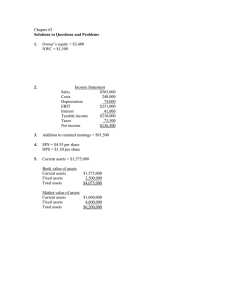

HW03 Solution: Lec 022: Cash Flows Total 90 pt 1. (20 pt) NuBattery Inc. just developed a new battery for electric cars. Tesla has offered to buy the technology from NuBattery for $120m (after-tax). However, NuBattery wants to explore the feasibility of commercializing the technology on its own. The commercialization project will last 3 years. NuBattery has spent $20m on research and development (R&D) so far, which cannot be recovered. The commercialization project requires an investment of $90m on equipment at the beginning of the project. o The equipment will be depreciated according to the MACRS 3-year schedule over the project’s 3-year life. o The salvage value is $15m. The sales are projected to be $100m, $120m, $210m for years 1, 2, and 3 respectively. Cash operating costs are estimated to be 50% of sales. Net working capital (NWC) requires an initial investment of $5m. Afterwards, the amount of NWC (end of year balance) is estimated to be 10% of annual sales. At the end of the project, all net working capital will be recovered. At the end of the project, the technology is estimated to be worth $30m (after-tax) only in the market (vs. $120m now) because competitors should have caught up by then. NuBattery's current marginal tax rate is 30% and its cost of capital is 10%. (i) Is the $20m spent on R&D so far an incremental cash flow that should be included in the NPV analysis? Why? (1 pt) No, it’s sunk cost. (ii) What are the annual depreciation expenses? (1 pt) 0 Depreciation 1 2 3 30.00 40.01 13.33 Annual Dep = Initial Equipment Cost * Depreciation Schedule (iii) What is the capital gain tax that the company has to pay when they sell the equipment at the end of the project’s life? (3 pt) BV = Initial Equip. Cost – Acc. Dep = 90 – (30+40.01+13.33) = 90 – 83.33 =6.67 (1 pt) CG tax = (MV – BV)(T) = (15 – 6.67)(0.3) = 2.50 (1 pt) (iv) Use the (a) NPV and (b) IRR decision rules to determine whether NuBattery should take on the commercialization project or not. (15 pt) (all in $m) Year (1) Operating Cash Flows (OCF): Sales - Operating costs -Depreciation = EBIT (1) OCF = EBIT(1-T)+Dep (4 pt) (2) Other CFs: Equipment (2 pt) NWC Cash Flow (2 pt) Opportunity cost (2 pt) (2) Other CFs (3) Total Incremental Cash Flows = (1)+(2) (1 pt) MACRS Operating expenses (% Sales) Operating expenses NWC (% Sales) NWC CG taxes: Accumulated depreciation BV = Capex - Accum. Dep MV (salvage) CG tax = (MV - BV)*T Tax rate Discount rate NPV (2 pt) IRR (2 pt) 0 1 2 3 0 100 50 30.00 20.00 44.00 120 60 40.01 20.00 54.00 210 105 13.33 91.67 77.50 -5 -2 -5 -2 12.50 12 30 54.50 -215.00 39.00 52.00 132.00 0.4445 50% 60 10% 12 0.1481 50% 105 5 0.3333 50% 50 10% 10 -90 -5 -120 -215 0 83.33 6.67 15.00 2.50 30% 10% -37.40 < 0 1.53% <10% => Reject! => Reject! 2. (15 pt) The GreenBall Inc. is evaluating the possibility of entering the golf ball manufacturing business. Last month the company spent $15m to rent the equipment for a small scale test run. Based on the results of the test run, the company came up with the following estimates: The equipment has to be purchased at the beginning of the project (year 0). The original cost of the equipment is $105m, but the company can deduct the $15m payment it made to the equipment supplier last month for the test run if the company decides to purchase the equipment. The original cost of the equipment, $105m, will be depreciated straight line to zero over the project's 3-year life. The end-of-life salvage value is $30m. The planned factory site is currently rented out to a neighboring company. If the company decides to enter the golf ball manufacturing business, it will lose $25m in after-tax rental income every year during the project's 3-year life. Sales of golf balls are projected to be $90m, 210m, and $160m, for years 1,2, and 3 respectively; operating expenses are estimated to be 50% of sales. Net working capital (NWC) investment of $3m is needed at the beginning of the project (year 0). Afterwards, an additional annual investment (or spending) of $5m is necessary for years 1-2. At the end of the project, all NWC will be recovered. The company's average tax rate is 25% and its marginal tax rate is 30% The company’s cost of capital is 10%. Use the NPV decision rule to determine whether GreenBall Inc. should enter the golf ball manufacturing business or not. (15 pt) (all in $m) Year (1) OCF Sales - Operating expenses - Depreciation = EBIT (1) OCF = (EBIT)*(1-T)+Dep (4 pt) (2) Other CFs Equipment (4 pt) NWC Cash Flow (2 pt) Opportunity cost (2 pt) (2) Other CFs (3) Total Incremental Cash Flow (1 pt) Operating expenses (% Sales) 0 1 2 3 0 90 45 35 10 42 210 105 35 70 84 160 80 35 45 66.5 -93 -5 -25 -30 -5 -25 -30 21 13 -25 9 -93 12 54 75.5 50% 50% 50% -90 -3 Tax rate 30% Discount rate 10% NPV (1 pt) 19.26 NPV > 0, the company should enter the golf ball manufacturing business (1 pt) 3. (all numbers are in thousands; 8 pt) Jaffrey Inc. is considering the purchase of an automation machine with a cost of $350. The machine has an economic life of 5 years. It will be fully depreciated over the 5-year life using the straight-line method, and then be sold at $70 at the end of the 5-year life. The machine will replace 2 workers whose combined annual salaries are $100. However, this machine also requires additional investment in net working capital of $30 in the beginning, which will be fully recovered at the end of the machine’s life. The marginal tax rate is 30%. Is it worthwhile to purchase this automation machine if the company’s required rate of return is 10%? (all in $000s) (1) OCF Sales Operating costs Depreciation EBIT (1) OCF = EBIT(1-t) + Dep (4 pt) 0 1 2 3 4 5 0 0 -100 70 30 91 0 -100 70 30 91 0 -100 70 30 91 0 -100 70 30 91 0 -100 70 30 91 (2) Other CFs Equipment (2 pt) NWC CF (1 pt) (2) Other CFs -350 -30 -380 0 0 0 0 49 30 79 (3) Total Incremental CFs -380 91 91 91 91 170 Tax rate Discount rate 30% 10% NPV (1 pt) 14.01 >0 ==> Accept! 4. The Locker Co. has $250,000 in taxable income. (10 pt) (i) What are the company’s income taxes according to the tax rate table below? (5 pt) Taxable Income Bracket 0 – $50,000 $50,000 - $75,000 $75,000 - $100,000 $100,000 - $335,000 Marginal Tax Rate (%) 15 25 34 39 (in thousands) Taxes = (50)(0.15) + (75-50)(0.25) + (100-75)(0.34) + (250-100)(0.39) = 7.5 + 6.25 + 8.5 + 58.5 = 80.75 (ii) What is the company’s average tax rate? (2 pt) Average tax rate = 80.75/250 = 32.3% (ii) Locker Co is evaluating a new project, which is projected to increase the company’s taxable income from its current level of $250,000 to $330,000. What is the tax rate the company should use in estimating the incremental free cash flows of the new project? Briefly describe your reasoning. (3 pt) $250,000 - $330,000 falls in the 39% tax bracket, so the company should use 39%, i.e. its marginal tax rate, in estimating the new project’s incremental cash flows. 5. (7 pt) Your boss is evaluating two printers for the office. Printer A costs $500, has an annual operating cost of $60, and will last 5 years. Printer B costs $300, has an annual cost of $150, and will last 3 years. One of your colleagues conducts an NPV analysis based on your company's cost of capital of 10%. (cash flows and NPVs shown in the following table). He thinks that since NPV of Printer B > NPV of Printer A, the office should purchase Printer B. Year Printer A Cash Flows Printer A NPV 0 -500 -727.45 1 -60 2 -60 3 -60 Printer B Cash Flows Printer B NPV -300 -673.03 -150 -150 -150 4 -60 (i) Do you agree with your colleague's analysis and recommendation? Why? (2 pt) These two printers have different lives, so looking at the NPV of the project's life is not appropriate. (2 pt) 5 -60 (ii) If you were to analyze this problem, what would be your recommendation? Show your analysis and the numbers that help you reach your recommendation. (5 pt) We should look at EAC (equivalent annual cost) instead. The EACs are as follows: Year A's CF for EAC A's NPV of EAC 0 1 -191.90 2 -191.90 3 -191.90 -270.63 -270.63 -270.63 4 -191.90 5 -191.90 -727.45 B's CF for EAC B's NPV of EAC -673.03 Cost of capital 10% EAC(A) = 191.90 (since it's a cost, the sign in the table above is negative) (2 pt) EAC(A): N=5, I=10%, PV=-727.45, FV=0 => PMT=191.90 EAC(B) = 270.63 (2 pt). EAC(A): N=3, I=10%, PV= -673.03, FV=0 => PMT=270.63 => Printer A's cost is cheaper on an annual basis, so we should choose Printer A. (1 pt) 6. (10 pt) Could you think of one example in real life where you apply the knowledge you acquired in this lecture to analyze the problem and come up with a decision? Illustrate with numbers and calculations. If you cannot think of any example, you can make up a problem based on the material in this lecture and then perform an analysis to solve it. 7. (5 pt) Which concepts in this lecture do you find most interesting? Why? 8. (5 pt) Which concepts in this lecture do you find a bit difficult to comprehend? What can the professor do to help you better under them? Formula Sheet Lec 022 (1) Cash Flow of the Firm = Operating Cash Flows (OCF) + Other Cash flows (equipment buy/sale, NWC, opportunity cost etc.) (2) OCF (top-down) = Sales – Costs – Taxes (3) OCF (bottom-up) = (EBIT – Taxes) + Depreciation = EBIT*(1-T) + Depreciation (4) EBIT = Sales – Costs – Depreciation (5) Taxes = EBIT*T = (Sales – Costs – Depreciation)*T (6) Salvage after-tax = MV - Capital gain taxes = MV - (MV - BV)*T (7) BV = Initial Cost of Equipment – Accumulated Depreciation (8) 1 + nominal rate = (1 + real rate) * (1 + inflation) (9) Real CF = Nominal CF / (1 + inflation) (10) MACRS Schedule