Financial Accounting Questions and Answers

advertisement

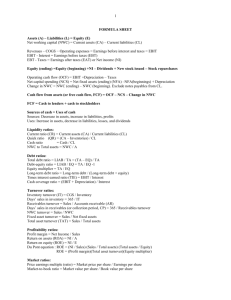

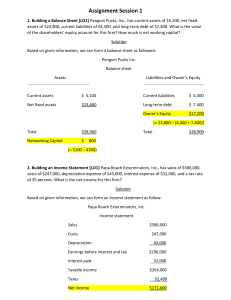

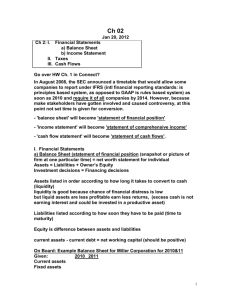

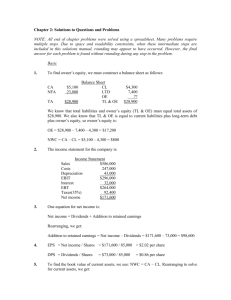

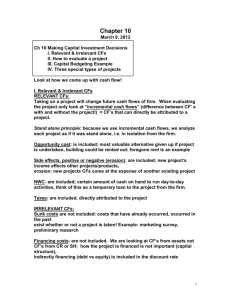

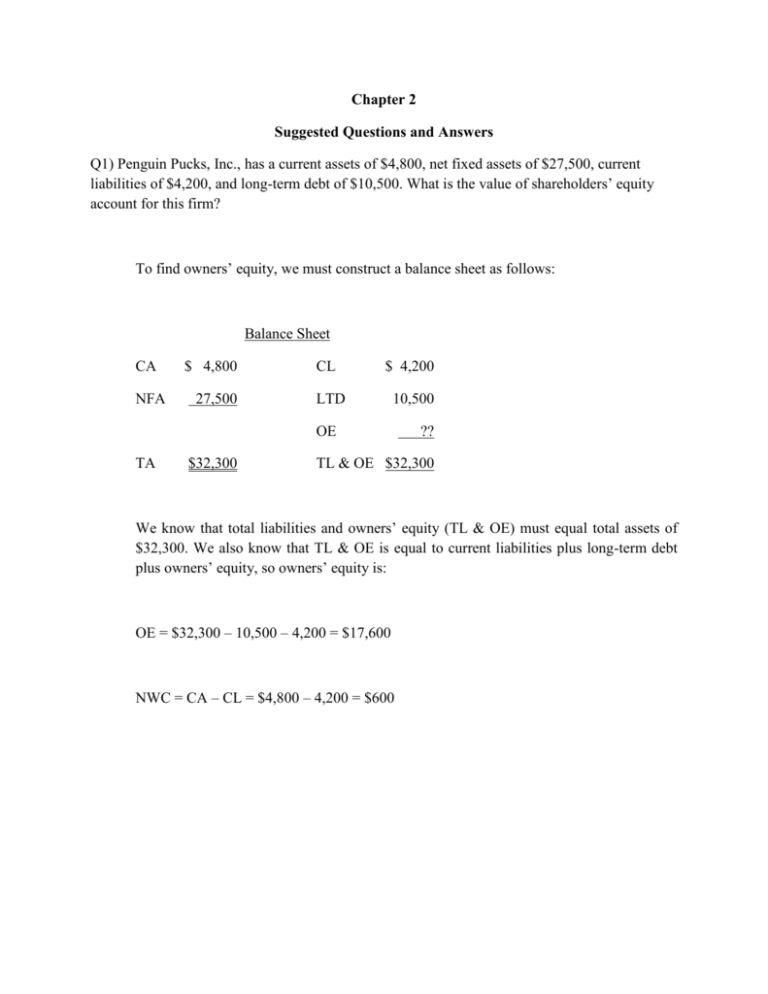

Chapter 2 Suggested Questions and Answers Q1) Penguin Pucks, Inc., has a current assets of $4,800, net fixed assets of $27,500, current liabilities of $4,200, and long-term debt of $10,500. What is the value of shareholders’ equity account for this firm? To find owners’ equity, we must construct a balance sheet as follows: Balance Sheet CA NFA $ 4,800 27,500 CL $ 4,200 LTD 10,500 OE TA $32,300 ?? TL & OE $32,300 We know that total liabilities and owners’ equity (TL & OE) must equal total assets of $32,300. We also know that TL & OE is equal to current liabilities plus long-term debt plus owners’ equity, so owners’ equity is: OE = $32,300 – 10,500 – 4,200 = $17,600 NWC = CA – CL = $4,800 – 4,200 = $600 Q2) Billy’s Exterminators, Inc., has a sales of $734,000, costs of $315,000, depereciation expense of $48,000, interest expense of $35,000, and a tax rate of 35%. What is the net income for this firm? The income statement for the company is: Income Statement Sales $734,000 Costs 315,000 Depreciation EBIT Interest EBT 48,000 $371,000 35,000 $336,000 Taxes (35%) 117,600 Net income $218,400 Q8) Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense pf $1,400. If the tax rate is 35%, what is the operating cash flows, or OCF? To calculate OCF, we first need the income statement: Income Statement Sales $39,500 Costs 18,400 Depreciation EBIT Interest Taxable income Taxes (35%) Net income 1,900 $19,200 1,400 $17,800 6,230 $11,570 OCF = EBIT + Depreciation – Taxes = $19,200 + 1,900 – 6,230 = $14,870 Q10) The 2010 balance sheet of Greystone, Inc., showed current assets of $3,120 and current liabilities of $1,570. The 2011 balance sheet showed current assets of $3,460 and current liabilities of $1,980. What was the company’s 2011 change in net working capital, or NWC? Change in NWC = NWCend – NWCbeg Change in NWC = (CAend – CLend) – (CAbeg – CLbeg) Change in NWC = ($3,460 – 1,980) – ($3,120 – 1,570) Change in NWC = $1,480 – 1,550 = –$70 Q21) Zigs Industries had the following operating results for 2011: sales= $27,360; cost of goods sold= $19,260; depreciation expense= $4,860; interest expense= $2,190; dividends paid= $1,560. At the beginning of the year, net fixed assets were $16,380, current assets were $5,760, and current liabilities were $3,240. At the end of the year, net fixed assets were $20,160, current assets were $7,116, and the current liabilities were $3,780. The tax rate for 2011 was 34% a) what is the net income for 2011? b) What is the operating cash flow for 2011? c) What is the cash flow from assets for 2011? Is this possible? Explain. a. Income Statement Sales $27,360 Cost of goods sold 19,260 Depreciation EBIT 4,860 $ 3,240 Interest Taxable income 2,190 $ 1,050 Taxes (34%) Net income 357 $ 693 b. OCF = EBIT + Depreciation – Taxes = $3,240 + 4,860 – 357 = $7,743 c. Change in NWC = NWCend – NWCbeg = (CAend – CLend) – (CAbeg – CLbeg) = ($7,116 – 3,780) – ($5,760 – 3,240) = $3,336 – 2,520 = $816 Net capital spending = NFAend – NFAbeg + Depreciation = $20,160 – 16,380 + 4,860 = $8,640 CFA = OCF – Change in NWC – Net capital spending = $7,743 – 816 – 8,640 = –$1,713 The cash flow from assets can be positive or negative, since it represents whether the firm raised funds or distributed funds on a net basis. In this problem, even though net income and OCF are positive, the firm invested heavily in both fixed assets and net working capital; it had to raise a net $1,713 in funds from its stockholders and creditors to make these investments. Chapter 3 Suggested Questions and Answers Q1) SDJ, Inc., has net working capital of $2,710, current liabilities of $3,950, and inventory of $3,420. What is the current ratio? What is the quick ratio? Using the formula for NWC, we get: NWC = CA – CL CA = CL + NWC = $2,710 + 3,950 = $6,660 So, the current ratio is: Current ratio = CA / CL = $6,660/$3,950 = 1.69 times And the quick ratio is: Quick ratio = (CA – Inventory) / CL = ($6,660 – 3,420) / $3,950 = 0.82 times Q2) Diamond Eyes, Inc., has sales of $18 million, total assets of $15.6 million, and total debt of $6.3 million. If the profit margin is 8%, what is net income? What is ROA? What is ROE? We need to find net income first. So: Profit margin = Net income / Sales Net income = Sales(Profit margin) Net income = ($18,000,000)(0.08) = $1,440,000 ROA = Net income / TA = $1,440,000 / $15,600,000 = .0923, or 9.23% To find ROE, we need to find total equity. Since TL & OE equals TA: TA = TD + TE TE = TA – TD TE = $15,600,000 – 6,300,000 = $9,300,000 ROE = Net income / TE = 1,440,000 / $9,300,000 = .1548, or 15.48% Q7) If Roten Rooters, Inc., has an equity multiplier of 1.45, total asset turnover of 1.80, and a profit margin of 5.5%, what is its ROE? ROE = (PM)(TAT)(EM) ROE = (.055)(1.80)(1.45) = .1436, or 14.36% Q22) Firm A and B have debt-total asset ratios of 45% and 35% and returns on total assets of 9% and 12%, respectively. Which firm has a greater return on equity? The solution requires substituting two ratios into a third ratio. Rearranging D/TA: Firm A Firm B D / TA = .45 D / TA = .35 (TA – E) / TA = .45 (TA – E) / TA = .35 (TA / TA) – (E / TA) = .45 (TA / TA) – (E / TA) = .35 1 – (E / TA) = .45 1 – (E / TA) = .35 E / TA = .55 E / TA = .65 E = .55(TA) E = .65 (TA) Rearranging ROA, we find: NI / TA = .09 NI / TA = .12 NI = .09(TA) NI = .12(TA) Since ROE = NI / E, we can substitute the above equations into the ROE formula, which yields: ROE = .09(TA) / .55(TA) = .09 / .55 = 16.36% ROE = .12(TA) / .65 (TA) = .12 / .65 = 18.46%