Chapter 02

advertisement

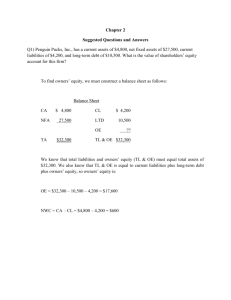

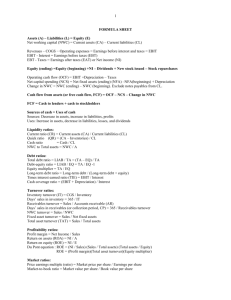

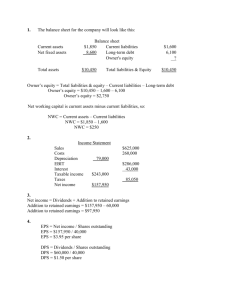

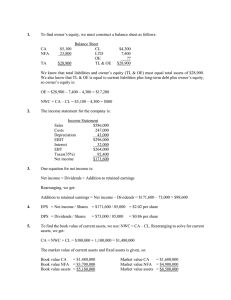

Ch 02 Jan 20, 2012 Ch 2: I. Financial Statements a) Balance Sheet b) Income Statement II. Taxes III. Cash Flows Go over HW Ch. 1 in Connect? In August 2008, the SEC announced a timetable that would allow some companies to report under IFRS (intl financial reporting standards: is principles based system, as opposed to GAAP is rules based system) as soon as 2010 and require it of all companies by 2014. However, because make stakeholders have gotten involved and caused controversy, at this point not set time is given for conversion. - 'balance sheet' will become 'statement of financial position' - 'income statement' will become 'statement of comprehensive income' - 'cash flow statement' will become 'statement of cash flows'. I. Financial Statements a) Balance Sheet (statement of financial position (snapshot or picture of firm at one particular time) = net worth statement for individual Assets = Liabilities + Owner’s Equity Investment decisions = Financing decisions Assets listed in order according to how long it takes to convert to cash (liquidity) liquidity is good because chance of financial distress is low but liquid assets are less profitable earn less returns, (excess cash is not earning interest and could be invested in a productive asset) Liabilities listed according to how soon they have to be paid (time to maturity) Equity is difference between assets and liabilities current assets - current debt = net working capital (should be positive) On Board: Example Balance Sheet for Miller Corporation for 2010&11 Given: 2010 2011 Current assets Fixed assets 1 Current liabilities Long-term debt Assets: 2010 2011 (02 cash =424, A/R= 705, Inv 1300) Current assets 2205 2429 Fixed assets 7344 7650 Total assets 9549 10,079 Liabilities & Owners’ Equity 2010 2011 Current liabilities 1003 1255 Long-term debt 3106 2085 4109 3340 Equity( 9549-4109) 5440 6,739 Total liabilities & equity 9549 10,079 (note: equity also includes add to retained earnings) [(How is common equity determined for balance sheet: 4 components: 1. Par value (par value x # of shares outstanding) 2. Capital in excess of par value: (capital surplus, add. paid-in capital) exists because shares are sold above their par value: (sales price - par value) #of shares sold. example: par value = $1 sales price = $15 # of shares sold = 1000 capital surplus: (15-1) x 1000 = 14,000 par value can only be distributed when company is liquidated important: 3. retained earnings: Net income - dividends = retained earnings (CH. 2) 4. Treasury stock = stock repurchased after it was issued, reported at cost] assets includes acc. depreciation) right side: financing = capital structure (debt vs. equity) Ch 15 more debt the more leverage: magnifying glass. magnify gains and losses Balance sheet gives info on liquidity and leverage important for creditors However, does not give info on real or market value of firm. $ amounts of assets are cost not actual market value (according to GAAP). (Old car cost in 1940: $2000 accounting value would be cost - depreciation car is depreciated over 10 years has not value today; but in fact worth a fortune) 2 market value is what we talk about when we try to optimize value of stocks market value is important for financial manager but is difficult to estimate b) Income Statement (Statement of Comprehensive Income) measures performance over time (a year) a video or film! Example: Miller Corp. Jan 1 – Dec 31 2011 Sales: COGS: Depreciation: Interest: Dividends: Tax rate: 4507 2633 952 196 250 35% Sales -COGS -Depreciation EBIT (op. earn.) -Interest Taxable Income (EBT) -Taxes (726x.35) Net Income two ways to express taxes: % or decimal 35% = .35 35% of $1000= 1000x.35=350 4507 investment decisions -2633 - 952 922 -196 financing decisions 726 254 472 Dividends Add. to retained earnings 250 222 (472-250) 3 Noteworthy things on income statement: 1. According to GAAP (general accepted accounting principles): revenue is shown in income statement when it accrues (time of sale) & expense figures are matched to point of sale (cost of producing a product are matched and reported with sale) Actual cash in- and outflow occurs at different times. Example cash flow time line? 2. Income statement does not represent actual cash flows 3 One reason: income statement contains non-cash items (depreciation). 3. In finance: concerned with variable and fixed costs, but accountants treat costs as product (COGS (raw materials and hammer) and period (S, G&A) both can be fixed and variable Before we go into cash flows: talk about taxes II. Taxes two things in life are certain: death & taxes, taxes are always changing important cash outflow distinguish between average and marginal tax rates average : total taxes/ total taxable income marginal : tax rate applicable to next dollar earned example: company has total taxable income of $150,000 7500 + 6250 + 8500 + 19500 = 41,750 $50,000 (.15) + 25,000 (.25) + 25,000 (.34) + 50,000 (.39) = $41,750 tax 41,750/150,000 = .2783 or 27.83% = average tax rate marginal rate: .39 When do we use average and marginal tax rates? for computing company’s total tax liability: average for evaluating cash flows generated from a new investment: marginal (because investment creates cash flows that are taxed above existing profits) in capital budgeting decisions III. Cash Flows Accounting cash flows: on statement of CFs (next chapter) $ coming in - $ flowing out can be derived from financial statements “statement of cash flow” looks at sources and uses in detail (beg. Cash + sources - uses = > Ending cash) Financial CF (used for capital budgeting: use balance sheet identity for cash flows: A B C cash flow from assets = cash flow to creditors + cash flow to stockholders cash is created through assets and used to pay creditors and owners How are these cash flows calculated? 4 A. Cash flow from assets (also called Free cash flow: company is free to distribute cash to investors because it is not needed for NWC or fixed assets investment) has three components: (CF free to be distributed to creditors and shareholders) 1. operating cash flows 2. - net capital spending 3. - change in net working capital operating cash flow - net capital spending - change in NWC =cash flow from assets (a growing company could have a negative cash flow from assets if it invested in fixed assets for example, i.e. it raised more money than it paid out) 1. Operating cash flow: tells us whether firm’s cash inflows from operations covers everyday cash outflows (should be positive for healthy firm) EBIT (revenues - costs - dep., we don’t include financing expenses) + depreciation (we don’t want to include depr. because its not a cash outflow) -taxes (tax has to be included because it is a cash outflow) = operating cash flow Miller Corporation 2011: EBIT 922 + depreciation 952 -taxes -254 operating cash flow 1620 2. Net Capital spending computes what part of operating cash flow is reinvested in the firm net spending in fixed assets money spent on fixed assets - money received from sale of fixed assets ending net fixed assets -beginning net fixed assets +end. Depreciation (during the year) 5 =net investment in fixed assets (if negative firm sold more assets than it purchased) Miller Corporation: 2011 net fixed assets (net of dep) -2010 net fixed assets + 2011 depreciation) net cap. spending 7650 -7344 +952 1258 3. Change in net working capital ending NWC -beginning NWC =change in NWC (if positive this is the investment in NWC for the year) Miller corporation ending NWC 1174 (2011: 2429-1255) cur. assets-cur. liab. -beginning NWC 1202 (2010: 2205-1003) cur. assets-cur. liab. change in NWC - 28 OCF 1620 -NetCapSp -1258 -chg in NWC +28 CF from Ass. 390 B. Cash flow to creditors interest paid -new borrowing = cash flow to creditors Miller Corporation: interest -net new borrowing cash flow to creditors 196 -(-1021) (2085-3106) (2011- 2010 long-term debt) 1217 C. Cash flow to shareholders dividends paid - net new equity raised (net n equ=- stock repurchased+new stock issues) =cash flow to shareholders Rasputin Corp. dividends -net new equity raised cash flow to shareholders 250 2011 equ.-2010 equ. add. to ret.earn. 2011 -1077 (6739-5440=1299 1299- 222=1077) -827 6 CF to creditors + CF to sh. holder = CF from assets 1217 -827 390 7