Performance of Pension

advertisement

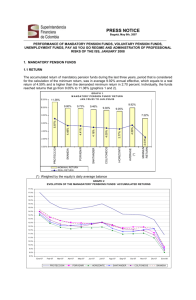

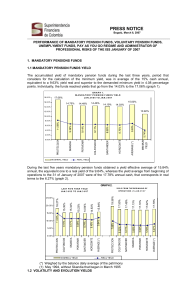

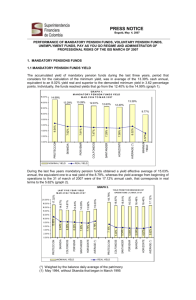

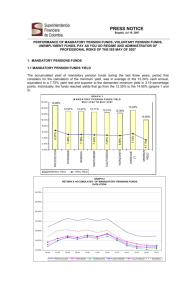

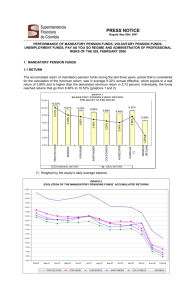

PRESS NOTICE Bogotá, January 16th, 2007 PERFORMANCE OF MANDATORY PENSION FUNDS, VOLUNTARY PENSION FUNDS, UNEMPLOYMENT FUNDS, PAY AS YOU GO REGIME AND ADMINISTRATOR OF PROFESSIONAL RISKS OF THE ISS, NOVEMBER 2007 1. MANDATORY PENSION FUNDS 1.1 RETURN The accumulated return of mandatory pension funds during the last three years, period that is considered for the calculation of the minimum return, was in average 12.56% annual effective, which equals to a real return of 7.26% and is higher than the demanded minimum return in 3.65 percent. Individually, the funds reached returns that go from 11.61% to 14.01% (graphics 1 and 2). G R A P H 1. M A N D A T O R Y P E N S IO N F UN D S ' R E T UR N N O V .3 0 t h/ 0 4 T O N O V .3 0 t h/ 0 7 16.00% 14.01% 14.00% 12.43% 12.35% 12.05% 12.00% 12.56% 11.95% 11.61% 8.91% 10.00% 8.00% AVERAGE (*) MINIMUN 3.78% RETURN 7.26% 6.35% HORIZONTE COLFONDOS 6.68% 6.77% SANTANDER SKANDIA PORVENIR 0.00% PROTECCION 2.00% 7.06% 7.14% 4.00% 8.64% 6.00% NOM INA L RETURN REA L RETURN (*) Weighed by the equity’s daily average balance GRAPH 2 EVOLUTION OF THE MANADATORY PENSIONS FUNDS´ ACCUMULATED RETURNS 19.00% 18.50% 18.00% 17.50% 17.00% 16.50% 16.00% 15.50% 15.00% 14.50% 14.00% 13.50% 13.00% 12.50% 12.00% 11.50% 11.00% 11-06 12-06 01-07 PROTECCION 02-07 03-07 PORVENIR 04-07 05-07 HORIZONTE 06-07 07-07 SANTANDER 08-07 09-07 COLFONDOS 10-07 SKANDIA 1 During the last five years, mandatory pension funds obtained an average return of 13.73%, which equals to a real return of 7.95%, whereas the average return from the beginning of operations on November the 31st, 2007 was 16.28% annual effective, which is equal, in real terms, to 5.25% (graph 3). GRAPH 3. 16.28% 16.04% 5.03% COLFONDOS 5.25% 16.04% 5.03% SANTANDER 15.55% 15.55% 4.59% SKANDIA 4.59% 15.71% 4.73% 13.73% 4.00% PORVENIR 6.69% 6.00% 7.95% 12.65% 6.93% HORIZONTE 12.83% 7.10% SANTANDER 13.36% 7.60% 13.75% 13.32% COLFONDOS 8.00% 7.97% 10.00% SKANDIA 12.00% 9.78% 14.00% 7.56% 16.00% PORVENIR 18.00% 15.66% 20.00% 17.87% R E T UR N F R O M T H E B E G IN N IN G O F O P E R A T IO N S ( 1) N O V .3 0 t h/ 0 7 LA S T F IV E Y E A R S R E T UR N N O V .3 0 t h/ 0 2 T O N O V .3 0 t h/ 0 7 2.00% NOM INA L RETURN AVERAGE (*) HORIZONTE PROTECCION AVERAGE (*) PROTECCION 0.00% REA L RETURN (*) Weighed by the equity’s daily average balance (1) May 1994, excepting Skandia that began in March 1995 1.2 RETURN AND VOLATILITY 1.2.1 MONTHLY RETURN AND VOLATILITY Monthly Average Return (annual effective) The monthly average return of Mandatory Pension Funds during the last thirty-six months was between 12.45% and 15,36% (annual effective rate), with an annualized volatility of 5,53% and 7,15%, respectively. The return and volatility of each one of those funds are shown in graph 4. GRAPH 4 MANDATORY PENSION FUNDS MONTHLY AVERAGE RETURN AND VOLATILITY NOVEMBER 30th 2004 -NOVEMBER 30th 2007 16.00% Protección 15.50% 15.00% 14.50% Skandia 14.00% Porvenir 13.50% Colfondos Santander 13.00% 12.50% Horizonte 12.00% 11.50% 11.00% PORTFOLIO OF REFERENCE 10.50% 10.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% VOLATILITY 2 1.2.2 VOLATILITY AND ACCUMULATED RETURN The accumulated average return of Mandatory Pension Funds during the last thirty-six months, was between 9.77% and 14.01% (annual effective rate), with annualized volatilities of 2,08% and 2,97%, respectively. The return and volatility of each one of those funds are shown in graph 5. (*) It belongs to the accumulated return of the last 36 months 1.3 VALUE OF THE FUNDS The value of mandatory pension funds reached on November 30th, 2007 the amount of USD 24.507 millions, USD 29 millions less than the value registered on October 31st, in other words, 0.1%. Regarding the same month in 2006, the funds have had an increase of 34.1%, which is equal to 6,232 US million dollars (graph 6 and 7, Chart 1.1). GR A P H 6. V A LUE O F E A C H F UN D A N D IT S P A R T IC IP A T IO N WIT H IN T H E S Y S T E M N O V .3 0 T H 2 0 0 7 - US M ILLIO N D O LLA R S 7,000 26.9% 24.9% 6,000 5,000 14.5% FUND VA LUE 36 0.1% SKANDIA PLAN ALTERNATIVO 1,055 4.3% 2,973 SANTANDER SKANDIA 3,558 HORIZONTE PROTECCION 0 PORVENIR 1,000 COLFONDOS 2,000 12.1% 4,183 6,104 3,000 17.1% 6,598 4,000 P ERCENTA GE OF P A RTICIP A TION 3 24,507 0.1%- 24,536 3.9% 2.2% 1.2%- 8.4% 23,610 21,775 11.9% 23,287 23,572 21,070 8.5%- 5,000 5.2% 5.9% 10,000 20,029 19,378 0.9% Feb-07 15,000 3.4% 19,205 0.7%- 20,000 Jan-07 19,347 18,276 25,000 1.8% US MILLION DOLLARS 30,000 23,790 GR A P H 7. V A LUE O F T H E F UN D S LA S T Y E A R E V O LUT IO N FUNDS VALUE Nov-07 Oct-07 Sep-07 Jul-07 Jul-07 Jun-07 May-07 Apr-07 Mar-07 Dec-06 Nov-06 - MONTHLY VARIATION 1.4 AFFILIATES The number of affiliates with the individual savings with solidarity regime on the 30th day of November 2007, was 7.784.275, with an increase of 0.9%, that is, 69.847 more individuals affiliated than the ones reported on October 31st 2007. Regarding the same month in 2006, the funds have had an increase of 11.8%, which is equal to 822.845 affiliates (Graph 8). GR A P H 8. A F F ILIA T E S A N D P A R T IC IP A T IO N O F E A C H F UN D WIT H IN T H E S Y S T E M N O V .3 0 T H 2 0 0 7 29.2% 2,400,000 2,100,000 21.6% 1,800,000 SKANDIA 352 0.0% 7,784,275 7,714,428 7,487,857 7,406,882 7,344,705 7,258,846 7,197,578 7,121,325 7,074,020 7,010,287 7,200,000 6,961,430 7,800,000 7,582,676 N UM B E R O F A F F ILIA T E S LA S T Y E A R E V O LUT IO N 8,100,000 7,500,000 SKANDIA PLAN ALTERNATIVO 65,927 0.8% 1,079,538 SANTANDER COLFONDOS HORIZONTE P ERCENTA GE OF P A RTICIP A TION 7,653,566 A FFILIA TES PROTECCION PORVENIR 300,000 0 13.9% 1,216,605 600,000 1,468,083 900,000 15.6% 1,678,779 1,200,000 2,274,991 18.9% 1,500,000 1.1% 1.3% 0.9% 0.8% 0.9% Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 1.2% May-07 0.8% 0.9% 0.7% Feb-07 Apr-07 0.9% Jan-07 1.1% 0.7% Dec-06 Mar-07 0.8% 6,600,000 Nov-06 6,900,000 AFFILIATES Jun-07 6,300,000 MONTHLY VARIATION 4 11.80% AFFILIATES' EVOLUTION IN THE LAST FIVE YEARS 8,000,000 10.30% 7,000,000 10.20% 10.70% 6,000,000 10.40% 5,000,000 4,000,000 3,000,000 7,784,275 3,227,381 4,556,894 6,961,430 2,828,280 4,133,150 6,312,164 % VARATION TOTAL MEN WOMEN Nov-07 Nov-06 Nov-05 Nov-04 Nov-03 2,577,512 3,734,652 5,700,421 2,338,357 5,172,514 2,121,066 0 3,051,448 1,000,000 3,362,064 2,000,000 54.9% of the mandatory pension funds’ total members are active, in other words, 4.276.218; and 45.1%, which equals to 3.508.057 are inactive. Those inactive members are those who have not made any quotations in at least the last six months (graph 9). GR A P H 9 A C T IV E A N D IN A C T IV E A F F ILIA T E S B Y E A C H F UN D N O V .3 0 T H 2 0 0 7 1,400,000 1,200,000 A CTIVE 62 SKANDIA PLAN ALTERNATIVO 290 21,784 44,143 SKANDIA SANTANDER 547,920 531,618 614,580 COLFONDOS 602,025 720,392 HORIZONTE PORVENIR - PROTECCION 200,000 747,691 1,031,825 400,000 646,954 600,000 956,365 800,000 1,318,626 1,000,000 INA CTIVE 54.8% 54.9% 45.2% 45.1% Nov-07 54.2% 45.8% Sep-07 Oct-07 53.9% 53.6% 46.4% Jul-07 46.1% 53.6% 46.4% Jun-07 Aug-07 53.3% 46.7% May-07 52.3% 47.7% Mar-07 52.7% 52.1% 47.9% Feb-07 51.9% 48.1% Jan-07 51.9% 48.1% Dec-06 52.0% 48.0% 54.0% Nov-06 A C T IV E A N D IN A C T IV E A F F ILIA T E S LA S T Y E A R E V O LUT IO N 52.0% 48.0% 46.0% 47.3% 50.0% 44.0% ACTIVE Apr-07 42.0% INACTIVE 5 54.6% of the Individual Savings Regime’s total members belongs to non-quoting members, which is equal to 4.249.388 people; and 45.4%, that is 3.534.887 people, are quoting members (graph 10). The non-quoting members are those who are affiliated but are not pensioned yet and that, for some reason, did not make the mandatory payment for the reported moth. G R A P H 10 Q UO T IN G A N D N O N - Q UO T IN G A F F ILIA T E S B Y F UN D N O V .3 0 T H 2007 1,400,000 1,200,000 1,000,000 QUOTING SKANDIA 123 229 SKANDIA PLAN ALTERNATIVO 27,420 38,507 685,059 394,479 SANTANDER 664,098 552,507 911,279 556,804 COLFONDOS - HORIZONTE 837,511 841,268 200,000 PROTECCION 400,000 1,123,898 1,151,093 600,000 PORVENIR 800,000 NON-QUOTING 56.8% 56.3% 56.7% 56.5% 56.2% 56.0% 55.1% 54.6% 43.2% 43.7% 43.3% 43.5% 43.8% 44.0% 44.9% 45.4% Apr-07 May-07 Jun-07 Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 57.5% 42.5% Feb-07 57.7% 58.5% 41.5% Jan-07 42.3% 58.0% 42.0% Dec-06 Mar-07 58.4% 60.0% 41.6% 65.0% Nov-06 Q UO T IN G A N D N O N - Q UO T IN G A F F ILIA T E S LA S T Y E A R E V O LUT IO N 55.0% 50.0% 45.0% 40.0% 35.0% 30.0% 25.0% NON-QUOTING QUOTING 83.2% of the total number of the people affiliated with the mandatory pension funds, earn an income of less than two minimum wages, 10.8% earn an income between two and four minimum wages and 6% earn more than four minimum wages. 56% of the affiliates are between 15 and 34 years old, where 55.5% of them are men and 44.5% women. 95.4% of the affiliated people with the system correspond to workers under contract and 4.6% to independent workers. When talking about the origin of the affiliates, it is important to say that 59.3% belongs to the people who are affiliated to the system, 28.5% come from the Instituto de Seguros Sociales” (“ISS”), 11.7% from transfers between AFPs and 0.5% come from the Government social security funds (Chart 1.2). 1.5 PENSIONERS On November 30th 2007, the Individual Savings with Solidarity Regime has 25.712 pensioners, 15.184 for survival, 5.773 for invalidity and 4.755 for old age retirement (graph 11). 6 52.2% of the pensioners, that is 13.416, have chosen the modality of programmed retirement pension; 47.8%, 12.295 pensioners, the immediate life rent and 1 pensioner elected the programmed retirement with deferred life rent (Chart 1.3). SURVIVAL INVALIDITY SKANDIA P.A SKANDIA 17 287 205 120 45 958 571 SANTANDER HORIZONTE PORVENIR PROTECCION 0 602 1,000 500 2,343 2,454 3,444 457 2,000 1,500 COLFONDOS 1,360 2,500 1,098 688 1,710 3,500 3,000 2,530 3,098 4,000 3,724 G R A P H 11 P E N S IO N E R S B Y F UN D N O V .3 0 T H 2 0 0 7 RETIREMENT AGE 25,712 25,403 25,057 24,738 24,373 23,970 23,592 23,181 22,915 22,302 25,000 21,944 21,598 30,000 22,531 N UM B E R O F P E N S IO N E R S LA S T Y E A R E V O LUT IO N 1.2% 1.4% 1.3% 1.7% Jul-07 1.5% 1.6% Jun-07 1.8% 1.2% 1.7% 1.0% 1.6% Jan-07 10,000 1.6% 1.2% 15,000 Dec-06 20,000 5,000 PENSIONERS Nov-07 Oct-07 Sep-07 Aug-07 May-07 Apr-07 Mar-07 Feb-07 Nov-06 - MONTHLY VARIATION P E N S IO N E R S ' E V O LUT IO N IN T H E LA S T F IV E Y E A R S 30,000 25,712 25,000 21,944 18,503 20,000 15,942 Nov-05 17.2% Nov-04 18.6% 16.1% 5,000 16.1% 10,000 13,728 21.9% 15,000 Nov-06 Nov-07 Nov-03 PENSIONERS VARIATION 7 1.6 INVESTMENT PORTFOLIO On November 30th 2007, the Mandatory Pension Funds portfolio’s value reached USD$ 24,459 thousand millions, showing an increase of 2.4% in comparison to the end of the previous month, when it was USD$ 24,352 thousand millions. At the end of November 2007, 70% of the above mentioned funds’ portfolio, that is USD$17,245 million belongs to fixed income investments; 26.3%, USD$ 6,439 million, to investments in equity; 3.7%, USD$ 899 million, to overnight deposits and 0.7%, USD$ 775 million, to net position in derivatives (rights minus obligations) (Graph 12 and Chart 1.4). GRAPH 12 PORTFOLIO DIVERSIFICATION: FIXED INCOME, CHANGEABLE INCOME, OVERNIGHT DEPOSITS AND DERIVATIVES - NOV 30th 2007 US THOUSAND DOLLARS 100% Fixed income 69.0% Changeable Income 68.9% 68.7% 73.5% 62.2% 67.9% 70.0% 71.0% Overnight Deposits 25.0% 26.5% Derivatives 0% 0.4% 4.1% B B VA HORIZONTE 4,138,071 29.5% 30.1% 1.6% 0.4% 0.8% COLFONDOS 3,654,236 SA NTA NDER 2,949,131 26.3% 22.9% 2.5% 1.1% P ORVENIR 6,563,680 2.8% 0.1% P ROTECCION 6,061,813 12.8% 0.7% 5.8% 26.3% 25.5% SKA NDIA P ENSIONA R 1,039,731 3.2% 0.5% SKA NDIA P LA N A LTERNA TIVO 36,332 SYSTEM 24,458,955 FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION TOTAL PORTFOLIO'S LAST YEAR EVOLUTION - US MILLION DOLLARS 100% 80% 60% 40% 20% 0% NOV-06 18,190 DIC-06 19,284 Derivatives JA N-07 19,147 FEB -07 19,346 M A R-07 A P R-07 19,975 21,032 Overnight Deposits M ay-07 23,551 Jun-07 23,259 Jul-07 23,790 A UG-07 21,768 Changeable Income Sep-07 23,423 Oct-07 24,352 No v-07 24,459 Fixed income Investment in public debt continues being the most significant one of these funds. On November 30th 2007, these investments represented 44.5% of the portfolio’s total value (national debt represents the 40.7%, external national debt 1.5% and territorial organizations and decentralized entities 2.2%), followed by the securities issued by institutions supervised by other regulatory authorities with 19.5%, securities issued by the Institutions supervised by the Financial 8 Superintendency which had a participation of 16.8% and participation a 13.6% (Graph 13). the external investments with a GRAPH 13 PORTFOLIO'S CLASIFICATION : BY ISSUER NOV 30th 2007 - US THOUSAND DOLLARS 100% Internal Public Debt 22.0% Institutions watched by other regulatory authority 40.1% 37.9% 38.8% 33.4% 42.5% 40.7% 43.1% Institutions supervised by the Financial Superintendency 12.4% External Investment 18.4% Overnight Deposits 14.2% 22.8% 13.4% 21.7% 20.4% 19.5% 19.6% Domestic debt securities issued under Law 80/93 and Decree 2681/93 22.7% 19.4% External Public Debt 14.6% Securities issued, guaranteed by Fogafin (Financial Insitution Guarantee Fund) 37.5% 15.7% 16.1% 16.9% Others (1) 4.1% 0% 1.4% 3.8% 0.8% 1.6% 3.1% 2.5% 0.2% 1.6% 0.9% 2.8% 0.4% 2.3% 0.7% 1.4% BBVA HORIZONTE 4,138,071 17.9% 14.8% 8.1% 16.8% 14.1% 14.8% 2.3% 15.0% COLFONDOS 3,654,236 SANTANDER 2,949,131 1.6% 1.3% 1.4% 1.4% 2.4% PORVENIR 6,563,680 13.6% 5.8% 0.7% 3.5% 1.4% 4.1% 0.4% 2.9% PROTECCION 6,061,813 0.2% SKANDIA PENSIONAR 1,039,731 3.2% 2.2% 12.8% 1.5% 1.4% 1.9% 1.1% SKANDIA PLAN ALTERNATIVO 36,332 SYSTEM 24,458,955 (1) Others: Derivatives net position TOTAL PORTFOLIO'S LAST YEAR EVOLUTION BY ISUUER US MILLION DOLLARS 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% NOV-06 18,190 DIC-06 19,284 JA N-07 19,147 FEB -07 19,346 M A R-07 19,975 A P R-07 21,032 M ay-07 23,551 Jun-07 23,259 Jul-07 23,790 A UG-07 21,768 Sep-07 23,423 Oct-07 24,352 No v-07 24,459 Internal Public Debt Domestic debt securities issued under Law 80/93 and Decree 2681/93 Institutions supervised by the Financial Superintendency External Public Debt Institutions w atched by other regulatory authority Securities issued, guaranteed by Fogafin (Financial Insitution Guarantee Fund) External Investment Others The 73.6% of the portfolio mentioned before is denominated in Colombian pesos, 13.7% in UVR, 11% in US Dollar, 1.3% in euros and the remaining 0.4% in British Pound, Real and Yen. (Graph 14). 9 GR A P H 14 P OR T F OLIO'S C LA SIF IC A T ION : B Y C UR R ER N C Y N OV 30th 2007 - US T H OUSA N D D OLLA R S 100% Col Peso 59.7% UVR 72.1% 74.9% 69.2% 70.8% 73.6% 77.1% 77.8% US Dollar 10.2% Euro 16.1% 13.6% 13.6% 15.5% 6.7% Others (1) 12.9% 0% 0.0% 8.4% 1.4% 0.5% BBVA HORIZONTE 4,138,071 COLFONDOS 3,654,236 11.0% SANTANDER 2,949,131 11.0% 7.2% 0.1% 0.0% PORVENIR 6,563,680 28.1% 12.1% 14.6% 2.1% 2.4% 2.6% 13.7% 14.3% 1.6% 1.4% PROTECCION 6,061,813 2.0% 0.4% SKANDIA PENSIONAR 1,039,731 SKANDIA - PLAN ALTERNATIVO 36,332 1.3% SYSTEM 24,458,955 (1) Others: British Pound, Real, Euro and Yen TOTAL PORTFOLIO'S LAST YEAR EVOLUTION BY CURRENCY US MILLION DOLLARS 78% 68% 58% 48% 38% 28% 18% 8% -2% NOV-06 18,190 Others DIC-06 19,284 JAN-07 19,147 FEB-07 19,346 Euro MAR-07 19,975 APR-07 21,032 UVR May-07 23,551 Jun-07 23,259 Jul-07 23,790 US Dollar AUG-07 21,768 Sep-07 23,423 Oct-07 24,352 Nov-07 24,459 Col Peso Regarding the foreign currency position, it is observed that 53.4% is covered from the exchange rate fluctuation risk. The uncovered part represents the 5.9% of the funds’ total value (Graph 15 and Chart 4). 10 GRAPH 15 MANDATORY PENSION FUNDS PERCENTAGE'S LAST YEAR EVOLUTION WITHOUT COVERAGE (MAXIMUM LIMIT 30%) 13.0% 12.0% 11.0% 10.0% 9.0% 8.0% 7.1% 6.6% 6.2% 5.8% 5.5% 5.3% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Nov-06 Dic-06 Ene-07 Feb-07 Mar-07 Abr-07 May-07 Jun-07 Jul-07 Ago-07 Sep-07 Oct-07 PROTECCION PORVENIR HORIZONTE SANTANDER SKANDIA COLFONDOS Nov-07 On the other hand, 29% of the portfolio is invested in fixed income securities issued in Colombian pesos, 17.8% of the portfolio is invested in stocks, 16% is linked to CPI issues, 13.7% is invested in fixed income linked to UVR, 8.5% in Shares (Derived from securitization processes, Mutual Funds, Unit trust funds and Index Fund), 6.7% is linked to the DTF, 4.3% is invested in fixed income denominated in US Dollar, 3.2% in Overnight Deposits and the rest (0.9%) are securities linked to fixed income in Real from Brazil, CPI middle income, Libor, British Pound and net position in derivatives. (Graph 16 and Chart 1.5). G R A P H 16 P O R T F O LIO 'S C LA S IF IC A T IO N : F LA T R A T E B Y C UR R E N C Y , C H A N G E A B LE IN C O M E , O V E R N IG H T D E P O S IT S - N O V 3 0 t h 2 0 0 7 - US T H O US A N D D O LLA R S 100% Flat Rate - Col Peso 28.4% 27.4% 28.9% 31.7% 24.7% 21.3% 29.0% 29.8% STOCKS 11.1% IPC 16.2% 17.9% 15.8% 15.5% 13.5% 19.6% 13.9% 16.1% 13.6% 13.6% Flat Rate - US Dollar 10.6% Others (1) 0% 0.5% 4.1% 7.3% B B VA HORIZONTE 4,138,071 0.8% 5.8% 6.0% 3.1% 0.8% 3.2% 1.6% 2.1% 0.5% COLFONDOS 3,654,236 SA NTA NDER 2,949,131 8.5% 8.5% 5.0% 7.1% 6.6% 13.7% 1.9% 9.8% 9.2% 9.3% 4.3% 15.6% 14.3% 6.7% 10.3% Overnight Deposits 10.2% 16.0% 17.4% DTF 17.8% 12.0% 21.3% 19.5% Flat Rate - UVR Shares 17.1% 13.7% 20.2% 2.5% P ORVENIR 6,563,680 6.5% 5.3% 3.1% 7.0% 5.7% 0.7% 3.2% 0.8% P ROTECCION 6,061,813 SKA NDIA P ENSIONA R 1,039,731 12.8% 6.7% 4.2% 7.0% 0.9% SKA NDIA - P LA N A LTERNA TIVO 36,332 3.2% SYSTEM 24,458,955 (1) Real from Brazil, Libor, British 11 FIXED INCOME BY INTEREST RATE TYPE , EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION TOTAL PORTFOLIO'S LAST YEAR EVOLUTION US MILLION DOLLARS 35% 30% 25% 20% 15% 10% 5% 0% NOV-06 DIC-06 JAN-07 FEB-07 MAR-07 APR-07 May-07 Jun-07 Jul-07 18,190 19,284 19,147 19,346 19,975 21,032 23,551 23,259 23,790 OTHERS IPC SHARES AUG-07 Sep-07 Oct-07 21,768 23,423 24,352 FIXED INCOME COL PESO FIXED INCOME US DOLLAR STOCKS Nov-07 24,459 FIXED INCOME UVR DTF Regarding the classification of the portfolio by credit risk, it is remarkable that 45.7% are securities issued by the Nation, 26.6% are investments that do not require qualification, 20% are investments with AAA qualification, 3.6% with AA+, and the rest (4.1%) belongs to securities with AA, AA-, A+, A, A-, 1+, BBB+, BBB, BBB-, B and securities issued by Fogafin (Graph17) GRAPH 17 PORTFOLIO'S CLASIFICATION: BY CREDIT RISK NOV 30th 2007 100% 25.2% NATION 47.8% 45.7% 45.2% 39.0% 39.1% 51.7% 45.7% 15.4% N/A 4.7% AAA 28.7% 27.3% 31.0% 37.8% 11.4% 33.2% 26.6% 40.2% AA+ 8.8% OTHERS (1) 0% 14.2% 19.4% 5.2% 4.1% 3.5% 4.1% PROTECCION PORVENIR 17.6% 16.6% 1.8% 4.4% 2.7% 3.9% 32.3% 17.4% HORIZONTE 20.0% 5.0% SANTANDER SKANDIA - P.A 11.0% SKANDIA 2.4% 2.2% COLFONDOS 3.6% 4.1% SYSTEM (1) AA, AA-, A+, A, A-, 1+, BBB+, BBB, BBB-, B and securities issued by Fogafin Note (1): In order to establish the percentages, one has to take into account the portfolio’s total value, not including the derivatives net position. Finally, it is worth to point out that 1.7% of the fixed income portfolio has a remaining maturity of 180 days, 1.4% between 181 and 360 days, 6.9% between 361 and 720 days, 15.9% between 721 and 1080 days, 11.2% between 1081 and 1440 days, 10.6% between 1441 and 1800 days, 2.7% between 1801 and 2160 days, 24.6% between 2161 and 2880 days, 9.1% between 2881 and 3600 days and 15.9% has a maturity superior to 10 years (Graph 18 and Chart 1.6). 12 GRAPH 18 FIXED RATE PORTFOLIO BY REMAINING MATURITY DAYS NOV 30th 2007 100% 9.1% 12.6% 9.1 > 3600 14.2% 19.8% 23.6% 6.3% 7.9% 10.0% 9. 2881 - 3600 39.3% 32.7% 16.1% 2.3% 5. 1081 - 1440 9.6% 16.6% 3.3% C 6.9% 14.2% 10.8% 7.6% 8.4% 3. 361 - 720 1. 0 - 180 0% 1.6% 5.6% 1.3% 0.9% 2.0% PROTECCION PORVENIR 2.5% 2.7% 8.7% 10.6% 11.7% 11.2% 15.3% 15.9% 9.6% 6.9% 11.6% 9.1% 14.2% 4.2% 16.6% 8.1% 19.1% 20.3% 24.6% 8.1% 4.9% 10.6% 2. 181 - 360 25.1% 17.3% 4.0% 4. 721 - 1080 9.1% 15.2% 8.5% 2.0% 2.5% 9.3% 18.2% 29.2% 7. 1801 - 2160 6. 1441 - 1800 15.9% 14.3% 9.4% 8. 2161 - 2880 15.9% 1.3% 10.2% 7.2% 2.0% 2.0% 3.3% HORIZONTE SANTANDER 12.2% 10.4% 6.0% 8.4% 4.4% 0.4% SKANDIA PENSIONAR 2.1% 0.6% SKANDIA PLAN ALTERNATIVO 1.4% 1.3% 1.7% COLFONDOS SYSTEM 2. VOLUNTARY PENSIONS FUNDS 2.1 VALUE OF THE FUNDS The total value of the voluntary pension funds administrated by pension fund administrator societies, fiduciary societies and insurance agencies, on November 30th 2007 reached the value of USD 3.328 millions, 1.8% less than the value registered on October 31st 2007. (Graph 19). 1,100 GRAPH 19 VALUE OF EACH FUND AND ITS PARTICIPATION WITHIN THE SYSTEM NOV.30th 2007 - US MILLION DOLLARS 1,056 1,000 900 804 800 700 31.7% 569 600 500 24.2% 400 300 17.1% 246 175 200 161 86 68 68 7.4% 100 5.3% 4.8% 2.6% 2.0% 2.0% 36 31 1.1% 0.9% 15 10 0.5% 0.3% 2 0.1% 2 0.0% FUND VALUE PERCENTAGE OF PARTICIPATION FIDUCOR FIDUPENSIONES FIDUCOR MULTIPENSIONES FIDUPOPULAR PLAN FUTURO MULTIOPCION FIDUPOPULAR PLAN FUTURO PROTECCION SMURFIT FIDUALIANZA ABIERTO VISION FIDUCOLOMBIA RENTAPENSION COLSEGUROS SANTANDER HORIZONTE COLFONDOS CLASS FIDUDAVIVIENDA DAFUTURO PORVENIR PROTECCION SKANDIA MULTIFUND 0 3,328 3,388 3,308 3,110 3,400 3,412 3,499 3,269 3,151 3,135 3,223 0.3% Dec-06 3,153 3,214 3,000 8.5%- 1.8%- 2.4% 6.4% 0.3%- 3.7% 2.5%- 1,000 0.5% 1,500 0.6%- 2,000 7.0% 2,500 2.2%- US MILLION DOLLARS 3,500 0.2% 4,000 Nov-06 V A LUE O F T H E F UN D S LA S T Y E A R E V O LUT IO N 500 FUNDS VALUE Nov-07 Oct-07 Sep-07 Aug-07 Jul-07 Jun-07 May-07 Apr-07 Mar-07 Feb-07 Jan-07 - MONTHLY VARIATION 2.2 AFFILIATED The number of affiliates with the voluntary pensions funds administrated by pension fund administrator societies, fiduciary societies and insurance agencies on November 30th 2007 was 495.130, showing an increase of 1.756 members, compared to the number reported on the final day of the previous month (graph 20). GRAPH 20 AFFILIATES AND PARTICIPATION OF EACH FUND WITHIN THE SYSTEM NOV.30th 2007 100,000 92,094 90,000 80,000 18.6% 89,502 18.1% 76,577 70,000 15.5% 60,000 56,355 50,000 11.4% 49,114 9.9% 40,000 46,271 9.3% 45,608 9.2% 10,000 11,407 2.3% 4,802 3,023 1.0% 0.6% 1,468 976 0.3% 0.2% AFFILIATES FIDUPOPULAR PLAN FUTURO MULTIOPCION PROTECCION SMURFIT FIDUALIANZA ABIERTO VISION FIDUPOPULAR PLAN FUTURO COLSEGUROS SANTANDER HORIZONTE FIDUCOLOMBIA RENTAPENSION SKANDIA MULTIFUND COLFONDOS CLASS PORVENIR FIDUDAVIVIENDA DAFUTURO PROTECCION 0 156 0.0% 133 0.0% FIDUCOR MULTIPENSIONES 17,644 3.6% 20,000 FIDUCOR FIDUPENSIONES 30,000 PERCENTAGE OF PARTICIPATION 14 495,130 A F F ILIA T E S LA S T Y E A R E V O LUT IO N 492,521 496,000 0.5% Nov-07 0.4% Sep-07 0.5% 0.4% Aug-07 490,050 488,304 0.1% Jul-07 486,511 485,896 0.1% Jun-07 0.5%Apr-07 0.2%- 0.0% Mar-07 May-07 0.1%Feb-07 0.1% 482,000 0.5% 0.4% 484,000 Oct-07 486,000 485,434 489,045 486,449 488,000 489,219 486,926 490,000 489,263 492,000 489,900 494,000 Jan-07 Dec-06 Nov-06 480,000 A FFILIA TES M ONTHLY VA RIA TION A F F ILIA T E S ' E V O LUT IO N IN T H E LA S F IV E Y E A R S 486,926 500,000 450,000 495,130 449,047 403,396 400,000 365,868 9.3%- 200,000 150,000 100,000 1.7% 250,000 8.4% 300,000 22.7% 20.1% 350,000 50,000 0 Nov-03 AFFILIATES Nov-04 Nov-05 Nov-06 Nov-07 VARIATION 48.1% of the affiliates earn an income of less than two minimum wages, 9.3% have an income between two and four minimum wages and 42.6% earn more than four minimum wages. 66.6% of the affiliated people are between 30 and 54 years old, where, 51% are men and 49% women. 71% of the affiliates with the system belongs to workers under contract and 29% to independent workers. 2.3 INVESTMENT PORTFOLIO On November 30th 2007, the portfolio’s value of the voluntary pensions funds managed by the pensions funds and unemployment funds managers, fiduciary entities and insurance companies reached USD$ 3,340 million, showing an decrease of 1.1% compared to the end of the previous month, when it was USD$ 3,378 million. At the end of November 2007, 57.4% of these funds’ portfolios, USD$1,918 million belong to fixed income investments; 20.6%, USD$ 687 million to investments in equity, 20.4%, $683 million dollars to overnight deposits and 1.6%, $51 million dollars to net position in derivatives. (Graph 21 and Chart 2.1). 15 GRAPH 21 PORTFOLIO DIVERSIFICATION: FIXED INCOME, CHANGEABLE INCOME, OVERNIGHT DEPOSITS AND DERIVATIVES - NOV 30th 2007 - US THOUSAND DOLLARS 20.4% 1.2% 20.6% 57.4% 0.4% SYSTEM 0.1% 0.8% 35.2% 3,340 63.9% COLSEGUROS 68,366 40.3% 26.7% 33.0% FIDUCOR - M ULTIP ENSIONES 2,104 39.5% 60.5% FIDUCOR - FIDUP ENSIONES 1,644 0.1%2.1% 2.3% 95.5% FIDUCOLOM B IA - RENTA P ENSION 67,952 7.0% 21.4% 71.6% FIDUCIA RIA DA VIVIENDA - DA FUTURO 243,141 5.8% 39.8% 54.4% FIDUCIA R - M ULTIOP CION 9,565 11.0% 89.0% FIDUCIA R - P LA N FUTURO 15,359 15.3% 11.9% 72.8% A LIA NZA - A B IERTO VISION 35,072 3.6% 20.6% 8.6% 67.2% SKA NDIA - M ULTIFUND 1,059,153 32.0% 18.4% 49.6% P ROTECCION - ESM URfIT 30,775 28.2% 1.4% 45.6% 24.8% P ROTECCION 804,924 22.5% 0.2% 34.4% 42.9% P ORVENIR 572,965 5.3% 16.0% 78.7% SA NTA NDER 86,382 18.5% -0.1% 40.1% 41.5% COLFONDOS 180,645 7.6% 67.5% 24.8% B B VA HORIZONTE 161,533 0.1% -0.2% 99.8% Active Report Operations Derivatives Changeable Income Overnight Deposits Fixed income The securities issued by Institutions supervised by the Financial Superintendency are the most significant investments of these funds. On November 30th 2007, these investments represented 31.9%, followed by the overnight deposits with 20.6%, Debt public investment with 13.4% (national debt represents 11.2%, external national debt 0.9% and territorial organizations and decentralized entities 2.2%), the external investments represent 17.9%, and issues by institutions supervised by other regulatory authorities have a participation of 13.3% (Graph 22 and Chart 2.1). GRAPH 22 PORTFOLIO'S CLASIFICATION : BY ISSUER NOV 30th 2007 - US THOUSAND DOLLARS 1.2% 11.2% 2.2% 13.3% 17.9% 31.9% 20.6% 1.7% SYSTEM 15.0% 0.1% 3.1% 3.4% 18.2% 27.6% 7.1% 11.9% 15.8% 3,340 38.1% 0.8% COLSEGUROS 68,366 40.4% 10.0% 8.5% FIDUCOR - M ULTIP ENSIONES 2,104 15.2% 60.5% 24.3% FIDUCOR - FIDUP ENSIONES 1,644 0.1% 1.2% 22.6% 2.6% 5.6% 6.7% 2.3% 58.9% FIDUCOLOM B IA - RENTA P ENSION 67,952 7.6% 3.6% 3.0% 19.0% 45.4% 21.4% FIDUCIA RIA DA VIVIENDA - DA FUTURO 243,141 6.0% 2.9% 5.2% 8.0% 39.8% 38.1% FIDUCIA R - M ULTIOP CION 9,565 2.9%1.6% 1.7% 79.9% 11.0% 2.9% FIDUCIA R - P LA N FUTURO 15,359 6.9% 7.7% 15.1% A LIA NZA - A B IERTO VISION 35,072 1.7% 3.6% 5.6% 1.6% 31.9% 10.7% 14.7% 26.3% P ROTECCION 804,924 0.2% 2.0% 0.3% 11.3% 16.5% 34.4% 16.4% 20.7% P ORVENIR 572,965 24.7% 4.9% 3.9% 0.9% P ROTECCION - ESM URfIT 30,775 24.8% 13.4% 1.8% 22.0% 18.4% 4.4% 30.3% 17.1% 1.9% 36.3% 8.6% SKA NDIA - M ULTIFUND 1,059,153 23.3% 1.6% 2.5% 16.1% 8.7% 13.3% 9.5% 16.0% 27.7% SA NTA NDER 86,382 41.5% 11.4% 19.0% COLFONDOS 180,645 -0.1% 3.8% 57.6% 11.9% 0.8% 0.1% 2.7% 15.8% 4.4% 3.8% 24.8% 44.6% B B VA HORIZONTE 161,533 -2% 98% Others (1) Domestic debt securities issued under Law 80/93 and Decree 2681/93 Institutions watched by other regulatory authority Derivatives Internal Public Debt Overnight Deposits Overnight Deposits Institutions supervised by the Financial Superintendency (1) FOGAFIN AND DERIVATIVES NET POSITION 16 83% of the above mentioned portfolio is denominated in Colombian pesos, 13% in US Dollars, 2.5% in UVR, 1.2% in Euros and the remaining 0.3% in British pound, Real from Brazil, Yen, and Canadian Dollar (Graph 23). GRAPH 23 PORTFOLIO'S CLASIFICATION: BY CURRERNCY NOV 30th 2007 - US THOUSAND DOLLARS 13.0% 0.3%2.5% 83.0% SYSTEM 3,340 1.2% 91.7% 8.3% COLSEGUROS 68,366 100.0% FIDUCOR - MULTIPENSIONES 2,104 100.0% FIDUCOR - FIDUPENSIONES 1,644 4.2% 8.4% 87.4% FIDUCOLOMBIA - RENTAPENSION 67,952 94.9% 2.6% 2.4% FIDUCIARIA DAVIVIENDA - DAFUTURO 243,141 3.1% 91.7% 5.2% FIDUCIAR - MULTIOPCION 9,565 98.1% 1.9% FIDUCIAR - PLAN FUTURO 15,359 99.2% 0.8% ALIANZA - ABIERTO VISION 35,072 1.0% 76.4% 21.7% SKANDIA - MULTIFUND 1,059,153 0.1% 91.3% 4.8% 3.9% 2.6% 5.1% PROTECCION - ESMURfIT 30,775 81.9% 9.5% PROTECCION 804,924 0.9% 1.9% 82.2% 14.6% PORVENIR 572,965 1.3% 0.1% 3.0% 4.9% 91.7% 0.3% SANTANDER 86,382 88.1% 3.6% 6.7% 1.6% COLFONDOS 180,645 93.5% 0.9% 4.5% BBVA HORIZONTE 161,533 1.1% 0% 100% Others (1) Euro UVR US Dollar Col Peso (1) British Pound, Real, Yen and Canadian Dollar Concerning to foreign currency position, it is observed that 30.4% is covered from the exchange rate fluctuation risk. The uncovered part represents 10.2% of the funds’ total value (Chart 4). On the one hand, 24.2% of the portfolio is invested in fixed income securities denominated in Colombian pesos, 20.6% in overnight deposits, 10% is linked to CPI, 11.8% is linked to the DTF, 10.3% in Shares (Derived from securitization processes, Mutual Funds, unit trust funds, and Indexed Funds), 10.2% of the portfolio is invested in stocks, 3.7% is invested in fixed income denominated in US Dollar, 2.5% in fixed income investments linked to UVR, and the rest (3.8%) are fixed income securities denominated in Euro, and net position in derivatives.(Graph 24 and Chart 2.2). 17 GRAPH 24 PORTFOLIO'S CLASIFICATION: FLAT RATE BY CURRENCY, CHANGEABLE INCOME, OVERNIGHT DEPOSITS - NOV 30th 2007 US THOUSAND DOLLARS 2.6% 2.8% 3.7% 10.0% 10.2% 20.6% 11.8% 10.3% 24.2% 3.8% SYSTEM 10.0% 7.7% 8.7% 26.5% 3.6% 0.8% 3,340 42.7% COLSEGUROS 68,366 4.5% 15.8% 10.7% 17.7% 10.8% 40.4% FIDUCOR - M ULTIP ENSIONES 2,104 39.5% 60.5% FIDUCOR - FIDUP ENSIONES 1,644 4.2% 17.1% 7.7% 45.4% 0.7% 1.4% 2.3% 21.2% FIDUCOLOM B IA - RENTA P ENSION 67,952 29.2% 2.6% 20.4% 3.7%3.3% 21.4% 19.4% FIDUCIA RIA DA VIVIENDA - DA FUTURO 243,141 15.3% 3.0% 5.8% 12.8% 39.8% 23.3% FIDUCIA R - M ULTIOP CION 9,565 2.9% 1.9% 9.2% 11.0% 37.1% 37.9% FIDUCIA R - P LA N FUTURO 15,359 0.8% 13.9% 29.3% 38.1% 1.4% 11.9% 4.6% A LIA NZA - A B IERTO VISION 35,072 1.0% 9.9% 8.8% 2.1% 8.2% 8.0% 8.8% 12.6% 32.0% 8.6% SKA NDIA - M ULTIFUND 1,059,153 4.8% 17.8% 2.4% 1.7% 2.3% 30.3% 18.4% 22.3% P ROTECCION - ESM URfIT 30,775 5.1% 1.7% 5.8% 14.2% 14.3% 13.8% 18.8% 24.8% 1.5% P ROTECCION 804,924 1.9% 12.9% 5.7% 13.5% 9.0% 3.9% 34.4% 17.3% 1.4% P ORVENIR 572,965 3.0% 2.5% 1.9% 3.4% 29.5% 17.4% 16.0% 25.9% 0.4% SA NTA NDER 86,382 3.6% 0.9% 7.0% 8.4% 8.4% 10.1% 20.1% 41.5% COLFONDOS 180,645 1.3% 0.9% 1.0% 2.9% 4.7% 12.7% 17.1% 34.6% 24.8% B B VA HORIZONTE 161,533 -1% 99% Others (1) Flat Rate - UVR Libor Flat Rate - US Dollar IPC STOCKS Shares DTF Overnight Deposits Flat Rate - Col Peso ´(1) Securitization, Mutual Funds, Index Funds and Unit Trust Funds ´(2) Libor, Fixed income Euros, Canadian Dollar, CPI middle income and Derivatives Net Position On the other hand, 32.4% of the fixed income securities’ portfolio has a remaining maturity of 180 days, 9.4% between 181 and 360 days, 14.6% between 361 and 720 days, 11.7% between 721 and 1080 days, 10.8% between 1081 and 1440 days, 7.7% between 1441 and 1800 days, 2% between 1801 and 2160 days, 4.5% between 2161 and 2880 days, 3.7% between 2881 and 3600 days and 3.2% has a remaining maturity superior to 10 years (Graph 25 and Chart 2.3). GRAPH 25 FIXED RATE PORTFOLIO BY REMAINING MATURITY DAYS NOV 30th 2007 32.1% 14.5% 9.8% 11.8% 7.7% 10.8% 2.0% 4.5% 3.7% 3.2% SYSTEM 6.4% 9.2% 40.1% 19.4% 11.3% 1.2% 12.4% COLSEGUROS 53.8% 13.7% 32.5% FIDUCOR - M ULTIPENSIONES 100.0% FIDUCOR - FIDUPENSIONES 8.8% 27.6% 31.2% 7.4% 3.6% 0.7% 2.0%0.7%0.7% 17.3% FIDUCOLOM BIA - RENTAPENSION 38.3% 5.0% 24.3% 10.5% 15.2% 5.7% 1.0% FIDUCIARIA DAVIVIENDA - DAFUTURO 50.6% 14.3% 10.4% 11.0% 9.3% FIDUCIAR - M ULTIOPCION 64.0% 11.8% 20.3% 2.1%1.8% FIDUCIAR - PLAN FUTURO 27.7% 19.1% 31.8% 8.8% 17.1% 13.8% 3.3% 13.1% 14.9% 5.8% 9.9% 15.5% 2.6% 2.1% 0.1% 0.9% ALIANZA - ABIERTO VISION 7.2% 6.3% SKANDIA - M ULTIFUND 1.6% 3.7% 11.2% 34.1% 13.9% 21.9% 11.8% 1.8% PROTECCION - ESM URfIT 25.3% 18.4% 12.4% 4.2% 23.3% 2.0%2.6% 10.2% 1.2% 0.4% PROTECCION 46.6% 4.8% 5.8% 13.1% 4.8% 11.7% 1.7% 8.0% 1.8%1.7% PORVENIR 9.8% 17.0% 13.0% 14.9% 18.0% 3.3% 4.0% 3.6% 9.2% 7.2% SANTANDER 17.4% 17.9% 21.4% 5.5% 0.4% 7.2% 12.9% 3.2%2.3% COLFONDOS 32.4% 4.5% 24.5% 11.6% 13.0% 6.8% 1.3% 1.0% 2.6%2.3% BBVA HORIZONTE 0% 100% 1. 0 - 180 2. 181- 360 3. 361- 720 4. 721- 1080 5. 1081- 1440 6. 1441- 1800 7. 1801- 2160 8. 2161- 2880 9. 2881- 3600 9.1> 3600 18 3. UNEMPLOYMENT FUNDS 3.1 RETURN Between November 30th 2005 and November 30th 2007, the funds had an average return of 2.78% annual effective, which equals to a real return of -1.99%. It is noteworthy to emphasize that these returns oscillated between 1.72% and 4.82% (graph 26). G R Á F IC O 2 6 . F UN D S ' R E T UR N N O V .3 0 t h/ 0 5 T O N O V .3 0 t h/ 0 7 4.82% 2.66% 2.78% 2.21% 2.53%- 2.11%- 1.49%- -2.00% 0.05%- 0.00% 1.16%- 2.00% 1.72% NOM INA L RETURN PROMEDIO (*) HORIZONTE COLFONDOS PROTECCION SKANDIA SANTANDER -6.00% PORVENIR -4.00% 0.28%- MINIMUM 4.91%RETURN 3.31% 1.99%- 3.65% 4.00% 3.00%- 6.00% REA L RETURN (*) Weighed by equity’s average daily balance The mandatory minimum return certified by the Financial Superintendency for the above mentioned period was -0.28% annual effective. In average, the funds had a higher return in 3.06 percentage points. 3.2. RETURN AND VOLATILITY 3.2.1 MONTHLY RETURN AND VOLATILITY The monthly average return of the unemployment funds during the last twenty-four months, was between 2,26% and 5,42% (annual effective), with annualized volatilities of 4,10% and 5.98 % respectively. The return and volatility for each one of those funds are shown in graph 27. MONTHLY AVERAGE RETURN AND VOLATILITY GRAPH 27 UNEMPLOYMENT FUNDS MONTHLY AVERAGE RETURN AND VOLATILITY NOVEMBER 30th 2005 -NOVEMBER 30th 2007 7.00% 6.50% 6.00% Skandia 5.50% Santander 5.00% 4.50% Porvenir 4.00% Protección 3.50% Colfondos 3.00% Horizonte 2.50% 2.00% 1.50% PORTFOLIO OF REFERENCE 1.00% 4.00% 4.50% 5.00% 5.50% 6.00% VOLATILITY 19 3.2.2 ACCUMULATED RETURN AND VOLATILITY The accumulated average return of the unemployment funds during the last twenty-four months, was between the 2.30% and 5,08% (annual effective), with annualized volatility of 4,80% and 3.85%, respectively. The average return and volatility for each one of those funds are shown in graph 28. (*) ACCUMULATED AVERAGE RETURN GRAPH 28 UNEMPLOYMENT FUNDS ACCUMULATED AVERAGE RETURN AND VOLATILITY NOVEMBER 30th 2005 -NOVEMBER 30th 2007 5.80% 5.50% 5.20% 4.90% 4.60% 4.30% 4.00% 3.70% 3.40% 3.10% 2.80% 2.50% 2.20% 1.90% 1.60% 1.30% 1.00% 0.70% 0.40% 0.10% -0.20% -0.50% -0.80% 3.10% Skandia Porvenir Santander Protección Colfondos Horizonte PORTFOLIO OF REFERENCE 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% 4.00% 4.10% 4.20% 4.30% 4.40% 4.50% 4.60% 4.70% 4.80% 4.90% 5.00% VOLATILITY (*) It belongs to the accumulated return of the last 24 months EVOLUTION OF THE UNEMPLOYMENT FUNDS' ACCUMULATED RETURNS 11.50% RENTABILIDAD ACUMULADA 9.50% 7.50% 5.50% 3.50% 1.50% Nov-06 Dic-06 Ene-07 PROTECCION Feb-07 Mar-07 PORVENIR Abr-07 May-07 HORIZONTE Jun-07 Jul-07 SANTANDER Ago-07 Sep-07 COLFONDOS Oct-07 Nov-07 SKANDIA 20 3.3 VALUE OF THE FUNDS On November 30th, the funds reached the value of $1.887 millions (graphs 29 and 30), 3.9% less than the value registered on October 31st, that is, $77 millions. Taking into account the same month in 2006, the funds have had an increase of 15.5%, in other words, $253 millions. GR A P H 29. V A LUE O F E A C H F UN D A N D IT S P A R T IC IP A T IO N WIT H IN T H E S Y S T E M - N O V .3 0 T H 2 0 0 7 - US M ILLIO N D O LLA R S 30.5% 600 23.7% 500 19.5% FUND VA LUE COLFONDOS 217 SANTANDER 239 HORIZONTE PORVENIR PROTECCION 100 0 11.5% 368 200 39 2.1% 12.7% 447 300 SKANDIA 576 400 P ERCENTA GE OF P A RTICIP A TION 1,964 0.0% 3.9%- Oct-07 Nov-07 1,887 1,964 4.1% Sep-07 1,886 2,151 2.9%Jul-07 12.3%- 2,216 6.0%- 2,358 2,211 Jun-07 3.8%- 1,000 6.7% 1,645 1.5%- 1,500 0.3% 1,670 2.3% Dec-06 39.3% 1,633 1.5%- 2,000 Nov-06 2,500 2,204 2,291 GR A P H 30. V A LUE O F T H E F UN D S ' LA S T Y E A R E V O LUT IO N US M ILLIO N D O LLA R S 500 FUNDS VALUE Aug-07 May-07 Apr-07 Mar-07 Feb-07 Jan-07 0 MONTHLY VARIATION 3.4 AFFILIATES The number of people affiliated with the funds on November 30th 2007 was 4.037.387, with a decrease of 1%, that is, 40.658 less people compared to the ones that were with the funds on October 31st 2007. (Graph 31). Taking into account the same month in 2006, the funds have had an increase of 8%, in other words, 296.046 affiliates. GR A P H 31 A F F ILIA T E S A N D P A R T IC IP A T IO N O F E A C H F UN D WIT H IN T H E S Y S T E M - N O V .3 0 T H 2 0 0 7 1,400,000 29.6% 1,200,000 21.9% 525,899 COLFONDOS 29,791 0.7% 559,137 200,000 13.1% SANTANDER 833,081 400,000 13.9% PROTECCION 600,000 20.7% 878,668 1,190,522 800,000 HORIZONTE 1,000,000 A FFILIA TES SKANDIA PORVENIR 0 P ERCENTA GE OF P A RTICIP A TION 21 4,017,098 4,037,387 4,078,045 4,129,922 4,196,664 4,264,601 4,341,806 4,427,219 4,507,429 4,578,911 3,703,398 4,100,000 3,710,477 4,900,000 3,721,053 A F F ILIA T E S LA S T Y E A R E V O LUT IO N 1.0%Oct-07 0.5%- 1.3%- 1.6%Jul-07 Sep-07 1.8%Jun-07 1.6%- 1.9%May-07 Aug-07 1.8%Apr-07 0.2%Jan-07 1.6%- 0.3%Dec-06 23.6% 0.6%- 1,700,000 Nov-06 2,500,000 Mar-07 3,300,000 900,000 A FFILIA TES Nov-07 Feb-07 100,000 M ONTHLY VA RIA TION AFFILIATES' EVOLUTION IN THE LAST FIVE YEARS 4,500,000 8.00% 12.00% 4,000,000 3,500,000 9.80% 3.30% 8.50% 3,000,000 2,500,000 2,000,000 Nov-03 MEN Nov-04 WOMEN Nov-05 TOTAL Nov-06 4,017,098 1,407,850 2,609,248 3,721,053 1,358,092 2,362,961 3,322,041 1,223,581 2,098,460 3,024,545 1,127,880 1,896,665 0 2,926,854 500,000 987,446 1,000,000 1,939,408 1,500,000 Nov-07 % VARATION 95.9% of the total members are dependent workers, 2.6% are voluntary members and 1.5% are independent workers. On the other hand, 65% of the funds’ members are men and 35% women (Chart 3.2). 3.5 INVESTMENT PORTFOLIO On November 30th 2007, the portfolio’s value of the unemployment funds was USD$ 1,896 million, showing a decrease of 3.6% regarding what it was presented at the end of the previous month, when it had a value of USD$ 1,968 million. At the end of November 2007, 78.8% of the above mentioned funds’ portfolio, that is, USD$ 1,495 million belongs to fixed income investments; 18.1%, USD$ 342 million to investments in equity, 2.8%, USD$ 53 million to overnight deposits and 0.3%, 5 million to net position in derivatives (right less obligations) (Chart 3.3 and Graph31) 22 GRAPH 31 PORTFOLIO DIVERSIFICATION: FIXED INCOME, CHANGEABLE INCOME, OVERNIGHT DEPOSITS AND DERIVATIVES - NOV 30th 2007 - US THOUSAND DOLLARS 100% Fixed income Changeable Income 79.2% 80.4% 77.2% 77.7% 20.3% 19.2% 80.0% 78.8% 79.7% Overnight Deposits Derivatives 17.9% Active Report Operations 18.8% 15.8% 11.4% 18.0% 4.7% 0.8% 0% 2.1% BBVA HORIZONTE 370,291 -0.1% 0.9% COLFONDOS 450,161 0.1% 2.0% 0.4% SANTANDER 240,579 4.2% 3.1% PORVENIR 577,466 PROTECCION 448,458 4.2% SKANDIA 38,999 0.3% 2.8% 0.1% SYSTEM 1,896,124 FIXED INCOME, EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION TOTAL PORTFOLIO'S LAST YEAR EVOLUTION - US MILLION DOLLARS 100% 85% 70% 55% 40% 25% 10% -5% No v-06 1,638 Dic-06 1,682 JA N-07 1,646 Derivatives Feb-07 2,305 M ar-07 2,222 A P R-07 2,221 Overnight Deposits M ay-07 2,387 Jun-07 2,243 Jul-07 2,160 A UG-07 1,903 Changeable Income Sep-07 1,985 Oct-07 1,968 No v-07 1,896 Fixed income The investments in public debt are the most important ones within these funds. On November 30th 2007, this investments represented 51.1% of the portfolio’s total value (national debt represents 43.5%, external national debt 1.9% and territorial organizations and their decentralized 5.6%), followed by the securities issued by the institutions supervised by the Financial Superintendency with18.4%, the Institutions supervised by other regulatory authorities with 16.9%, and external investments with 9.9% and overnight deposits with 2.8% (Graph 32) 23 Internal Govermment Debt 99.0% GRAPH 32 PORTFOLIO'S CLASIFICATION : BY ISSUER NOV 30th 2007 - US THOUSAND DOLLARS 100.0% Institutions watched by other regulatory authority Internal Public Debt 27.9% Institutions supervised by the Financial Superintendency Institutions watched by the Financial Supervision 41.1% 43.8% 43.3% 41.9% 43.6% 49.1% Institutions watched by other regulatory authority 20.5% External Public Debt External Investment Domestic debt securities Other public debt issued under Law 80/93 and Decree 2681/93 17.5% 24.1% 14.6% 20.4% 18.4% titles 11.5% 13.5% 13.0% 17.2% Overnight Deposits 15.4% International Investment 18.1% 13.8% 16.9% 18.8% 7.0% External Public Debt 13.4% 10.6% Overnigth Others (1) Deposits 5.3% 2.1% 1.6% 0.0% Others (1) 8.0% 1.4% 0.9% -1.0% BBVA HORIZONTE 370,291 1.0% 14.0% 4.7% 7.1% 2.0% 1.8% 3.2% $ 421,068 5.6% 4.2% 1.6% 6.8% 0.7% COLFONDOS SANTANDER PORVENIR PROTECCION 450,161 240,579 577,466 PORVENIR 448,458 COLFONDOS HORIZONTE $ 252,113 8.6% 6.0% 3.9% 3.1% 0.3% 9.9% 6.1% 9.1% SKANDIA 38,999 PROTECCION $ 662,463 $ 516,388 2.8% 1.9% 0.9% SYSTEM 1,896,124 SANTANDER $ 264,935 (1) FOGAFIN AND DERIVATIVES NET POSITION TOTAL PORTFOLIO'S LAST YEAR EVOLUTION BY ISUUER US MILLION DOLLARS 60% 50% 40% 30% 20% 10% 0% Nov-06 Dic-06 JAN-07 Feb-07 Mar-07 APR-07 May-07 Jun-07 Jul-07 AUG-07 Sep-07 Oct-07 Nov-07 1,638 1,682 1,646 2,305 2,222 2,221 2,387 2,243 2,160 1,903 1,985 1,968 1,896 Others (1) International Investment Institutions w atched by other regulatory authority Institutions w atched by the Financial Supervision Internal Public Debt Domestic debt securities issued under Law 80/93 and Decree 2681/93 External Public Debt 74.3% of the above mentioned portfolio is denominated in Colombian pesos, 15.2% in UVR, 8.8% in US Dollar, 1.5% in euros, 0.2% in Real from Brazil, and the rest in yen (Graph 33) 24 SKANDIA $ 43,288 GRAPH 33 PORTFOLIO'S CLASIFICATION: BY CURRERNCY NOV 30th 2007 - US THOUSAND DOLLARS 100% Col Peso 64.3% UVR 71.2% 73.8% 77.5% 74.2% 74.4% 78.1% US Dollar Euro 18.5% 16.4% 16.5% 12.6% Others (1) 1.4% 0% BBVA HORIZONTE 370,291 COLFONDOS 450,161 16.3% 10.1% 7.7% 8.3% 9.9% 15.2% 17.3% 10.3% 8.8% 6.3% 1.4% 2.4% SANTANDER 240,579 2.3% PORVENIR 577,466 0.4% 1.6% PROTECCION 448,458 0.9% SKANDIA 38,999 1.5% 0.3% SYSTEM 1,896,124 (1) Yen TOTAL PORTFOLIO'S LAST YEAR EVOLUTION BY CURRENCY US MILLION DOLLARS 80% 70% 60% 50% 40% 30% 20% 10% 0% No v-06 1,638 Dic-06 1,682 JA N-07 1,646 EURO Feb-07 2,305 M ar-07 2,222 UVR A P R-07 2,221 M ay-07 2,387 Jun-07 2,243 US DOLLAR Jul-07 2,160 A UG-07 1,903 Sep-07 1,985 Oct-07 1,968 No v-07 1,896 COL PESO In terms of the foreign currency position, it is observed that 53.4% is covered from the exchange rate fluctuation risk and the uncovered part represents 4.9% of the funds’ total value (Graph 34 and Chart 4) 25 GRAPH 34 UNEMPLOYMENT FUNDS PERCENTAGE'S LAST YEAR EVOLUTION WITHOUT COVERAGE (MAXIMUM LIMIT 30%) 11.0% 10.0% 9.0% 8.0% 7.4% 7.0% 6.0% 6.0% 5.0% 4.5% 4.0% 3.8% 3.5% 3.0% 2.0% 1.0% 0.8% 0.0% Nov-06 Dic-06 Ene-07 Feb-07 Mar-07 PROTECCION SANTANDER Abr-07 May-07 Jun-07 Jul-07 PORVENIR SKANDIA Ago-07 Sep-07 Oct-07 Nov-07 HORIZONTE COLFONDOS On the other hand, 30.3% of the portfolio is invested in fixed income issues denominated in Colombian pesos, 23.2% is linked to CPI, 15.2% is invested in fixed income linked to UVR, 8% in Shares (Derived from securitization processes, Mutual Funds, unit trust funds, and Indexed Funds), 10% of the portfolio is invested in stocks, 7.3% linked to DTF, 2.8% in Overnight deposits, 1.7% in fixed income denominated in US Dollar, 0.7% are fixed income issues denominated in Euros, and the remaining 0.8% are securities denominated in Real from Brazil, Libor, and net position in derivatives. (Graph 35 and Chart 3.4) GRAPH 35 PORTFOLIO'S CLASIFICATION: FLAT RATE BY CURRENCY, CHANGEABLE INCOME, OVERNIGHT DEPOSITS - NOV 30th 2007 - US THOUSAND DOLLARS 100.00% Flat Rate - Col Peso 20.4% IPC 28.2% 27.3% 30.0% 34.3% 30.3% 34.6% Flat Rate - UVR 14.6% Shares 24.5% 23.4% 23.7% 25.2% DTF 16.5% 10.3% Overnight Deposits 17.4% 9.4% 10.7% 11.4% 8.0% 8.9% 10.0% 9.0% 8.5% 15.2% 3.5% 11.0% 10.5% Flat Rate - US Dollar Others (1) 7.9% 16.4% 12.6% 8.7% 4.7% 1.4% 8.0% 6.7% 12.4% 0.00% 1.8% 2.1% 0.5% BBVA HORIZONTE 370,291 0.9% 1.0% 1.4% COLFONDOS 450,161 6.1% 5.3% 7.8% (1) (2) 23.2% 18.5% 21.4% Participations 3.1% 0.7% 2.0% 1.9% SANTANDER 240,579 2.2% 2.3% PORVENIR 577,466 5.0% 18.0% 7.3% 2.8% 4.2% 1.7% 1.7% PROTECCION 448,458 1.6% SKANDIA 38,999 SYSTEM 1,896,124 Securitization, Mutual Funds, Unit Trust Funds and Index Funds Libor, Real, Overnight Deposits and Derivatives net position 26 FIXED INCOME BY INTEREST RATE TYPE , EQUITY, OVERNIGHT DEPOSITS AND DERIVATIVES NET POSITION TOTAL PORTFOLIO'S LAST YEAR EVOLUTION US MILLION DOLLARS Nov-07 1,896 Oct-07 1,968 Sep-07 1,985 AUG-07 1,903 Jul-07 2,160 Jun-07 2,243 May-07 2,387 APR-07 2,221 Mar-07 2,222 Feb-07 2,305 JAN-07 1,646 Dic-06 1,682 Nov-06 1,638 Oct-06 1,655 M 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Others FIXED INCOME EURO Flat Rate - Col Peso IPC Flat Rate - UVR DTF Flat Rate - US Dollar Shares Participations In terms of the portfolio’s classification by credit risk, it is observed that 46.4% are securities issued by the Nation, 23.5% of the investments have a AAA qualification, 21% are investments that do not require qualification, 7.7% has a AA+ qualification 1.4% belong to securities issued by Fogafin with AA-, A+, A, 1+, BBB, BBB- qualification (Graph 36) GRAPH 36 PORTFOLIO'S CLASIFICATION: BY CREDIT RISK NOV 30th 2007 100% NATION 37.1% 44.8% 53.6% 42.9% 49.7% 45.2% 46.4% AAA 24.5% N/A (1) 18.6% 16.6% 27.4% 30.7% 3.0% AA+ 15.7% 34.4% 27.0% 21.0% 17.0% 13.8% 18.7% 12.9% OTHERS 5.9% 8.1% 0% 1.2% PROTECCION (1) (2) 23.5% 27.4% 1.0% PORVENIR 0.4% 3.6% HORIZONTE 9.7% 3.7% SANTANDER SKANDIA 4.4% 7.7% 1.0% 1.4% COLFONDOS SYSTEM Investments: Unit Trust Funds, Mutual Funds, Index Funds and Stocks Fogafin AA-, A+, A, 1+, BBB, BBB- Finally, it is important to mention that 3.3% of the fixed income portfolio has a remaining maturity of 180 days, 2.3% between 181 and 360 days, 9.2% between 361 and 720 days, 24.3% between 721 and 27 1,080 days, 12.6% between 1,081 and 1,440 days, 10.6% between 1,441 and 1800 days, 4.6% between 1801 and 2,160 days, 19% between 2,161 and 2,880 days, 8.6% between 2881 and 3.600 days and 5.5% has a remaining maturity of 10 years or higher (Graph 37 and Chart 3.5). GRAPH 37 FIXED RATE PORTFOLIO BY REMAINING MATURITY DAYS NOV 30th 2007 100.0% 4.6% 6.1% 9.1 > 3600 3.8% 4.6% 4.4% 12.0% 7.0% 10.3% 12.3% 14.3% 16.3% 24.5% 8.6% 9.4% 9. 2881 - 3600 21.7% 5.5% 12.9% 21.0% 19.0% 4.7% 8. 2161 - 2880 0.9% 6.2% 7. 1801 - 2160 7.2% 5.9% 8.1% 5.4% 9.5% 5.0% 8.5% 6. 1441 - 1800 17.4% 17.7% 10.5% 4.6% 3.6% 7.6% 10.6% 7.0% 12.5% 16.2% 5. 1081 - 1440 12.6% 11.0% 10.0% 4. 721 - 1080 20.9% 26.7% 19.3% 24.3% 23.8% 32.0% 3. 361 - 720 20.1% 17.1% 2. 181 - 360 15.8% 11.0% 6.7% 1. 0 - 180 1.3% 3.7% 4.6% 6.2% 1.8% 2.4% 2.4% 0.0% PROTECCION PORVENIR HORIZONTE 9.2% 8.0% 4.2% 0.3% 1.9% 4.4% 4.4% SANTANDER SKANDIA 2.3% 3.3% 1.0% COLFONDOS SYSTEM 4. PAY AS YOU GO REGIME 4.1 PENSION RESERVE FUND´S EQUITY Pay as you go pension reserve funds’ equity at the end of the month of November 2007 reported a balance of USD 1.266,3 million dollars, a lower value of USD 58,7 million dollars related to the one registered in October 2007, which is equal to a decrease of 4,43% (graph 38). The total of reserves in November of 2007 is distributed as follows: Retirement Age USD 1.185,7 million dollars, Invalidity USD 6,0 million dollars and Survival USD 74,6 million dollars (chart 5). GRAPH 38 RESERVE FOUNDS' EQUITY 45.01% 29.21% 65.0 5.14% 65.4 62.1 4.90% 61.0 38.5 39.6 3.04% 160.7 163.6 369.9 10 377.1 100 570.0 12.69% 618.2 Millions of Dollars 1,000 1 ISS CAPRECOM Oct-07 CAXDAC Nov-07 P. ANTIOQUIA FONPRECON CAJANAL Participation in November 2007 28 LAST YEAR EVOLUTION OF RESERVE FUNDS' EQUITY 2.24% -4.43% 1,266.3 1,324.9 1,295.8 7.23% 1,208.5 1,321.0 1,218.5 3.67% 1,277.4 1.33% -8.52% 1,045.4 300.0 1,060.1 1,046.1 900.0 600.0 0.07% 1.33% 1,113.6 2.73% 6.43% 1,017.6 Milions of Dolars 1,200.0 1,074.2 14.71% -4.61% 8.41% 0.0 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun-07 EQUITY VALUE Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 MONTHLY VARIATION Source: Supervised Entities 4.2 AFFILIATES According to the data sent by the administrator entities of the above mentioned Regime, for September and October 2007, the total number of affiliates was 6.108.198 and 6.111.816, respectively, which equals to an increase of 3.618 affiliates, representing 0,06%. “CAJANAL”´s data is included taking into account preliminary information, and “FONPRECON”´s data is in process of evaluation which is composed as follows: In September 2007, 112 belong to Law 4th of 1992 (Members of the “Congreso de la República”) and 616 to Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and “Fondo de Previsión Social”); in October 2007 the distribution was: 115 and 608, respectively (graph 39). GRAPH 39 AFFILIATES 98.93% 10,000,000 1,000,000 0.98% 100,000 0.02% 10 728 723 0.01% 1,059 1,062 1,261 1,264 2,173 60,000 60,000 0.02% 2,166 100 6,046,600 1,000 0.04% 6,042,978 10,000 1 ISS CAJANAL (1 ) CAPRECOM Sep-07 P. ANTIOQUIA Oct-07 CAXDAC FONPRECON (2) Participation in October 2007 5,996,177 0.06% 0.01% 1.07% 0.11% 0.24% 0.07% 0.12% 0.08% 0.06% 6,111,816 5,984,905 0.11% 6,108,198 0.19% 6,092,235 0.08% 6,077,640 0.00% 5,979,853 AFFILIATES' EVOLUTION IN THE LAST YEAR 2,000,000 1,000,000 6,103,456 6,096,216 6,070,854 3,000,000 6,006,601 4,000,000 6,006,159 5,000,000 6,002,842 6,000,000 0 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 AFFILIATES Apr-07 May-07 Jun-07 Jul-07 Aug-07 Sep-07 Oct-07 MONTHLY VARIATION (1) Acording to preliminary information The total amount of quotations in October 2007 was USD 115,174 thousand dollars. The variations by gender of the total of affiliates, between the months of August and September in 2007, are these ones: (See the details by each Administrator as it’s shown in chart 6). 29 Affiliated Men Quoting Affiliated Women Non Quoting Quoting TOTALES Non Quoting Quoting Non Quoting Great Total TOTALS SEPTEMBER/07 TOTALS OCTOBER/07 765.446 1.187.099 2.929.168 2.511.162 1.141.072 692.452 1.272.512 1.721.103 1.906.518 1.879.551 4.201.680 4.232.265 6.108.198 6.111.816 VARIATIONS: ABSOLUTE VARIATION PERCENTAGE VARIATION 421.653 55,09% -418.006 -14,27% -448.620 -39,32% 448.591 35,25% -26.967 -1,41% 30.585 0,73% 3.618 0,06% In October of 2007, 36,7% of the total of affiliates with the “ISS”, are active, that represents, 2.219.466 and 63,3%, which is equal to, 3.827.134 are inactive. Inactive affiliates are those ones who did not make the obligatory payment in at least the last six months. 30% of the total of affiliates for each of the administrators of the Pay As You Go Regime in October 2007, without including “CAJANAL” and “FONPRECON”, belongs to people who quote, representing 1.818.828; and 70% belongs to people who do not quote, representing 4.232.265. It is noteworthy to clarify that people who do not quote are those affiliates and not-pensioners, who for some reason did not do the mandatory payment during the reported month (graph 40). 1,815,504 10,000,000 GRAPH 40 AFFILIATES' CLASIFICATION 4,231,096 1,000,000 100,000 2,062 10,000 1,020 1,000 817 241 111 242 100 10 1 ISS CAPRECOM P. ANTIOQUIA QUOTING MEMBERS CAXDAC NON-QUOTING MEMBERS QUOTING AND THE NON QUOTING AFFILIATES' EVOLUTION IN THE LAST YEAR 100% 90% 80% 70% 66% 66% 67% 34% 33% 68% 67% 68% 32% 33% 32% Jan-07 Feb-07 69% 68% 69% 69% 69% 69% 70% 60% 50% 40% 30% 20% 34% 31% 32% 31% 31% 31% 31% Jun-07 Jul-07 Aug-07 Sep-07 30% 10% 0% Oct-06 Nov-06 Dec-06 Mar-07 Apr-07 May-07 NON-QUOTING MEMBERS Oct-07 QUOTING MEMBERS Source: Supervised Entities 4.3 PENSIONERS The number of pensioners that were reported by each administrator in October 2007 was 986.431, which represents an increase of 6.606 pensioners in comparison to September 2007, representing 0,67% (graph 41). 725.885 out of this total belong Old Age Pension, 38.706 to Invalidity and 221.840 to Survival (chart 7). Regarding the number of pensioners by gender, 580.103 are men and 406.328 are women (graph 42). 22.571 of the pensioners in “CAPRECOM” in the month October 2007 are divided as it follows: 13.640 are pensioners before the Law 100/93 came into force; 8.781 are pensioners after the coming into force of the Law 100/93 and the entity is responsible for the payment of that people’s pension, FONCAP and others; 150 in the Advance Plan of Pensions (PAP) which is in charge of the employer. 2.054 of the pensioners reported by “FONPRECON”, 810 are under the Law 4th of 1992 (Ex-members of the “Congreso de la República”) and 1.244 are under the Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and of the “Fondo de Previsión Social”). 30 According to the article 33 of the Law 100/93, which was modified by the article 9° of Law 797 of 2003, in the Pay As You Go Regime, the age of the retirement for the men is 60 years and they must have 1.100 weeks of contribution at the desired retirement time, whereas for the women, their mandatory age of the retirement is 55 years but the time of contribution continues being equal, meaning 1.100 weeks for them, as well. 10,000,000 GRAPH 41 PENSIONERS 74.65% 22.56% 1,000,000 2.29% 0.21% 690 0.07% 690 2,044 2,233 2,225 10 22,571 22,516 222,520 100 0.23% 221,812 1,000 736,363 730,538 10,000 2,054 100,000 1 ISS CAJANAL CAPRECOM (1) Sep-07 P. ANTIOQUIA Oct-07 FONPRECON (2) CAXDAC Participation in October 2007 PENSIONERS EVOLUTION'S IN LAST YEAR 1.000.000 0,68% 0,63% 0,72% 0,40% 0,58% 0,50% 0,40% 0,56% 0,55% 0,57% 0,60% 0,53% 0,67% 968.808 974.632 979.825 Jun-07 Jul-07 Aug-07 Sep-07 986.431 963.362 958.077 952.761 948.979 Dec-06 943.470 Nov-06 200.000 938.753 400.000 935.055 922.569 600.000 928.398 800.000 0 Oct-06 Jan-07 Feb-07 Mar-07 Apr-07 TOTAL PENSIONERS May-07 Oct-07 VARIATION PENSIONERS EVOLUTION'S TO THE "ISS", LAST FIVE YEARS, BY THE GENUS 800.000 200.000 251.419 736.363 484.944 679.491 453.491 626.630 226.000 Oct-04 201.013 Oct-03 425.617 579.675 180.088 300.000 537.149 400.000 161.750 500.000 399.587 600.000 375.399 PENSIONERS 700.000 100.000 - MEN Oct-05 WOMEN Oct-06 Oct-07 TOTAL Source: Supervised Entities 31 GRAPH 42 THE NUMBER OF PENSIONERS BY THE GENUS 6. 32 8 40 14 70% 2. 09 0 1. 08 4 .7 29 10 87 25 80% 8 1. 41 9 90% 12 8 100% 60% 0. 10 3 58 80 20% .4 30 1. 14 9 .8 42 11 1. 17 48 30% 6 4. 94 4 40% 56 2 50% 10% 0% IS S CAXDAC FONPRECON CAPRECOM MEN P.ANTIOQUIA CAJANAL TOTAL WOMEN According to the administrator’s report, the monthly salary value of pensioners for October 2007, was USD 487.412,5 thousand dollars (graph 43). USD$419.698,2 thousand of this total belong to Old Age Pension, USD$16.691,2 thousand to Invalidity and USD$51.023,0 to Survival (chart 7). In October 2007 CAPRECOM reported USD 22.248,4 thousand dollars as it follows: (a) USD 11.666,3 thousand dollars – It’s the value of the participation of the organization in which the pensioners were affiliated, the participation that is in charge of the communications sector and the participation that does not belong to the sector, by pensions recognized before the Law 100 of 1993 came into force, in comparison to the payments that were not made; (b) USD 10.424,7 thousand dollars – It’s the value of the organization’s participation in which the pensioners were affiliated, the participation that is in charge of the communications sector, the participation in charge of the FONCAP and the participation that does not belong to the sector, by pensions recognized after the Law 100 of 1993 came into force, in comparison to the payments that were not made; (c) USD 157,5 thousand dollars – It’s the value of the pension that according to the Advance Plans of Pensions (PAP) is totally paid by the employer, until the affiliate fulfills the general requirements established in the current norms which determine that the employer continues quoting to the FONCAP. USD 6.579,5 thousand dollars reported by “FONPRECON” are distributed as it follows: USD 5.361,0 thousand dollars belong to the pensioners covered under the Law 4 th of 1992 (Ex-members of the “Congreso de la República”) and USD 1.218,5 thousand dollars belong to the pensioners covered under the Law 100 of 1993 (Administrative Personal of the “Congreso de la República” and of the “Fondo de Previsión Social”). 27.37% 100,000.0 1,326.7 0.27% 1,278.7 1,674.8 6,579.5 6,480.4 22,248.4 0.34% 1,645.4 10.0 130,276.0 100.0 322,170.5 1,000.0 1.35% 21,679.1 133,412.7 4.56% 10,000.0 310,601.1 US Thousand Dollars 1,000,000.0 GRAPH 43 PENSION PAYMENTS 66.10% 1.0 ISS CAJANAL Sep-07 CAPRECOM (1) Oct-07 FONPRECON (2) CAXDAC P. ANTIOQUIA Participation in October 2007 Source: Supervised Entities ** They includes the additional monthly pay The average grade for this Regime’s payment of the pension in October 2007 was USD 494,1 dollars, more than 2,58% compared to last month’s pension payment (graph 44). 32 GRAPH 44 AVERAGE PENSION PAYS 494,1 481,7 437,5 425,2 599,6 587,3 1.000,0 594,1 574,7 962,8 2.000,0 985,7 3.000,0 2.427,3 2.384,7 4.000,0 3.203,3 3.170,4 Dollars 5.000,0 0,0 FONPRECON CAXDAC CAPRECOM P. ANTIOQUIA Sep-07 CAJANAL ISS SYSTEM´S AVERAGE Oct-07 EVOLUTION IN THE LAST YEAR OF THE PENSION PAYMENTS 700,000 62.2% Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun/07 (**) (**) 3.3% 487,412.5 471,960.6 478,523.5 0 8.4% -9.0% 435,387.1 -37.0% 10.2% 760.065,1| 100,000 3.5% 480,476.3 200,000 2.7% 436,002.1 300,000 6.3% 421,253.7 400,000 -2.5% 395,759.8 -34.1% 410,030.7 4.7% 600,621.1 500,000 385,801.5 600,000 370,385.4 US Thousand Dollars 58.2% Jul-07 Aug-07 Sep-07 Oct-07 Pension Payment Value Monthly variation Source: Supervised Entities ** They includes the additional monthly pay 4.4 INVESTMENT PORTFOLIO The balances of the pensional reserve funds’ investment portfolios in November 2007 (having in mind what is established in Law 490/1998 and in the statutory Decree 1404/1999 (July 28th 1999), “CAJANAL” transferred its reserves to “FOPEP” and therefore does not present a balance; and in the case of the “Instituto de Seguros Sociales” – “ISS” – the resources which are part of the Subsidiary Regime) are included, representing a value of USD 1.072,2 million dollars compared to USD 1.101,6 million dollars in October 2007, showing a decrease of USD 29,4 million dollars which is equal to -2,67% (graph 45). The total of investments in November of 2007 is distributed for each pensional modality as follows: Retirement age USD 992,0 million dollars, Invalidity USD 12,0 million dollars and Survival USD 68,2 million dollars (chart 8). GRAPH 45 INVESTMENT PORTFOLIO 1,000 41.32% 34.48% 61.2 5.71% 60.8 38.0 160.3 3.54% 38.7 369.7 376.8 443.0 10 162.7 100 462.5 US Million Dollars 14.95% 1 ISS CAPRECOM Oct-07 CAXDAC Nov-07 P.ANTIOQUIA FONPRECON Participation in November 2007 33 INVESTMENT PORTFOLIOS´ EVOLUTION, LAST YEAR 1,072.2 1,101.6 3.04% -2.67% 1,078.7 600 1,069.0 800 993.0 4.53% -8.39% 7.65% 1,084.0 3.22% 1,071.2 -0.02% 0.18% 945.5 4.60% 904.5 2.14% 874.8 200 876.3 400 874.7 US Million Dollars 1,000 836.3 14.09% -0.69% 1.19% 0 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun-07 PORTFOLIO VALUE Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 MONTHLY VARIATION Source: Supervised Entities In November 2007, 91,6% of the portfolios were invested in TES, the remaining 8,4% were represented in other bonds different to Nation bonds contained in the funds administrated by “CAXDAC”. “CAXDAC”’s investment portfolio is different to other pay as you go reserve funds, due to the fact that this entity, in investment matters, is ruled by the norms issued by the Financial Superintendency for Private Pension Fund Administrators and its classification in November of 2007 is the following one: The investments’ portfolio value of Retirement age’s reserves, Invalidity and Survival of CAXDAC on the 30th day of November 2007 was USD 162,7 million dollars, increasing the value registered in 2,9% at the end of the previous month, date in which it was USD 162,7 million dollars. At the end the month of November 2007, 86,1% of the above mentioned reserves, that is, USD 138.075 thousand dollars belong to investments in fixed income; 13,7%, USD 21.939 thousand dollars belong to changeable income investments; 0,6%, USD 977 thousand dollars to overnight deposits; and -0,4% USD -681 thousand dollars, to net position in derivatives (rights minus obligations) (graph 46). GRAPH 46 CAXDAC - PORTFOLIO CLASIFICATION IN: FIXED AND VARIABLE INCOME, DEPOSITS AT SIGHT AND DERIVATIVES NET POSITION NOVEMBER 30, 2007 - THOUSAND OF US DOLLARSS 90% INVESTMENTS IN FIXED INCOME INVESTMENTS IN VARIABLE INCOME 85.31% 86.13% 14.52% 13.69% DEPOSITS AT SIGHT 99.49% 99.29% NET POSITION IN DERIVATIVES 0.39% 0.46% 0.12% INVALIDITY USD$4.686 0.25% SURVIVAL USD$4.667 0.62% OLDNESS -0.45% USD$150,958 0.61% -0.43% TOTAL USD$160,311 -10% SOURCE: Caxdac In November 2007, the most significant investments were represented in 27,03% of the portfolio’s total value by securities issued by institutions supervised by other regulatory authorities; then come the securities issued by the nation (internal national debt) with a representation of 24.16%; securities issued by entities supervised by the Financial Superintendency with 14,82%; securities issued by external 34 entities with 14,52%; External public debt with 11,84%; securities issued by territorial organizations and decentralized entities had a participation of 7,44%, and other investments had a participation of 0,18% (graph 47). GRAFPH 47 CAXDAC - PORTFOLIO CLASIFICATION IN: TYPE OF ISSUER NOVEMBER 30, 2007 - THOUSAND OF US DOLLARSS 100% 19.24% 20.74% 27.46% 27.03% 23.96% 24.16% INSTITUTIONS WATCHED BY OTHER REGULATORY AUTHORITY NATION - INTERNAL PUBLIC DEBT INSTITUTIONS WATCHED BY “SUPERINTENDENCIA FINANCIERA DE COLOMBIA” 25.64% 29.13% INVESTMENTS OF OUTSIDE NATION -PUBLIC DEBT OF OUTSIDE TERRITORIAL ORGANIZATIONS AND DECENTRALIZED ENTITIES 13.66% OTHER INVESTMENTS (1) 34.07% 14.82% 33.07% 14.74% 12.58% 9.89% 12.08% 14.52% 11.84% 0.00% 0.00% 8.21% 7.07% 0.39% 0% INVALIDITY USD$4.686 7.44% 7.43% 0.46% 0.17% SURVIVAL USD$4.667 0.18% OLDNESS USD$150,958 TOTAL USD$160,311 SOURCE: Caxdac (1) Overnight deposits and net position in derivatives (rights minus obligations) 5. ISS´s PROFFESIONAL RISKS ADMINISTRATOR 5.1 RESERVES FOR PROFESSIONAL RISKS With the Law 776 of 2002 coming into force, in the 1° article, and according to the instruction of External Circular 044 of the Financial Superintendency, the “Instituto de Seguros Sociales” (“ISS”) adopted the technical reserves regime for the life insurance companies that administrate the professional risks sector; and as a result, during the last semester, the “ISS” presents in its financial statements the amount of each of the following reserves: (Graph 48). 29.2 20.4 94.0 27.9 1,294.7 1,466.2 29.8 20.8 97.7 28.6 1,326.5 1,503.5 29.2 20.2 94.3 28.0 1,290.1 1,461.9 27.3 18.7 90.4 26.5 1,198.8 1,361.8 29.8 20.5 100.5 29.5 1,312.1 1,299.7 1,492.4 20.2 29.7 100.0 29.7 1,000.0 107.4 10,000.0 1,486.8 Millions of dollars GRAPH 48 - PROFESSIONAL RISKS RESERVES 10.0 1.0 Jun-07 TOTAL RESERVES Jul-07 1-MATHEMATICAL RESERVE Aug-07 2-DEVIATION OF SINISTER Sep-07 3-WARNED SINISTER 4-NOT WARNED SINISTER Oct-07 Nov-07 5-PROFESSIONAL ILLNESS SOURCE: ARP-ISS/ FINANCIAL STATEMENTS IN VERIFYING PROCESS 5.2 EMPLOYERS AND AFFILIATE EMPLOYEES The employees affiliated with the ISS´s professional risk insurance company (ARP) during last year (between October 2006 and October 2007) report an increase of 6,45%, being in the first period 279.952 affiliates and in October 2007 being 297.997. The affiliated workers during the same period increased in 8,97%, being 1.545.264 in October 2006 and 1.683.855 in the above mentioned period. For the months of September and October 2007, the number of affiliated employers increased 279, which equals to 0,09%, and the affiliated workers increased in 4.215, which is equal to 0,25% (graph 49). The ARP quotations in October 2007 was USD 10,0 million dollars. 35 Graph 49 EMPLOYEES AND WORKERS AFFILIATED 1,700,000 1,679,640 1,683,855 Sep-07 Oct-07 297,997 297,718 1,678,129 296,508 1,677,271 Jul-07 296,626 1,667,270 294,008 Jun-07 295,004 1,633,168 Apr-07 294,025 1,613,728 Mar-07 294,050 1,616,281 1,610,226 Feb-07 294,153 500,000 293,073 279,952 700,000 290,030 1,608,836 900,000 283,057 1,545,264 1,100,000 1,555,476 1,300,000 1,634,008 1,500,000 300,000 100,000 -100,000 Oct-06 Nov-06 Dec-06 Jan-07 EMPLOYEES May-07 Aug-07 WORKERS SOURCE: ARP-ISS 5.3 PENSIONERS In October 2007, 11.015 from the total of the 23.119 pensioners who make the payments to the ISS´s ARP belong to survival pension and 12.104 to invalidity pension. During the last year, the number of pensioners for survival displayed an increase of 3,30%, regarding invalidity an increase of 0,68% and taking into account the total of pensioners an increase of 1,91%. For the months of September and October 2007 the data of pensioners regarding survival, invalidity and the total system displayed an increase of 51, 34 and 85 people respectively which represents 0,47%, 0,28% and 0,37% (graph 50). The monthly salary value of ARP’s pensioners in October 2007, was USD 6,1 million dollars and USD 3,2 million dollars of this total belong to survival and USD 2,9 million dollars to invalidity. GRAPH 50 PENSIONERS 10,901 12,073 12,027 Sep-07 23,119 Aug-07 11,015 12,104 Jun-07 23,034 10,869 12,056 May-07 10,964 12,070 10,840 12,048 Apr-07 23,006 10,845 12,063 Mar-07 10,933 12,073 22,908 10,818 12,060 Feb-07 22,974 22,878 10,791 12,051 Jan-07 22,925 22,842 10,761 12,049 Dec-06 22,888 22,787 10,744 12,043 Nov-06 10,000 22,810 22,729 10,702 Oct-06 22,685 10,663 12,022 20,000 0 SURVIVAL INVALIDITY Jul-07 Oct-07 TOTAL SOURCE: ARP-ISS 5.4 MANDATORY QUOTATIONS AND PENSION PAYMENTS Between the months of November 2006 and November 2007, ISS´s ARP received USD 120,2 million dollars in quotations from affiliated employers, for a monthly average of USD 9,2 million dollars. The amount paid during the same period on pension payments was USD 88,8 million dollars, for a monthly average of USD 5,9 million dollars, taking into account that the law establishes 14 annual pension payments. Financial statements and statistical reports are being evaluated and are also in depuration process in order to be adjusted according to the instructions of External Circular 044/2003 (graph 51). MANDATORY QUOTATIONS Aug-07 Sep-07 Oct-07 11.2 10.1 10.0 10.0 9.3 Jul-07 6.1 Jun/07 (**) 5.9 May-07 5.6 Apr-07 6.3 6.3 Mar-07 12.3 11.6 5.6 Feb-07 7.9 9.9 9.3 8.0 7.6 5.3 Jan-07 5.4 Dec-06 5.3 Nov-06 (**) 5.0 3.7 8.8 9.2 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 13.2 Millions of Dollars GRAPH 51 - MANDATORY QUOTATIONS AND PENSION PAYMENTS Nov-07 (**) MONTHLY TOTAL PENSION PAYMENTS SOURCE: ARP-ISS ** They include the additional monthly payment 36