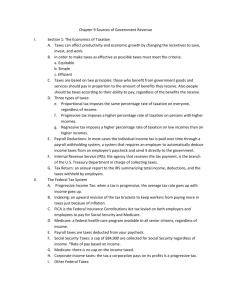

Chapter 9 Sources of Government Revenue Section

advertisement

Chapter 9 Sources of Government Revenue Section 1 • Sin tax • a relatively high tax • Raise revenue – Used to fund treatment and prevention • Discourage an undesirable product – Liquor – Tobacco • Incidence of a tax • the final burden of the tax Tax loopholes • exceptions or oversights in the tax law that allow select individuals and businesses to avoid paying taxes. • Raise a question of fairness. Individual income tax • tax on a person annual earnings (salary, wages, tips, etc.) • A complex tax • Many rules apply to – how much is taxable – How much is deductible Marginal and Average Taxes Worksheet • Marginal tax rate- the rate at which the last dollar of income is taxed. (Not a flat rate across entire income.) • Average Tax- average tax burden across entire income. • Personal Exemption- a dollar amount provided by the Federal Government that is deducted from income for yourself and each dependent. Government provides deductions to help the economy. • Examples – Yourself – Child (each) – Mortgage Sales tax • levied on most consumer products • Simple tax – Paid on time of purchase – Uniform for all products • CA = 7.5% • Exemptions include: – Basic foods (not processed) – Child care – medicine Benefit principles of taxation • those who benefit from government goods and services should pay in proportion to the amount of benefits they receive • A guiding principle of taxation. – Ex: Gas tax paid only by users at gas stations • Pays for interests of users of gasoline • Highways Ability-to-pay principle of taxation • the belief that people should be taxed according to their ability to pay. • Recognizes – That society cannot measure the benefits derived from government spending. – The assumption is that people with higher incomes suffer less discomfort paying taxes than people with lower incomes. Proportional tax • imposes the same percentage of taxation on everyone, regardless of income. – A 20% tax would mean • $10,000 income, tax would be $2000. • $100,000 income, tax would be $20,000 – Examples • Some states have a proportional income tax. • Tithe- a payment of 10% of your income to a religious organization. Average tax rate • total taxable income divided by the total income • Constant, regardless of income – If income increases, the percentage stays the same. Progressive tax • imposes a tax with a higher rate of taxation on person with higher income. • Marginal tax rate • Applies a levy to the next dollar of taxable income • The rate increases as the amount of taxable income increases – – – – $10,000 income, tax is $1000 $20,000 income, tax is $2000 $100,000 income, tax is $20,000 Points of percentage increase are called “brackets” Regressive tax • A tax that imposes a higher percentage rate of taxation on low incomes than on high incomes. • Sales tax is harder on lower income people than higher income people. • Examples: – Sin Taxes – Sales Tax – Social Security (caps out at higher levels of income) Section 2: • Payroll withholding system • requires the employer to automatically deduct income taxes from an employee’s paycheck. – W-2 form starts the process – W-2 statement informs employee • total annual gross income, • net income, • taxes withheld. Internal Revenue Service (IRS) • Branch of the US government that collects taxes. • Part of the Department of the Treasury Tax return • an annual report filed by the employee to the IRS – Total income – Deductions – Taxes withheld by employers • Must be submitted by April 15th if employee owes any more taxes. – If employer paid more taxes, the employee will receive a payment from the government. Indexing • an upward revision of the tax brackets to keep workers from paying more in taxes just because of inflation. FICA • Federal Insurance Contributions Act – Tax levied on both employers and employees to pay for Social Security and • Medicare • A federal health-care program available to all senior citizens – Regardless of paying the tax for Social Security and Medicare • Payroll tax – Revenue deducted from a person’s paycheck by the government. • FICA Corporate tax • a corporation pays an income tax as if it were an individual. • Based on profits • Brackets as of printing were: – 15% up to $50,000 – 25% $50,001 to $75,000 – 34% $75,001 to $18.3 million – 35% $18.3 million and over. Excise tax • A tax on the manufacture or sale of selected items – – – – – – – Gasoline Liquor Telephone service Tires Legal betting Coal Luxury goods • A regressive tax as lower-income people pay more of their income than higher income people. Luxury good • good or service where demand for the good rises faster than income, when income grows. – Vehicles over $40,000 – Large pleasure boats – Private planes – Jewelry – Furs • Phased out by Congress in 2002 Estate tax • tax levied on the transfer of property when a person dies. • Usually on property OVER $2 million. • Aka, “death tax” Gift tax • tax on large amount of money or wealth “donated” by a person to others to avoid paying larger income taxes. Customs duty • tax on imported goods or goods brought in by travelers from other countries. – Automobiles – Jewelry – Metals • Until 1913, the main source of revenue of the United States – Replaced by income tax that year. User fees • Charges for the use of a good or service. • Ex: National park fees Assessments: Checking for Understanding • 1 List the ways that taxes influence the economy. • Resource allocation • Behavior adjustment • Productivity and growth • Incidence of a tax • 3 Describe the economic impact of taxes • They affect – resource allocation – Consumer behavior – The nation’s productivity and growth • • • • 4 List three criteria to evaluate taxes. Equity Simplicity Efficiency • 5 The two main principles of taxation. (just list them) • Benefit principle • Ability-to-pay principle • 6 Explain the characteristics of proportional, progressive, and regressive taxes. • Proportional: – Same percentage rate of taxation on everyone • Progressive: – Imposes higher percentage rate on person with higher incomes • Regressive: – Imposes a higher percentage rate on lower incomes as compared to high incomes. Assessments: Checking for Understanding • 1 List the federal government’s most important revenue sources. • Individual income taxes • FICA taxes • Corporate income taxes • 3 Describe the progressive nature of the individual income tax. • It imposes a higher percentage rate of taxation on persons with higher income. • 4 Identify the main marginal tax brackets in the corporate income tax structure . • 15% • 25% • 34% • 35% • 5 Describe the other sources of government revenue. • Excise taxes • Estate taxes • Gift taxes • Customs duties • User fees for the use of a good or service. image, p. 224 • What information does the graph show for the period 1980 to 2000? • Total government receipts grew from 500% of the 1940 level to over 700% Image, p. 225 • Who is likely to bear the greater burden- the producer or consumer- if a tax is placed on medicine? • The demand for medicine is generally inelastic • The consumer will bear the greater burden of a tax on medicine. images, p. 227 • According to the ability-to-pay principle, how is the amount each person has to pay determined? • The amount each pays depends on how much income each earns images, p. 228 • Under which type of tax do individuals with lower incomes pay a smaller percentage than do those with higher incomes? • Progressive tax image, p. 232 • How did these occurrences change the composition of government revenues between 1990 and 2004? • Borrowing decreased and taxes increased Image, p. 233 • How much in taxes would an individual with $40,000 of taxable income pay? • $6,810.00 • Solution: • $3,910 + .25 ($40,000 – $28,400) = • $3,910 + $2,900 = $6,810 image, p. 234 • Is the FICA tax a progressive or regressive tax? Explain your reasoning. • A regressive tax • Because the Social Security portion of FICA is capped at a certain income level – The higher the income, the lower the FICA tax. image, p. 235 • What are luxury Goods? • Goods or services for which the demand rises faster than income when income grows.