Performance of Pension - Superintendencia Financiera de Colombia

advertisement

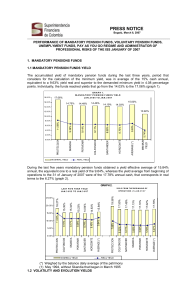

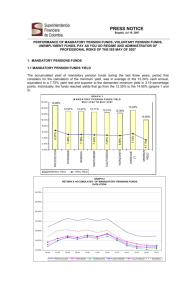

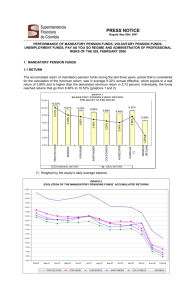

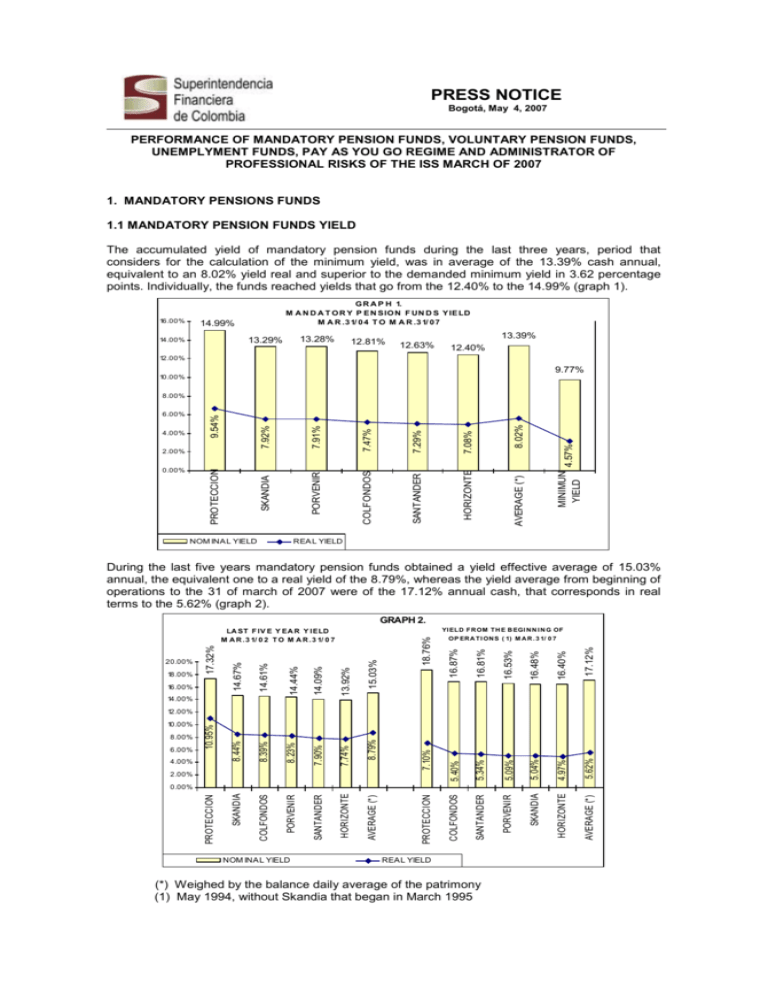

PRESS NOTICE Bogotá, May 4, 2007 PERFORMANCE OF MANDATORY PENSION FUNDS, VOLUNTARY PENSION FUNDS, UNEMPLYMENT FUNDS, PAY AS YOU GO REGIME AND ADMINISTRATOR OF PROFESSIONAL RISKS OF THE ISS MARCH OF 2007 1. MANDATORY PENSIONS FUNDS 1.1 MANDATORY PENSION FUNDS YIELD The accumulated yield of mandatory pension funds during the last three years, period that considers for the calculation of the minimum yield, was in average of the 13.39% cash annual, equivalent to an 8.02% yield real and superior to the demanded minimum yield in 3.62 percentage points. Individually, the funds reached yields that go from the 12.40% to the 14.99% (graph 1). 16.00% G R A P H 1. M A N D A T O R Y P E N S IO N F UN D S Y IE LD M A R .3 1/ 0 4 T O M A R .3 1/ 0 7 14.99% 13.28% 13.29% 14.00% 12.81% 13.39% 12.63% 12.40% 12.00% 9.77% 10.00% NOM INA L YIELD AVERAGE (*) MINIMUN 4.57% YIELD 8.02% 7.08% HORIZONTE SKANDIA PROTECCION 0.00% 7.29% 7.47% COLFONDOS 2.00% SANTANDER 7.91% 4.00% 7.92% 9.54% 6.00% PORVENIR 8.00% REA L YIELD During the last five years mandatory pension funds obtained a yield effective average of 15.03% annual, the equivalent one to a real yield of the 8.79%, whereas the yield average from beginning of operations to the 31 of march of 2007 were of the 17.12% annual cash, that corresponds in real terms to the 5.62% (graph 2). GRAPH 2. 17.12% 16.40% 16.48% 16.53% 16.81% OP ER A TI ON S ( 1) M A R . 3 1/ 0 7 16.87% 15.03% 13.92% 14.09% 14.44% 14.61% 16.00% 14.67% 18.00% 17.32% 20.00% 18.76% YI ELD FR OM TH E B EGI N N I N G OF LA ST F IV E Y EA R Y IELD M A R .3 1/ 0 2 T O M A R .3 1/ 0 7 14.00% 5.40% 5.34% 5.09% 5.04% 4.97% 5.62% SANTANDER PORVENIR SKANDIA HORIZONTE AVERAGE (*) 7.74% HORIZONTE 2.00% COLFONDOS 7.90% SANTANDER 7.10% 8.23% PORVENIR 8.79% 8.39% 4.00% COLFONDOS 6.00% 8.44% 8.00% SKANDIA 10.00% 10.95% 12.00% NOM INA L YIELD PROTECCION AVERAGE (*) PROTECCION 0.00% REA L YIELD (*) Weighed by the balance daily average of the patrimony (1) May 1994, without Skandia that began in March 1995 1.2 VOLATILITY AND EVOLUTION YIELDS The average of the calculated accumulated yields during the last thirty and six months of the funds was the 16.94% of annual cash and its volatility (standard deviation) of the 1.84%. This average for the last two years was of the 17.08%, with a volatility of the 2.17%, where as for the last year the yield average was in the 15.42% and its volatility in 1.44%. The yield average and its volatility of each one of the funds during the mentioned periods are reflected in graphs 3, 4, 5 and 6. GRAPH 3 MANDATORY PENSION FUNDS RETURN´S ACCUMULATED AVERAGE AND VOLATILITY MAR 31 2004 -MAR 31 2007 20.90% 20.60% ACCUM. YEILD AVERAGE 20.30% 20.00% Protección 19.70% 19.40% 19.10% 18.80% 18.50% 18.20% 17.90% Skandia 17.60% 17.30% Sistema 17.00% 16.70% Colf ondos 16.40% Porvenir Horizonte Santander 16.10% 15.80% 15.50% 1.50% 1.55% 1.60% 1.65% 1.70% 1.75% 1.80% 1.85% 1.90% 1.95% 2.00% 2.05% 2.10% 2.15% 2.20% VOLATILENESS GRAPH 4 MANDATORY PENSION FUNDS RETURN´S ACCUMULATED AVERAGE AND VOLATILITY MAR 31 2005 -MAR 31 2007 20.80% 20.50% 20.20% Protección ACCUM. YEILD AVERAGE 19.90% 19.60% 19.30% 19.00% 18.70% 18.40% 18.10% Skandia 17.80% 17.50% 17.20% Sis tem a Colfondos 16.90% 16.60% Porvenir 16.30% Horizonte Santander 16.00% 15.70% 1.70% 1.73% 1.76% 1.79% 1.82 % 1.85% 1.88 % 1.91% 1.94 % 1.97% 2.00 % 2.03 % 2.06 % 2.09 % 2.12 % 2.15% 2.18 % 2.21 2.24 % % 2.27 % 2.30 % 2.33 % 2.36 % 2.39 % 2.42 % 2.45 % 2.48 % VOLATILENESS GRAPH 5 MANDATORY PENSION FUNDS RETURN´S ACCUMULATED AVERAGE AND VOLATILITY MAR 31 2006 - MAR 31 2007 22.50% 22.00% 21.50% 21.00% ACCUM. YEILD AVERAGE 20.50% 20.00% 19.50% 19.00% Protección 18.50% 18.00% 17.50% 17.00% 16.50% 16.00% Colfondos Horizonte 15.00% Skandia Sis tem a Porvenir 15.50% Santander 14.50% 14.00% 13.50% 13.00% 1.00 % 1.04 % 1.08 1.12% 1.16% 1.20 % % 1.24 % 1.28 % 1.32 % 1.36 % 1.40 % 1.44 % 1.48 % 1.52 % 1.56 % 1.60 % 1.64 % 1.68 % 1.72 % 1.76 % 1.80 % 1.84 % 1.88 % 1.92 % 1.96 % 2.00 % VOLATILENESS GRAPH 6 RETURN´S ACCUMULATED OF MANADATORY PENSIONS FUNDS EVOLUTION 24.00% 22.00% 20.00% 18.00% 16.00% 14.00% 12.00% 03/2006 04/2006 05/2006 PROTECCION 06/2006 07/2006 PORVENIR 08/2006 09/2006 HORIZONTE 10/2006 11/2006 SANTANDER 12/2006 01/2007 02/2007 COLFONDOS 03/2007 SKANDIA 1.3 VALUE OF THE FUNDS The value of mandatory pension funds reached to the 31 of March of 2007 a value of USD 20.029 millions, superior in USD 652 millions the value registered to the 28 of February, that is to say, a 3.4% (graph 7, Chart 1.1). GR A PH 7. V A LU E OF EA C H F U N D A N D IT S PA R T IC IPA T ION IN T HE SY ST EM M A R .3 1T H 2 0 0 7 - M ILLION S U S D OLLA R 26.8% 5,500 24.8% 5,000 4,500 4,000 17.2% 3,500 SKANDIA SANTANDER 0.7%- 20,029 3.4% 19,378 0.9% 19,205 5.9% 1.8% 1.6% 4.2% 6.4%- 7.4%- 5,000 3.4%- 10,000 19,347 18,276 17,957 6.8% 16,812 10.9%15,879 14,323 15,305 16,534 17,111 15,000 16,553 V A LUE O F T H E F UN D S LA S T Y E A R E V O LUT IO N 1.5%- MILLONES DE USD COLFONDOS P ERCENTA GE OF P A RTICIP A TION 25,000 20,000 SKANDIA PLAN ALTERNATIVO FUND VALUE HORIZONTE PORVENIR 0 PROTECCION 500 26 0.1% 2,457 1,500 1,000 816 4.1% 12.3% 2,947 2,000 3,448 2,500 4,965 5,370 14.7% 3,000 FUNDS VALUE Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Sep-06 Aug-06 Jul-06 Jun-06 May-06 Apr-06 Mar-06 - MONTHLY VARIATION 1.4 AFFILIATED The number of affiliated with the regime of individual saving with solidarity to the 31 of march of 2007 ascended to a 7.197.578, with an increase of the 1.1%, that is to say, 76.253 affiliated as opposed to the number reported to the 31 of march of 2007. (Graph 8). GR A PH 8 . A F F ILIA T ED A N D PA R T IC IPA T ION OF EA C H F U N D IN T HE SY ST EM M A R .3 1T H 2 0 0 7 2,400,000.00 28.0% 2,100,000.00 A FFILIA TED P ERCENTA GE OF P A RTICIP A TION 336 0.0% SKANDIA PLAN ALTERNATIVO 62,962 0.9% SKANDIA 14.6% 1,048,474 15.6% SANTANDER PROTECCION 0.00 PORVENIR 300,000.00 HORIZONTE 600,000.00 1,566,855 900,000.00 2,013,291 1,200,000.00 1,383,375 19.2% 1,500,000.00 COLFONDOS 1,122,285 21.8% 1,800,000.00 7,121,325 7,074,020 7,010,287 6,961,430 6,906,460 6,853,741 6,757,284 6,701,261 6,648,211 6,588,211 6,900,000 6,536,567 7,200,000 6,799,647 7,500,000 7,197,578 N UM B E R O F A F F ILIA T E D LA S T Y E A R E V O LUT IO N 1.1% 0.7% 0.9% 0.7% 0.8% 0.8% 0.8% 0.6% 0.8% 0.8% 0.8% Apr-06 0.9% 1.0% 6,300,000 Mar-06 6,600,000 AFFILIATED Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Sep-06 Aug-06 Jul-06 May-06 Jun-06 6,000,000 MONTHLY VARIATION Of the total of affiliated with the funds of mandatory pension funds, the 52.3% correspond to affiliated active, that is to say, 3.764.318 and the 47.7%, that is 3.433.260 to affiliated inactive. The inactive affiliated ones are those that have not carried out quotations in at least last six months (graph 9). GR A P H 9 A C T IV E S A N D IN A C T IV E S A F F ILIA T E D B Y E A C H F UN D M A R .3 1T H 2 0 0 7 1,200,000 1,000,000 A CTIVES 288 48 SKANDIA PLAN ALTERNATIVO SKANDIA SANTANDER 43,552 19,410 476,527 571,947 549,786 572,499 653,194 730,181 COLFONDOS PORVENIR - HORIZONTE 200,000 920,707 646,148 400,000 PROTECCION 600,000 1,120,264 893,027 800,000 INA CTIVES 51.9% 48.1% Jan-07 52.3% 51.9% 48.1% Dec-06 52.1% 52.0% 48.3% Oct-06 48.0% 48.5% Sep-06 Nov-06 51.5% 48.7% Aug-06 51.7% 51.3% 51.6% 48.4% Jun-06 51.1% 51.6% 48.4% 51.5% 52.0% 51.3% 53.0% May-06 A C T IV E S A N D IN A C T IV E S A F F ILIA T E D LA S T Y E A R E V O LUT IO N 51.0% 50.0% 47.7% 47.0% 47.9% 48.9% 48.5% 48.0% 48.7% 49.0% ACTIVES Mar-07 Feb-07 Jul-06 Apr-06 Mar-06 46.0% INACTIVES Of the total of affiliated in the Regime of Individual Saving the 57.7% corresponds to non-quoting members, is to say to 4.155.749 people; the 42.3%, that is 3.041.829 people, are quoting members (graph 10). Meaning by non-quoting members those who are affiliated but are not pensioned yet, and that for some reason, they did not realized the mandatory payment for the reported moth. 1,200,000 G R A P H 10 A F F ILIA T E D C O N T R IB UT O R S A N D N O N C O N T R IB UT O R S B Y F UN D M A R .3 1T H 2 0 0 7 1,000,000 QUOTING 131 205 SKANDIA PLAN ALTERNATIVO SKANDIA SANTANDER 29,254 33,708 689,619 358,855 530,156 COLFONDOS HORIZONTE PORVENIR - PROTECCION 200,000 592,129 919,653 463,722 695,785 400,000 871,070 600,000 1,053,893 959,398 800,000 NON-QUOTING 60.9% 60.9% 60.5% 60.0% 60.0% 59.9% 59.1% 58.3% 58.4% 58.0% 58.5% 57.5% 57.7% 39.1% 39.1% 39.5% 40.0% 40.0% 40.1% 40.9% 41.7% 41.6% 42.0% 41.5% 42.5% 42.3% Apr-06 May-06 Jun-06 Jul-06 Aug-06 Sep-06 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 65.0% Mar-06 C O N T R IB UT O R S A N D N O N C O N T R IB UT O R S A F F ILIA T E D LA S T Y E A R E V O LUT IO N 60.0% 55.0% 50.0% 45.0% 40.0% 35.0% 30.0% 25.0% NON-QUOTING QUOTING Of the total number of affiliated with the funds of mandatory pension funds, the 83.4% happen less than two minimum wages, the 10.5% perceive income between two and four minimum wages and the 6.1% win more than four minimum wages. The 55.9% of the affiliated ones oscillate between the 15 and 34 years old, of which, in this segment, the 55.4% are men and the 44.6% women. The 96.4% of the total number of affiliated with the system correspond to workers with labor bond and the 3.6% to independent workers. As far as the origin of the affiliated ones, it is important to write down that the 57.1% correspond to people who entered in the system, 30.1% come from the Pay As You Go Régime, the 12.2% to transfers between AFPs and the 0.6% comes from the Government social security funds (Chart 1.2). 1.5 PENSIONERS To the 31 of march of 2007 the Regime of individual saving with solidarity counts on 22.915 pensioners, 13.945 for survival, 4.939 for invalidity and 4.031 of retirement age (graph 11). The 51.1% of the pensioners are to say 11.705, have decided on the modality of programmed retiree's pension; the 48.9%, 11.209 pensioners, by the one of immediate life rent and 1 pensioner by the one of retirement programmed with deferred life rent (Chart 1.3). 2,180 2,265 INVA LIDITY SKANDIA SKANDIA P.A 12 146 SANTANDER HORIZONTE PORVENIR PROTECCION SURVIVA L COLFONDOS 500 0 106 39 232 834 351 469 1,500 1,000 515 1,190 2,000 936 606 2,500 1,425 2,215 3,000 3,177 2,864 3,500 3,353 4,000 G R A P H 11 P E N S IO N E R S S B Y F UN D M A R .3 1T H 2 0 0 7 RETIREM ENT A GE 1.7% 1.0% 22,302 1.6% Jan-07 21,944 1.6% Dec-06 21,598 1.2% 1.2% 21,101 1.4% 2.2% 20,812 20,371 1.3% 20,102 0.8% Jun-06 1.3% Apr-06 1.5% 19,948 1.2% 18,000 Mar-06 19,000 May-06 20,000 19,412 21,000 19,660 22,000 21,346 23,000 22,531 24,000 22,915 N UM B E R O F P E N S IO N E R S LA S T Y E A R E V O LUT IO N PENSIONERS Mar-07 Feb-07 Nov-06 Oct-06 Sep-06 Aug-06 Jul-06 17,000 MONTHLY VARIATION 1.6 INVESTMENT PORTFOLIO As of March 31 2007, the value of portfolio of Mandatory Pension Funds reached USD$ 19,975 million, showing a increase of 3.3% with respect to the end of the previous month, when it was of USD$ 19,346 million. To the closing of March 2007, 77.1% of portfolio of the mentioned funds, that is to say, USD$15,404 million correspond to investments of fixed income; the 20.9%, USD$ 4,169 million, to investments in equity; the 1.5%, USD$ 306 million, to overnight deposits and the 0.5%, USD$ 96 million, to the net position in derivatives (right less obligations) (Graph 12 and Chart 1.4). GRAPH 12 PORTFOLIO DIVERSIFICATION: FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MAR 31TH 2007 - THOUSANDS OF US DOLLAR - 99% FIXED INCOME 76.6% 79.8% EQUITY 73.1% 80.7% 70.9% 75.7% 77.1% 73.0% OVERNIGHT DEPOSITS 20.5% 21.9% 25.5% 21.5% 22.4% 16.6% 18.9% 20.9% DERIVATIVES NET POSITION- 8.2% 1.9% -1% 1.0% 0.2% 1.8% 0.9% 1.2% 0.2% 1.8% 0.4% 1.8% 3.4% 0.5% 1.5% 0.1% COLFONDOS $ 2,944,124 HORIZONTE $ 3,438,408 PORV ENIR $ 5,345,382 PROTECCION $ 4,956,502 SA NTA NDER $ 2,451,378 SKA NDIA A LTERNA TIV O $ 25,506 SKA NDIA $ 813,323 SY STEM $ 19,974,624 LAST YEAR EVOLUTION OF TOTAL PORTFOLIO IN FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION - MILLION OF US DOLLAR 100% 80% 60% 40% DERIVATIVES NET POSITION OVERNIGHT DEPOSITS EQUITY FIXED INCOME Mar-07 19,975 M Feb-07 19,346 M JAN-07 19,147 M DIC-06 19,284 M NOV-06 18,190 M OCT-06 17,879 M SEP-06 16,687 M AUG-06 16,423 M JUL-06 15,734 M JUN-06 14,240 M MAY-06 15,297 M APR-06 16,541 M 0% MAR-06 17,112 M 20% Investment in public debt continues being the most significant in these funds. At March 31 2007, these investment represented the 47.6% of the value total of portfolio (national debt commits the 41.4%, external national debt 3.6% and territorial organizations and decentralized entities 2.6%), followed of the titles emitted by institutions watched by other regulatory authority with 19.2% and titles emitted by the Institutions watched by the Financial Supervisión that counted on a participation of the 15.5% (Graph 13 Chart 1.4 ). GRAP H 13 P ORTFOLIO DIVERSIFICATION BY ISSUER M AR 31TH 2007 - THOUSANDS OF US DOLLAR 100% Internal govermment debt 18.9% 24.3% Institutions watched by other regulatory authority 41.4% 38.0% 40.9% 44.2% 43.1% 42.5% 13.4% Institutions watched by the Financial Supervisión 19.0% 13.9% International Investment 20.3% 14.6% 17.3% 19.2% 22.9% External Public Debt 23.6% 22.0% 13.3% 18.0% 42.7% Fogafin 15.5% 16.8% 11.8% 14.0% Other public debt titles 12.2% 17.0% 16.1% 13.4% 13.5% 4.8% Others (1) 0% 1.9% 0.9% 3.8% COLFONDOS $ 2,944,124 1.2% 2.5% 4.9% 1.5% 2.1% 2.7% HORIZONTE $ 3,438,408 (1) Ovenight deposits and Derivatives net position 3.3% 1.2% 2.7% 1.3% PORVENIR $ 5,345,382 3.0% 2.7% 4.1% 1.4% PROTECCION $ 4,956,502 13.9% 11.2% 11.3% 3.2% 0.5% 4.1% 8.6% 1.9% SANTANDER $ 2,451,378 5.1% 2.0% SKANDIA ALTERNATIVO $ 25,506 SKANDIA $ 813,323 3.6% 1.8% 2.6% SYSTEM $ 19,974,624 LAST YEAR EVOLUTION OF TOTAL PORTFOLIO BY ISUUER MILLION OF US DOLLAR 45% 40% 35% 30% 25% 20% 15% 10% Mar-07 19,975 M Feb-07 19,346 M JAN-07 19,147 M DIC-06 19,284 M NOV-06 18,190 M OCT-06 17,879 M SEP-06 16,687 M AUG-06 16,423 M JUL-06 15,734 M JUN-06 14,240 M MAY-06 15,297 M APR-06 16,541 M 0% MAR-06 17,112 M 5% INTERNAL GOVERMMENT DEBT Institutions w atched by the Financial Supervision EXTERNAL GOVERMMENT DEBT INSTITUTIONS NONWACHED BY THE BANKING SUPERINTENDENCY FOGAFIN INTERNATIONAL INVESTMENT OTHERS MUNICIPAL BONDS The 71.9% of portfolio mention before is denominated in Colombian pesos, the 14.6% in UVR, the 11.2% in US Dollar, the 1.5% in euros and rest 0.8% in British Pound, Real, Yen and Canadian Dollar. (Graph 14). GR A P H 14 P OR T F OLIO D IVER SIF IC A T ION B Y C UR R EN C Y M A R 31T H 2007 - T H OUSA N D S OF US D OLLA R - 100% COL Peso (Includes Derivatives Net Position) 46.4% UVR 64.8% 68.9% 70.3% 73.0% 71.9% 72.2% 80.2% US Dollar 9.8% Euro 15.1% 40.7% 18.0% 15.2% 14.8% 14.3% 14.6% 9.1% 11.0% 11.2% 8.3% 3.1% 1.5% SYSTEM $ 19,974,624 1.3% 0.8% SKANDIA $ 813,323 2.2% 0.1% SKANDIA ALTERNATIVO $ 25,506 2.1% 1.5% 0.3% PROTECCION $ 4,956,502 HORIZONTE $ 3,438,408 (1) British Pound, Real, Yen and Canadian Dollar COLFONDOS $ 2,944,124 0% 1.7% 2.6% 1.1% 0.7% 18.8% 13.4% SANTANDER $ 2,451,378 10.2% 8.5% PORVENIR $ 5,345,382 Others (1) LAST YEAR EVOLUTION OF TOTAL PORTFOLIO BY CURRENCY M ILLION OF US DOLLAR 78% 68% 58% 48% 38% 28% 18% 8% OTHERS EURO UVR US DOLLAR Mar-07 19,975 M Feb-07 19,346 M JAN-07 19,147 M DIC-06 19,284 M NOV-06 18,190 M OCT-06 17,879 M SEP-06 16,687 M AUG-06 16,423 M JUL-06 15,734 M JUN-06 14,240 M MAY-06 15,297 M APR-06 16,541 M MAR-06 17,112 M -2% COL PESO Concerning the foreing currency position, it is observed that 29.5% of this position is covered from the exchange rate fluctuation risk. Uncovered portion represents the 9.5% of the total value of the funds (Graph 15 and Chart 4). GRAPH 15 MANDATORY PENSION FUND PERCENTAGE WITHOUT COVER (MAXIMUM 20%) 0.15 0.12 11.62% 11.19% 10.62% 0.09 7.90% 0.06 5.75% 3.97% 0.03 0 Mar-06 Abr-06 May-06 Jun-06 Jul-06 Ago-06 Sep-06 Oct-06 Nov-06 Dic-06 Ene-07 Feb-07 PROTECCION PORVENIR HORIZONTE SANTANDER SKANDIA COLFONDOS Mar-07 Of another part, the 28.6% of portfolio is invested in fixed income issues denominated in colombian peso, 19.2% indexed to CPI issues, the 14.6% to fixed income in UVR, the 13.8% of portfolio is invested in stocks, 7% in Shares (Derived from securitizacion processes, Mutual Funds, Unit trust funds and Index Fund), the 7.3% to the DTF, 6% to fixed income in US Dollar, the 0.5% to fixed income in euros and rest 2.9% are titles indexed to fixed income in Real from Brazil, the variation of the UVR, CPI middle income, Libor, Overnight Deposits and net position in derivatives. (Graph 16 and Chart 1.5). GR A P H 16 P OR T F OLIO D IVER SIF IC A T ION ON F IXED IN C OM E B Y IN T ER EST R A T E T YP E, EQUIT Y, OVER N IGH T D EP OSIT S A N D D ER IVA T IVES N ET P OSIT ION M A R 31T H 2007 - T H OUSA N D S OF US D OLLA R - 100% Fixed income - Col Pesos 27.1% Fixed income - Col Pesos CPI 17.7% 19.8% 100% 28.6% 27.2% 29.6% 29.4% 32.5% CPI 17.6% 15.2% Fixed income - UVR 15.1% 19.4% 22.6% Fixed income - UVR 18.8% 19.2% 9.8% 15.1% DTF 24.7% DTF 1.6% 14.3% 6.0% Fixed income - US Dollar 18.0% 15.2% 14.6% 14.8% 23.2% 9.1% 6.7% Fixed income - US Dollar Stocks Stocks 13.9% 7.3% 8.5% 7.2% 7.3% 4.1% 6.1% 5.8% 6.8% 6.4% 7.6% 6.0% 12.4% 2.2% 14.0% Shares (1) 13.6% 19.4% 9.5% 13.1% 14.1% 13.8% 9.5% Shares (1) 0.5% 2.2% 7.1% 5.9% 7.9% Fixed income - Euro 4.3% 1.5% 2.5% Fixed income - Euro0% 0% COLFONDOS HORIZONTE PORVENIR $ 2,944,124 $ 3,438,408 $ 5,345,382 COLFONDOS HORIZONTE Others (2) Others (2) $ 2,645,680 $ 3,089,623 $ 4,790,576 SANTANDER 7.0% 8.6% 2.3% 1.5% PROTECCION $ 4,956,502 PORVENIR 1.4% 8.4% 6.1% SKANDIA 7.8% 0.5% 2.9% SKANDIA SYSTEM $ 2,451,378 ALTERNATIVO $ 19,974,624 SKANDIA PROTECCION SANTANDER $ 813,323 SKANDIA $ 25,506 $ 4,445,828 $ 2,191,422 ALTERNATIVO $ 693,189 $ 22,528 ´(1) Securitization, Mutual Funds, Index Funds, Unit Trust Funds ´(2) Real from Brazil, Libor, Floating UVR, CPI Middle income, Overnight Deposits and Derivatives net position LAST YEAR EVOLUTION OF TOTAL PORTFOLIO OF FIXED INCOME BY INTEREST RATE TYPE , EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MILLION OF US DOLLAR 35% 30% 25% 20% 15% 10% 5% OTHERS FIXED INCOME COL PESO FIXED INCOME EURO FIXED INCOME UVR CPI FIXED INCOME US DOLLAR DTF SHARES STOCKS Mar-07 19,975 M Feb-07 19,346 M JAN-07 19,147 M DIC-06 19,284 M NOV-06 18,190 M OCT-06 17,879 M SEP-06 16,687 M AUG-06 16,423 M JUL-06 15,734 M JUN-06 14,240 M MAY-06 15,297 M APR-06 16,541 M MAR-06 17,112 M 0% As far as the classification of portfolio by credit risk, it is observed that the 45% are titles emitted by the Nation, the 24.5% are investments with qualification AAA, the 4.9% AA+, the 1% AA, 1.6% AA-, 18.2% are investments that do not require qualification and rest 4.8% corresponds to titles emitted by the Fogafin, titles with A+, A, 1+, BBB+, BBB, BBB-, B, E, titles with distant qualification and Titles of emitters in Liquidation (graph17) SYSTEM $ 17,878,847 Source: INFORMATION SUPPLIED BY AFP¨S 1) Titles FOGAFIN, Securities with A+, 1+, A, BBB+, BBB, BBB-, B, E, titles with distant qualification and Titles of emitters in Liquidation (2) Investments: Unit Trust Funds, Mutual Fund, Index Fund and Stocks Note 1: For effects to establish the percentage, the total value of portafolio considers excluded the net position in derivatives Note 2: For the titles with provision the net value of purchase was taken from amortizations of capital Finally, it is possible to write down that 2.2% of portfolio of fixed income have an inferior maturity to 180 days, the 2.6% between 181 and 360 days, the 5.2% between 361 and 720 days, the 13.2% between 721 and 1080 days, the 12.3% between 1081 and 1440 days, the 8.7% between 1441 and 1800 days, the 11.1% between 1801 and 2160 days, the 16% between 2161 and 2880 days, 16% between 2881 and 3600 days and the 12.7% have a maturity superior to 10 years (Graph 18 and Chart 1.6). GRAPH 18 PORTFOLIO MATURITY FIXED INCOME PORTFOLIO DIVERSIFICATION (Maturity in days) MAR 31TH 2007 100% 1.3% > 3600 10.4% 12.0% 11.5% 15.0% 5.6% 12.7% 10.1% 20.3% 2881 - 3600 21.9% 12.8% 16.7% 17.6% 19.7% 15.3% 2161 - 2880 10.8% 4.5% 18.2% 1801 - 2160 16.0% 7.6% 10.1% 21.3% 8.2% 16.0% 3.9% 11.1% 23.5% 11.6% 1441 - 1800 20.2% 12.3% 16.0% 1081 - 1440 8.9% 10.2% 3.8% 25.6% 13.1% 8.2% 8.7% 7.9% 8.7% 8.9% 10.1% 721 - 1080 9.2% 18.5% 12.9% 12.3% 361 - 720 13.1% 10.8% 17.9% 6.4% 12.4% 181 - 360 14.4% 13.5% 14.0% 13.2% 13.9% 5.8% 0 - 180 4.8% 6.0% 1.2% 0% 2.5% 2.1% 1.9% COLFONDOS HORIZONTE 2.7% 3.7% PORVENIR 4.3% 7.3% 4.1% 4.7% 1.5% PROTECCION 0.8% 4.3% 0.4% SANTANDER 1.8% SKANDIA ALTERNATIVO 5.2% 7.9% 11.3% 0.4% SKANDIA 2.6% 2.2% SYSTEM 2. VOLUNTARY PENSIONS FUNDS 2.1 VALUE OF THE FUNDS The total value of the voluntary pensions funds administrated by pension fund administrator societies, fiduciary societies and insurance agencies to the 31 of march of 2007, reached the sum of USD 3.151 millions, 0.5% superior to the registered value to the 28 of February of 2007. (Graph 19). 950 GRAPH 19 VALUE OF EACH FUND AND ITS PARTICIPATION IN THE SYSTEM MAR.31th 2007 - MILLIONS US DOLLAR 927 900 850 800 741 750 700 650 600 557 550 500 29.4% 450 400 350 23.5% 300 250 250 17.7% 192 181 200 87 150 62 60 7.9% 100 6.1% 5.7% 2.8% 50 2.0% 1.9% 33 28 1.0% 0.9% 13 14 0.4% 0.5% 3 0.1% 2 0.1% 1 0.0% FUND VALUE HELM TRUST CREDIVALOR FIDUCOR MULTIPENSIONES FIDUCOR FIDUPENSIONES FIDUPOPULAR PLAN FUTURO FIDUPOPULAR PLAN FUTURO MULTIOPCION PROTECCION SMURFIT FIDUALIANZA ABIERTO VISION COLSEGUROS FIDUCOLOMBIA RENTAPENSION SANTANDER COLFONDOS CLASS HORIZONTE FIDUDAVIVIENDA DAFUTURO PORVENIR PROTECCION SKANDIA MULTIFUND 0 PERCENTAGE OF PARTICIPATION 3,135 3,151 0.6%- 0.5% Feb-07 Mar-07 3,223 0.3% Dec-06 3,153 3,214 0.2% Nov-06 3,084 0.9% Sep-06 3,207 3,057 1.3% Aug-06 3,019 2,915 3,500 3,214 3,461 4,000 3,577 V A LUE O F T H E F UN D S LA S T Y E A R E V O LUT IO N 2,500 7.1%- 500 4.0% 2.2%- 1,000 9.3%- 3.2%- 1,500 3.6% 2,000 0.3%- MILLONES DE USD 3,000 FUNDS VALUE Jan-07 Oct-06 Jul-06 Jun-06 May-06 Apr-06 Mar-06 - MONTHLY VARIATION 2.2 AFFILIATED The number of affiliated with the voluntary pensions funds administrated by pension fund administrator societies, fiduciary societies and insurance agencies to the 31 of march of 2007 ascended to 489.045, displaying an superior of 174affiliated, as opposed to the number reported to the closing of the previous month (graph 20). 13 GRAPH 20 AFFILIATED AND PARTICIPATION OF EACH FUND IN THE SYSTEM MAR.31th 2007 100,000 94,196 89,600 90,000 80,000 19.3% 18.3% 72,998 70,000 14.9% 60,000 53,299 50,000 10.9% 40,000 47,963 46,525 9.8% 9.5% 42,675 8.7% 30,000 12,190 2.5% 10,000 4,688 3,730 1.0% 0.8% 1,440 1,321 0.3% 0.3% 204 0.0% 159 0.0% AFFILIATED FIDUCOR MULTIPENSIONES HELM TRUST CREDIVALOR FIDUPOPULAR PLAN FUTURO MULTIOPCION PROTECCION SMURFIT FIDUALIANZA ABIERTO VISION FIDUPOPULAR PLAN FUTURO COLSEGUROS SANTANDER SKANDIA MULTIFUND FIDUCOLOMBIA RENTAPENSION HORIZONTE COLFONDOS CLASS PORVENIR PROTECCION FIDUDAVIVIENDA DAFUTURO 0 93 0.0% FIDUCOR FIDUPENSIONES 17,964 3.7% 20,000 PERCENTAGE OF PARTICIPATION N UM B E R O F A F F ILIA T E D LA S T Y E A R E V O LUT IO N 0.0% Mar-07 489,045 0.1%Feb-07 489,219 0.1% Jan-07 489,900 0.5% Dec-06 489,263 0.4% Nov-06 486,926 484,829 0.4% Oct-06 483,134 0.1%Sep-06 483,419 0.8%- 0.2%- 1.5% 1.3% 480,000 0.7% 485,000 2.1%- 490,000 485,642 495,000 493,899 491,827 500,000 498,005 499,102 505,000 A FFILIA TED Aug-06 Jul-06 Jun-06 May-06 Apr-06 Mar-06 475,000 M ONTHLY VA RIA TION 2.3 INVESTMENT PORTFOLIO As of March 31 2007, the value of portfolio of the voluntary pensions funds managed by the pensions funds and unemployment funds managers, fiduciary entities and insurance companies reached USD$ 3.161 million, showing a increase of 0.4% with respect to the end of the previous month, when it was of USD$ 3.147 million. At the end of March 2007, 60.7% of portfolio of the these funds, USD$1,920 million corresponds to fixed income investments; 18.8%, USD$ 595 million to investments in equity; 19.1%, $603 million dollars to overnight deposits and 1.4%, $43 million dollars to net position in derivatives. (Graph 21 and Chart 2.1.1). 14 GRAPH 21 PORTFOLIO DIVERSIFICATION: FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MAR 31TH 2007 - THOUSANDS OF US DOLLAR - 19.1% 1.4% 18.8% 60.7% SYSTEM 3.6% 14.9% 17.1% $ 3,161,382 64.4% SKA NDIA M ULTIFUND 13.4% 11.1% SA NTA NDER 14.9% 28.9% $ 87,153 56.2% P ROTECC. SM URFIT 29.7% 20.2% 19.1% 1.7% 22.0% $ 743,056 57.3% P ORVENIR 5.1% $ 28,336 50.1% P ROTECCION 0.2% $ 929,294 75.5% $ 561,562 90.0% 4.8% HORIZONTE $ 191,271 35.0% 65.0% HELM T. CREDIVA LOR 37.6% $ 783 56.3% 6.1% FIDP OP U. M ULTIOP CION $ 13,476 63.7% 36.3% FIDP OP U. P LA N FUTURO $ 14,219 34.4% 6.0% 59.6% FIDUDA V. DA FUTURO $ 250,178 35.8% 17.7% 46.4% FIDUCOR M ULTIP ENSIONES $ 2,382 3.8% 84.7% 11.5% FIDUCOR FIDUP ENSIONES $ 2,522 19.6% 75.9% 4.4% FIDCOLOM . RENTA P ENSION 12.9% 6.4% FID A LIA N A B IERTO VISION 4.2% $ 62,219 80.7% 11.1% $ 32,520 84.7% COLSEGUROS $ 60,092 35.4% 19.5% 45.1% COLFONDOS CLA SS $ 182,318 -1.0% 99.0% DERIVATIVES -NET POSITION- OVERNIGHT DEPOSITS EQUITY FIXED INCOME The investments in Debt public investment is the most significant investment portfolio of these funds. At March 31 2007 these investments represented 24.3%, (national debt commits 18.9%, external national debt 2.6% and territorial organizations and decentralized entities 2.7%), followed by the outside investments with the 20.3%, titles emitted by Institutions watched by the Financial Supervisión with the 24.1%, and issues by of institutions watched by other regulatory authority with the 10.4% (Graph 22 and Chart 2.1.1). 2.6% 2.7% 19.6% 1.4% GRAPH 22 PORTFOLIO DIVERSIFICATION BY ISSUER MAR 31TH 2007 - THOUSANDS OF US DOLLAR - 10.4% 24.1% 18.9% 20.3% SYSTEM 6.4% 1.9% 15.0% 3.6% 3.7% 33.9% 26.0% $ 3,161,382 9.5% SKANDIA MULTIFUND 5.9% 13.6% 16.9% 29.0% SANTANDER 15.3% 10.0% 1.5% 18.6% 30.7% $ 87,153 23.9% PROTECC. SMURFIT 20.8% 0.3% 3.3% 15.1% 17.3% 16.5% 0.2% 5.7% 6.7% 11.7% 0.1% 4.6% 20.8% 27.5% 7.0% 11.0% 24.0% 18.6% PORVENIR $ 743,056 $ 561,562 40.8% HORIZONTE 35.0% $ 28,336 26.7% PROTECCION 19.6% 1.7% $ 929,294 26.9% 7.7% $ 191,271 5.7% 59.3% HELM T. CREDIVALOR 37.6% 3.5% 36.3% 1.7% 34.4% 5.3% 11.8% 5.5% 35.8% 42.0% 6.1% 37.4% 18.8% FIDPOPU. MULTIOPCION $ 13,476 FIDPOPU. PLAN FUTURO $ 14,219 12.8% 29.8% 13.0% $ 783 5.6% 3.1% 30.0% 14.2% 8.5% FIDUDAV. DAFUTURO $ 250,178 7.0% FIDUCOR MULTIPENSIONES FIDUCOR FIDUPENSIONES 0.8% 7.3% 24.8% 12.9% 13.8% 4.2% 13.3% 6.7% 33.4% 0.8% 6.4% 14.0% 35.7% FIDCOLOM. RENTAPENSION $ 62,219 FID ALIAN ABIERTO VISION $ 32,520 0.7% 0.7% 25.5% COLSEGUROS 35.7% 0.2% 4.3% 8.4% 11.4% 16.9% $ 60,092 23.2% COLFONDOS CLASS -1% 99% Derivatives -net po sitio n- Others (1) External P ublic Debt Other public debt titles Institutio ns watched by o ther regulato ry autho rity Institutio ns watched by the Financial Supervisio n Internatio nal Investment Internal Go vermment Debt (1) FOGAFIN AND OVERNIGTH DEPOSITS $ 2,522 26.8% 57.3% 14.6% $ 2,382 10.0% 5.3% 84.7% $ 182,318 15 The 76.8% of portfolio mention before is denominated in Colombian pesos, the 16.9% in US Dollars, the 4.2% in UVR, the 1.5% in Euros and the rest 0.6% in British pound, Reales Yen, and Canadian Dollar (Graph 23). GRAPH 23 PORTFOLIO DIVERSIFICATION BY CURRENCY MAR 31TH 2007 - THOUSANDS OF US DOLLAR 0.6% 1.5% 4.2% 16.9% 76.8% SYSTEM 0.1%1.5% 2.7% 30.8% $ 3,161,382 64.9% SKANDIA MULTIFUND 0.1% 0.3%5.2%3.0% SANTANDER 6.4% 7.8% $ 87,153 85.8% PROTECC. SMURFIT 3.4% 1.9% $ 929,294 91.4% 4.7% PROTECCION 4.2%0.9% 0.6% $ 28,336 77.4% 12.5% 18.9% 75.3% 4.8% 4.7% PORVENIR $ 743,056 $ 561,562 90.5% HORIZONTE $ 191,271 100.0% HELM T. CREDIVALOR 0.2% 5.9% $ 783 93.9% FIDPOPU. MULTIOPCION $ 13,476 FIDPOPU. PLAN FUTURO $ 14,219 100.0% 0.1% 3.1% 6.6% 90.2% FIDUDAV. DAFUTURO $ 250,178 93.0% 7.0% FIDUCOR MULTIPENSIONES $ 2,382 100.0% FIDUCOR FIDUPENSIONES 8.2% 5.7% 86.1% 0.7% 0.1% FIDCOLOM. RENTAPENSION $ 62,219 FID ALIAN ABIERTO VISION $ 32,520 99.2% 12.9% 8.0% 79.1% COLSEGUROS 2.1% $ 2,522 7.4% 4.1% $ 60,092 86.4% COLFONDOS CLASS 0% $ 182,318 100% Others (1) euro UVR US Dollar COL Peso (Includes Derivatives Net Position) (1) British Pound, Real, Yen, and Canadian Dollar Concerning the foreign currency position, it is observed that 38.7% of this position is covered from the exchange rate fluctuation risk. Uncovered portion represents 11.6% of the total value of the funds (Chart 4). On the other hand, the 21.1% of the portfolio is invested in fixed income issues denominated in Colombian pesos, the 14.1% indexed to CPI, 13.8% in Shares (Derived from securitization processes, Mutual Funds, unit trust funds, and Indexed Funds), the 11.3% to the DTF, 8.8% in fixed income denominated in US Dollar, the 5% of portfolio is invested in stocks , the 4.2% to fixed income in UVR, and the rest 21.6% are fixed income issues denominated in Euro, Real, British Pound, Canadian Dollar, titles indexed to Libor, CPI middle income, overnight deposits and net position in derivatives.(Graph 24 and Chart 2.1.2). GRAPH 24 PORTFOLIO DIVERSIFICATION ON FIXED INCOME BY INTEREST RATE TYPE, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MAR 31TH 2007 - THOUSANDS OF US DOLLAR 5.0% 21.6% 4.2% 11.3% 8.8% 13.8% 21.1% 14.1% SYSTEM 1.1% 21.3% 2.7% 15.1% 18.0% 16.0% $ 3,161,382 16.3% 9.6% SKANDIA M ULTIFUND 11.1% 12.8% 5.2% 4.9% 8.5% 24.0% 14.9% 7.8% 0.7% 3.5% $ 929,294 22.3% 35.1% SANTANDER 4.9% $ 87,153 18.6% 25.6% PROTECC. SM URFIT 20.2% 4.7% 1.7% 7.8% 11.2% 18.4% 11.4% PROTECCION 5.6% 22.3% 15.6% 4.2% 5.2% 16.3% 2.0% 4.8% 2.2% 7.6% 21.8% 2.7% 53.5% HORIZONTE 53.3% 35.0% $ 743,056 22.0% 8.6% PORVENIR 5.3% $ 28,336 24.4% 6.0% $ 561,562 $ 191,271 5.7% HELM T. CREDIVALOR 32.6% 37.6% 6.1% 24.3% 39.7% 34.5% 1.4% 6.6% 17.9% 17.4% 4.6% $ 783 10.2% 13.5% 18.1% 31.5% FIDPOPU. M ULTIOPCION $ 13,476 FIDPOPU. PLAN FUTURO $ 14,219 4.0% FIDUDAV. DAFUTURO 35.8% 17.7% 21.3% $ 250,178 25.2% FIDUCOR M ULTIPENSIONES FIDUCOR FIDUPENSIONES 19.6% 8.2% 1.6% 32.7% 4.4% 18.5% 5.6% 35.6% 0.8% 33.8% 0.2%8.0% 8.9% 14.6% 10.9% 6.9% 4.1% 1.0% 5.9% 12.6% COLFONDOS CLASS 100% Stocks Fixed income - UVR Fixed income - US Dollar DTF Shares (1) $ 60,092 21.1% 13.0% 0% Others (2) $ 32,520 30.5% 22.6% COLSEGUROS 35.4% $ 62,219 11.4% FID ALIAN ABIERTO VISION 4.2% $ 2,522 14.9% FIDCOLOM . RENTAPENSION 12.9% $ 2,382 3.8% 1.5% 10.0% 84.7% CPI Fixed income - Col Pesos ´(1) Securitization, Mutual Funds, Index Funds and Unit Trust Funds ´(2) Libor, Fixed income Euros, Real, British Pound, Canadian Dollar, CPI middle income, Overnight Deposits and Derivatives Net Position $ 182,318 16 Of another part, the 16.8% of portfolio of fixed income have an inferior maturity to 180 days, 7.9% between 181 and 360 days, 12.8% between 361 and 720 days, 19.3% between 721 and 1080 days, 11.4% between 1081 and 1440 days, 7.7% between 1441 and 1800 days, 8% between 1801 and 2160 days, 4.8% between 2161 and 2880 days, 8.8% between 2881 and 3600 days and the 2.4% have a maturity superior to 10 years (Graph 25 and Chart 2.1.3). GRAPH 25 PORTFOLIO MATURITY FIXED INCOME PORTFOLIO DIVERSIFICATION (Maturity in days) MAR 31TH 2007 7.9% 16.8% 12.8% 11.4% 19.3% 8.0% 7.7% 4.8% 8.8% 2.4% SYSTEM 9.5% 18.8% 16.0% 4.4% 7.4% 5.3% 18.4% 6.7% 10.2% 3.3% SKANDIA MULTIFUND 12.2% 4.7% 14.9% 6.7% 15.5% 7.1% 2.6% 12.4% 12.4% 11.5% SANTANDER 6.9% 19.1% 6.5% 6.8% 29.4% 9.1% 11.5% 1.4% 9.4% PROTECC. SMURFIT 13.1% 10.5% 5.3% 29.6% 5.8% 6.2% 12.1% 5.3% 2.0% 10.1% PROTECCION 39.7% 4.2% 5.0% 12.1% 8.2% 5.9% 5.9% 5.1% 14.0% PORVENIR 16.0% 13.5% 10.1% 18.6% 12.5% 15.7% 5.6% 1.1% 6.9% HORIZONTE 100.0% HELM T. CREDIVALOR 21.2% 26.8% 32.0% 9.4% 4.5% 6.1% FIDPOPU. MULTIOPCION 43.1% 35.9% 12.8% 1.8% 3.8% 2.6% FIDPOPU. PLAN FUTURO 19.2% 9.2% 23.1% 18.7% 6.5% 7.1% 13.1% 1.6% 1.4% FIDUDAV. DAFUTURO 41.5% 8.4% 14.4% 31.6% 4.1% FIDUCOR MULTIPENSIONES 21.2% 78.8% FIDUCOR FIDUPENSIONES 10.8% 24.2% 31.0% 11.2% 10.1% 4.9% 2.7% 2.8% 1.3%0.9% FIDCOLOM. RENTAPENSION 34.9% 4.6% 13.2% 9.8% 1.7% 23.3% 12.4% 0.1% FID ALIAN ABIERTO VISION 15.5% 13.9% 2.3% 37.9% 4.7% 19.0% 4.6% 0.9% 1.2% 4.9% 2.6% 12.5% COLSEGUROS 4.8% 2.7% 15.5% 6.0% 22.8% 19.0% 9.2% COLFONDOS CLASS 0% 100% 0 - 180 181 - 360 361 - 720 721 - 1080 1081 - 1440 1441 - 1800 1801 - 2160 2161 - 2880 2881 - 3600 > 3600 3. UNEMPLOYMENT FUNDS 3.1 YIELD During the period 31 march of 2005 to 31 march of 2007, the funds obtained a yield average of the 7.98% cash annual, equivalent to a real yield of the 2.89%. It is important to emphasize that these yields oscillated between the 5.96% and the 10.03% (graph 26). GR Á F IC O 26. F UN D S YIELD M A R .31/ 05 T O M A R .31/ 07 12.00% 10.00% 10.03% 9.22% 8.52% 7.98% 7.82% 8.00% NOM INAL YIELD 0.96% RENTABILIDAD MINIMA 2.89% 0.96% COLFONDOS PROMEDIO (*) 1.22% HORIZONTE SANTANDER SKANDIA 0.00% PORVENIR 2.00% 5.96% 5.96% PROTECCION 2.74% 3.40% 4.00% 4.07% 4.84% 6.23% 6.00% REAL YIELD (*) Weighed by the balance daily average of the patrimony The obligatory minimum yield certified by the Superintendencia Financiera de Colombia for the mentioned period was of the 5.96% annual cash. In average, the funds surpassed in 2.02 percentage points this minimum yield. 17 3,2 VOLATILITY AND EVOLUTION YIELDS The average of the calculated accumulated yields during the last twenty-four months of the unemployment funds was 12.07% of annual cash and its volatility (standard deviation) of the 2.64%. This average for the last year was of the 10.01%, with a volatility of the 1.84%, the yield average and its volatility of each one of the funds during the mentioned periods is reflected in graphs 27, 28 and 29. GRAPH 27 UNEMPLOYMENT FUNDS RETURN´S ACCUMULATED AVERAGE AND VOLATILITY MAR 31 2005 - MAR 31 2007 GRAPH 28 UNEMPLOYMENT FUNDS RETURN´S ACCUMULATED AVERAGE AND VOLATILITY MAR 31 2006 - MAR 31 2007 16.50% 16.00% 15.50% 15.00% 14.50% 14.00% Porvenir ACCUM. YEILD AVERAG ACCUM. YEILD AVERAGE 17.00% 16.30% 16.00% 15.70% 15.40% 15.10% 14.80% 14.50% 14.20% 13.90% 13.60% 13.30% 13.00% 12.70% 12.40% 12.10% 11.80% 11.50% 11.20% 10.90% 10.60% 10.30% Skandia Horizonte Sistema Santander 13.50% 13.00% 12.50% 12.00% Porvenir 11.00% 10.50% Sistema 10.00% 9.50% 9.00% Colfondos Protección 8.50% Protección 8.00% 7.50% 1.90% 1.93% 1.96% 1.99% 2.02 2.05 2.08 2.11% 2.14% 2.17% 2.20 2.23 2.26 2.29 2.32 2.35 2.38 2.41% 2.44 2.47 2.50 2.53 2.56 2.59 2.62 2.65 2.68 2.71% 2.74 2.77 2.80 2.83 2.86 2.89 % % % % % % % % % % % % % % % % % % % % % % % % Horizonte 11.50% 7.00% % 1.40% 1.48% 1.56% 1.64% 1.72% 1.80% 1.88% VOLATILENESS 1.96% 2.04% 2.12% 2.20% 2.28% 2.36% 2.44% 2.52% 2.60% 2.68% VOLATILENESS GRAPH 29 RETURN´S ACCUMULATED OF UNEMPLOYMENT FUNDS EVOLUTION 18.40% 16.40% 14.40% 12.40% 10.40% 8.40% 6.40% 4.40% 03/2006 04/2006 05/2006 06/2006 PROTECCION 07/2006 PORVENIR 08/2006 09/2006 HORIZONTE 10/2006 11/2006 SANTANDER 12/2006 01/2007 02/2007 COLFONDOS 03/2007 SKANDIA 3.3 VALUE OF THE FUNDS The funds reached to the 31 of March of 2007 a value of $2.204 millions, a 3.8% inferior one to the registered value to the 28 of February, that is to say, $87 millions (graph 30). GR A P H 30. V A LUE O F E A C H F UN D A N D IT S P A R T IC IP A T IO N IN T H E S Y S T E M - M A R .3 1T H 2 0 0 7 - M ILLIO N S US D O LLA R 31.0% 700 24.1% 600 FUND VA LUE 42 1.9% P ERCENTA GE OF P A RTICIP A TION SKANDIA HORIZONTE PROTECCION PORVENIR 100 0 11.9% COLFONDOS 261 200 12.1% 420 531 300 682 400 SANTANDER 268 19.1% 500 2,291 39.3% 1,645 1,670 1,633 1,659 1.5%- 2.3% 1.5%- 2.7% 9.7%Jun-06 Oct-06 10.6%May-06 2.3%- 7.7%Apr-06 Sep-06 7.9%- 1,000 Mar-06 1,500 3.8%- 1,653 0.3%Aug-06 1,616 1,657 5.4% Jul-06 1,572 2,000 1,741 1,947 2,500 2,110 V A LUE O F T H E F UN D S LA S T Y E A R E V O LUT IO N M ILLIO N S US D O LLA R 2,204 18 500 FUNDS VALUE Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 0 MONTHLY VARIATION 3.4 AFFILIATED The number of affiliated with the funds on the 31 of March of 2007 was 4.507.429, displaying an inferior of the 1.6%, that is to say, 71.482 affiliated as opposed to the number reported to the 28 of February of 2007. (Graph 31). GR A P H 31 A F F ILIA T E D A N D P A R T IC IP A T IO N O F E A C H F UN D IN T H E S Y S T E M - M A R .3 1T H 2 0 0 7 1,400,000 30.7% 1,200,000 21.5% 12.2% 30,241 0.7% 200,000 549,002 612,137 400,000 13.6% 960,212 600,000 21.3% 969,852 800,000 1,385,985 1,000,000 A FFILIA TED SKANDIA COLFONDOS SANTANDER PROTECCION HORIZONTE PORVENIR 0 P ERCENTA GE OF P A RTICIP A TION 4,507,429 4,578,911 3,703,398 3,710,477 3,721,053 3,744,028 3,769,872 3,813,605 3,866,581 3,924,267 3,994,994 4,100,000 4,060,847 4,900,000 4,124,343 N UM B E R O F A F F ILIA T E D LA S T Y E A R E V O LUT IO N 1.5%- 1.6%- 1.8%- 1.5%- 1.4%- 1.1%- 0.7%- 0.6%- 0.3%- 0.2%- Apr-06 May-06 Jun-06 Jul-06 Aug-06 Sep-06 Oct-06 Nov-06 Dec-06 Jan-07 1.6%- 1.1%- 1,700,000 Mar-06 2,500,000 23.6% 3,300,000 900,000 A FFILIA TED Mar-07 Feb-07 100,000 M ONTHLY VA RIA TION Of the total of affiliated, the 96.3% correspond to dependent workers, the 2.3% to affiliated voluntary and 1.4% with independent workers. Of another part, the 65.5% of the affiliated the funds are men and the 34.5% women (To see Chart 3.2). 19 3.5 INVESTMENT PORTFOLIO As of March 31 2007, the value of portfolio of the unemployment funds reached USD$ 2,222 million, showing a decrease of 3.60% with respect to the end of the previous month, when it was of USD$ 2,305 millions. To the closing of March 2007, the 84.4% of portfolio of the mentioned funds, that is to say, USD$ 1,875 million correspond to investments of fixed income; the 14.3% USD$ 317 million to investments in equity, the 1.1%, USD$ 25 million to overnight deposits and 0.2% USD$ 4 million to the net position in derivatives (right less obligations) (Chart 3.3 and Graph31). GRAPH 31 PORTFOLIO DIVERSIFICATION: FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MAR 31TH 2007 - THOUSANDS OF US DOLLAR 99% FIXED INCOME EQUITY 81.1% 83.5% 86.3% 85.0% 83.6% 85.7% 84.4% DERIVATIVES -NET POSITION- OVERNIGHT DEPOSITS 16.8% 2.1% 1.1% 0.1% -1% COLFONDOS $ 262,778 HORIZONTE $ 423,409 0.8% 0.2% PORVENIR $ 687,211 11.4% 13.5% 15.4% 12.4% 14.3% 14.0% 0.1% 3.8% 1.5% PROTECCION $ 536,106 1.2% 0.3% SANTANDER $ 270,322 1.1% SKANDIA $ 41,709 0.2% SYSTEM $ 2,221,536 LAST YEAR EVOLUTION OF TOTAL PORTFOLIO IN FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION - MILLION OF US DOLLAR 100% 85% 70% 55% 40% 25% DERIVATIVES NET POSITION OVERNIGHT DEPOSITS EQUITY FIXED INCOME Mar-07 2,222 M Feb-07 2,305 M JAN-07 1,646 M Dic-06 1,682 M Nov-06 1,638 M Oct-06 1,655 M Sep-06 1,617 M AGO/06 1,646 M Jul-06 1,653 M Jun-06 1,587 M May-06 1,765 M Abr-06 1,968 M -5% Mar-06 2,134 M 10% The investment in public debt is most significant in these funds. At March 31 2007, this investment represented the 56.7% of the value of the total of portfolio (national debt commits the 48.8%, external national debt the 3.1% and territorial organizations and his decentralized the 4.8%), followed by Institutions watched by other regulatory authority with the 15.5%, the titles of institutions watched by the Financial Supervision with the 15.7%, the titles emitted and investments in the outside with the 10.5% (Graph 32) 20 100.0% GRAPH 32 PORTFOLIO DIVERSIFICATION BY ISSUER MAR 31TH 2007 - THOUSANDS OF US DOLLAR - Internal Govermment Debt 99.0% Institutions w atched by other regulatory authority 25.9% 39.8% 45.2% Institutions w atched by the Financial Supervision 49.4% 51.7% 48.8% 55.5% 13.2% External Public Debt 18.8% 11.7% 21.9% Other public debt titles 15.5% 15.4% 19.7% 15.1% 12.9% 12.6% 21.4% 2.8% International Investment 15.7% 19.2% 9.7% 11.2% 5.2% 5.2% 4.7% 3.1% 3.1% 18.4% Others (1) 1.4% -1.0% COLFONDOS $ 262,778 6.9% 10.2% 10.9% 2.1% 0.0% 4.9% 2.8% 3.9% 4.7% 14.1% 10.5% 9.6% 7.6% 1.5% 1.6% COLFONDOS HORIZONTE PORVENIR HORIZONTE PROTECCION $ 207,090 $ 423,409 $ 687,211 $ 327,042 $ 536,106 4.8% 7.3% 1.6% 1.0% PORVENIRSKANDIA PROTECCION SANTANDER SYSTEM $ 470,630$ 41,709 $ 376,181 $ 270,322 $ 2,221,536 SANTANDER $ 215,103 (1) FOGAFIN , OVERNIGHT DEPOSITS AND DERIVATIVES LAST YEAR EVOLUTION OF TOTAL PORTFOLIO BY ISUUER MILLION OF US DOLLAR 60% 50% 40% 30% 20% Mar-07 2,222 M Feb-07 2,305 M JAN-07 1,646 M Dic-06 1,682 M Nov-06 1,638 M Oct-06 1,655 M Sep-06 1,617 M AGO/06 1,646 M Jul-06 1,653 M Jun-06 1,587 M May-06 1,765 M Abr-06 1,968 M 0% Mar-06 2,134 M 10% OTHERS INTERNA TIONA L INVESTM ENT FOGA FIN INSTITUTIONS NONWA CHED B Y THE B A NKING SUP ERINTENDENCY Institutio ns watched by the Financial Supervisio n INTERNA L GOVERM M ENT DEB T M UNICIP A L B ONDS EXTERNA L GOVERM M ENT DEB T The 77.6% of portfolio in mention are denominated in Colombian pesos, the 12.3% in UVR, the 8.2% in US Dollar, the 1% in euros, the 0.6% in real, and the rest 0.2% in yen and Canadian dollar. (Graph 33) SKANDIA $ 27,833 21 GRAPH 33 PORTFOLIO DIVERSIFICATION BY CURRENCY MAR 31TH 2007 - THOUSANDS OF US DOLLAR COL Peso (Includes Derivatives Net Position) 99% US Dollar 64.6% UVR 74.1% 77.6% 76.2% 78.8% 83.7% 84.0% EURO Real 21.9% 8.8% . 8.2% 9.6% 7.6% 3.3% others(1) 7.4% 15.3% 10.8% 11.1% 13.3% 7.1% 1.5% -1% COLFONDOS $ 262,778 12.3% 12.8% 2.6% 0.3% 1.8% HORIZONTE $ 423,409 PORVENIR $ 687,211 1.9% 0.8% PROTECCION $ 536,106 SANTANDER $ 270,322 0.7% 0.2% SKANDIA $ 41,709 1.0% 0.6% SYSTEM $ 2,221,536 (1) Yen and Canadian Dollar LAST YEAR EVOLUTION OF TOTAL PORTFOLIO BY CURRENCY M ILLION OF US DOLLAR 80% 70% 60% 50% 40% EURO UVR US DOLLAR Mar-07 2,222 M Feb-07 2,305 M JAN-07 1,646 M Dic-06 1,682 M Nov-06 1,638 M Oct-06 1,655 M Sep-06 1,617 M AGO/06 1,646 M Jul-06 1,653 M Jun-06 1,587 M May-06 1,765 M Abr-06 1,968 M Mar-06 2,134 M 30% 20% 10% 0% COL PESO Concerning the foreing currency position, it is observed that the 33.6% of the same one are covered from the exchange rate fluctuation risk and that the discovered part represents 6.7% of the total value of the funds (Graph 34 and Chart 4) GRAPH 34 UNENPLOYMENT FUNDS PERCENTAGE WITHOUT COVER (MAXIMUM 20% 0.15 0.12 10.78% 0.09 7.32% 0.06 5.23% 4.99% 0.03 1.61% 1.25% 0 Mar-06 Abr-06 May-06 Jun-06 PROTECCION SANTANDER Jul-06 Ago-06 Sep-06 Oct-06 PORVENIR SKANDIA Nov-06 Dic-06 Ene-07 Feb-07 HORIZONTE COLFONDOS Mar-07 22 On the other hand, the 39.9% of the portfolio is invested in fixed income issues denominated in Colombian pesos, the 22.7% indexed to CPI, the 12.3% to fixed income in UVR, 7.5% in Shares (Derived from securitization processes, Mutual Funds, unit trust funds, and Indexed Funds), 6.7% of portfolio is invested in stocks, 4.9% to DTF, 3.7% in fixed income in US Dollar, 0.3% are fixed income issues denominated in euro, and the rest, 2% are titles in Real, Libor, overnight deposits and net position in derivatives. (Graph 35 and Chart 3.4) GRAFICO 35 PPORTFOLIO DIVERSIFICATION ON FIXED INCOME BY INTEREST RATE TYPE, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION MAR 31TH 2007 - THOUSANDS OF US DOLLAR Fixed income - Col Pesos 100.00% CPI 29.0% Fixed income - UVR 35.1% 40.7% 38.0% 43.4% 39.9% 44.6% Fixed income - US Dollar 12.5% DTF 22.2% 12.8% 25.7% Shares (1) 21.9% 22.7% 31.4% 19.0% 18.7% 15.3% Fixed income - Euro 10.8% 7.1% 3.4% 8.8% 11.1% 6.5% 5.8% 2.3% 5.1% Others (2) 8.0% 5.0% 9.3% 6.2% 2.9% 1.5% 7.8% 6.2% 4.9% 0.5% 4.9% 7.5% 5.0% 2.0% 0.9% 1.5% 1.0% 3.7% 10.1% 4.6% 3.2% 7.6% 0.2% 2.1% Stocks 12.3% 13.3% 2.4% 5.0% 8.9% 6.4% 0.3% 6.7% 4.1% 0.00% COLFONDOS $ 262,778 HORIZONTE $ 423,409 PORVENIR $ 687,211 PROTECCION $ 536,106 SANTANDER $ 270,322 SKANDIA $ 41,709 SYSTEM $ 2,221,536 ´(1) Securitization, Mutual Funds, Unit Trust Funds and Indexed Funds ´(2) Libor, Real, Overnight Deposits and Derivatives net position As far as the classification of portfolio by credit risk, it is observed that the 51.8% are titles emitted by the Nation, the 24.7% are investments with qualification AAA, the 8.1% AA+, the 1.3% AA, the 10.8% are investments that do not require qualification, and rest 3.4% corresponds to titles emitted by Fogafin, titles with qualification AA-, A+, A, 1+, 1 BBB+, BBB, BBB-, B titles with distant qualification and Titles of emitters in Liquidation (Graph 36) GRAPH 36 PORTFOLIO DIVERSIFICATION BY CREDIT RATING MAR 31TH 2007 100% Sovereign 90% AAA 38.5% 80% 42.6% 49.9% AA+ 51.8% 51.7% 52.2% 58.3% 70% 60% 50% 28.4% AA 40% 36.3% Don´t require (2) 20.0% 20.0% 26.6% 24.7% 30% 25.8% 20% 2.2% 1.6% 9.4% 8.7% 1.1% 1.9% 21.6% 6.2% 8.1% 2.4% Others (1) 10% 15.7% 1.3% 9.3% 12.6% 8.7% 1.8% 15.5% 10.8% 6.1% 6.2% 1.5% 0% COLFONDOS HORIZONTE 4.7% PORVENIR 5.6% 0.9% 2.2% PROTECCION SANTANDER 3.4% 3.6% SKANDIA SYSTEM Source: INFORMATION SUPPLIED BY AFP¨S (1) Fogafin, AA-, A+, A, 1+, 1, B, BBB+, BBB, BBB-, titles with distant qualification and Titles of emitters in Liquidation (2) Investments: Unit Trust Funds, Mutual Fund, Index Fund and Stocks Note 1: For effects to establish the percentage, the total value of portafolio considers excluded the net position in derivatives Note 2: For the titles with provision the net value of purchase was taken from amortizations of capital 23 Finally, it is important to write down that the 5.3% of portfolio of fixed income have an inferior maturity to 180 days, the 7% between 181 and 360 days, the 7.9% between 361 and 720 days, the 17.2% between 721 and 1,080 days, the 12.4% between 1,081 and 1,440 days, the 8.8% between 1,441 and 1800 days, the 11.9% between 1801 and 2,160 days, the 11.6% between 2,161 and 2,880 days, the 11.6% between 2881 and 3.600 days and the 6.2% have a maturity superior to 10 years (Graph 37 and Chart 3.5). GRAPH 37 PORTFOILO MATURITY FIXED INCOME PORTFOLIO DIVERSIFICATION (Maturity in days) MAR 31TH 2007 100.0% > 3600 0.9% 4.5% 7.8% 6.2% 6.3% 9.9% 12.4% 14.0% 2881 - 3600 12.1% 10.9% 5.6% 11.6% 14.8% 12.7% 3.9% 5.5% 2161 - 2880 10.6% 11.6% 14.1% 1801 - 2160 14.5% 19.7% 10.6% 16.5% 11.4% 11.9% 9.5% 10.3% 5.5% 6.6% 5.2% 1441 - 1800 13.8% 1081 - 1440 8.8% 10.1% 18.7% 19.3% 2.9% 5.5% 12.1% 8.4% 26.9% 12.4% 11.4% 721 - 1080 10.1% 11.0% 19.8% 19.9% 361 - 720 25.9% 16.0% 5.7% 181 - 360 17.2% 4.1% 15.5% 24.8% 7.9% 3.4% 10.5% 6.9% 5.3% 3.6% 0.0% COLFONDOS HORIZONTE PORVENIR 7.0% 3.7% 10.3% 1.5% 0 - 180 4.4% 6.3% 0.2% PROTECCION 5.3% 5.7% 0.6% SANTANDER SKANDIA SYSTEM 4. PAY AS YOU GO REGIME 4.1 PENSION RESERVE FUND´S EQUITY Pay as you go pension reserve fund’s equity to the closing of the month of March 2007 it reported a balance of USD 1.074,2 million dollars, superior value USD 14,1 million dollars in relation to the registered one in February of 2007, which means a growth of the 1,33% (graphical 38). The total of reserves to March of 2007 is distributed thus: Retirement Age USD 1.016,2 million dollars, Invalidity USD 4,0 million dollars and Survival USD 54,0 million dollars (chart 5). Graph 38 Reserve's Found Equited 43,82% 30,41% 11,99% 71,3 41,9 40,9 32,4 31,6 73,9 3,90% 3,01% 128,8 326,6 318,6 470,7 10 126,1 6,88% 100 471,6 Millions of Dollars 1.000 1 ISS CAPRECOM Feb-07 CAXDAC P. ANTIOQUIA Mar-07 FONPRECON CAJANAL Participation to Mar/07 Last Year Evolution of Reserve´s Funds Equity 13,05% 2,73% 0,07% 1,33% 1,33% 1.046,1 1.060,1 1.074,2 1.045,4 1.017,6 Jan-07 Feb-07 Mar-07 956,1 May-06 845,7 Apr-06 824,5 Mar-06 300,0 11,25% 6,43% 2,58% -7,34% 780,5 757,1 -3,99% 788,6 600,0 -3,35% 701,6 -6,66% 816,0 Milions of Dolars 900,0 5,64% 0,0 Jun-06 Jul-06 Aug-06 EQUITY VALUE Source: Supervised Entities Sep-06 Oct-06 Nov-06 MONTHLY VARIATION Dec-06 24 4.2 AFFILIATES According to the numbers sent by the administrator entities of the mentioned Regime, for January and February of 2007, the total number of affiliates was of 6.002.842 and 6.006.159, respectively, showing a growth of 3.317 affiliated, representing 0,06%. “CAJANAL”´s number is included taking into account preliminary information, and “FONPRECON”´s data is in process of evaluation is composed as follows: In January 2007, 103 correspond to Law 4th of 1992 (Members of the “Congreso de la República”) and 616 to Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and of the “Fondo de Previsión Social”); in February 2007 the distribution was: 103 and 614, respectively (graph 39). Graph 39 Affiliates 98,87% 10.000.000 1.000.000 1,00% 100.000 0,08% 0,02% 10 0,01% 717 719 1.067 1.068 1.347 1.355 4.562 60.000 0,02% 4.858 100 60.000 1.000 5.938.466 5.934.842 10.000 1 ISS CAJANAL (1 ) CAPRECOM Jan-07 P. ANTIOQUIA Feb-07 CAXDAC FONPRECON Participation to Feb/07 (1) According to preliminary information (2) In January 2007: 103 correspond to Law 4th of 1992 and 616 to Law 100 of 1993; in February 2007 the distribution was: 103 and 614, respectively. (Figures in verification) Last year Affiliates´ Evolution 0,32% 0,42% 0,16% 0,18% 0,17% 0,21% 0,04% 0,11% 0,08% 0,00% 0,11% 0,19% 0,06% Dec-06 Jan-07 6.006.159 Oct-06 6.002.842 Sep-06 5.996.177 Jun-06 5.984.905 5.927.648 Mar-06 2.000.000 5.967.080 5.902.690 Feb-06 3.000.000 5.979.853 5.957.848 May-06 4.000.000 5.979.834 5.947.686 Apr-06 5.000.000 5.964.481 5.938.334 6.000.000 1.000.000 0 Jul-06 Aug-06 AFFILIATES Nov-06 Feb-07 MONTHLY VARIATION Source: Supervised Entities From the total of affiliates for each of the administrators of the Pay As You Go Regime in February 2007, without including “CAJANAL” and “FONPRECON”, 33% corresponds to people who quote, representing 1.933.165; and 67% corresponds to people who do not quote, representing 4.012.277. It is understood like people who do not quote to those affiliated and not-pensioners yet, who for some reason, with they did not do the mandatory payment during the month for which is reported. The total amounts who quote in February 2007 ascended to USD 105,104 thousands of dollars (graph 40). Graph 40 Affiliates clasification 1.927.396 10.000.000 4.011.070 1.000.000 100.000 4.451 10.000 1.061 1.000 286 111 257 810 100 10 1 ISS CAPRECOM P. ANTIOQUIA QUOTING MEMBERS CAXDAC NON-QUOTING MEMBERS Last Year Contributors and Non-Contributors Affiliates´ Evolution 100% 90% 80% 70% 69% 68% 68% 32% 32% 67% 68% 67% 32% 33% 67% 68% 33% 32% 66% 66% 67% 68% 67% 60% 50% 40% 30% 20% 31% 33% 34% 34% 33% 32% 33% Dec-06 Jan-07 Feb-07 10% 0% Feb-06 Mar-06 Apr-06 May-06 Jun-06 Jul-06 Aug-06 NON-QUOTING MEMBERS Sep-06 Oct-06 Nov-06 QUOTING MEMBERS Source: Supervised Entities 4.3 PENSIONERS The number of pensioners that reported by each-one of the administrators to February 2007 was 943.670, presenting a rise of 4.917 pensioners with respect to January 2007, representing 0.5% (graph 41). Of this total, 690.802 correspond to Oldness, 38.011 to Invalidity and 214.857 to Survival (chart 6). 25 In “CAPRECOM”, of the 22,070 pensioners to January 2007, 13.716 are pensioners prior to the entrance in use of Law 100/93; 4.762 are pensioners in use of Law 100/93 for which the organization concurs and others; 3.439 pensioners in use of Law 100/93 concur FONCAP with quota fixed share, and 153 are of the Advance Plan of Pensions (PAP) to employer responsibility. From the 2.018 pensioners reported by “FONPRECON”, 811 correspond to Law 4th of 1992 (Exmembers of the “Congreso de la República”) and 1.207 to Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and of the “Fondo de Previsión Social”). “CAJANAL”´s data is provided by the Partnership “FOPEP”. According to article 33 of Law 100 of 1993, modified by the article 9° of Law 797 of 2003, in the Pay As You Go Regime, the age of the retirement for the men is 60 years and must at any time have contributed with 1.100 weeks. Whereas for the women the age of the retirement is 55 years, but the weeks of the contribution continue being equal, meaning 1.1005 weeks at any time. Graph 41 Pensioners 73,95% 23,20% 1.000.000 2,34% 0,21% 693 0,07% 694 2.013 2.147 22.061 2.136 10 0,23% 2.018 218.902 100 218.126 1.000 697.840 10.000 693.723 100.000 22.070 10.000.000 1 ISS CAJANAL CAPRECOM (1) Jan-07 Feb-07 P. ANTIOQUIA FONPRECON (2) CAXDAC Participation to Feb/07 (1) CAPRECOM: In February 2007: 13.716 are pensioners prior to the entrance in use of Law 100/93; 4.762 are pensioners in use of Law 100/93 concurs organization and others; 3.439 pensioners in use of Law 100/93 concur FONCAP with quota fixed share, and 153 are of the Advance Plan of Pensions (PAP) to employer responsibility. (Numbers in evaluation) (2) FONPRECON: In January 2007: 811 correspond to Law 4th of 1992 and 1.202 to Law 100 of 1993; in February 2007 the distribution was: 811 and 1.207, in the same order. (Figures in verification) Last Year Pensioners´ Evolution Oct-06 Nov-06 0,40% 0,52% 943.670 Sep -06 0,72% 938.753 0,63% 935.055 Au g -06 0,68% 928.398 Ju l-06 0,78% 922.569 0,61% 916.367 0,75% 909.284 892.741 885.672 400.000 873.954 600.000 868.994 800.000 0,48% 903.761 0,57% 0,80% 896.992 0,11% 1,34% Jan -07 Feb -07 200.000 0 Feb -06 M ar-06 Ap r-06 M ay-06 Ju n -06 TOTAL PENSIONERS Dec-06 VARIATION Source: Supervised Entities According to the administrator’s report, the monthly payroll value of pensioners for February 2007, ascended to USD 410.030,7 thousand of dollars (graph 42). In CAPRECOM, from the USD 20.059,7 thousand dollars reported in January 2007: (a) USD 10.832,3 thousand dollars - It corresponds to the value of the quota fixed share of the organization in which was affiliated the pensioners, the quota fixed share in charge of the sector of the communications and the quota fixed share of outside the sector, by pensions recognized prior to the entrance in use of the Law 100 of 1993, as opposed to which contributions were not made; (b) USD 8.772,6 thousand dollars - It corresponds to the value of the quota fixed share of the organization in which was affiliated the pensioners, the quota fixed share in charge of the sector of the communications and the quota fixed share of outside the sector by pensions recognized after the entrance in use of the Law 100 of 1993, as opposed to which contributions were made; (c) USD 306,0 thousand dollars - It corresponds to the value of the quota fixed share in charge of the “FONCAP” by pensions recognized after the entrance in use of the Law 100 of 1993 which contributions were made; (d) USD 148,7 thousand dollars - It corresponds to the value of the pension that by effect of the Advance Plans of Pensions (PAP) the employer assumes the totality of the same one, until than the affiliated fulfills the established general requirements in the effective norms and which the employer continues quoting to the “FONCAP”. From the USD 5.932,1 thousand of dollars reported by “FONPRECON”, USD 4.878,7 thousand dollars correspond to Law 4th of 1992 pensioners (Ex-members of the “Congreso de la República”) and USD 1.053,3 thousand dollars to Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and of the “Fondo de Previsión Social”). The CAJANAL´s information is provided by the Partnership “FOPEP”. 26 Graph 42 Pension Pays 64,79% 28,16% 0,36% 1.093,5 1.427,9 0,35% 1.495,1 5.932,1 5.871,0 1.501,9 10,0 1,45% 20.059,7 113.825,6 100,0 265.649,6 245.348,7 10.000,0 1.000,0 4,89% 115.466,4 100.000,0 18.160,9 Thousands of Dollar 1.000.000,0 1,0 ISS CAJANAL (1) CAPRECOM (2) Jan-07 FONPRECON (3) Feb-07 CAXDAC P. ANTIOQUIA Participation to Feb/07 (1) Information Partnership FOPEP (2) "CAPRECOM": (a) USD 10,832,3 thousand of dollars - It corresponds to the value of the quota fixed share of the organization in which was affiliated the pensioners, the quota fixed share in charge of the sector of the communications and the quota fixed share of outside the sector, by pensions recognized prior to the entrance in use of the Law 100 of 1993, as opposed to which contributions were not made. (b) USD 8,772,6 thousand of dollars - It corresponds to the value of the quota fixed share of the organization in which was affiliated the pensioners, the quota fixed share in charge of the sector of the communications and the quota fixed share of outside the sector by pensions recognized after the entrance in use of the Law 100 of 1993, as opposed to which contributions were made. (c) USD 306,0 thousand of dollars - It corresponds to the value of the quota fixed share in charge of the FONCAP by pensions recognized after the entrance in use of the Law 100 of 1993 which contributions were made. (d) USD 148,7 thousand of dollars - It corresponds to the value of the pension that by effect of the Advance Plans of Pensions (PAP) the employer assumes the totality of the same one, until than the affiliated fulfills the established general requirements in the effective norms and which the employer continues quoting to the FONCAP. (Numbers in evaluation) (3) "FONPRECON": In February 2007, 4.878,7 thousand USD correspond to Law 4th/92 and 1.053,3 thousand USD to Law 100/93. (Figures in verification) Last Year Pension Pays Evolution 62,2% 600.000 52,3% May-06 Sep-06 Oct-06 395.759,8 6,3% 410.030,7 Apr-06 -2,5% 385.801,5 330.758,0 Mar-06 345.837,3 340.692,5 Feb-06 503.808,0 343.772,0 100.000 4,7% 2,3% 0,9% 600.621,1 -2,9% 370.385,4 -0,9% 353.837,2 -0,2% 300.000 200.000 -34,1% -31,9% 1,5% 342.889,1 400.000 344.624,7 Thousand of dollars 500.000 Jan-07 Feb-07 0 Jun-06 Jul-06 Aug-06 Pension Pay Value Nov-06 Dec-06 Monthly variation Source: Supervised Entities The arithmetic average of the payment of the pension for this Regime in February 2007 was USD 434,5 dollars, above in 5,73% of last month’s pension pay (graph 43). 434,5 411,0 380,7 353,7 527,5 521,8 1.000,0 665,1 2.000,0 511,9 908,9 823,2 3.000,0 2.157,4 Dollars 4.000,0 2.164,1 2.916,5 5.000,0 2.939,6 Graph 43 Average Pension Pays 0,0 FONPRECON CAXDAC CAPRECOM P. ANTIOQUIA CAJANAL (1) Jan-07 ISS SYSTEM´S AVERAGE Feb-07 (1) Information Partnership FOPEP Last Year Pension Pays´ Average 61,14% 51,60% Mar-06 Apr-06 Aug-06 Sep-06 Oct-06 -2,90% Nov-06 Dec-06 Jan-07 5,73% 434,5 -34,58% 3,97% 411,0 384,7 Feb-06 370,5 393,4 100,00 396,6 200,00 1,52% 379,4 300,00 0,25% 423,2 -32,45% -3,68% 646,9 -2,21% 401,5 -0,81% 386,1 1,40% 400,00 561,7 Dollars 500,00 380,3 600,00 0,00 May-06 Jun-06 Jul-06 SYSTEM´S AVERAGE Source: Supervised Entities MONTHLY VARIATION Feb-07 27 4.4 INVESTMENT PORTFOLIO The balances of the portfolios of investments of the pensionales reserve funds to March of 2007 (having in mind that, according to what is established in Law 490 from 1998 and statutory Decree 1404 from 28 of July of 1999, “CAJANAL” transferred its reserves to “FOPEP” and therefore does not present balance; and in the case of the “Instituto de Seguros Sociales” – “ISS” – are included the resources corresponding to the Subsidiary Regime) ascend to USD 904,5 million dollars compared to 876,3 million dollars in February 2007, showing an increase of USD 28,2 million dollars that represent 3,22% (graph 44). The total of the investments to March of 2007 is distributed for each pensional modality, thus: Retirement age USD 835,0 million dollars, Invalidity USD 10,4 million dollars and Survival USD 59,1 million dollars (chart 7) Graph 44 Investment Portfolio 41,54% 36,08% 14,21% 4,61% 41,7 32,2 30,6 40,7 3,56% 128,5 125,8 326,3 318,3 10 375,8 100 360,9 Millions of dollars 1.000 1 ISS CAPRECOM CAXDAC Feb-07 Mar-07 P.ANTIOQUIA FONPRECON Participation to Mar/07 Last Years Investment Portfolio´s Evolutionnes Jun-06 778,5 769,5 656,3 May-06 -0,02% Oct-06 Nov-06 Dec-06 Jan-07 0,18% 3,22% 904,5 4,60% 729,0 705,3 749,8 400 2,14% -6,94% 600 500 5,18% 876,3 1,17% 874,7 -5,94% 5,55% 700 786,1 Millions of Dollars 800 11,08% 874,8 -4,62% 836,3 -2,64% 818,8 900 300 200 100 0 Mar-06 Apr-06 Jul-06 Aug-06 PORTFOLIO VALUE Sep-06 Feb-07 Mar-07 MONTHLY VARIATION Source: Supervised Entities In March of 2007, 90,0% of portfolios were invested in TES, the remaining 10,0% were represented in other bonds different to Nation bonds, contained in the funds administrated by “CAXDAC”. “CAXDAC”´s investment portfolio is substantially different to other pays as you go reserve funds, due to the fact that this entity, in investment matters, is ruled by the norms issued by the “Superintendencia Financiera de Colombia” for Private Pension Fund Administrators (graph 45). Graph 45 PORTFOLIO CLASIFICATION IN: FIXED AND VARIABLE INCOME, DEPOSITS AT SIGHT AND DERIVATIVES NET POSITION Thousands of pesos 300.000.000 250.000.000 200.000.000 150.000.000 94,76% 100.000.000 50.000.000 0,36% 4,84% 0,04% 0 DEPOSITS AT SIGHT Portfolio Participation INV VARIABLE INCOME BONDS INV FIXED INCOME BONDA FORWARD AGREEMENTS VARIABLE RENT BY ISSUER HIGH LIQUIDITY STOCKS 25,19% LOW LIQUIDITY STOCKS 4,08% 68,36% 0,19% 2,18% PARTICIPATION IN ORDINARY COMMON FUNDS PARTICIPATION IN SPECIAL COMMON FUNDS PARTICIPATION IN FUNDS OF VALUES 28 INT T IT OF DEBT PUBL ISHES EMIT T ED OR GUARANT EED BY T HE NAT ION VARIABLE RENT BY ISSUER EXT ERN T IT OF DEBT PUBL ISHES EMIT T ED Or GUARANT EED BY T HE NAT ION OT HER PUBL IC DEBT T IT L ES (DEC2681/93) 1,00% 8,46% 8,68% 22,20% 1,63% T IT S OF CREDIT CONT ENT , DERIVAT IVES OF T IT UL ARIZACION MORT GAGE PORT FOL IO T IT S OF CONT ENT CREDIT ICO, DERIVAT IVES OF PROCESSES OF DIFFERENT T IT UL ARIZACION PORT FOL IO T IT S ISSUES, ENDORSED ACCEPT ED OR GUARANT EED BY "SFC" 9,23% T IT S ISSUES FROM ENT IT IES NOT SUPERVISED BY "SFC" 10,26% T IT S ISSUES, ENDORSED Or GUARANT EED FROM FOREIGN GOVERNMENT S 17,24% 0,04% 15,79% T IT S ISSUES, ENDORSED Or GUARANT EED FROM FOREIGN BANKS 5,46% T IT S ISSUES, ENDORSED OR GUARANT EED FROM MUL T IL AT ERAL ORGANISMS T IT S ISSUES FROM ORGANIZAT IONS Of T HE OUT SIDE, DIFFERENT FROM BANKS SOURCE: Caxdac 5. ISS´s PROFFESIONAL RISKS ADMINISTRATOR 5.1 RESERVES FOR PROFESSIONAL RISKS With occasion of the expedition of Law 776 of 2002, in the article 1°, and in concordance with the instruction of External Circular 044 of “Superintendencia Financiera de Colombia”, the “Instituto de Seguros Sociales” (“ISS”) adopted the technical reserves regime for the life insurance companies that administrate the field of professional risks; in consequence, during the last semester, the “ISS” presents in its balance statement the amount of each of the following reserves: (Graph 46). 26,8 17,6 105,1 26,8 1.140,2 1.316,5 26,1 17,1 101,6 26,1 1.108,9 1.279,7 25,6 16,8 97,2 25,6 1.099,1 1.264,4 25,4 16,7 97,4 25,4 1.130,1 1.295,1 24,8 16,1 95,2 24,8 1.088,8 1.249,6 24,4 100,0 15,8 94,4 1.000,0 24,4 1.230,5 10.000,0 1.071,5 Millions of dollars Graph 46 - Professional Risks Reserves 10,0 1,0 Oct-06 Nov-06 TOTAL RESERVES Dec-06 1-MATHEMATICAL RESERVE Jan-07 2-DEVIATION OF SINISTER Feb-07 3-WARNED SINISTER Mar-07 4-NOT WARNED SINISTER 5-PROFESSIONAL ILLNESS SOURCE: ARP-ISS/ FINANCIAL STATEMENTS IN VERIFYING PROCESS 5.2 EMPLOYERS AND AFFILIATE EMPLOYEES Affiliated employees to the ISS´s professional risk insurance company (ARP) during last year (between February 2006 and February 2007) they report an increase on 8,83% from 270.277 passing to 294.153, respectively. The workers affiliated, during the same lapse, displayed an increase of 15,95%, when happening from 1.393.935 coming, to 1.616.281. For the months of January and February of 2007, the number of affiliated employers increased in 1.080, representative ones of 0,37%, and the affiliated workers increased in 6.055, is to say 0,38% (graph 47). The amounts who quote ARP in February of 2007 ascended to USD 7,63 million of dollars. Graph 47 Employees and workers affiliates 1.620.000 1.616.281 294.153 1.610.226 293.073 1.608.836 290.030 1.555.476 283.057 1.545.264 279.952 279.653 1.445.846 274.487 1.438.653 262.454 1.409.926 278.208 1.408.120 277.439 1.408.712 276.514 420.000 275.732 620.000 270.277 820.000 1.393.935 1.020.000 1.406.807 1.220.000 1.543.208 1.420.000 220.000 20.000 -180.000 Feb-06 Mar-06 Apr-06 May-06 Jun-06 Jul-06 Aug/06 EMPLOYEES Sep-06 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 WORKERS SOURCE: ARP-ISS 5.3 PENSIONERS From the total of 22.842 pensioners who report the ISS´s ARP in February 2007, 10.791 correspond to survival pension and 12.051 to invalidity pension. During last year, the number of pensioners of survival pension showed a growth of 0.85%, invalidity pension a reduction of -0.62% and the total of pensioners reported an increment of 0,07%. For the months of January and February of 2007, the number of pensioners by survival, invalidity and the total, they displayed increases in 30, 2 and 32 respectively, 29 representing 0,28%, 0,02% and 0,14% (graph 48). The monthly payroll value of pensioners ARP for February 2007, ascended to USD 5,3 million dollars; of this total, USD 2,9 million dollars correspond to survival and USD 2,4 million dollars to invalidity. Graph 48 Pensioners 22.842 22.810 22.787 22.729 22.685 22.645 22.599 22.573 22.547 22.870 22.833 22.826 22.908 20.000 10.791 12.051 10.761 12.049 10.744 12.043 10.702 12.027 10.663 12.022 10.577 11.996 10.627 12.018 May-06 10.601 11.998 10.773 12.135 Apr-06 10.552 11.995 10.737 12.133 12.119 10.714 12.126 10.700 10.000 0 Feb-06 Mar-06 Jun-06 Jul-06 Ago-06 SURVIVAL Sep-06 INVALIDITY Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 TOTAL SOURCE: ARP-ISS 5.4 MANDATORY QUOTATIONS AND PENSION PAYMENTS Graph 49 Mandatory quotations and pension pays 8,0 5,4 7,6 5,3 Oct-06 5,3 Sep-06 4,0 5,0 Aug-06 3,7 Jul-06 8,8 9,2 8,1 8,1 7,8 8,0 8,0 4,7 May-06 4,6 Apr/06 4,6 Mar-06 4,5 4,6 7,0 4,7 6,0 5,0 8,0 7,4 10,0 7,8 12,0 6,7 Millions of Dollars 14,0 13,2 Between the months of March 2006 and March 2007, ISS´s ARP received USD 102,1 million dollars in quotations from affiliate employers, for a monthly average of USD 7,9 million dollars. The amount paid during the same period on pension payments ascended to USD 70,8 million dollars, for a monthly average of USD 4,7 million dollars, taking into account that law establishes an annual cancellation of 14 pension payments. Financial statements and statistical reports are in evaluation and depuration process in order for them to be adjusted to the instructions of External Circular 044 of 2003 (graph 49). Jan-07 Feb-07 Mar-07 2,0 0,0 Jun-06 MANDATORY QUOTATIONS SOURCE: ARP-ISS Nov-06 Dec-06 MONTHLY TOTAL PENSION PAY