1 FORMULA SHEET Assets (A) – Liabilities (L) = Equity (E) Net

advertisement

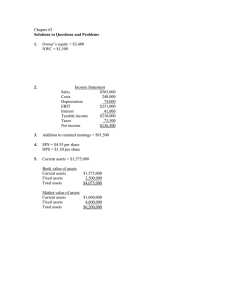

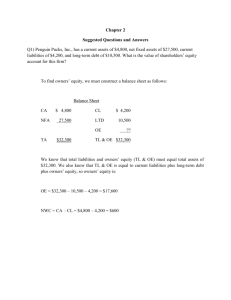

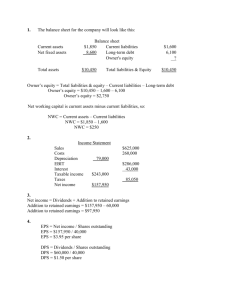

1

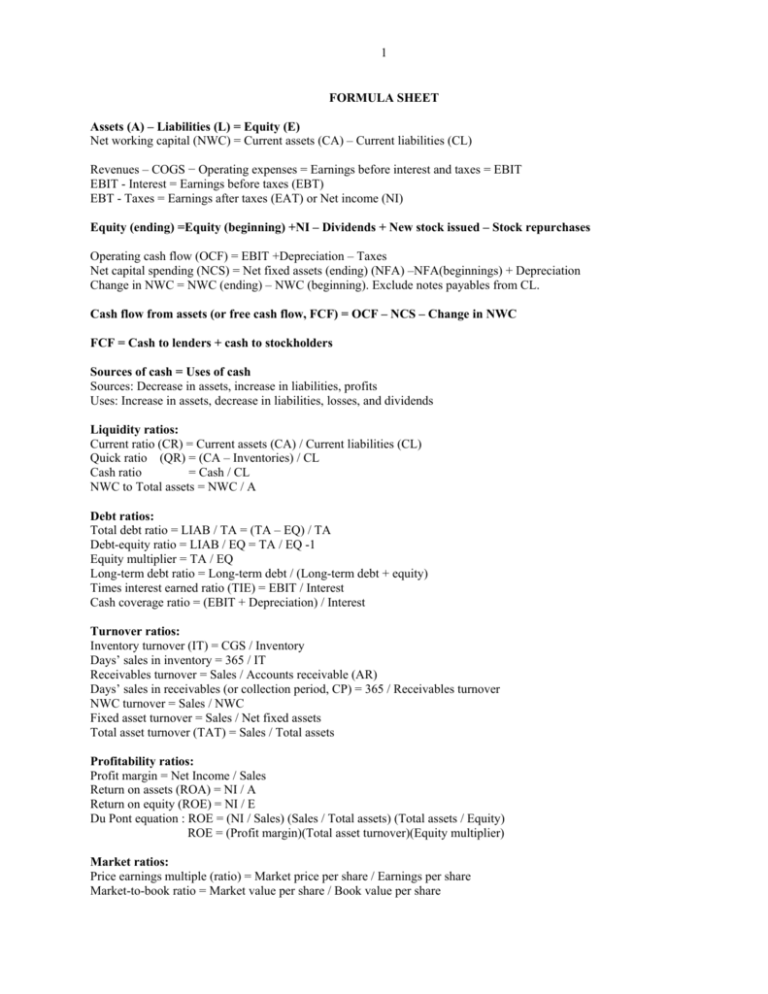

FORMULA SHEET

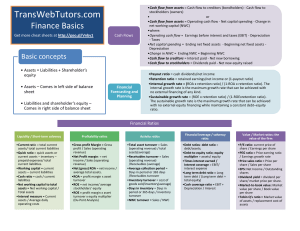

Assets (A) – Liabilities (L) = Equity (E)

Net working capital (NWC) = Current assets (CA) – Current liabilities (CL)

Revenues – COGS − Operating expenses = Earnings before interest and taxes = EBIT

EBIT - Interest = Earnings before taxes (EBT)

EBT - Taxes = Earnings after taxes (EAT) or Net income (NI)

Equity (ending) =Equity (beginning) +NI – Dividends + New stock issued – Stock repurchases

Operating cash flow (OCF) = EBIT +Depreciation – Taxes

Net capital spending (NCS) = Net fixed assets (ending) (NFA) –NFA(beginnings) + Depreciation

Change in NWC = NWC (ending) – NWC (beginning). Exclude notes payables from CL.

Cash flow from assets (or free cash flow, FCF) = OCF – NCS – Change in NWC

FCF = Cash to lenders + cash to stockholders

Sources of cash = Uses of cash

Sources: Decrease in assets, increase in liabilities, profits

Uses: Increase in assets, decrease in liabilities, losses, and dividends

Liquidity ratios:

Current ratio (CR) = Current assets (CA) / Current liabilities (CL)

Quick ratio (QR) = (CA – Inventories) / CL

Cash ratio

= Cash / CL

NWC to Total assets = NWC / A

Debt ratios:

Total debt ratio = LIAB / TA = (TA – EQ) / TA

Debt-equity ratio = LIAB / EQ = TA / EQ -1

Equity multiplier = TA / EQ

Long-term debt ratio = Long-term debt / (Long-term debt + equity)

Times interest earned ratio (TIE) = EBIT / Interest

Cash coverage ratio = (EBIT + Depreciation) / Interest

Turnover ratios:

Inventory turnover (IT) = CGS / Inventory

Days’ sales in inventory = 365 / IT

Receivables turnover = Sales / Accounts receivable (AR)

Days’ sales in receivables (or collection period, CP) = 365 / Receivables turnover

NWC turnover = Sales / NWC

Fixed asset turnover = Sales / Net fixed assets

Total asset turnover (TAT) = Sales / Total assets

Profitability ratios:

Profit margin = Net Income / Sales

Return on assets (ROA) = NI / A

Return on equity (ROE) = NI / E

Du Pont equation : ROE = (NI / Sales) (Sales / Total assets) (Total assets / Equity)

ROE = (Profit margin)(Total asset turnover)(Equity multiplier)

Market ratios:

Price earnings multiple (ratio) = Market price per share / Earnings per share

Market-to-book ratio = Market value per share / Book value per share

2

Financial Planning

Internal growth rate = ROA x b / (1- ROA x b)

Sustainable growth rate = ROE x b / (1- ROE x b)

where ROA= return on assets, ROE= return on equity, b= retention ratio

EFN = g x (A – OCL) – PM x S x b x (1+g)

where g =projected growth in sales, A=assets, OCL=operational current assets, PM=profit margin

Raising Capital

Value of a right = PRO – PX = ( PRO – PS ) / (N + 1)

where PRO = the rights-on price, PX = ex-rights price, PS = the subscription price

and N is the number of rights needed to buy one new share at the subscription price

Time Value of Money

PV = FVt /(1+r)t

PV=present value, FV=future value, r=interest rate, t=number of periods

FVAt = A x [(1+r)t -1 ] / r

PVA = A x [1 – (1+r)-t ] / r

C= cash amount, FVAt = future value of an annuity of C dollars per period, PVA=present value of an annuity of C

dollars per period, r=interest rate, t=number of periods.

PV= C / r the perpetuity value

EAR = [1 + (Quoted rate/m)]m -1

EAR=effective annual rate, m= the number of times the interest is compounded per year.

Quoted rate is sometimes called APR (annual percentage rate)

Bonds

P = C x {1 – [1/ (1+r)t ] } / r + 1,000 / (1+r)t

P=current price of bond, C=coupon payments per period, t= the number of coupon payments, r= yield-to-maturity

per period

Fisher effect

(1+R) = (1+r) x (1+h)

R= the nominal rate, r=the real rate, h= the rate of inflation

Stocks

Constant growth case

P0 = D0 x (1+g) / (R – g) = D1 / (R – g) and

R= D1 / P0 + g

P0= value of a share of stock, D0 current dividends per share, D1=next year’s dividends per share

R= required return by shareholders, g= the rate of growth of dividends (earnings and share prices)

Operating cash flow (OCF)

OCF= Net income + Depreciation = EBIT – Taxes + Depreciation

OCF= Sales – Costs – Taxes

OCF= (Sales – Costs) (1- T) + Depreciation x T

where T is the corporate tax rate

3

Break-Even and Degree of Operating Leverage (DOL)

Accounting break-even quantity = (FC + D) / (P – v)

Cash break-even quantity = FC/ (P – v)

Financial break quantity is the quantity that makes the net present value zero.

FC=fixed costs, P=price per unit, v=variable cost per unit

Q =quantity

DOL = 1 + FC / OCF = (P – v) x Q / [(P – v) x Q –FC]

The Security Market Line (SML)

E(Ri) = Rf + [Rm – Rf] x Betai

Cost of Capital

WACC = (E/V) x RE + (P/V) x RP + (D/V) x RD x ( (1 – TC)

WACC=the weighted average cost of capital, RE =cost of equity, RP =cost of preferred stock, RD =before-tax cost

of debt, TC =corporate tax rate..

V= E+P+D

Dollar return

Pt+1 – Pt + Dt

Percent Return

(Pt+1 – Pt + Dt)/Pt

Mean Return

_

X = (R1 + R2 + R3)/3 o r ∑Ri / n

E(R) = Rµ = P1R1 + P2R2 + P3R3 or ∑PiRi

Geometric Mean

[(1 + r1)(1 + r2)(1 + r3)]1/3 or Π(1 + ri)1/ n

Variance

_

_

_

_

Var = [(R1 – X)2 + (R2 – X)2 + (R3 – X)]2/2 or ∑(Ri – X)2/n-1

σ2 = P1(R1 - Rµ)2 + P2(R2 - Rµ)2 + P3(R3 - Rµ)2 or ∑ Pi(Ri - Rµ)2