Show which type of financial management decisions are related to

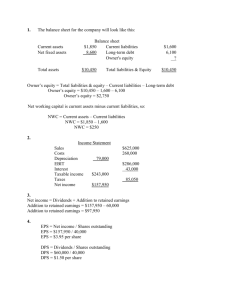

advertisement

1. a. b. c. d. 2. Show which type of financial management decisions are related to the following examples (Capital structure, Capital budgeting, Working capital management Deciding on whether to expand a manufacturing plant Capital budgeting deciding whether to issue new equity Capital structure modifying the firm’s credit collection policy with its customers Working capital management deciding whether to use the proceeds to retire outstanding debt Capital structure Sheffield Co. shows the following information on its 2010 income statement: sales = $153,000; costs = $81,900; other expenses = $5,200; depreciation expense = $10,900; interest expense = $8,400; taxes = $16,330; dividends = $7,200. In addition, you're told that the firm issued $2,600 in new equity during 2010, and redeemed $3,900 in outstanding long-term debt. a. What is the 2010 operating cash flow? b. What is the 2010 cash flow to creditors? c. What is the 2010 cash flow to stockholders? d. If net fixed assets increased by $19,475 during the year, what was the addition to NWC? Formula: OCF = EBIT + Depreciation – Taxes Cash flow to creditors = Interest paid – Net new borrowing Cash flow to stockholders = Dividends paid – Net new equity Cash flow from assets = Cash flow to creditors + Cash flow to stockholders Net capital spending = Depreciation + Increase in fixed assets Cash flow from assets = OCF – Change in NWC – Net capital spending ANSWER: a. To calculate the OCF, we first need to construct an income statement. The income statement starts with revenues and subtracts costs to arrive at EBIT. We then subtract out interest to get taxable income, and then subtract taxes to arrive at net income. Doing so, we get: Income Statement Sales $153,000 Costs 81,900 Other Expenses 5,200 Depreciation 10,900 EBIT $55,000 Interest 8,400 Taxable income $46,600 Taxes 16,330 Net income $30,270 Dividends $7,200 Addition to retained earnings 23,070 Dividends paid plus addition to retained earnings must equal net income, so: Net income = Dividends + Addition to retained earnings Addition to retained earnings = $30,270 – 7,200 Addition to retained earnings = $23,070 So, the operating cash flow is: OCF = EBIT + Depreciation – Taxes OCF = $55,000 + 10,900 – 16,330 OCF = $49,570 b. The cash flow to creditors is the interest paid, minus any new borrowing. Since the company redeemed long-term debt, the net new borrowing is negative. So, the cash flow to creditors is: Cash flow to creditors = Interest paid – Net new borrowing Cash flow to creditors = $8,400 – (–$3,900) Cash flow to creditors = $12,300 c. The cash flow to stockholders is the dividends paid minus any new equity. So, the cash flow to stockholders is: Cash flow to stockholders = Dividends paid – Net new equity Cash flow to stockholders = $7,200 – 2,600 Cash flow to stockholders = $4,600 d. In this case, to find the addition to NWC, we need to find the cash flow from assets. We can then use the cash flow from assets equation to find the change in NWC. We know that cash flow from assets is equal to cash flow to creditors plus cash flow to stockholders. So, cash flow from assets is: Cash flow from assets = Cash flow to creditors + Cash flow to stockholders Cash flow from assets = $12,300 + 4,600 Cash flow from assets = $16,900 Net capital spending is equal to depreciation plus the increase in fixed assets, so: Net capital spending = Depreciation + Increase in fixed assets Net capital spending = $10,900 + 19,475 Net capital spending = $30,375 Now we can use the cash flow from assets equation to find the change in NWC. Doing so, we find: Cash flow from assets = OCF – Change in NWC – Net capital spending $16,900 = $49,570 – Change in NWC – $30,375 Change in NWC = $2,295 3. The ABC Company has net profits of $10 million, sales of $150 million, and 2.5 million shares of common stock outstanding. The company has total assets of $75 million and total stockholders’ equity of $45 million. It pays $ 1 per share in common dividends, and the stock trades at $20 per share. Given this information, determine the following: a. b. c. d. e. ABC Company’s EPS. ABC Company’s book value per share and price-to-book-value ratio. The firm’s P/E ratio. The company’s net profit margin. The stock’s dividend payout ratio and its dividend yield. Formula: (i) (ii) (iii) Net profits after taxes Preferred dividends Number of common shares outstanding Stockholders' equity Book value per share Number of common shares outstanding Market price of stock EPS (iv) (v) (vi) Dividend yield Net profit after taxes Total revenues Dividends per share EPS Dividends per share Market price of common stock ANSWER: (i) Net profits after taxes Preferred dividends Number of common shares outstanding For ABC: (ii) $10,000,000 $0 $4 per share 2,500,000 Stockholders' equity Book value per share Number of common shares outstanding For ABC: Price-to-book value $45,000,000 $18 per share 2,500,000 Market price of common stock Book value per share For ABC: Price-to-book value (iii) $20 1.11 $18 Market price of stock EPS For ABC: (iv) $20 = 5 times $4 Net profit after taxes Total revenues For ABC: $10,000,000 6.7% $150,000,000 Dividends per share EPS (v) For ABC: Dividend payout Dividend yield $1 25% $4 Dividends per share Market price of common stock For ABC: Dividend yield $1 5% $20 (vi) 4. PEG ratio Stock's P/E ratio 5/7.5 .667 35 years growth rate in earnings Future Value and Multiple Cash Flows. Ali Sdn Bhd, has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the future value of these cash flows in Year 3? What is the present value of these cash flows? Year 1 2 3 Cashflow ($) 800 1000 1200 PV = 800/(1+0.1) + 1000/(1+0.1) 2+1200/(1+0.1)3=2455.297 FV= 800*(1+0.1)2+1000*(1+0.1)1+1200=3268 5. Calculating Rates of Return. During 2013, I sold my car for a price of $18000. Unfortunately I he had purchased it in 2003 at a price of $65000. What was his annual rate of return on this car? Formula: FV = PV(1 + r)t Solving for r, we get: r = (FV / PV)1 / t – 1 ANSWER: r = ($18000 / $65000)1/10 – 1 r = –0.1205