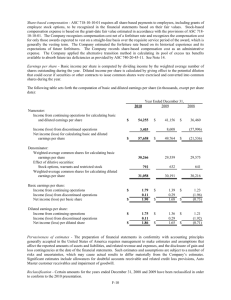

net of tax

advertisement

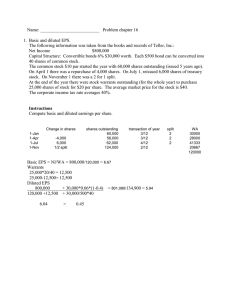

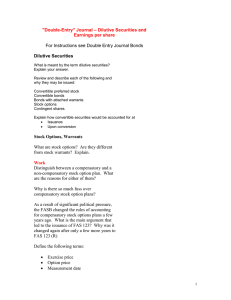

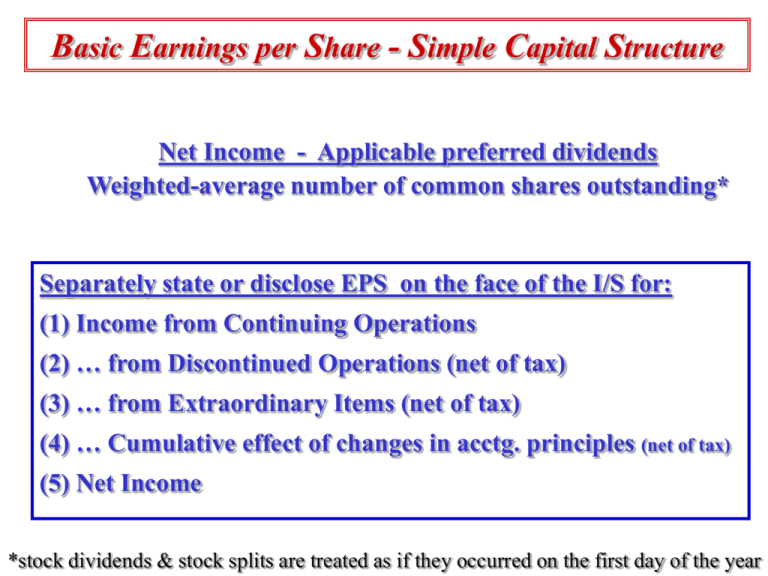

Basic Earnings per Share - Simple Capital Structure Net Income - Applicable preferred dividends Weighted-average number of common shares outstanding* Separately state or disclose EPS on the face of the I/S for: (1) Income from Continuing Operations (2) … from Discontinued Operations (net of tax) (3) … from Extraordinary Items (net of tax) (4) … Cumulative effect of changes in acctg. principles (net of tax) (5) Net Income *stock dividends & stock splits are treated as if they occurred on the first day of the year Diluted Earnings per Share - Complex Capital Structure Increased Net Income - Decreased preferred dividends Increased Wtd.-average common shares outstanding STEP 1: Calculate Basic EPS STEP 2: Identify potentially dilutive securities STEP 3: Disregard antidilutive securities (based on the security holder’s most advantageous conversion or exercise) [in reference to Income Before Extraordinary Items & Accounting Change] STEP 4: Calculated Diluted EPS *takes into account the effect of all dilutive potential common shares that would have been outstanding if issued Diluted Earnings per Share - Finding Dilutive Securities CONVERTIBLE SECURITIES -- use if converted method (1) Increase income: (a) representing the related preferred dividends (b) for the after tax interest expense (1-TaxRate)(IntExp) (2) Increase the weighted average shares outstanding * assumes conversion at the earliest possible date that it could have occurred * if convertible debt was issued at a premium or a discount, the interest expense (net of tax) must be computed after giving consideration to amortization Diluted Earnings per Share - Finding Dilutive Securities OPTIONS & WARRANTS -- use Treasury Stock Method # shares issuable times the Exercise/option price per share = Proceeds rec’d from the assumed exercise of options/warrants Proceeds rec’d from assumed exercise of options/warrants Divide by ave market price per share = # treasury shares acquired # share issuable - # treasury shares acquirable = incremental # of shares (assumed issued & not reacquired) * assumes issuance at the beginning of the year Diluted Earnings per Share - Finding Dilutive Securities Contingent Issue Agreement If these shares are issuable upon the mere passage of time or upon the attainment of a certain earnings or market price level, and this level is met at the end of the year, they should be considered as outstanding for the computation of earnings per share.