PA 3003: Nonprofit & Public Financial Management Humphrey

advertisement

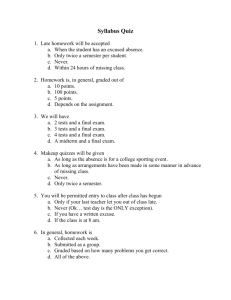

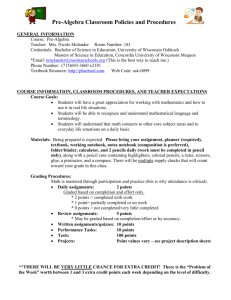

PA 3003: Nonprofit & Public Financial Management Humphrey School of Public Affairs, University of Minnesota Spring 2016, Wednesday, 9:45 to 11:00 BruH 131A, 3 Credits I. Course Description This introductory course is designed to equip current and future nonprofit and public managers with the practical financial management tools and analytical techniques they need to be successful in their careers. Course work is very applications oriented, with case studies and real-world exercises used to provide managers with the basic concepts and collaborative methods they need for team project and budget planning, program analysis, interpreting financial reports, identifying and resolving organizational performance issues. PA3003 is a core course in the Nonprofit/Public Track Management Minor in the Carlson School of Management, and is also open to all students who wish to gain a better understanding of nonprofit and public financial planning and analysis techniques to become more effective managers, regardless of their specialty. While not a prerequisite, students will benefit from some prior coursework in accounting and finance. A technology-facilitated, flexible learning model is used to effectively equip students with the hands-on participatory tools they need to compete in the new economy. Students are provided access to a series of short video lessons that may be completed at their convenience. Class time is dedicated to direct interaction with the instructor and TA, as students apply those lessons by solving practical case studies in a small team setting. This Flipped Classroom approach offers each student flexible access to online tutorials, which consist of both video lessons and short quizzes. In-class, active learning sessions reinforce these lessons with problem-solving exercises completed in small teams, with assistance from the instructor as needed. Online and personal tutorial assistance is also available as students take responsibility for their learning. The course format generally covers one topic per week, with methodologies studied individually at the beginning of the week, practical team-based exercises on Wednesday and individual graded assignments due on Friday: Online video lessons and quizzes are completed individually before Tuesday noon to earn participation points. These background lessons must be completed for students to productively contribute in team learning activities. With these outside lectures, the class only meets on Wednesdays. On Wednesday, students participate in team learning activities, developing practical skills by collaboratively solving case study exercises related to the topic of the week. Each small team submits its work online, and selected teams present their solutions at the end of each class, followed by interactive discussions. This work is ungraded, but counts toward participation points. For those students who need tutoring assistance, office hours are available on Wednesday, Thursday and Friday. Online discussion forums are also available for students to post questions, and review shared answers from the instructor. Individually completed graded homework on the same weekly topic is submitted online each Friday evening. Exercises are similar to those completed during the Wednesday class, and include both individual and small team assignments. Student workload involves an average of about 30 to 45 minutes of online videos per week, a semester total of nine ungraded team exercises completed in class, seven individually graded homework assignments, two graded team case studies and two exams, all of which are designed to help students apply the concepts and practical techniques learned in the course. The total grade consists of 35 percent individual and team graded assignments, 40 percent midterm and final exams, and 25 percent participation. The participation grade is determined by on-time, successful completion of the online lessons/quizzes, active participation in Wednesday ungraded team exercises and punctual attendance. The midterm and final involve analyses of actual budgets and financial reports. Students are permitted to use one page (front and back) of whatever notes they wish for the exams. II. Desired Student Outcomes 1. Understand financial management concepts and techniques as an integral part of nonprofit and public management, 2. Obtain basic knowledge, terminology and working skills in nonprofit and public budgeting, accounting and financial management, 3. Develop the capability to perform basic budget and financial analysis of nonprofit and public organizations, and 4. Improve collaborative problem solving and communication skills in a technology facilitated environment. III. Instructors Co-Instructors and a Teaching Assistant share responsibilities for this class. Ms King is responsible for the first half of the term (through the Midterm Exam), and Mr Gunyou for the second half of the term. Ms Winter is responsible for tutoring and all grading: John Gunyou 952-237-7499 jmgunyou@umn.edu Office: HHH 138 Hrs: Wed 11am, request Merrill King 952-939-8253 mking@eminnetonka.com Office: HHH 138 Hrs: Wed 11am, request Audra Winter, TA 920-629-2674 winte521@umn.edu Office: HHH 138 Hrs: Thur 6pm & Fri 9am IV. Learning Design A. Learning Methods Online video lessons and quizzes flexibly available to encourage greater student participation and comprehension, supplemented by class discussions. Active learning classroom environment, offering direct interaction with the instructor as students apply their knowledge by solving practical exercises and case studies in both individual and small team settings. B. Assignments Students are expected to individually complete the weekly three or four video lessons and quizzes by Tuesday 12:00 noon. Study Guides are provided so students can take notes during the Online Video Lessons to help answer the associated Quizzes. The timely completion of these online lessons counts toward individual participation points, which cumulatively represent 25 percent of the total grade. To receive credit for each quiz, all questions must be answered correctly, and students only have three attempts to do so. As a result, it is important that videos be carefully viewed for understanding, and that students not simply guess repeatedly at the answers. The flexibility provided with online lessons allows students to work ahead and at times most convenient to their schedules, and also requires them to accept responsibility for their learning. Wednesday attendance is mandatory, and students complete ungraded exercises during class, working collaboratively in small teams of three. Students must complete the video/quiz lessons to participate on these teams, and selected teams present their solutions at the end of each class. The purpose of this group work is to cooperatively learn from each other, so all students are expected to actively engage with their teammates. This work is ungraded, but counts toward participation points. There are seven individually completed graded assignments, plus two team case studies, which together constitute 35 percent of the final grade. Graded assignments are similar to the ungraded problem sets, and are due online by 9:00 PM Friday. The two team case studies are completed during Wednesday class, and all students in the group receive the same grade. All team members are expected to contribute to the overall project by doing a fair share of the work and helpfully communicating with other team members. Because the weekly assignments build on and complement each other, students are strongly encouraged not to fall behind. Should unavoidable conflicts or unanticipated issues arise, students are responsible for immediately communicating with the instructor and TA before the assignments are due to ensure they are completed in a timely manner. No excuse is accepted for tardy notifications, and “extra credit” is not an option. Midterm and final exams constitute 40 percent of the total grade. The midterm involves preparation and analysis of a budget, and for the final, analysis of the annual financial report of an actual nonprofit organization. The midterm and final exams provide an opportunity for students to demonstrate the financial analytical and communication skills they have learned. C. Student Assessment Rather than simply test rote retention, learning assessments are designed to allow students to demonstrate proficiency in practical, employable knowledge and experience. As in the professional world, the course emphasizes a combination of individual and team problem solving, all of which is graded accordingly. Respective values are: Video/Quiz Preparation (10 @ 1pt each) Team Ungraded Assignments (9 @ 1.5pts each) plus Class Attendance & Participation (1.5pts) Individual Graded Assignments (7 @ 3pts each) Team Case Studies (2 @ 7pts each) Exams (2 @ 20pts each) Total 10 points 15 21 14 40 100 points Assignments are expected to be complete, concise and on time. Graded homework will not be accepted after the deadline without the express permission of the instructor, which will only be provided for unavoidable or legitimate circumstances. Students are responsible for immediately notifying the instructor or the TA before class or due dates when such issues may arise, and for arranging to promptly submit any missed assignments when due, or as soon as possible thereafter. Students are encouraged to use the Excel spreadsheet templates and hints provided on Moodle. Grading levels are: Grade Minimum Points A AB+ B BC+ C CD+ D DNo Credit 93.3 and above 90.0 86.7 83.3 80.0 76.7 73.3 70.0 66.7 63.3 60.0 less than 60.0 The University of Minnesota grading system utilizes a plus and minus scale based on a 4.000 cumulative grade point scale in accordance with the following: A AB+ B BC+ C CD+ D 4.000 3.667 3.333 3.000 2.667 2.333 2.000 1.667 1.333 1.000 Outstanding achievement relative to course requirements Achievement significantly above course requirements Achievement that fully meets course requirements Worthy of credit, even though it fails to meet requirements An Incomplete may be assigned at the instructor’s discretion if, due to extraordinary circumstances, the student was unavoidably prevented from finishing the course work. A written agreement will specify how and when the unfinished work will be completed. D. Resources Moodle. This course has a U of MN Moodle 2.8 site. All assignments, including required video lessons, quizzes, power-point presentations, announcements, discussion forums, grades and homework templates are posted on this site. Students are strongly encouraged to check the Moodle site regularly for any course changes. Online lessons. Video lessons are available on Moodle. Each weekly topic includes three or four video lessons that average about nine minutes each. The lessons are not merely taped lectures, but rather, are designed to acquaint students with specific topics. Study guides are provided so students can take notes during the video lessons to help answer the associated quizzes, which gauge student participation and comprehension. Excel worksheets. Students are encouraged to use the Excel spreadsheets and hints that are provided on Moodle for selected assignments. For those students not familiar with Excel, YouTube video tutorials and Tip Sheet links are provided on Moodle. On request, the TA will offer Excel tutoring sessions early in the term. Supplemental Readings. Finkler, Steven A., et al. Financial Management for Public, Health, and Not-for-Profit Organizations. Pearson. All video lessons and exercises are provided on Moodle, so supplemental readings in this text book are optional. The book may be purchased or rented online at: http://instructors.coursesmart.com or accessed at e-reserves. E. Assignment Deadlines and Attendance The flipped classroom model requires that students accept responsibility for their learning by completing the preparatory video lessons and quizzes before the assigned deadlines to enable their active and productive participation in the Wednesday team learning activities. This online flexibility allows students to work ahead and at times most convenient for their schedules, so the assigned preparatory work must be completed by the deadlines to receive participation credit. Participation points will be deducted for absences, repeated tardiness and video/quiz lessons not appropriately completed. Timely completion of the assigned videos and quizzes ensures that students do not unfairly receive credit for the Wednesday in-class team participation points when they rely on other classmates who did complete the assigned background material on time. To that end, students must successfully complete the assigned video/quiz lessons to productively participate on the Wednesday team exercises. To receive participation credit for the background quizzes, all questions must be answered correctly, and students only have three attempts to do so. As a result, it is important that videos be carefully viewed for understanding, and that students not simply guess repeatedly at the answers. This expectation of responsible preparation reflects the professional world, where any failure to meet assigned deadlines can compromise the performance of other team members and the organization. Graded homework will not be accepted after the deadline without the express permission of the instructor, which will only be provided for unavoidable or legitimate circumstances. Attendance at all Wednesday active learning sessions is required. Students are expected to be prepared and be on time so they can actively participate in team assignments and class discussions. “Extra credit” is not an option in this course. When unexpected circumstances arise to prevent attendance or completion, students must notify either the instructor or TA before class and before due dates. This expectation is similar to that of every employer in the business world. You can not simply fail to show up; you must let your supervisor know ahead of time, not after the fact. F. University Policies Academic Dishonesty will not be tolerated, and the University of Minnesota’s Student Conduct Code will be strictly applied to ensure an environment that promotes academic achievement and integrity. Students are expected to do all their own work, complete all graded assignments by themselves and not discuss or share their work with others, with the sole exception of the two team case studies and weekly ungraded problem sets, which are collaboratively completed in teams of three. Students are also permitted to use one page (front and back) of whatever notes they wish for the midterm and final exams, and may use but not share a calculator. FAQ on scholastic dishonesty. Appropriate use of course materials. Students are encouraged to make liberal and effective use of the universally available YouTube videos and PowerPoints provided for this class; these resources are the equivalent of traditional textbooks. However, broadly disseminating transcript-like notes or accepting compensation for taking and distributing such notes undermines intellectual property rights, and violates the shared norms and standards of the academic community. Similarly, personal electronic devices may not be used in the classroom without the explicit permission of the instructor. Stress Management. Students may experience a range of issues that can cause barriers to learning, such as strained relationships, increased anxiety, alcohol and drug problems, feeling down, difficulty concentrating or lack of motivation. These mental health concerns may lead to diminished academic performance, so please be sure to let the instructor or TA know if and when such issues arise. A broad range of confidential mental health services is available to assist students with these and other concerns. Counselors are also available through the Humphrey Student Services office at 612-624-3800 to help students address immediate concerns. Safe and respectful environment. The University of Minnesota provides equal access to and opportunity in its programs and facilities, without regard to race, color, creed, religion, national origin, gender, age, marital status, disability, public assistance status, veteran status, sexual orientation, gender identity, or gender expression. The University is also committed to providing a safe and respectful environment free of sexual harassment. Such conduct interferes with students’ performance by creating an intimidating, hostile, and offensive academic environment, and will not be tolerated. V. Course Outline 1-20 (Wed) Introduction Course procedures and expectations, management context. Complete video lessons & quizzes before first class: 1-1 Online Lesson Overview 1-2 Financial Management 1-26 (Tue) Budget Planning Budget planning process and methodologies. Complete video lessons & quizzes (1pt): 2-1 Budget Process 2-2 Operating Budgets 2-3 Capital & Cash Budgets 2-4 Accounting Practices 1-27 (Wed) Ungraded Assignment 1: 1-1, 1-2 (1.5pt) 1-29 (Fri) Graded Assignment A Due: A-1(1pt), A-2(2pt) 2-2 (Tues) Budget Concepts Types of budgets, nonprofit issues and forecasting. Complete video lessons & quizzes (1pt): 3-1 Types of Budgets 3-2 Flexible Budgets 3-3 Performance Budgets 3-4 Budget Issues 3-5 Forecasting 2-3 (Wed) Team Ungraded Assignment 2: 2-1, 2-2 (1.5pt) 2-5 (Fri) Individual Graded Assignment B Due: B-1(1.5pt), B-2(1.5pt) 2-9 (Tue) Cost Analysis Budget costing concepts and breakeven analysis. Complete video lessons & quizzes (1pt): 4-1 Direct & Indirect Costs 4-2 Fixed & Variable Costs 4-3 Average & Marginal Costs 4-4 Breakeven Analysis 2-10 (Wed) Team Ungraded Assignment 3: 3-1, 3-2 (1.5pt) 2-12 (Fri) Individual Graded Assignment C Due: C-1(1pt), C-2(2pt) 2-16 (Tue) Capital & Cash Capital programming and working capital management. Complete video lessons & quizzes (1pt): 5-1 Capital Planning 5-2 Time Value of Money 7-1 Cash Management 2-17 (Wed) Team Ungraded Assignment 4: 4-1, 4-2, 4-3 (1.5pt) 2-19 (Fri) Individual Graded Assignment D Due: D-1(1pt), D-2(1pt), D-3(1pt) 2-23 (Tue) Financial Control Internal control and variance analysis. Complete video lessons & quizzes (1pt): 8-1 Internal Controls 8-2 Balanced Scorecard 8-3 Variance Analysis 2-24 (Wed) Team Ungraded Assignment 5: 5-1, 5-2, 5-3 (1.5pt) 3-1 (Tue) Team Case Study I Complete video lesson: R-1 Midterm review (Chapters 2-8) 3-2 (Wed) Team Case Study I Due In-class (7pt) 3-9 (Wed) Midterm Exam (20pt) 3-14 to 18 SPRING BREAK – no class 3-23 (Wed) In-Class Exercise on Public Finance (no preparation required) 3-29 (Tue) Balance Sheets Statements of financial position. Complete video lessons & quizzes (1pt): 10-1 Financial Position 10-2 Assets 10-3 Liabilities & Net Assets 12-1a Nonprofit Statements 10-4 Recording Transactions 3-30 (Wed) Team Ungraded Assignment 6: 6-1 (1.5pt) 4-1 (Fri) Individual Graded Assignment E Due: E-1(3pt) 4-5 (Tue) Reporting Results Activity and cash flow statements. Complete video lessons & quizzes (1pt): 11-1 Activity Statements 12-1b Nonprofit Statements 11-2 Cash Flow Statements 11-3 Recording Transactions 4-6 (Wed) Team Ungraded Assignment 7: 7-1 (1.5pt) 4-8 (Fri) Individual Graded Assignment F Due: F-1 (3pt) 4-12 (Tue) Government Financial statements for government organizations. Complete video lessons & quizzes (1pt): 12-2 Fund Accounting 13-1 Government Statements 13-2 Modified Accrual 4-13 (Wed) Team Ungraded Assignment 8: 8-1 (1.5pt) 4-15 (Fri) Individual Graded Assignment G Due: G-1(3pts) 4-19 (Tue) Statement Analysis Analyzing financial statements and ratios. Complete video lessons & quizzes (1pt): 15-1 Reviewing Statements 15-2 Reviewing Notes 15-3 Common Size Ratios 15-4 Other Ratios 4-20 (Wed) Team Ungraded Assignment 9: 9-1 (1.5pt) 4-26 (Tue) Team Case Study II Complete video lesson & quiz (1pt): 12-3 Healthcare Statements 4-27 (Wed) Team Case Study II Due In-Class (7pt) 5-3 (Tue) Final Exam Review Complete video lesson: R-2 Final review (Chapters 10-15) 5-4 (Wed) Final Exam (20 pt) John Gunyou, Co-Instructor Education: U.S. Air Force Academy University of California (UCLA) University of Colorado B.S. Economics M.A. Economics M.P.A. Finance Public sector: Three Rivers Park Board Chair, Met Council TAB Board, Minnetonka City Manager, Minnesota Commissioner of Finance, Minneapolis Finance Director, Minnesota Office of Technology Executive Director, Denver Regional COG Economist. Nonprofit & Private sectors: State Arts Board Treasurer, MPR Chief Administrative Officer, Jungle Theater Board, Onvoy Internet President, Omni Investments President, BBC Financial Consulting Partner, Hamline University Assistant Professor. Interests: Wife Kim, four daughters & one son (25 to 37), one grandson, hiking, biking, camping, writing, carpentry, all sports. Merrill King, Co-Instructor Education: Princeton University University of Texas B.A. Political Science M.P.A. LBJ School of Public Affairs Experience: City of Minnetonka Finance Director & Treasurer, Minnesota Executive Budget Officer, Texas Parks & Wildlife Budget Manager, Travis County Texas Budget Analyst, Texas Governor’s Office Budget Analyst, City of Dallas Financial Analyst. Professional: Government Finance Officers Association (GFOA) Budgeting & Fiscal Policy Committee Chair, Women’s Public Finance Network Chair. Interests: Two adult sons Audra Winter, Teaching Assistant Education: High school: Manitowoc, WI Lutheran High School College: Completing final year in Carlson School of Management, Double major in Public & Nonprofit Management and Finance Employment: Finance & Administration Intern at the Smithsonian's National Zoo in Washington, D.C.; Intern at Manitowoc County Domestic Violence Center; Purchasing Intern at Formrite Companies, Manitowoc, WI; Tour Guide/Visitor Services at Wisconsin Maritime Museum. Interests: Track & Field, playing piano, adventuring, family and friends.