1. The balance sheet for the company will look like this: Balance

advertisement

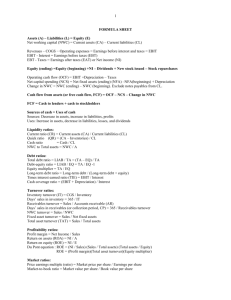

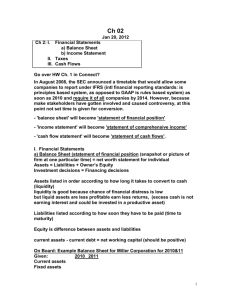

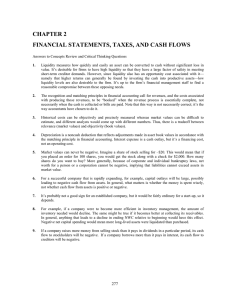

1. The balance sheet for the company will look like this: Current assets Net fixed assets Total assets Balance sheet $1,850 Current liabilities 8,600 Long-term debt Owner's equity $10,450 Total liabilities & Equity $1,600 6,100 ? $10,450 Owner’s equity = Total liabilities & equity – Current liabilities – Long-term debt Owner’s equity = $10,450 – 1,600 – 6,100 Owner’s equity = $2,750 Net working capital is current assets minus current liabilities, so: NWC = Current assets – Current liabilities NWC = $1,850 – 1,600 NWC = $250 2. Income Statement Sales Costs Depreciation 79,000 EBIT Interest Taxable income $243,000 Taxes Net income $157,950 $625,000 260,000 $286,000 43,000 85,050 3. Net income = Dividends + Addition to retained earnings Addition to retained earnings = $157,950 – 60,000 Addition to retained earnings = $97,950 4. EPS = Net income / Shares outstanding EPS = $157,950 / 40,000 EPS = $3.95 per share DPS = Dividends / Shares outstanding DPS = $60,000 / 40,000 DPS = $1.50 per share 6. Taxes = 0.15($50,000) + 0.25($25,000) + 0.34($25,000) + 0.39($315,000 – 100,000) Taxes = $106,100 7. Average tax rate = Total tax / Net income Average tax rate = $106,100 / $315,000 Average tax rate = .3368 or 33.68% The marginal tax rate is 39 percent. 9. Net capital spending = NFAend – NFAbeg + Depreciation Net capital spending = $2,120,000 – 1,875,000 + 220,000 Net capital spending = $465,000 10. Change in NWC = NWCend – NWCbeg Change in NWC = (CAend – CLend) – (CAbeg – CLbeg) Change in NWC = ($910 – 335) – (840 – 320) Change in NWC = $55 11. Cash flow to creditors = Interest paid – Net new borrowing Cash flow to creditors = Interest paid – (LTDend – LTDbeg) Cash flow to creditors = $49,000 – ($1,800,000 – 1,650,000) Cash flow to creditors = –$101,000 12. Cash flow to stockholders = Dividends paid – Net new equity Cash flow to stockholders = Dividends paid – (Commonend + APISend) – (Commonbeg + APISbeg) Cash flow to stockholders = $70,000 – [($160,000 + 3,200,000) – ($150,000 + 2,900,000)] Cash flow to stockholders = –$240,000 13. Cash flow from assets = Cash flow to creditors + Cash flow to stockholders Cash flow from assets = –$101,000 – 240,000 Cash flow from assets = –$341,000 Cash flow from assets = OCF – Change in NWC – Net capital spending –$341,000 = OCF – (–$135,000) – (760,000) OCF = –$341,000 – 135,000 + 760,000 OCF = $284,000 14. a. To calculate the OCF, we first need to construct an income statement. The income statement starts with revenues and subtracts costs to arrive at EBIT. We then subtract out interest to get taxable income, and then subtract taxes to arrive at net income. Doing so, we get: Income Statement Sales $138,000 Costs 71,500 Other Expenses 4,100 Depreciation 10,100 EBIT $52,300 Interest 7,900 Taxable income $44,400 Taxes 17,760 Net income $26,640 Dividends Addition to retained earnings $5,400 ? Dividends paid plus addition to retained earnings must equal net income, so: Net income = Dividends + Addition to retained earnings Addition to retained earnings = $26,640 – 5,400 Addition to retained earnings = $21,240 So, the operating cash flow is: OCF = EBIT + Depreciation – Taxes OCF = $52,300 + 10,100 – 17,760 OCF = $44,640 b. The cash flow to creditors is the interest paid, minus any new borrowing. Since the company redeemed long-term debt, the new borrowing is negative. So, the cash flow to creditors is: Cash flow to creditors = Interest paid – Net new borrowing Cash flow to creditors = $7,900 – (–$3,800) Cash flow to creditors = $11,700 c. The cash flow to stockholders is the dividends paid minus any new equity. So, the cash flow to stockholders is: Cash flow to stockholders = Dividends paid – Net new equity Cash flow to stockholders = $5,400 – 2,500 Cash flow to stockholders = $2,900 d. In this case, to find the addition to NWC, we need to find the cash flow from assets. We can then use the cash flow from assets equation to find the change in NWC. We know that cash flow from assets is equal to cash flow to creditors plus cash flow to stockholders. So, cash flow from assets is: Cash flow from assets = Cash flow to creditors + Cash flow to stockholders Cash flow from assets = $11,700 + 2,900 Cash flow from assets = $14,600 Net capital spending is equal to depreciation plus the increase in fixed assets, so: Net capital spending = Depreciation + Increase in fixed assets Net capital spending = $10,100 + 17,400 Net capital spending = $27,500 Now we can use the cash flow from assets equation to find the change in NWC. Doing so, we find: Cash flow from assets = OCF – Change in NWC – Net capital spending $14,600 = $44,640 – Change in NWC – $27,500 Change in NWC = $2,540