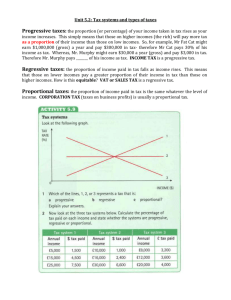

Progressive and Regressive Taxation

advertisement

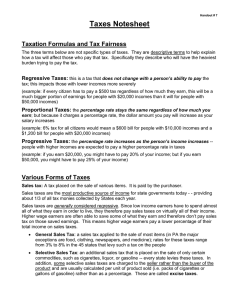

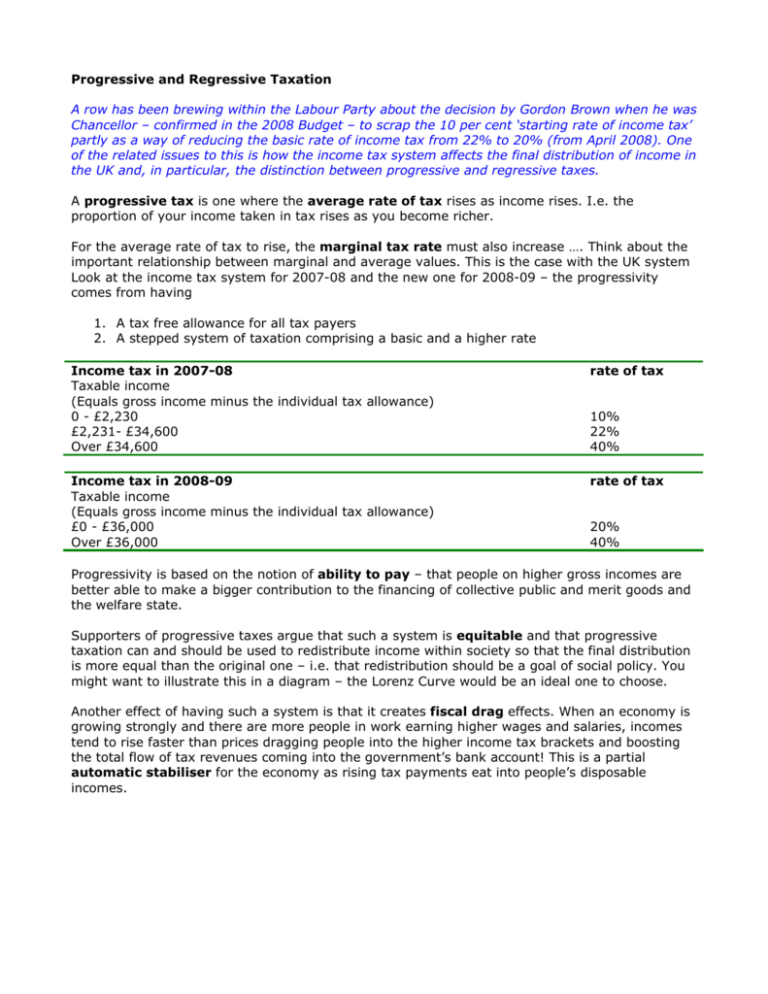

Progressive and Regressive Taxation A row has been brewing within the Labour Party about the decision by Gordon Brown when he was Chancellor – confirmed in the 2008 Budget – to scrap the 10 per cent ‘starting rate of income tax’ partly as a way of reducing the basic rate of income tax from 22% to 20% (from April 2008). One of the related issues to this is how the income tax system affects the final distribution of income in the UK and, in particular, the distinction between progressive and regressive taxes. A progressive tax is one where the average rate of tax rises as income rises. I.e. the proportion of your income taken in tax rises as you become richer. For the average rate of tax to rise, the marginal tax rate must also increase …. Think about the important relationship between marginal and average values. This is the case with the UK system Look at the income tax system for 2007-08 and the new one for 2008-09 – the progressivity comes from having 1. A tax free allowance for all tax payers 2. A stepped system of taxation comprising a basic and a higher rate Income tax in 2007-08 Taxable income (Equals gross income minus the individual tax allowance) 0 - £2,230 £2,231- £34,600 Over £34,600 rate of tax Income tax in 2008-09 Taxable income (Equals gross income minus the individual tax allowance) £0 - £36,000 Over £36,000 rate of tax 10% 22% 40% 20% 40% Progressivity is based on the notion of ability to pay – that people on higher gross incomes are better able to make a bigger contribution to the financing of collective public and merit goods and the welfare state. Supporters of progressive taxes argue that such a system is equitable and that progressive taxation can and should be used to redistribute income within society so that the final distribution is more equal than the original one – i.e. that redistribution should be a goal of social policy. You might want to illustrate this in a diagram – the Lorenz Curve would be an ideal one to choose. Another effect of having such a system is that it creates fiscal drag effects. When an economy is growing strongly and there are more people in work earning higher wages and salaries, incomes tend to rise faster than prices dragging people into the higher income tax brackets and boosting the total flow of tax revenues coming into the government’s bank account! This is a partial automatic stabiliser for the economy as rising tax payments eat into people’s disposable incomes. How progressive is the UK income tax system? Income tax payable: by annual income, 2007/08 United Kingdom Number of taxpayers (thousands) Total tax liability after tax reductions (£ million) Average rate of tax (percentages) Average amount of tax (£) 2,460 3,630 6,380 4,890 6,670 5,220 1,750 418 123 22 8 263 1,330 7,000 10,500 24,400 33,700 28,200 17,200 12,000 5,230 6,370 1.7 4.2 8.8 12.4 14.9 17.1 24.5 30.8 34.0 35.6 35.8 107 365 1,100 2,150 3,660 6,460 16,200 41,200 98,200 241,000 782,000 31,600 146,000 18.1 4,630 £5,225–£7,499 £7,500–£9,999 £10,000–£14,999 £15,000–£19,999 £20,000–£29,999 £30,000–£49,999 £50,000–£99,999 £100,000–£199,999 £200,000–£499,999 £500,000–£999,999 £1,000,000 and over All incomes Source: Social Trends 38 – www.statistics.gov.uk published April 2008 The progressivity can be seen by the rising average rate of tax measured as a percentage of gross income (income before tax). Why can the average rate of tax never reach 40%? Write down three ways in which the tax system could be made more progressive? 1 2 3 Regressive taxes A regressive tax is a tax unrelated to income that bears hardest on those least able to pay. The result is that the average rate of tax is greatest for those on lower incomes. Regressive taxes rarely are designed specifically to have this effect – but they have such a result because of the spending patterns and choices of the people affected by such taxes which is reflected in the percentage of their incomes allocated to specific goods and services. Examples to use in an exam answer might include: • The tax on national lottery tickets (12%) • Excise duties on smoking and alcohol and (before abolition) – betting and gaming duties • Higher fuel duties • Possible regressive effects of expanding the range of “green taxes” e.g. a tax on high fat foods or an aviation tax which raises the costs and prices of low cost airlines • Higher council taxes which hit older people on low incomes who happen to live in larger and more expensive houses • 5% VAT on household fuel and lighting • The TV licence fee? • Congestion pricing (road pricing) e.g. the London Congestion Charge? Many ‘hidden taxes’ also have regressive effects – examples here might include energy companies charging higher prices for customers not using direct debits (evidence shows that these tend to be poorer families without bank accounts). Or a rise in parking fines or a cut in the subsidy paid to bus companies. In the UK the standard rate of VAT is 17.5% - in theory this should also be classified as a regressive tax – but the effects are mitigated somewhat by the zero rating (0%) applied to basic groceries, children’s clothes, books and magazines etc. A better example is the controversial proposal in Jersey to introduce a goods and services tax (GST): “GST will initially be levied at 3% on almost all purchases, including many - like food, medicines, books and education - that are, for the most part, exempt from VAT in much of the rest of Europe. (Yacht fuel, curiously, attracts a zero rate.)” And what about the effects of tax havens and also those countries within the EU and beyond who have scrapped their progressive tax systems and introduced “flat-rate” taxes e.g. Poland, Russia and Slovakia? One of the undoubted consequences of this is that the gap between rich and poor will widen – the Gini-coefficient will increase as the scale of relative poverty / inequality increases. Good for incentives and growth? Or a prime cause of social problems? Check out your understanding: AS multiple choice tests: Indirect taxes http://vle.tutor2u.net/mod/quiz/view.php?id=1540 Taxation (macro): http://vle.tutor2u.net/mod/quiz/view.php?id=1480 A2 multiple choice tests: Economic effects of fiscal policy: http://vle.tutor2u.net/mod/quiz/view.php?id=2138