Company Assignment

advertisement

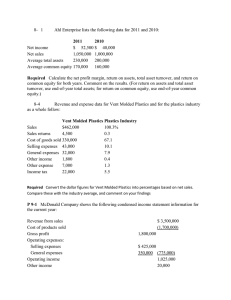

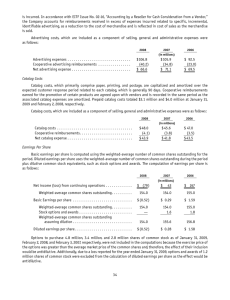

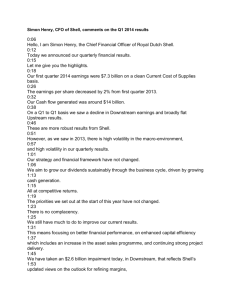

GBUS 160 COMPANY PROFILE TEST Date Assigned: Due Date: Suggested Relevant Material & Resources: Stock Market Reading on Bb, CNBC.com, On-line and Library resources, newspapers (e.g., Wall Street Journal; Washington Post, Dow Jones Factiva), current business journals and periodicals such as Business Week, Fortune, Forbes.. Overview: “What is the assignment?” The class will be assigned 5 companies by your instructor. Over the course of the semester you are expected be become an “expert” on these 5 companies by researching the companies and tracking their stocks. . It is critical that you devote significant efforts to understanding these 5 companies and your knowledge of these companies will be tested on the due date via an open book and open notes test. All information must be printed out before the test and students will not be allowed to use a computer or electronic devices during the test. This first test is the foundation for the stock project where you will keep abreast of financial and business news regarding these companies throughout the semester Learning Objectives: “What will we learn?” By completing this learning module you will: 1. Enhance research and evaluation skills and apply those skills to the performance and potential of publicly owned companies. 2. Acquire knowledge and insight about the nature of business and its function in modern society, the workings of the securities markets and basic techniques for investing in common stocks and other financial instruments. 3. Refine quantitative and qualitative analytical skills. 4. Further develop information literacy skills through the use of both on-line and printed resources. 5. Use computer technology including research tools, and word processing and spreadsheet software, for data gathering, analysis, and information transfer. 6. Develop and refine critical thinking skills including: Identification and evaluation of information and sources of information Distinguishing between facts, judgments and opinions Summarizing and organizing information Recognizing and developing conclusions Recognizing, interpreting, and applying complex texts, and instructions 8. Apply critical thinking standards such as Clarity Accuracy Industriousness Activity Process: “How do we do the assignment?” Step 1) Each student will answer the following questions for each company 1. History & Leadership: This is a brief “biography” of the company o Closing Price o Headquarters Location o Founder of company o When company started o Where company started Identify the “Top 5” occurrences/events/developments/moments of leadership (or lack thereof) that had a significant impact on the company’s present state. Consider issues that pertain to: How the company achieved sustainable competitive advantage(s) How the company has redefined consumer products, lives, etc. When leadership shifts happened – and why Reactions to competitive pressures o PLEASE: Do not rely entirely on the company’s website because it is going to be filled with all of the “good news” related to company history and performance. Dig for the “dirt.” Tell some of the events that the company may not want to admit and how they might affect potential or current investors. Chief Executive Officer o His/her name o age o salary o Dow Jones Factiva is an excellent source for this information 2. Financial Profile: Create an table in Word or Excel containing the following information for the last two fiscal years of the Company: 2007 2008 Total Revenue Total Net Income Net Income as a % of Revenue Market Capitalization ( ) Earnings per Share (for the year) Price / Earnings Ratio ( ) Dividends per Share (if any for the year) Dow Jones Factiva is an excellent source for this information Additional Notes Net Income/Total Revenue. Net Income can never be larger than revenue because Net Income is the Total Revenue minus all Expenses. If net income is 50 and expenses are 45, then NI is 5. Therefore NI/TR= 5/50 or 10% This tells you what % of revenue flowed through expenses and becomes profit. In other words 10 cents of every dollar is profit and the other 90 cents is used to cover expenses. Market Capitalization This is the stock price * the number of shares outstanding. This tells you the size of the company and allows you to compare companies in different industries. Multiply the number of shares outstanding currently in finance.yahoo.com times the stock price on December 31 of each year. The number of shares outstanding may have changed over the past two years, but the change will have a very small impact on the market capitalization. Earnings/Share EPS can be found by dividing the Net Income over the number of shares outstanding In Yahoo the income statement for the company says at the top "the figures below are in thousands". This means that every figure should be multiplied by 1000 for the actual number. Price / Earnings Ratio Use the share price for and the Earnings per Share from above Dividends per Share In historical prices, one of the options is Dividends. You will then have to add up the dividends that were paid between Jan 1 and Dec 31. 3. Recent Developments & Issues (within the last 12 months) : A description of any significant current issues (AT LEAST 5 ISSUES) affecting the company using as a subject guide and reference the company’s STAKEHOLDERS. These stakeholders are people that have an interest in what the company does. They include customers, suppliers, employees, investors, and the public. Issues to look for include earnings info, changes in prices, lawsuits for and against them, new products, etc. Note: You are not expected to address every stakeholder listed. Use your judgment in selecting those developments and issues that will have a significant impact on the success of the company.. Remember poor judgment may be evidence by being overly inclusive as well as under inclusive. Keep in mind that I follow and am familiar with all of the Companies and will be aware of developments and issues, making the same critical judgments expected of you. 4. Stock Performance: A list of the company’s stock performance for the last Three years To do this chart, you will need the historical stock prices from March 31, June 30 Sept 30 and Dec 31 for the last 3 years. If the 31st is a Saturday or Sunday, you cannot use the 31st because the market is closed on Saturday or Sunday. Use Friday the 29th or Friday the 30th because it is the last day of the quarter. What should the Company Profile Assignment look like? a. Print all information you might need for the test as you will not be able to use a computer or electronic device during the test. b. Be organized so that you can quickly find your answers. A suggested format is to answer all questions and then organize them using the following format: 1. History and Leadership 2. Financial Profile 3. Recent Developments & Issues ( within the last 12 months) 4. Stock Performance worksheet for all 5 companies for all 12 dates In order to help you find answers for the test, I would make sure these sections have the appropriate heading preceding your information. Number your sections and do not combine the answer to any question with another answer. c. You are answering the assignment questions to take the test. You do not need to turn in anything after the test. Grading Criteria: “How do I earn an A?” This project counts as 20 % of your final course grade. Your grade on this assignment is based on the following: Applying critical thinking standards such as: completeness, accuracy, and clarity. Using critical thinking skills such as: distinguishing between fact and opinion, evaluating sources of information, identifying and assessing critical issues, summarizing and organizing information, and developing conclusions.