34 is incurred. In accordance with EITF Issue No. 02

advertisement

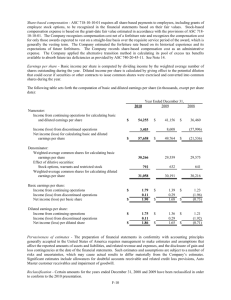

is incurred. In accordance with EITF Issue No. 02-16, “Accounting by a Reseller for Cash Consideration from a Vendor,” the Company accounts for reimbursements received in excess of expenses incurred related to specific, incremental, identifiable advertising, as a reduction to the cost of merchandise and is reflected in cost of sales as the merchandise is sold. Advertising costs, which are included as a component of selling, general and administrative expenses were as follows: Advertising expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cooperative advertising reimbursements . . . . . . . . . . . . . . . . Net advertising expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2008 2007 (in millions) 2006 $106.8 (40.2) $ 66.6 $105.9 (34.8) $ 71.1 $ 92.5 (23.0) $ 69.5 Catalog Costs Catalog costs, which primarily comprise paper, printing, and postage, are capitalized and amortized over the expected customer response period related to each catalog, which is generally 90 days. Cooperative reimbursements earned for the promotion of certain products are agreed upon with vendors and is recorded in the same period as the associated catalog expenses are amortized. Prepaid catalog costs totaled $3.1 million and $4.0 million at January 31, 2009 and February 2, 2008, respectively. Catalog costs, which are included as a component of selling, general and administrative expenses were as follows: Catalog costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cooperative reimbursements. . . . . . . . . . . . . . . . . . . . . . . . . . Net catalog expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2008 2007 (in millions) 2006 $48.0 (4.1) $ 43.9 $ 45.6 (3.8) $ 41.8 $ 47.0 (3.5) $ 43.5 Earnings Per Share Basic earnings per share is computed using the weighted-average number of common shares outstanding for the period. Diluted earnings per share uses the weighted-average number of common shares outstanding during the period plus dilutive common stock equivalents, such as stock options and awards. The computation of earnings per share is as follows: 2008 2007 2006 (in millions) Net income (loss) from continuing operations . . . . . . . . . . . . . Weighted-average common shares outstanding. . . . . . . . . . Basic Earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Weighted-average common shares outstanding. . . . . . . . . . Stock options and awards . . . . . . . . . . . . . . . . . . . . . . . . . . Weighted-average common shares outstanding assuming dilution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Diluted earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (79) $ 43 $ 247 154.0 154.0 155.0 $ (0.52) $ 0.29 $ 1.59 154.0 — 154.0 1.6 155.0 1.8 154.0 155.6 156.8 $ (0.52) $ 0.28 $ 1.58 Options to purchase 4.8 million, 3.4 million, and 2.8 million shares of common stock as of January 31, 2009, February 2, 2008, and February 3, 2007, respectively, were not included in the computations because the exercise price of the options was greater than the average market price of the common shares and, therefore, the effect of their inclusion would be antidilutive. Additionally, due to a loss reported for the year ended January 31, 2009, options and awards of 1.2 million shares of common stock were excluded from the calculation of diluted earnings per share as the effect would be antidilutive. 34