at 4% p.a. simple interest. Three months later, the prime rate increased and the rate on the loan changed to 4.25% p.a. If she repaid the loan in full in 8 months, calculate the total interest she paid on this loan. 4. On January 02, 2014, Chloe took a demand loan of $15,280 at 8.25% p.a. simple interest. On April 19, 2014, the prime rate decreased and the rate on the loan changed to 8% p.a. If Chloe cleared the loan on August 24, 2014, calculate the total interest she paid on this loan. 5. Jonah took a demand loan of $10,000 at 11% p.a. simple interest to start a graphics design firm. In three months he repaid $1000 towards the loan, and in six months he repaid another $1000. He cleared the balance at the end of one year. Calculate the size of his last payment. 6. Maya received a demand loan of $20,500 on January 15, 2014 from her bank at 12% p.a. simple interest. On April 12, 2014, she made a repayment of $5000 towards the loan and on July 16, 2014, she made a small repayment of $150. She cleared the rest of the loan on September 15, 2014. Calculate the size of her last repayment to clear the loan. 7. A 60-day interest-bearing promissory note for $37,500 has an interest rate of 2.25% p.a. and is dated December 20, 2013. Calculate the maturity value of the note. 8. On August 15, 2014, Sabina’s Bakery loaned $100,000 to one of its suppliers for 90 days in return for a 6% p.a. interestbearing promissory note. What is the maturity value of the note? Chapter 8 | Simple Interest and Applications 9. What is the face value of a 60-day interest-bearing promissory note dated April 18, 2014 with a maturity value of $10,078.08 and an interest rate of 4.75% p.a.? 10. What is the face value of a 90-day interest-bearing promissory note dated January 03, 2014 with a maturity value of $25,400.68 and interest rate of 6.50% p.a.? 11. What is the loan amount of a six-month, 3.4% p.a. non-interest-bearing promissory note that has a face value of $10,000? 12. How much did Owen pay for a two-month non-interest-bearing note that had a face value of $5000 and an interest rate of 9% p.a.? 13. Calculate the amount of proceeds if a 90-day interest-bearing note that had a face value of $10,000 and an interest rate of 7% p.a. was sold in 30 days when the interest rate was 8% p.a. 14. Valentino purchased a 60-day interest-bearing note at 3% p.a. that had a face value of $12,000. If he settled the note in 30 days at a discounted rate of 4% p.a., calculate his proceeds. 15. Wesley purchased a 90-day interest-bearing promissory note that had a face value of $125,000 and interest rate of 4.5% p.a. In 30 days, he sold the note for $125,500 to Walker. What rate did Walker earn on the note? 16. Paulina purchased a 120-day interest-bearing promissory note that had a face value of $50,000 and interest rate of 4.75% p.a. In 100 days, she sold the note for $50,590 to Casey. What rate did Casey earn on the note? 17. Karim purchased a non-interest-bearing note that had a face value of $5000 and was due in 60 days. If he sold the note in 45 days to another investor when the rate was 4% p.a., calculate the amount of proceeds and amount of discount on the note. 18. Calculate the amount of proceeds and discount if a 90-day non-interest-bearing note that had a face value of $10,000 was sold in 30 days when the interest rate was 7% p.a. 19. How much did Kenneth pay for a 91-day T-bill that has an interest rate of 2.25% p.a. and a face value of $5000? 20. Rodney invested his savings by purchasing a 364-day T-bill that had a face value of $20,000 and an interest rate of 5.75% p.a. Calculate how much he paid for this T-bill. 21. A non-interest-bearing promissory note with a face value of $75,000 is sold at a discount of 4.5%, 30 days before maturity. a. Calculate the proceeds from the sale. b. What rate did the purchaser realize on the note? 22. Khalid purchased a non-interest-bearing promissory note with a face value of $27,500 and sold it to Sankara 60 days before maturity at a discount of 3% p.a. a. How much did Sankara pay for the note? b. What rate did Sankara earn on the note? 23. Kenneth bought a 182-day T-bill that had a face value of $1000 discounted at 2.3% p.a. a. How much did he pay for the T-bill? b. After 45 days, if he sold the T-bill to his friend when the interest rate for the T-bill in the market was 2% p.a. at the time of the sale, calculate his selling price and profit or loss on the transaction. c. What rate of return did he realize while holding the T-bill? 24. Yuan purchased a 364-day T-bill that had a face value of $5000 and an interest rate of 6% p.a. a. How much did he pay for the T-bill? b. After 180 days, he sold the T-bill to Liam when the interest rate for this T-bill in the market was 5% p.a. Calculate his selling price and profit or loss on the transaction. c. What rate of return did he realize while holding the T-bill? 289